In the evening of June 4,MidlandThe Reserve Bank released the much-watched employment data.

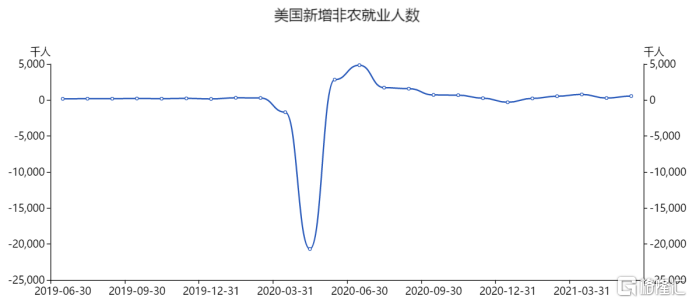

Data Display,The number of non-agricultural employment in the United States increased by 559,000 in May, an estimated increase of 674,000, with the previous value increasing by 266,000; the unemployment rate in May was 5.8%, the lowest since March last year, estimated at 5.9%, and the previous value was 6.1 %。

Stimulated by this news, the three major US stock index futures rose rapidly before the market.NasdaqThe 100 index futures turned red.

The employment data in May was not as good as expected, which surprised the market. At the same time, it greatly relieved that investors were worried.MidlandThe reserve reduction plan can be postponed again.

1. The economy recovers beyond expectations, and the unemployment rate has improved substantially

In the past few months, Powell and Yellen’s repeated exposures and the back and forth tests of US stocks have all illustrated a problem:What the market is trading right now isMidlandThe distance of the storage tightening liquidity window。

The Fed’s attitude has also become clear, and it has always anchored its policy framework at two points-Economic recovery, employment.Before these two data return to the pre-epidemic level, loosecurrencyThe possibility of sudden narrowing of the environment is extremely small.

So the situation presented is very interesting,Before the economic employment data came out, the market fell respectfully, Investors are afraid of accidents, which will then evolve into a game between “prisoners”, so they avoid risks in advance. If the data released is good, the U.S. stock market will continue to fall, and once it falls short of expectations, funds will rush back.

The Fed’s Beige Book published on June 2 showed thatThe U.S. economy has expanded moderately in the past two months, and the growth rate has increased slightly from the previous month.. Two-thirds of the regions experienced moderate growth in employment and wages during the reporting period, with the strongest employment growth in food services, hotels, and retail.

The employment data released last night confirmed this statement. The number of “small non-agricultural” ADP employment increased by 978,000, which exceeded market expectations, the fastest increase in the past year since June last year; the 64-point ISM service industry The index also slightly exceeded expectations and set a new record since 1997.

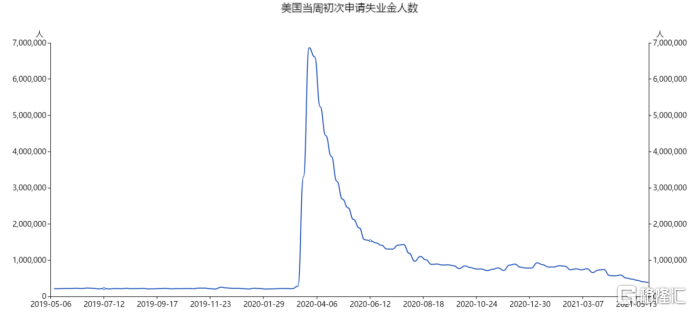

At the same time, the number of people applying for unemployment benefits for the first time in the United States fell to 385,000 last week, which was lower than the 393,000 expected by some economists and also lower than the previous value of 406,000 the previous week.

Although the non-agricultural employment data was upset, the overall situation was much better than the previous period, and the unemployment rate was slightly better than expected.

According to data from the US CDC, there are currently 169 million people in the United States who have received at least one dose of the vaccine, and 63% of the 18- to 65-year-old labor force has completed the vaccination. With the rapid spread of vaccines, blockades in various regions have been gradually lifted. For example, the Mayor of New York recently announced that New York City will be fully opened on July 1. These measures will drive further economic recovery.

The optimistic expectation of most Fed members is that with the full resumption of classroom teaching in schools across the United States in the fall, the state governments’ additional unemployment benefits during the epidemic will expire before September.The U.S. job market in the summer will usher in a significant boost。

According to the data before the epidemic, if the unemployment rate and labor participation rate are to return to normal levels, there will be an employment gap of more than 8 million.According to the current repair rate, it will take about 10 months。

Before that, it’s hard to say to raise interest rates.

2. When inflation is increasing, when will the liquidity turning point come?

The May spell of Sell in May did not play out on US stocks, but US stocks still underperformed other major markets. Not to mention the recent surge in Vietnam’s stock market, the S&P 500 even underperformed sharply.The Shanghai Composite Index。For investors, concerns about inflation and monetary policy changes are still “two dark clouds” hanging over their heads.。

April in the U.S.CPIThe data exceeded expectations. When the 4.2% growth was announced, a large number of people were frightened. The stock market plummeted, and the three major U.S. stock indexes fell by 2 to 3 points.

The Fed’s Beige Book pointed out that the overall domestic price pressure has increased further since May. Sales prices have risen moderately, and input costs have risen rapidly. However, the counter-attack of the epidemic in manufacturing countries such as India and Vietnam has caused the supply chain to be interrupted, further intensifying cost pressures.In addition, April’sPPIThe data increased by 6.2% year-on-year, and the pressure on the industrial side is expected to gradually spread to the consumer side.

However, as consumption after the US$1.9 trillion fiscal stimulus drops from its peak, the gap between supply and demand is expected to narrow and the pressure on inflation will also be eased. The demand side continued to release. In May, the US order backlog index rose from 55.7 to 61.1, but the growth rate slowed down month-on-month; the supply side was repairing, and the inventory index rose from 49.1 to 51.5 on the horizontal line.

In general,Inflationary pressure will still exist, and there will be no obvious signs of improvement in the short term。

We know that the root cause of the deterioration in inflation is the proliferation of liquidity in the US dollar. Biden’s epidemic relief bill and infrastructure plans have made the situation worse.

The recent reverse of the MidlandRepurchaseThe trading volume skyrocketed,The US$485 billion on May 27 set a historical record, and the funding scale on Thursday reached US$479 billion, which is still at a fairly high level.。

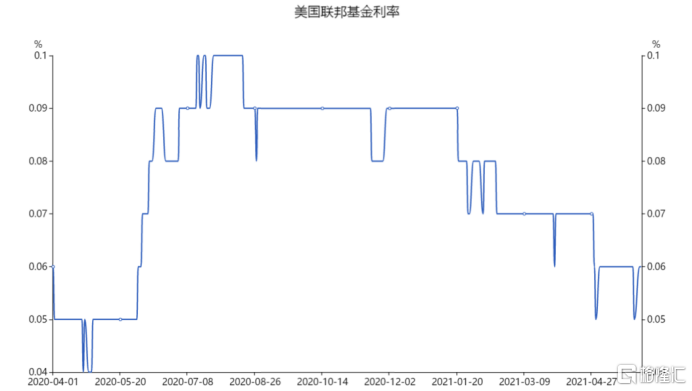

This matter needs to be combined with the marketinterest rateLook, because of the flood of liquidity, the federationfundinterest rateIn the past few months, it has continued to drop to a minimum of 0.05%. Many financial institutions are worried about the occurrence of negative interest rates. Therefore,Through the overnight reverse repo with the Fed to lock in the lower limit of interest rates, for the Fed it is equivalent to recovering part of the liquidity。

Basically, it can be concluded that in the context of inflationary pressures and economic recovery exceeding expectations, there is a high probability that liquidity tightening will be advanced.

Now the Fed has made some “small moves.”A few days ago, the Federal Reserve announced that it was preparing to sell some of the assets it purchased-for stability during the worst period of last year’s epidemicCreditCorporate bonds bought by the market.Just yesterday, the Federal Reserve Bank of New York stated that it will gradually sell the corporate bonds in the secondary market corporate credit facility (SMCCF) tool from June 7th.ETFbegin.

The turning point of liquidity tightening is not far away.

3. Conclusion

The continued volatility of US stocks shows that the market’s expectations are looking for consensus, and June is likely to become a key fork in the policy and market direction in the next period of time——The CPI data will be announced on June 10, followed by the FOMC meeting on June 15-16, at which time there will be discussions on reducing the scale of bond purchases.

Forecasting trends have never been very reliable, especially at inflection points and non-linear changes caused by the epidemic. Experts, including many economists, often expect large deviations, but we can analyze various possible situations. Impact:

The non-agricultural data fell short of expectations, which has given the market a sigh of relief.If inflation also eases and the bond purchase plan will continue to be postponed, then the market will usher in a new round of breathing window; conversely, if inflation unexpectedly exceeds expectations and forces the Fed to take action, the market will usher in a new round. Panic, after all, it is now prompting that the reduction is significantly earlier than expected.

All in all, the general direction of raising interest rates depends on the progress of economic employment restoration. The turning point is the resolution of reducing debt purchases. After the expected revision of May non-agricultural data, the market will be relatively optimistic. However, under inflation pressure, the Fed does not rule out some technical fine-tuning, such as raising the overnight reverse repo rate and the interest rate on excess reserves.

(Source: Gelonghui)

(Editor in charge: DF546)

Solemnly declare: The purpose of this information is to spread more information, and it has nothing to do with this stand.

.