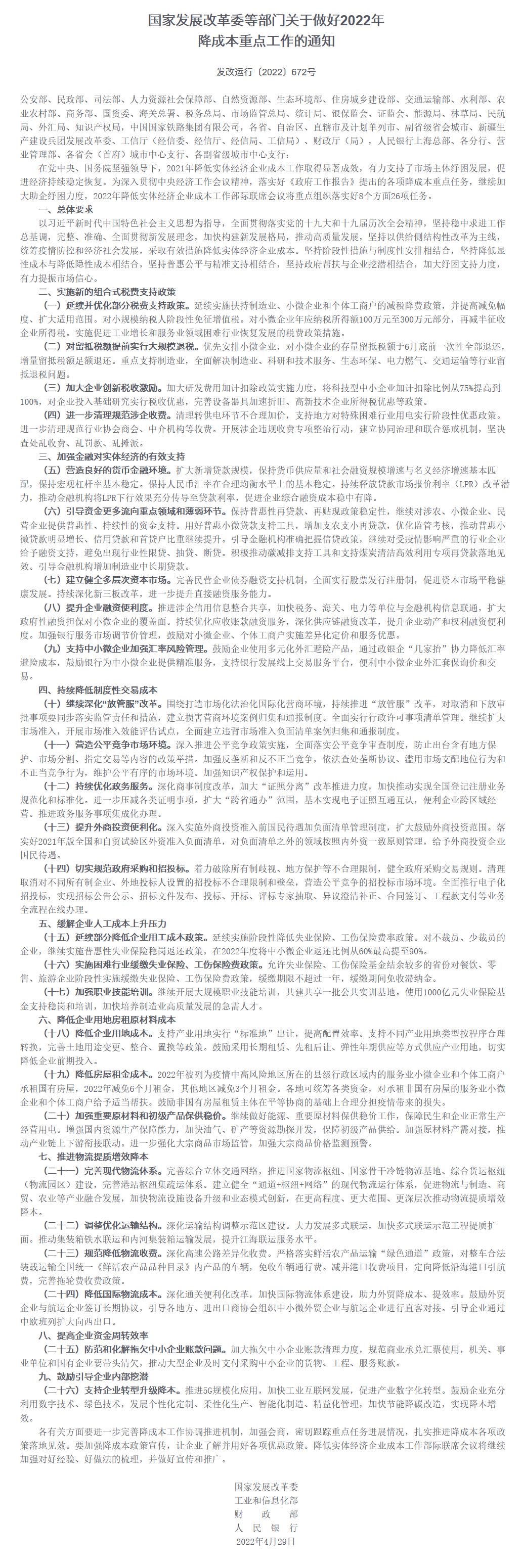

On May 10, the National Development and Reform Commission and other four departments jointly issued the “Notice on Doing a Good Job in Key Cost Reduction in 2022” (hereinafter referred to as the “Notice”), requiring the strengthening of financial support for the real economy.

The “Notice” makes it clear that a sound monetary and financial environment will be created. Expand the scale of new loans, keep the growth rate of money supply and social financing scale basically in line with the nominal economic growth rate, and keep the macro leverage ratio basically stable. Maintain the basic stability of the RMB exchange rate at a reasonable and balanced level. Continue to release the potential of the loan market quoted rate (LPR) reform, promote financial institutions to fully transmit the downward effect of LPR to loan interest rates, and promote the stability of the comprehensive financing cost of enterprises.

At the same time, guide more funds to flow to key areas and weak links. Maintain the stability of inclusive re-lending and re-discount policies, and continue to provide inclusive and continuous financial support to agriculture-related, small and micro enterprises, and private enterprises. Make good use of inclusive small and micro loan support tools, increase re-lending to support agriculture and small and medium-sized enterprises, optimize supervision and assessment, promote the significant growth of inclusive small and micro loans, and continue to increase the proportion of credit loans and first-time lenders. Guide financial institutions to accurately grasp credit policies, continue to provide financing support to enterprises in industries seriously affected by the epidemic, and avoid industry-specific loan restrictions, loan withdrawals, and loan terminations. Actively promoting the implementation of carbon emission reduction support tools and special re-lending to support the clean and efficient utilization of coal has been effective. Guide financial institutions to increase medium and long-term loans to manufacturing.

The “Notice” also proposes to establish and improve a multi-level capital market. Improve the bond financing support mechanism for private enterprises, fully implement the stock issuance registration system, and promote the stable and healthy development of the capital market. We will continue to deepen the reform of the New Third Board and further enhance our direct financing service capabilities.