recently,Ningde era(300750) launched a fixed increase financing plan of up to 58.2 billion yuan to raise market attention once again. If the fundraising can be successfully completed, it will set the largest private company’s fixed growth in A shares.

Judging from the performance of the secondary market on August 13,Ningde eraIt opened sharply lower by 4%, then surged higher by more than 5%, and finally closed up by 0.01%. The day’s turnover reached a record high of 14.09 billion yuan, with an amplitude close to 10%. Other lithium battery industry chain stocks also collectively rose and fell. The Salt Lake Lithium Extraction Index rose by nearly 7% during the intraday session, and finally closed up 2%.

according toNingde eraThe first quarterly report shows that on its bookscurrencyThere are still 71.677 billion in funds, 2020 and 2021Q1 operating cash flows of 18,11 billion yuan, and the unused funds raised in the second quarter amounted to 6.8 billion yuan.

“Leading” Ningde era is really short of money? How long can the industry’s “throne” sit after the funds are handed in?

The total amount of funds raised for two consecutive times has reached nearly 80 billion

In a nutshell, the fundraising purpose of CATL is “pure”-expansion, expansion, or expansion.

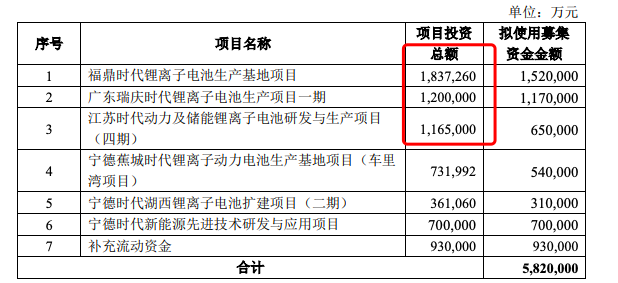

According to its fixed increase plan, after deducting the issuance costs, the funds are all intended to be used to expand the production capacity of lithium batteries, including 6 projects and supplementary working capital.

The capacity of this financing expansion includes a total of 137GWh of power battery capacity and 30GWh of energy storage cabinets, costing 41.9 billion.

Among them, three projects have invested more than 10 billion yuan, namely Fuding Times Lithium-ion Battery Production Base (hereinafter referred to as “Fuding Times”) and Guangdong Ruiqing Times Lithium-ion Battery Production Project Phase I (hereinafter referred to as “Ruiqing Times”) ), Jiangsu Times Power and Energy Storage Li-ion Battery R&D and Production Project (Phase 4) (hereinafter referred to as “Jiangsu Times”).

In addition, the first four projects are the early stageannouncementProjects, some projects such as Cheliwan have started construction. December 28, 2020Company AnnouncementSaid that it plans to invest in the construction of the Fuding Times production base, with a total project investment of no more than 17 billion yuan. In other words, CATL added another 1.3 billion yuan to this project.

It is estimated that after construction, Fuding Times will add about 60GWh of lithium-ion battery annual capacity; Ruiqing Times will add about 30GWh of lithium-ion battery annual capacity, Jiangsu Times will add about 30GWh of lithium-ion battery annual capacity, Cheliwan project 15GWh, Huxi II Phase 2GWh, totaling 137GWh.

The newly added project this time is the Huxi Expansion Project (Phase II), which plans to add a 30GWh energy storage cabinet project. The energy storage cabinet is the battery cell unit in the energy storage system, including energy storage batteries, liquid cooling and fire protection systems, and cooperates with partners to form a complete energy storage system after PCS and integration.

Among them, the Ruiqing Times Project is located in Zhaoqing City, Guangdong Province, which is alsoXiaopeng MotorsThe location of the production base. The project’s internal rate of return is 16.14% (after tax), and the total investment payback period is 6.16 years (after tax).

In addition, 9.3 billion is used to supplement working capital.

Combined with the previous planning, the total planned production capacity of CATL has exceeded 650GWh, which is expected to be completed in the next 2-3 years. CATL’s production target by 2025 has been raised from 529GWh to 606GWh. It can be seen that this expansion is relatively strong.

According to public information, the company’s total IPO funds raised in 2018 was 5.462 billion.

In 2020, the company raised 19.6 billion yuan through non-public issuance of stocks. The raised funds will be mainly used for the Ningde Times Hubei lithium-ion battery expansion project, Times Power (Phase 3), Sichuan Times Power Battery Project Phase I, and electricity Chemical energy storage frontier technology reserves research and development projects and supplementary working capital. The construction period of the investment project is three years, and the planned total production capacity is 52Gwh, which is expected to double the previous production capacity.

One year later, CATL stated that as of June 30, 2021, the company’s 19.6 billion yuan has already used 13.2 billion, and the 6.8 billion raised funds (including interest) have not been used.6.5 billion of which was used for purchasesBankStructured deposits and large deposit certificates are not yet due and will be used for subsequent project payments.

According to its announcement, from August 2020 to March 2021, CATL has intensively released 8 expansion projects with a total investment of 86.5 billion yuan.As of the end of the first quarter of this year, the company’s ending cash and cash equivalent balance was 65.79 billion yuan.

In May 2020, Ningde Times stated that the scope of use of the funds will include a new era power project (phase four), with a total investment of 11.65 billion yuan, of which 3.8 billion yuan will be used to raise funds, accounting for 19.37% of the funds raised in the non-public offering in 2020.

Let’s look at the transcript of the Ningde era.

According to its 2020 annual report, during the reporting period, power battery system sales were the company’s main source of income.During the reporting period, the company’s power battery system sales revenue was 39.426 billion yuan, accounting forOperating incomeOf 78.35%.

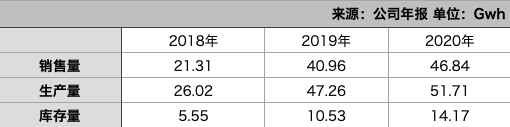

In 2020, the company achieved 46.84GWh of lithium-ion battery sales, a year-on-year increase of 14.36%, of which the sales of power battery systems were 44.45GWh, a year-on-year increase of 10.43%.

From 2018 to 2020, the company’s power battery system sales were 21.31GWh, 40.96GWh, 46.84GWh, the production volume was 26.02GWh, 47.26GWh, 51.71GWh, and the inventory was 5.55GWh, 10.53GWh, and 14.17GWh.

Among them, the sales volume growth rate was 79.83%, 92.21%, 14.35%, the production volume growth rate was 101.55%, 81.63%, 9.42%, and the inventory growth rate was 308.09%, 89.73%, and 34.57%.

In addition, the capacity utilization rate in 2019 and 2020 is 89.17% and 74.83%, respectively, showing a downward trend.

It can be seen that the sales of its power battery system have not yet achieved substantial growth in 2020. Excluding the impact of the epidemic, sales growth has continued to slow down, and capacity utilization has shown a downward trend, which may be due to the fact that the projects funded and constructed by it have not yet played a role.

Therefore, can the fundraising and production expansion of CATL really be digested by the market?

An “arms match” with LG

It is undeniable that the current new energy industry is unprecedentedly hot. CATL’s capacity expansion this time will help the company seize a larger market share in the energy storage market.

According to open source securities in MayResearch reportshow,After July this year, the demand for new energy vehicles will gradually rise. According to previous data from the China Automobile Association, it is estimated that domestic new energy vehicle sales will reach 2.497 million in 2021, an increase of 93.97% year-on-year; the corresponding domestic demand for power batteries is 124.85GWh, an increase of 90.1% year-on-year.

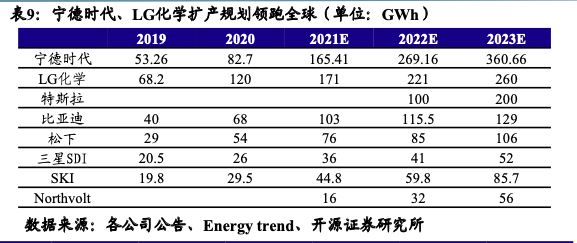

In the first half of 2021, CATL’s market share is 25.60%, ranking first in the world, and LG Chem’s market share is 24.05%, ranking second in the world, but the gap between the two is relatively small.

On the whole, LG Chem is relatively large in terms of both the scale of lithium battery business revenue and the total revenue scale, and the gap between the revenue of the lithium battery business of CATL and LG Chem has a tendency to widen.

In terms of market share, according to the data on the installed capacity of power lithium batteries, LG Chem’s market share has risen relatively rapidly, rising by nearly 12 percentage points in one and a half years, but the market share of CATL has dropped by 2.44 percentage points. .

In terms of revenue, from 2018 to 2020, both LG Chem and CATL’s lithium battery business revenues have risen steadily. In 2020, LG Chem’s lithium battery business revenue will be 73.9 billion yuan, with a total revenue of 173.235 billion yuan; CATL Lithium battery business revenue was 41.369 billion yuan, with a total revenue of 50.319 billion yuan.

From the perspective of lithium battery shipments, from 2018 to 2020, both LG Chem and CATL’s shipments have grown steadily. Among them, LG Chem’s growth rate is relatively fast, with an increase of 163.8% in two years, and CATL’s growth of 119.7 %. In 2020, the shipments of LG Chem and CATL will be 67Gwh and 46.8Gwh respectively.

From the perspective of lithium battery prices, LG Chem’s lithium battery prices are relatively high. From 2018 to 2020, the prices of LG Chem and CATL have steadily declined. In 2020, the price of LG Chem’s lithium batteries will be 11.03 yuan/wh. The battery price is 8.83 yuan/wh.

(The picture shows the research report data in May)

The Ningde era’s fund-raising expansion may be a measure of the development of LG Chem, an old rival.

There are giants besides “giants”. Currently, the leading companies operating in China’s lithium battery industry are Ningde Times,BYD、Guoxuan Hi-Tech. In 2020, the lithium battery shipments of the three companies will account for 70.1% of China’s total.

According to the certification data of China Automotive Research Institute, the total installed capacity of domestic power batteries in 2020 is 63.6GWh, an increase of 2% year-on-year, of which the company’s installed capacity is 31.9GWh, with a market share of 50%.BYD, AVIC lithium battery,Guoxuan Hi-Tech、Yiwei Lithium EnergyThen ranked 2 to 5 with 16.8%, 6.8%, 5.5%, and 2.5% respectively.

according toBYDAccording to the goal plan of 2021-2022, the total production capacity of batteries including “blade batteries” will reach 75GWh and 100GWh respectively.

According to the results of Tianyan’s query, on August 6, Yancheng Fudi Battery Co., Ltd. was established. Equity penetration shows that the company is 100% controlled by Fordy Industrial Co., Ltd., which is a wholly-owned subsidiary of BYD. So far, BYD has established or is building power battery production bases in Huizhou, Shenzhen, Xining, Qinghai, Bishan, Chongqing, Xi’an, Shaanxi, Guiyang, Guiyang, Bengbu, Changchun, and Nanchang, Jiangxi.

And AVIC lithium battery,Yiwei Lithium EnergyCompanies in the second tier are also accelerating their efforts to seize market share.

August 9,Yiwei Lithium EnergyIssue an announcement stating that it hasGrammySigned the “Memorandum of Cooperation on the Directional Recycling Supply of 10,000 Tons of Recycled Nickel Products”.The memorandum proposes that Yiwei Lithium will provide scrap nickel-containing power batteries and battery waste toGrammy, Since 2024,GrammyIt will supply Yiwei Lithium Energy with more than 10,000 tons of recycled nickel products (including nickel products such as nickel sulfate, ternary precursors and ternary materials) each year.This shows that by regenerating nickel, to a certain extentGo to the meetingReduce the production cost of Yiwei lithium battery.

On August 10, AVIC Lithium officially stated that the company signed an investment agreement with Hefei on the same day to build a new power battery and energy storage battery industrial base with an annual production capacity of 50GWh. At present, the battery production bases where AVIC Lithium has achieved mass production are located in Luoyang, Henan, Changzhou, Jiangsu and Xiamen, Fujian. The current production capacity is about 16GWh. The Hefei plant is the fifth battery expansion project officially announced by AVIC Lithium this year. The planned annual production capacity of the five projects will reach 175GWh.

Costs and prospects, who has the last laugh

The last highlight of the capital increase plan is “lithium.” At present, in the power battery market, the focus of controversy is whether the lithium iron phosphate battery or the ternary lithium battery is the focus of controversy.

Among them, lithium iron phosphate batteries have low cost, stable material structure, and higher safety, but are relatively poor in energy density, charge and discharge power, and volume; while ternary lithium batteries have higher energy density and smaller volume, which corresponds to The cost is high, and the safety is also lacking, and it is easy to cause spontaneous combustion.

According to data from the China Automotive Power Battery Industry Innovation Alliance, in July, the number of lithium iron phosphate batteries installed during the year surpassed that of ternary batteries for the first time.

According to detailed data, in July, the installed capacity of power batteries was 11.3GWh, an increase of 125.0% year-on-year and 1.7% month-on-month; the installed capacity of ternary batteries was 5.5GWh, an increase of 67.5% year-on-year, and a decrease of 8.2% month-on-month, accounting for 48.5%; phosphoric acid The iron-lithium loading volume was 5.8GWh, a year-on-year increase of 235.5% and a month-on-month increase of 13.4%, accounting for 51.5%.

Although all belong to the “lithium” camp, it is worth noting that at the end of March 2020, BYD’s “blade battery” has attracted market attention as soon as it was launched.

The “blade battery” is a lithium iron phosphate battery that overcomes the biggest shortcoming of the lithium iron phosphate battery by compressing its volume: insufficient energy density. The blade battery has greatly improved the space utilization rate, and the volumetric energy density has increased by more than 50%.

In August, some media reported that BYD’s “blade battery” will be released in the second quarter of next year.TeslaSupply.Currently equipped with “blade batteries”TeslaThe model has entered the C-sample testing stage, and there is also news that the first model of the two cooperation may be ModelY.

The above news has not been confirmed by both parties, it is a fact that BYD is actively expanding the production of “blade batteries”.

August 3, byBYD sharesWuwei Fudi Battery Co., Ltd., a wholly-owned subsidiary of Fudi Industrial Co., Ltd., is located in Anhui Wuwei with a registered capital of 50 million yuan. Its business scope includes battery manufacturing, battery sales, and new material technology research and development. It is BYD One of the layouts in the field of power batteries.

Due to the low cost of lithium iron phosphate and the upstream price increase of ternary lithium batteries, lithium iron carbonate batteries may be able to win a line of life in terms of cost.

However, from the perspective of the single GWh cost of the Ningde era power battery project, there is no obvious cost advantage. 4 The Fuding era, which has the lowest GWh per project, also has a cost of 310 million yuan. The Ruiqing era and the Jiangsu era have costs of 400 million and 390 million yuan respectively.

According to estimates, the previous two phases of Yiwei Lithium’s lithium iron phosphate battery project in Huizhou are expected to invest 4.9 billion yuan to reach a production capacity of 20GWh, with a total cost of 250 million yuan per GWh. Even if the cost of ternary lithium is higher, the cost per GWh is about 300 million yuan.

In addition, in the power battery market where lithium batteries dominate the world, it still faces problems such as low lithium raw material reserves and difficult mining. At present, the research and development of graphene, hydrogen fuel and other batteries have also made breakthroughs. Many technical routes are developing rapidly. The advantages and disadvantages of technologies are declining, and it is difficult to see the competition of routes. The future energy storage competition is not limited to the above-mentioned technologies, and the power battery technology may have to face a longer period of time.

At the end of July, CATL announced that it would launch the first-generation sodium-ion battery, claiming that it will charge 80% in 15 minutes, and the battery will not decay at minus 20 degrees.

Ningde Times stated that at present, the Ningde Times has initiated the industrialization of sodium-ion batteries, and a basic industrial chain will be formed in 2023. The energy density research and development goal of the next generation sodium ion battery is 200Wh/kg or more. The sodium-ion battery manufacturing process can be compatible with lithium-ion battery production equipment and processes, and the production line can be quickly switched to complete the rapid layout of production capacity.

But what I have to say is that the 40 billion expansion of production this time has nothing to do with “sodium”. Perhaps in the next step, the Ningde era still has to ask for money.

As of today’s close, CATL opened at 485 yuan per share and closed at 480 yuan per share, an increase of 0.63%.

(Source: CDC Finance)

.