During the National Day, a battle between “ice” and “fire” was staged in the peripheral market. On the one hand, energy prices and inflation expectations have strengthened again; on the other hand, due to increasing global stagflation concerns, most equity assets have recently undergone various degrees of adjustment.

According to statistics, during the National Day this year, major external indexes fluctuated sharply. As of October 6, the Nikkei 225, the Korean Composite Index, and the UK FTSE 250 had all fallen by more than 2%. However, on October 7, the world’s major stock indexes “rised”, and the Hang Seng Index rose 1% during the National Day.

In contrast, during the National Day, the commodity market represented by international oil and gas prices continued to flourish. As the “king of commodities”, international crude oil futures prices continued their previous strength during the National Day, with WTI crude oil prices hitting a 7-year high. At the same time, NYMEX natural gas futures prices are also approaching the highs set in February 2014. There is a view that, affected by high energy prices, the northern hemisphere may usher in an “expensive” winter in the fourth quarter of this year.

So, will the worrying “stagflation” really come? What is the impact of the “energy crisis” on the domestic economy and the A-share market? Are cyclical stocks still worth configuring? In the past few days, the reporter of “Daily Economic News” invited a number of institutional leaders to conduct an in-depth analysis of these key issues.

Peripheral stock markets fluctuated sharply during National Day

According to statistics from Choice, during the National Day this year, major external stock indexes fluctuated sharply. As of October 6, Nikkei 225, Korea Composite Index, Korea KOSPI200, British FTSE 250, etc. have all fallen by more than 2%. However, on October 7, the world‘s major stock indexes “rised”, and the Hang Seng Index rose 1% during the National Day.

In fact, since September this year, the external market has continued to show a pattern of weakness. According to the statistics of Choice, from September 1 to October 6, 2021, Korea Composite Index, Korea KOSPI200, FTSE AIM stocks, UK FTSE 250, Switzerland SMI, Sweden OMXSPI, Germany DAX, NASDAQ 100 The cumulative decline has exceeded 5%. During the same period, only 9 of the 39 major external stock indexes achieved gains, accounting for only 23%.

According to the observation of the strategy team of CICC, during the National Day this year, overseas markets were volatile and the cycle outperformed growth. On the whole, crude oil prices hit new highs amid supply concerns, and due to the “stagflation” worries caused by the surge in crude oil and natural gas prices, US bond interest rates once climbed to a high of 1.57%, and the stock market fluctuated sharply. From the perspective of US stocks, supported by the cyclical sector, the Dow Jones and S&P 500 index slightly outperformed the growth-oriented Nasdaq index. Affected by fluctuations in overseas markets, Hong Kong stocks first fell and then rose. During the National Day period, the Hang Seng Index rose slightly by 1%. From the perspective of the sector, it was also the leading cyclical sectors such as energy, real estate and construction, raw materials, and finance, while technology, medicine, and consumption were relatively behind.

It is worth noting that according to East Asia Qianhai Securities’ statistics, the overseas inflation data released during the National Day reflects high inflation in developed economies: PCE in the United States in August was 4.26% year-on-year, the largest increase since 1991; core PCE was 3.62% year-on-year. Driven by energy prices, HICP in the Eurozone in September increased by 3.4% year-on-year, a record high since September 2008; in September, HICP increased by 0.5% month-on-month.

Regarding the extent to which the A-share market will be disturbed by the external policy environment,Li Zhan, Chief Economist of Research Department of China Merchants FundTold reporters, “We believe that the short-term impact on the domestic market is limited. There are two main reasons. First, the difference in the pace of economic recovery has led to a’policy difference’ between my country and major developed countries. Next, it is expected that my country’s policies will not be forcibly “linked” to overseas. Second, the current Sino-US interest rate spread is relatively large, and the Sino-US exchange rate is also in a comfort zone. The direction of monetary policy does not need to be adjusted immediately because of the tightening of external policies.”

(As of 22:48, October 7, Beijing time)

In addition, from historical data, the first trading day after the National Day, the rise and fall are less. By comparing the data on the market fluctuations around the National Day in the past 11 years, it is found that the characteristics of selling before the holiday and buying after the holiday are particularly obvious. The probability of the Shanghai index rising on the 5th after the holiday is 80%.

European gas sees an epic skyrocket

Compared with the sharp volatility of major external stock markets, during the National Day this year, how can the international crude oil futures price, which is the “king of commodities”, “burn”. During the National Day, WTI crude oil prices have repeatedly hit 7-year highs. , Brent crude oil prices have repeatedly hit a 3-year high. In addition, international natural gas futures prices have repeatedly hit new highs.

A

WTI crude oil prices hit a 7-year high

On October 4th, at the “OPEC+” meeting, ministers from member states approved a plan to increase production by 400,000 barrels in November, which exceeded market expectations, and oil and gas prices rose accordingly. WTI crude oil once hit a record high in 7 years, and Brent crude oil also hit a 3-year high.

(As of 22:51, October 7, Beijing time)

In this regard, the chemical team of Everbright Securities recently analyzed and pointed out that the “OPEC+” meeting maintained the original production increase plan to exceed market expectations, which is good for rising oil prices. As the demand for crude oil continues to recover, the crude oil market is in short supply. The market expected that “OPEC+” will increase production in November. The “OPEC+” meeting maintained the original production increase plan to exceed market expectations, which is good for rising oil prices. On the one hand, “OPEC+” has increased production in an orderly manner and demand continues to recover. The crude oil supply and demand pattern is good; on the other hand, the price of natural gas has continued to rise this year, which has further promoted the price increase of crude oil, which is an alternative energy source for natural gas. On October 4, Burkina Faso oil rose 1.98 US dollars, or 2.5%, to close at 81.26 US dollars per barrel, rising to the highest level since 2018.

B

Dutch natural gas futures rose nearly 10 times

The data shows that international natural gas prices have maintained an upward trend in the recent period, and the cold winter is expected to accelerate the increase in natural gas prices. On October 4, the price of NYMEX natural gas futures rose by 3.51% to $5.816 per million British heat. On October 5, the price of NYMEX natural gas futures surged 9.78% to US$6.33 per million British heat.

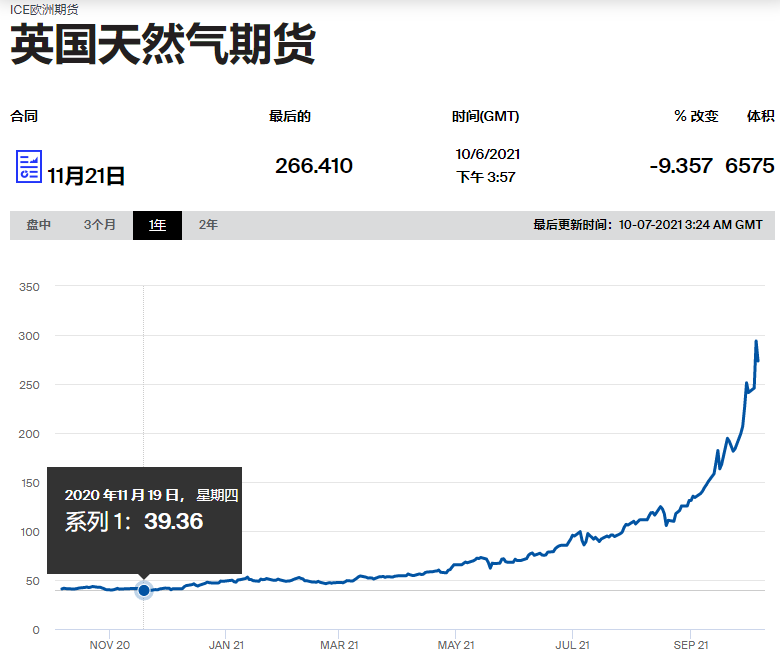

It is worth noting thatIn the past year, the TTF benchmark Dutch natural gas futures, which is regarded as the wind vane of European natural gas prices, rose nearly 10 times, and the British natural gas futures also rose sharply in the past year.

However, due to Russia’s statement that it will increase the supply of natural gas in the European market, on October 6, there was a sharp correction in international natural gas prices. On October 6, the price of NYMEX natural gas futures plummeted by 9.47%, basically reversing the gains of the previous two days.

(As of 22:51, October 7, Beijing time)

Nevertheless, the current trend that NYMEX natural gas futures prices are approaching the highs set in February 2014 has not changed. According to statistics, this year, the cumulative increase in NYMEX natural gas futures prices is close to 130%, while the cumulative increase in WTI crude oil is only about 60%.

The reporter of “Daily Business News” found in an interview that at present, some people in institutions have doubts about whether Russia can increase the supply of natural gas in the short term.

Chen Hongbin, Chief Economist and Assistant to the President of China Sea SecuritiesHe told reporters that, on the one hand, Russia’s natural gas consumption this year was relatively large, and on the other hand, because Russia’s “Beixi 2” natural gas project was sanctioned (although the “Beixi 2” project is about to be completed, it is within the EU. Still hesitating), and Russia’s existing natural gas capacity has basically reached the upper limit.

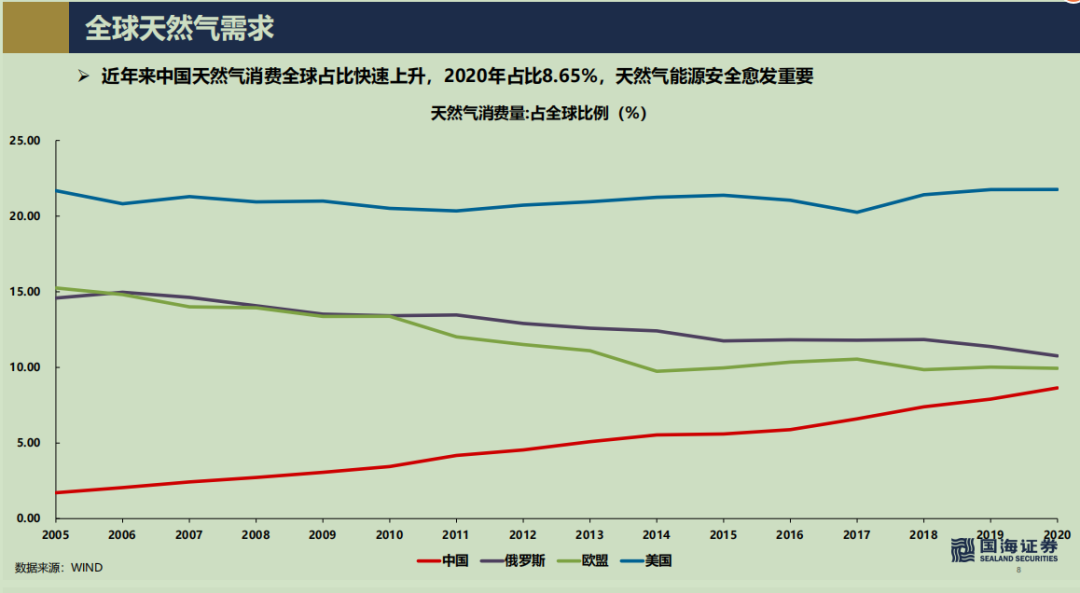

“In addition, China’s natural gas supply and demand gap this year has reached the highest level in history, and now China’s natural gas dependence on foreign countries exceeds 40%. Our natural gas imports are still mainly LNG imports. The problem with LNG lies in its supply side. Too much flexibility, there are hidden dangers in supply security for the demand side, unlike pipelines that are relatively rigid.” Chen Hongbin pointed out.

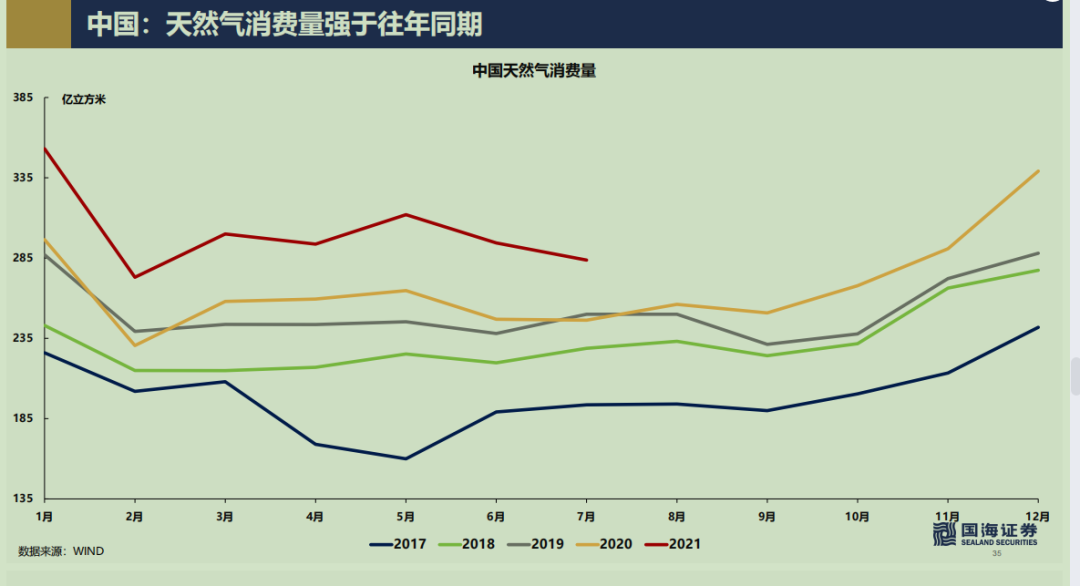

In the market, there are still some mainstream institutions that are clearly bullish on natural gas prices this winter. An analysis by the Everbright Securities Chemical Team pointed out that the increase in the cost of overseas natural gas has become an important driving force for my country’s current increase in natural gas prices. With the advent of the traditional peak season of winter, natural gas demand will further increase, the mismatch of supply and demand in the overseas natural gas industry may intensify, and the price of overseas natural gas may continue to rise. Superimposed on the mismatch of domestic natural gas supply and demand, the cold winter is expected to accelerate the rise of natural gas prices in my country.

C

Why is domestic coal in short supply?

Compared with its dependence on oil and gas imports, my country has been basically self-sufficient in coal for a long time, but this year even coal has been in short supply. In September of this year, thermal coal futures prices rose sharply by 60%.

The macro team of CICC pointed out in the latest September economic data outlook that the shortage of coal in the winter coal storage season may intensify. Prior to this in August, the Indonesian government imposed export restrictions on coal companies that did not fulfill their domestic market obligations, and global coal supply was tight. It also pushes up the price of imported coal, and in the context of safe production and carbon emission reduction, the increase in coal production capacity is slow.

In addition, in the opinion of some industry insiders, the heavy rains in Shanxi will also interfere with the supply of coal during the National Day.

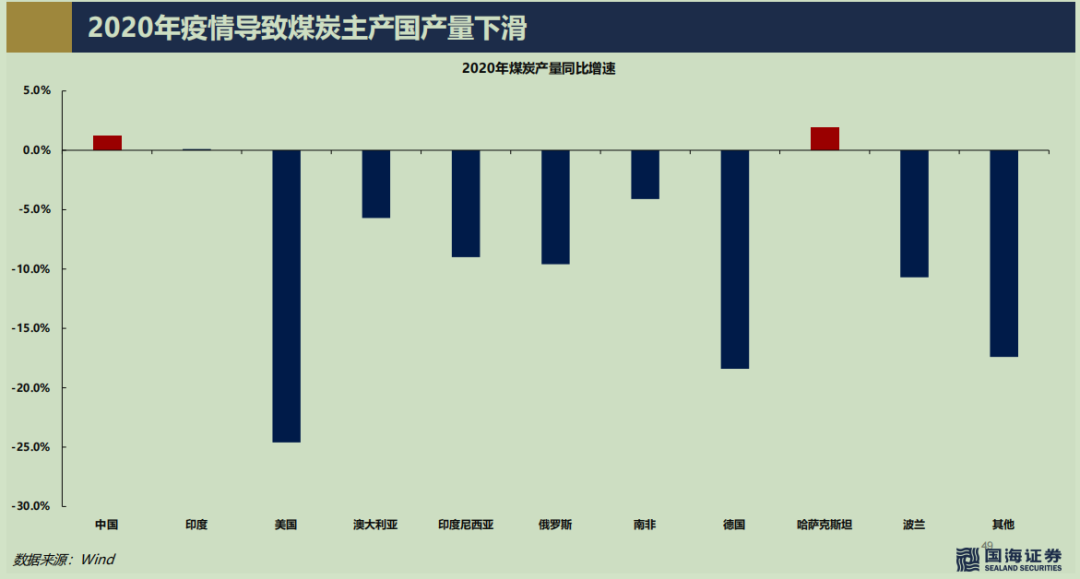

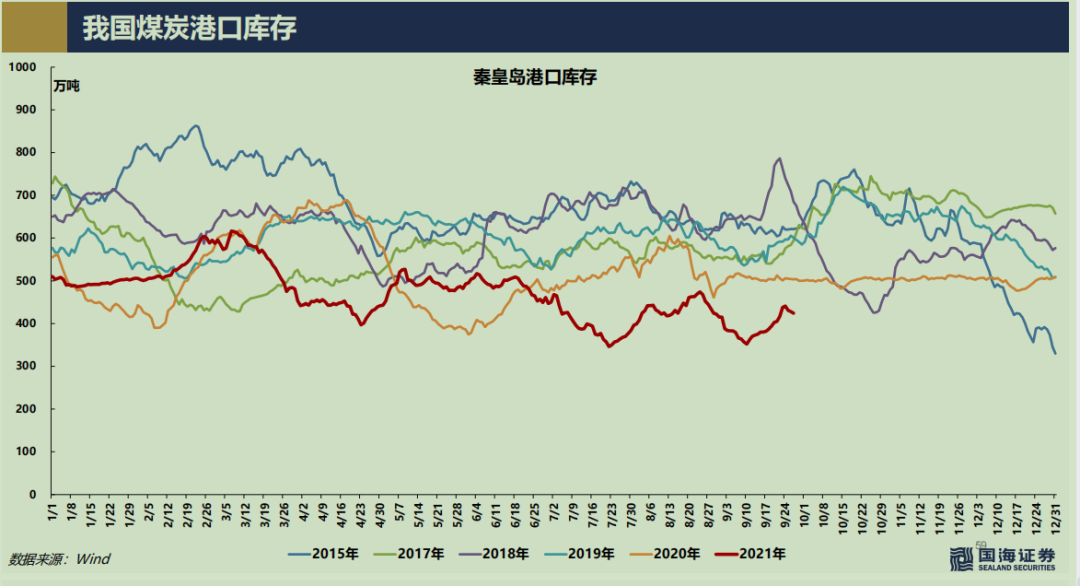

Image source: China Sea Securities

Chen Hongbin said that although domestic coal production has rebounded in August this year, the problem is that coal consumption has grown faster. From the perspective of the structure of electricity consumption this year, it is mainly because the growth rate of industrial electricity consumption far exceeds In previous years. This is mainly because the global epidemic has caused a large number of global industrial production orders to flock to China, which has led to an increase in China’s industrial electricity demand this year.

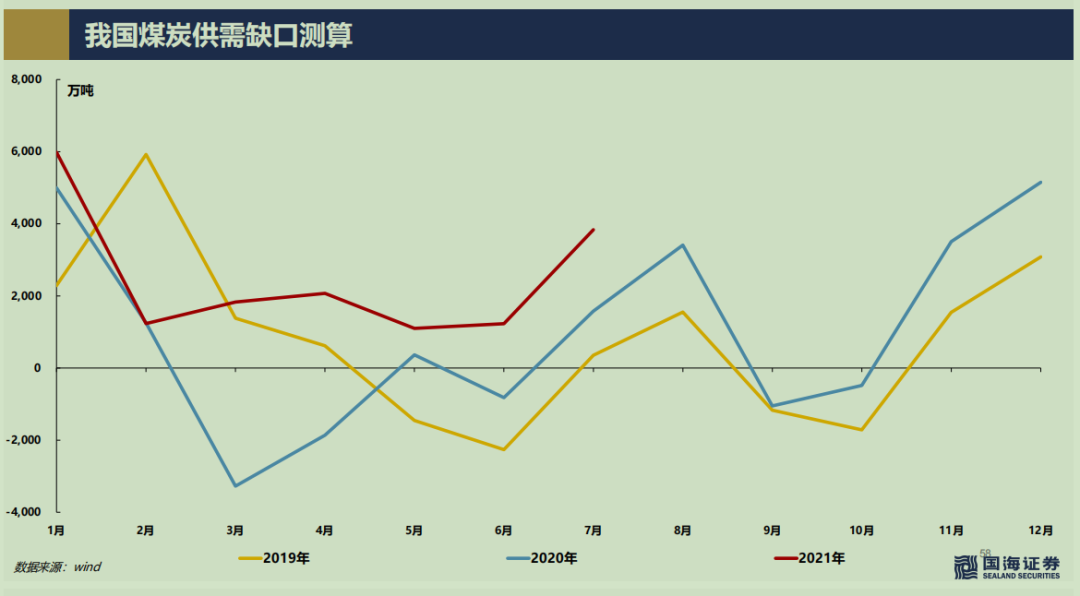

Image source: China Sea Securities

He pointed out that in this context, the current coal supply gap in my country can be described as extreme. For example, the coal inventory in the port has reached the lowest point in recent years, while the coal price has also reached the highest point in history. Power rationing and other measures have been implemented, but there is still a certain gap to make up for the current coal supply and demand gap.

“Under the current situation where demand exceeds demand, the current domestic coal capacity utilization rate is close to the peak of history. Although the current policy hopes that coal companies can expand their production capacity as soon as possible, it is still difficult in the short term because any coal company wants to expand production capacity. , Need to increase capital expenditure, but after the Yongmei Incident, the financing of coal companies has difficulties.” Chen Hongbin told reporters.

D

The BDI index continues to rise and hits a 10-year high

In addition, during the National Day, the continuous rise of the dry bulk shipping index is also worthy of attention. According to the statistics of the Huachuang Securities Delivery Team, as of October 5, the BDI index closed at 5409 points, an increase of 26% from the September average. Since the end of September, BDI has broken through and continued to hold 5,000 points, setting a new 10-year high. Among them, BCI closed at 9752, a 49% increase from the September average, which was the main driving force for BDI to rise, and it also rose 17.2% from last week.

In this regard, the Huachuang Securities Delivery Team analyzed and pointed out that in the short term, the strong performance of the Capesize freight rate of the Cape of Good Hope has driven the BDI freight index to rise sharply. In the medium term, the BDI freight rate has started its upward cycle for at least two to three years, and the freight rate may fluctuate upward within the economic range.

The Huachuang Securities Delivery Team believes that the supply cycle of “increasing freight rates-shipowner bookings increasing-supply release and freight rates falling” will be limited by shipyard berths and environmental protection constraints. It is expected that the continuity of this round of bulk operations will Stronger than in the past.

Shenwan Hongyuan’s delivery team said in its opinion recently that the recent dry bulk BDI index has continued to exceed expectations, and the global resumption of work and production next year will continue to promote the demand for dry bulk freight.

Will “stagflation” and “energy crisis” really come?

Judging from the above situation, during the National Day this year, overseas asset volatility has intensified, and the commodity market and the equity market have differentiated significantly. On the one hand, crude oil stands at US$80/barrel, leading commodities and inflation expectations to strengthen again. On the other hand, as global stagflation concerns have intensified, most of the global equity assets have recently undergone various degrees of adjustment.

According to the reporter’s observation, the word “stagflation” has become one of the focal points of recent heated discussions among major market institutions. The Guotai Junan macro team recently issued a view that the energy crisis that occurred in Texas and Europe in 2021 highlighted the pain of the transition from the old to the new energy. The sequelae of the stimulus of the epidemic is superimposed on it, and it is difficult to effectively solve the contradiction between supply and demand in the short term. The surge in global energy prices has further boosted inflation, superimposed on the slow and uneven economic recovery, and overseas economies are facing a stagflation relay, which may cause disturbances to external policies.

In an interview, Chen Hongbin, chief economist and assistant to the president of China Sea Securities, gave a detailed analysis of the reasons for the current market’s worries about “stagflation” and the future evolution of “stagflation”.

He said, “If we want to judge how long stagflation can last, we must first judge how long this round of energy shortages and energy crises will last? Because stagflation is mainly caused by the energy crisis.”

In Chen Hongbin’s view, this round of energy crisis is mainly caused by the supply and demand of natural gas and coal. In contrast, the supply and demand of oil cannot be regarded as a crisis.andThe main reasons for the current global natural gas supply problems areFour o’clock:

Image source: China Sea Securities

First of all, the most important factor is the epidemic. The epidemic has had a relatively large impact on the global energy supply, but it has not so much impact on demand. For example, the world’s major natural gas suppliers have experienced a decline in production this year.

Second, in the context of advancing carbon neutrality, the global preference for energy is collectively inclined to renewable energy such as wind power, hydropower, photovoltaics, and clean energy such as natural gas. However, the popularization of renewable energy requires the construction of long-term energy infrastructure. At present, natural gas is the easiest way to achieve carbon neutrality standards on the short end. This has also led to natural gas becoming a “public lover” in the energy field.

Third, due to the tight global shipping capacity, ocean shipping prices have repeatedly hit new highs.

Image source: China Sea Securities

Fourth, in the context of the global spread of the epidemic, the global supply chain is more dependent on China. And we did not have such plans and preparations before, so this will lead to a sudden increase of a large amount of industrial production capacity in the short-end. Corresponds to the energy consumption of each share, and the energy consumption of each share corresponds to the energy infrastructure of each share, and the infrastructure also corresponds to the supply of energy sources. The construction cycle of energy infrastructure is very long, which is also a deeper reason for this wave of energy tension.

Regarding the “sustainability” of the current global energy shortage, Chen Hongbin analyzed that it will be difficult to alleviate in the short term, and it may continue for a long time. It is expected that the northern hemisphere will usher in an “expensive winter” in the fourth quarter of this year.

Yi Bin, chief strategy analyst of Qianhai East Asia, told reporters that looking forward to the fourth quarter, as the northern hemisphere is about to usher in the peak of coal and electricity consumption in the winter, the shortage of petrochemicals will be difficult to resolve in the short term. The supply and demand gaps and strong energy prices brought about by the economic restart will continue to drive overseas inflation to a high level. At the same time, energy supply shortages and high prices will also drag industrial production and economic growth, and the global economy is facing similar stagflation pressures. At the same time, he pointed out that global liquidity expectations continue to be tightened. “On October 6, the Bank of New Zealand announced that it would raise the benchmark interest rate by 25 basis points to 0.5%, and stated that it will raise interest rates further next year to curb inflation and continue to rise. The central banks of South Korea and Norway have also raised interest rates before. Both the European Central Bank and the Federal Reserve have issued hawkish signals. The pressure of rising prices will further promote the normalization of monetary policies in major economies. For the equity market, The stagflation-like environment and the rise in interest rate levels are fundamentally different from the market environment at the end of last year. It is difficult for the market to replicate the re-inflation transactions at that time, and risks in overseas markets still need to be further released.”

As for,Will the energy shortage affect the domestic market? Will it affect my country’s economy? Chen Hongbin talked about his three points of thinking:

“First, we must first consider that high energy prices have an impact on each sector. Second, we must consider that our country’s policies will surely protect the economy and the people’s livelihood, and will definitely fight global problems. , But how many cards do we have and which policies will be introduced? This is what we must prejudge in advance when we do macro research. It is not just the issue of “dual control” now. Third, although we are in a global industry Midstream, but because the global industrial chain is very scarce, we have a say in transferring inflation. Therefore, we can choose to transfer inflation to the lower end, or even the possibility of transferring this inflation to the upper end. If we can effectively transfer inflation The transfer of inflationary pressure will help our country maintain the normal operation of its own economy. From our point of view, the current overall central policy, whether it is from the central bank’s monetary policy, or the corresponding trade policy and fiscal policy, has actually made a lot of efforts. Adjustments are expected in the next quarter, we believe that more policies will be introduced.”

Regarding the widespread “energy crisis” and “stagflation” concerns caused by the recent global price increases of oil, gas, and electricity, some institutions believe that although the crisis may not be quickly resolved in the short term, the market does not need to over-interpret this. In addition, the domestic and foreign markets need to be treated differently.

The strategy team of CICC recently pointed out that the reasons behind the rise in these energy prices are more comprehensive, and may be affected by multiple factors such as the epidemic, weather, geographic relations, and carbon reduction measures.These factors mainly come from the supply side, and are fundamentally different from the continuous “energy crisis” and long-term “stagflation” caused by strong demand and supply interruption in the 1970s.From China’s point of view, the intensified lack of electricity and coal in the third quarter was also caused by supply-side factors. However, on the eve of the National Day, the National Development and Reform Commission has begun to organize meetings to deploy energy and power guarantees, and the SASAC also emphasized that it will guarantee the supply. As an assessment requirement for energy companies, the media reported that coal imports have also been loosened. These have provided a guarantee for China’s coal and electricity supply in the fourth quarter and the first half of next year.

Yi Bin told reporters that since the domestic market, both commodity prices and monetary policy are expected to be revised earlier than overseas markets, the direct impact is relatively smaller than overseas markets.Macroeconomic growth rate returned to normal in the fourth quarterIn the context of the background, the advancement of monetary policy this year will be significantly ahead, and the fourth quarter of credit and local debt issuance are expected to show more than seasonal expansion.Following the comprehensive reduction of the RRR on July 15, the expected easing of the credit policy gradually fermented. On August 23, the central bank’s monetary and credit situation analysis symposium pointed out that “enhancing the stability of total credit growth” and “promoting the decline of real loan interest rates”;The third quarterly regular meeting of the Monetary Policy Committee of the Central Bank again mentioned “enhancing the stability of total credit growth.”On the other hand, the abnormal fluctuations in earnings growth caused by the epidemic disturbance have gradually subsided, and the predictability of future earnings has been greatly enhanced. This will also promote the market’s long-term growth in the future after the first financial reporting season after the normalization of the economy. Make new predictions.In addition, as China-US trade negotiations gradually return to the right track, superimposing the G20 summit and the Global Climate Conference at the end of October will further enhance the risk appetite of the domestic market.

How long will the pressure on this round of global stagflation last? Li Zhan, chief economist of the Research Department of China Merchants Fund, said in an interview with reporters,In the short term, the pressure of stagflation in the fourth quarter is still relatively high, but it is expected that after the cold winter peak season in the northern hemisphere, the energy crisis at home and abroad will be partially alleviated. The phased end of the stagflation pattern may appear after the first quarter of next year. To completely eliminate the panic, you need to wait for two signals, One is the rapid increase in the proportion of renewable energy power supply, and the marginal adjustment of the pace of carbon neutral policies. Second, developed economies have stepped into the channel of monetary policy tightening, and global liquidity has brought restraint on commodity prices.

Li Zhan reminded that in the medium and long term, under the leadership of carbon neutrality, the energy supply and demand contradiction in the energy system reform will still be large, and the frequency of energy crises will be higher. At the same time, the contradiction between the supply and demand of new energy-related metals will increase, and the pressure of stagflation may be increased. It will last a long time. First, traditional energy is subject to carbon-neutral policies and actively shrinks production capacity or undergoes transformation, which increases the contradiction between supply and demand. Since 2021, energy companies such as Chevron, EXXON, and Shell have increased their investment in clean energy production or sold oil assets, which will affect the global energy supply capacity . Even if the production capacity is guaranteed, high-carbon energy will have to pay a high premium to achieve carbon neutrality. Second, new energy power generation is greatly affected by weather and other factors, which magnifies the vulnerability of the energy supply chain. In the context of the transition between old and new energy, we believe that the frequency of “energy crises” will continue to increase significantly in the future. Third, building a new energy system and achieving carbon neutrality in other industries will drive the demand for bulk commodities, especially related metals. According to estimates by the International Energy Agency (IEA), if new energy-related metals such as copper, lithium, cobalt, nickel, and rare earths are achieved by 2050, their overall demand will expand six times. In the mid-to-long term, mines are faced with insufficient production capacity and an enlarged supply gap.

Is there still a chance for the fourth quarter cycle sector?

Since the beginning of this year, the market performance of cyclical industries such as non-ferrous metals, coal, chemical, steel, etc. is really impressive. However, most of the cyclical industries in the past September have risen and fallen, and some industries have also seen relatively large declines. Some investors can’t help asking, is this cyclical stock market peaking?

Judging from the October A strategic outlook issued by major brokerages, institutions currently have large differences on the performance of cyclical stocks in October and even the entire fourth quarter.

The securities firms that support the cyclical stocks in the future include securities firms such as Kaiyuan Securities, while the securities firms that believe that the cyclical sector may be under pressure in the fourth quarter include Industrial Securities, CICC and other institutions.

Mu Yiling, chief strategy analyst at Kaiyuan Securities, recently analyzed and pointed out that the recent high trading enthusiasm and high volatility of cyclical stocks may indeed mean the risk of short-term adjustment, but the market retracement still exceeds our expectations. Analyze the reasons for market adjustments: Affected by the tightening of the “dual control of energy consumption” policy, the market’s concerns about the capacity utilization rate of cyclical stocks and the suppression of the demand side continue to intensify; U.S. Treasury interest rates soared again overnight, the U.S. stock market plummeted, and risky assets The retracement also suppressed the larger A-share gains in the previous period. Compared with the logical deduction of the above-mentioned fundamentals, the signs that the market is dominated by risk sentiment to a certain extent are more obvious. It is worth mentioning that the current trading structure of the cyclical sector is still relatively stable: long-term funds represented by the northward capital allocation plate are still flowing in, which proves that global investors are still optimistic about the main line of “carbon neutrality” Express your stance. Mou Yiling said that investors can hold cyclical stocks for the holiday (National Day), and the holdings for the holiday are: crude oil, non-ferrous metals, real estate, banking, steel, cement and coal.

Although Industrial Securities still included some cyclical stocks in its October gold stock portfolio, the Industrial Securities strategy team still expressed concerns about the performance of cyclical stocks in the fourth quarter. Industrial Securities pointed out in its strategic viewpoints recently that there will be no systemic risks in the market in the next stage, and positions are not the main contradiction, but structure is still the supremacy. Under the stock game pattern, funds are surging back and forth in various sectors, bringing about the rapid rotation, switching, and “seesaw” effect of this year’s market style. At present, funds have begun to shift from the cyclical resource product sector to looking for new offensive directions. After experiencing a wave of trend increases brought about by the increasing supply and demand gap, with the rapid decline of the domestic economy and the demand side of the resource sector will gradually decline, the fourth quarter, especially the mid-to-late cyclical stock market, may face more obvious adjustments and differentiation. As a result, funds began to look for new offensive directions from the cycle resource product sector. The Industrial Securities strategy team expects that the follow-up market style will be more balanced, focusing on three directions: technological innovation growth, consumption, and new infrastructure.

The strategy team of CICC also pointed out the risks of cyclical stocks in the latest view. “The core contradiction of China’s policy adjustment has shifted from focusing on structural issues such as dual-carbon energy conservation to protecting people’s livelihood and stabilizing the economy. In this context Under the circumstances, commodity prices that are more affected by China’s domestic supply and demand may fluctuate more. We continue to remind the stock market of the risk of stock price fluctuations in some relevant cyclical sectors of the stock market.”

Yi Bin, chief strategy analyst of Qianhai East Asia, said in an interview with reporters that for cyclical products, under the pattern of weak supply and demand, the future needs to pay attention to the marginal changes in policies. “As the macroeconomic growth rate returns to normal in the fourth quarter The weakening of domestic commodity demand will be a high probability event; on the other hand, with the arrival of the northern winter heating season, the pressure of high coal prices on residential heating costs will continue to increase, which will also force related industrial policies to show marginal changes.”

Based on the relevant policies recently issued by various departments, he analyzed and pointed out that the recent energy supply policy continues to advance, and the pressure on domestic energy prices is expected to ease. On September 29, the National Development and Reform Commission responded to the reporter’s response to the work of ensuring energy supply for this winter and spring: In response to the tight coal supply and demand this year, six major measures will be taken simultaneously to ensure the use of coal this winter and the next spring and the winter demand of residents. On the same day, Shanxi and 14 provinces, autonomous regions and municipalities signed a medium- and long-term coal supply guarantee contract for the fourth quarter. On September 30, the “Notice of China Coal Industry Association and China Coal Transportation and Marketing Association on Further Doing a Good Job in the Work of Protecting Electricity and Coal” was issued. The quarterly cash should be fulfilled at no less than 1/4 of the annual contract volume, and the performance rate of the signed long-term power coal agreement contract should reach or exceed 100% in the fourth quarter. On October 5, the China Banking and Insurance Regulatory Commission issued the “Notice Concerning Matters Concerning the Normal Production of the Coal and Electricity Industry and Orderly Circulation of the Commodity Market to Ensure the Stable Operation of the Economy”. The notice clearly stated that the focus is on ensuring the reasonable financing needs of coal-fired power, coal, steel and other production enterprises. . On the same day, the National Railway Group stated that it is making every effort to ensure the transportation of electricity and coal this winter and next spring. We will make every effort to ensure coal storage in power plants for more than 7 days, increase the intensity of coal loading in Northeast China, and start the work of ensuring coal supply for power generation and heating in winter.

“On the other hand, for the A-share cyclical sector, historically, the phased peak is often earlier than the commodity price. Even if commodity prices continue to rise further in the fourth quarter, it does not mean that the traditional cyclical sector is still There is room for further upside. Take the cyclical industry market driven by the supply-side structural reform in 2017 as an example. At that time, the price of cyclical products continued to rise until September 2017, but the relative index of neutral cyclical style continued to be weaker than that after May. The market, so investors should not be too optimistic.” Yi Bin frankly told reporters.

Looking forward to the A-share market in the fourth quarter, Yi Bin believes that “as the macroeconomic growth rate returns to normal, the monetary environment tends to be loose, commercial bank credit is accelerated, and the macro liquidity turning point is expected to appear in the middle of the fourth quarter. From the perspective of corporate profitability, After the third quarterly report, the market is expected to form a new consensus on the medium-term profit trend of the growth sector. From the perspective of risk appetite, Sino-US trade negotiations are gradually returning to the right track. The G20 summit in late October and the United Nations Climate Change Conference in early November are expected to promote market risks. An important catalyst for sentiment improvement. From a market perspective, with the relatively fully adjusted consumer sector valuation switch market unfolding as scheduled, and the “winter turbulence” market on the main track of future growth, the market center is expected to move up further in the fourth quarter. “

reporter:Wang Haiyun

Editor: Wu Yongjiu

Vision: Zou Li

typesetting:Wu Yongjiu Ma Yuan