You can make money when other people chop their hands on Double Eleven, Feitian Moutai is waiting for you! There are also limited-time low-price discounts on seven major investment tools, not to be missed.[点击进入活动页面]

For stock trading, you can look at the research report of Jin Qilin analysts. It is authoritative, professional, timely and comprehensive, helping you tap potential opportunities!

Source: Beijing Business Daily

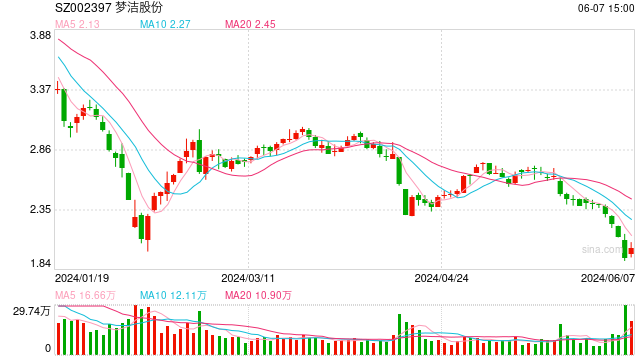

Several management personnel, including the company and its chairman, were investigated.Mengjie sharesThe “black swan” incident of (rights protection) caught investors off guard, and the short-term sharp drop in stock prices made investors distressed, but the crisis of trust in listed companies made investors even more chilled. A listed company whose management has been collectively filed for investigation cannot even do basic compliance operations. How can it create investment value for shareholders?

A listed company and a number of senior executives were put on file for investigation. The announcement showed that they were suspected of violating laws and regulations in information disclosure. The intuitive feeling given to investors was that this was a “nest case”. For listed companies, the occasional case of a single executive or management being investigated may not arouse excessive worry among investors, but listed companies together with many executives will make investors feel scared. What kind of listed company is this? Where does the investment value of such a listed company come from? Let me ask, which investor dares to hold such a listed company for a long time without any distractions? Once such a crisis of confidence arises in the minds of investors, it will be difficult to eliminate.

From the perspective of stock price performance, the stock price of Mengjie shares has been at a low level for a long time. On April 28, 2022, it fell to a low of 2.62 yuan. Judging from the stock price, Mengjie shares can’t be compared with blue chip stocks; judging from the company’s performance performance, the loss per share in 2021 is 0.21 yuan, and the three regular reports in 2022 are also losses. Therefore, judging from this operating performance, even if these financial data are true, investors would not dare to buy and hold shares in Mengjie.

The performance of Mengjie shares has been weak in recent years, and losses have increased since the beginning of this year. Today’s filing and investigation has greatly reduced the company’s image in the minds of shareholders. In fact, it is normal for listed companies to lose money, and shareholders are not so afraid of performance losses. However, the collective investigation of executives will have a huge impact on the investment judgment of shareholders. Whether the operating performance is good or not depends mainly on the management of the listed company. If the management makes a difference, loss-making stocks are a good opportunity for low-level layout. But the management has a “conviction record”, who will hold such a listed company for a long time?

The data shows that in recent years, the directors, supervisors and executives of Mengjie Co., Ltd. have continuously reduced their holdings of stocks. Even if the company’s stock price has fallen to a historical low, they are still reducing their holdings. Even if they are not optimistic about their own company’s stocks, what reason do investors have to hold them for a long time?

In fact, some investors who bought Mengjie shares did not have the purpose of value investment. They planned for the restructuring expectation of Mengjie shares. Recently, Mengjie shares have indeed changed hands. However, the sudden investigation may make the company’s restructuring expectations come to naught. During the investigation period, the major asset restructuring of listed companies is restricted. More importantly, the results of the investigation are unknown. If the punishment results exceed investors’ expectations, then investors will suffer huge losses.

For shareholders, the requirements are actually not high. Listed companies operate legally, steadily improve their performance, and stabilize cash dividends. As long as they do this, shareholders dare to hold for a long time, but now many listed companies do not even have these three basic points. It can’t be done, and I think about how to harvest leeks through capital means every day. Such an approach really makes stockholders feel cold.

Massive information, accurate interpretation, all in the Sina Finance APP

Editor in charge: He Songlin