requirements: – Give us all the pictures!

– VAR must contribute to more justice, not less. That’s what Barcelona president Joan Laporta says in

Operation Praetorian: MP requests preventive detention for Madureira and “Polaco” | public ministry

This Tuesday, the Public Prosecutor’s Office (MP) requested preventive detention for Fernando Madureira, leader of the Super

Postpone old age? People feel that now they get older later

In the last century, reaching 70 years old marked the beginning of old age for many people.

Popular Stories

Germany’s SAP’s cloud business sales increase 24% in the first quarter | Reuters

On April 22nd, German software giant SAP announced its first quarter financial results, with cloud business sales

requirements: – Give us all the pictures!

– VAR must contribute to more justice, not less. That’s what Barcelona president Joan Laporta says in

Operation Praetorian: MP requests preventive detention for Madureira and “Polaco” | public ministry

This Tuesday, the Public Prosecutor’s Office (MP) requested preventive detention for Fernando Madureira, leader of the Super

Postpone old age? People feel that now they get older later

In the last century, reaching 70 years old marked the beginning of old age for many people.

Travel & Explore the world

Germany’s SAP’s cloud business sales increase 24% in the first quarter | Reuters

On April 22nd, German software giant SAP announced its first quarter financial results, with cloud business sales

requirements: – Give us all the pictures!

– VAR must contribute to more justice, not less. That’s what Barcelona president Joan Laporta says in

Operation Praetorian: MP requests preventive detention for Madureira and “Polaco” | public ministry

This Tuesday, the Public Prosecutor’s Office (MP) requested preventive detention for Fernando Madureira, leader of the Super

Postpone old age? People feel that now they get older later

In the last century, reaching 70 years old marked the beginning of old age for many people.

Jurgen Klopp: Liverpool boss hails Trent Alexander-Arnold

Liverpool manager Jurgen Klopp believes it will be good for Trent Alexander-Arnold to have a new manager

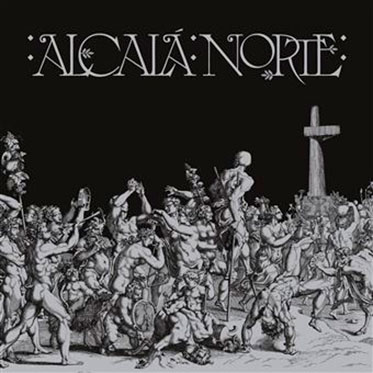

Alcalá Norte, review of his debut album of the same name (2024)

You can pretend, but you weren’t prepared for the overwhelming full-length debut of Alcala North. Normal, on

Beijing Motor Show 2024, dates and everything there is to see

Listen to the audio version of the article If in Europe car shows lose appeal year after