Are you looking for best ETFs to invest in the Indian market? L’Indian economy and, in general, i emerging markets they attract the attention of many investors looking for high yields and for this reason I thought I’d do a quick research on the ETFs you can buy if you want to focus on this country.

In fact, in this article we will try to understand why investing in ETFs is so convenient, and then we will see together which are the best ETFs to invest in.

Enjoy the reading!

This article talks about:

An overview of ETFs

If you are interested in knowing how to invest in India ETFsthen you most likely already know what are ETFs and what benefits they can have for you.

I prefer ETFs compared to other forms of investment because with relatively low figures they allow you to access good diversification and have decidedly lower costs than, for example, Mutual funds. In my strategy, investment through ETFs finds ample space and for this reason I became passionate about the subject.

It is in fact a transparent investment method and, in addition to low management costs, it allows you to invest by significantly diversifying your investment.

Not sure how to invest?

Find out which investor you are. Are enough 3 minutes to discover the best strategy for you.

>> START NOW! <

A look at India

ETFs can be based on a particular market, tracking an index, or they can be based on a particular one commodity. In our case we can only be interested in theIndia and try to understand why this country attracts the attention of investors around the world.

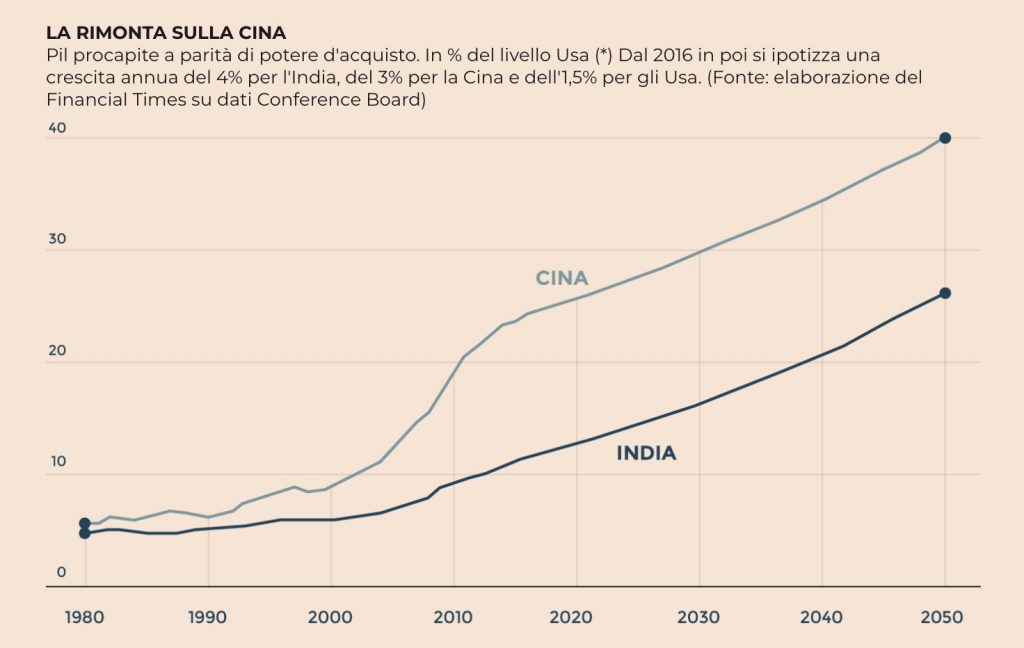

India is conceptually part of the emerging countries, i.e. those nations once considered developing that are making very significant progress in the economic field. The growth of this country which, we recall, is among the largest in the world in terms of inhabitants, is practically second only to Chinese.

It should come as no surprise that countries like India are growing so much: we in the West have reached a level of well-being such that increases in GDP, when there are any, are of limited magnitude because essentially we are already at a fairly high point of wealth and the growth rate can only be modest.

When, on the other hand, we approach nations that started from a more disadvantaged situation, it is clear that the percentages of increase are higher.

In the image, taken from The sun 24 hoursyou can see that the progress known by India and China is far from irrelevant and, in the light of the forecasts of almost all international observers, the trend will continue in this direction.

The Indian manufacturing system has several strengths: among these the high level of human capital, characterized by a significant level of education achieved particular attention to the training system, and the English language which allows the country to have relations with important partners such as the United States, the United Kingdom and the EU .

We often associate India with the industry manufacturingand this is partly correct, even if it is not the only sector that we have to consider.

In fact, there are companies from other sectors that are richer and that are listed on the stock exchange therefore, in fact, they will be precisely the ones in which you will find yourself investing if you have to choose an ETF: let’s talk about the sector linked to world of servicesdell’informaticafrom the banks and of financefrom the raw material and ofautomotive industry.

India is going through a period of transition which began with the liberalization of many sectors of the economy which have had many controversies and created various inequalities. However, this has not prevented the large global multinationals from opening offices in this market precisely to exploit the strengths which I exposed to you.

L’Indian economy of today is driven by exports and is heavily outsourced thanks to high value-added services that serve the whole world.

However, it should be emphasized that a substantial part of the population still somehow lives off agriculture which, in various regions, borders on subsistence. This is a sign that changes, as always, do not concern 100% of the population but are developing step by step, often leaving the masses behind.

Major Indian Indices

Given the necessary premises, let’s come to the more purely financial part and focus on the main indices that represent the Indian stock market.

Among these, I would like to point out the most important:

MSCI India

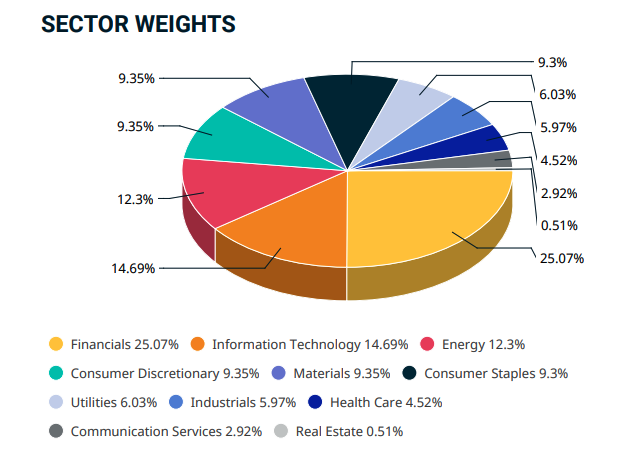

Consisting of 79 components, it replicates the performance of leading Indian companies. Diversification, as you can see from the information Sheetis well assorted both in the number of components and in the sectors.

Growth in recent years has been impressive but there have been substantial setbacks, a sign that investing in countries like this involves a certain exposure to risk although the long-term trends appear to be positive.

Obviously, with the post-COVID-19 uncertainties, this volatility trend in the medium term can only continue as the Indian economy is in any case closely linked to the West.

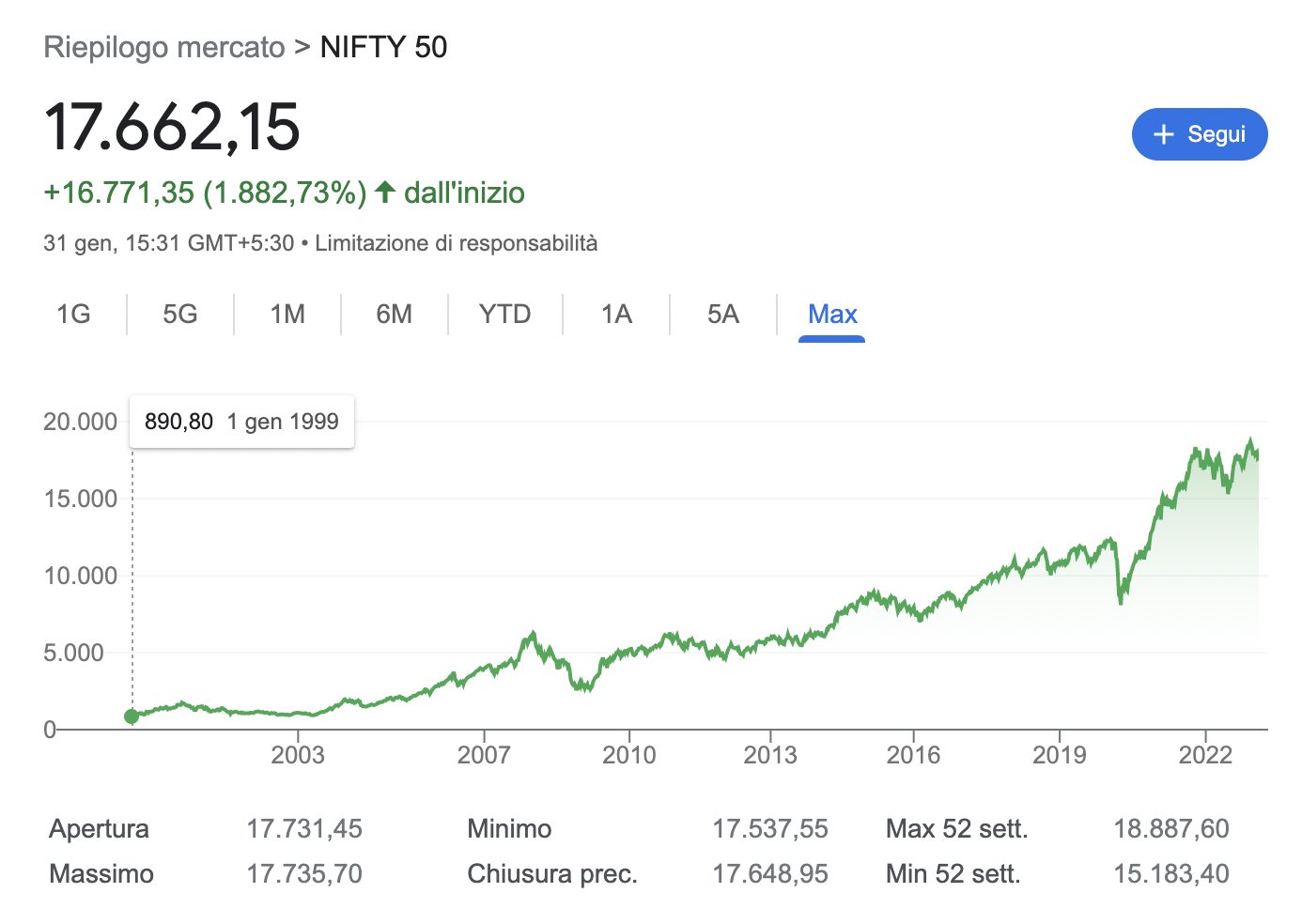

Nifty 50

The data on this index date back to 1996 and highlight the performance of the country’s top 50 companies. The index in question, to understand each other, is a “cousin” of our FTSE MIB.

The same arguments above apply here too: you must in any case combine the apparently positive trend with the greater volatility of an economy which, while growing, can suffer major setbacks in the short term.

The three best India ETFs on Borsa Italiana

Now that we’ve seen the major indices, let’s focus on the ETFs available on the Italian Stock Exchange.

Amundi MSCI India UCITS ETF

The index MSCI India tracks leading Indian stocks.

The fund was launched at April 2018therefore it is quite recent, and has a small size, equal to 93 million euros.

The method of replication is synthetic and does not possess currency hedging.

The fund is domiciled in Luxembourg and the dividend policy is ad accumulationi.e. they are not distributed to investors but are reinvested in the fund itself.

I management costs amount to 0.80% per annum.

Il risk profile for this ETF is equal to 6 on a scale of 1 to 7, so we’re talking about a high risk.

If we focus on thesector allocation we see that in first place there are companies in the financial sector, with 25.11%, followed by companies of new technologies with 14.69% and finally in third place we find companies operating in the energy sector with 12.21 %.

Lyxor MSCI India UCITS ETF

The index MSCI India tracks leading Indian stocks.

This fund has a large size of 574 million euros and was launched at October 2006.

The replication method is synthetic and has no currency hedging.

The fund is domiciled in France and the dividend policy is ad accumulationi.e. they are reinvested in the fund itself.

I management costs amount to 0.85% per annum.

Il risk profile also for this fund is of 6.

L’sector allocation of the fund sees the finance sector in first place with 25.07%, followed by the new technologies sector with 14.69% and the energy sector with 12.30%.

Xtrackers Nifty 50 Swap UCITS ETF

The Nifty 50 index tracks 50 stocks from 22 sectors of the Indian economy.

The fund has an average size of 126 million euro and was listed on July 2007so it’s a mature fund.

The method of replication is synthetic and does not possess currency hedging.

The fund is domiciled in Luxembourg and the dividend policy is ad accumulationi.e. they are reinvested in the fund itself.

I management costs amount to 0.85% per annum.

Il risk profile also for this fund is of 6.

L’sector allocation of the fund sees the finance sector in first place with 36.54%, followed by the information technology sector with 13.95% and the energy sector with 12.43%.

Conclusions

We have seen the best ETFs to invest in the Indian market and some aspects of particular interest for a choice of this type.

The idea of investing in emerging marketswith a not too high share of one’s financial resources, must certainly be kept in mind in the asset allocation.

Emerging markets, as is often mistakenly done to simplify, are not all the same: the country you decide to focus on must be studied, analyzed and, in some ways, understood.

If you believe in India’s growth you can definitely invest in ETFs to limit risk and minimize costs.

As we have seen, however, these are funds that have a high risk profile, since all 3 ETFs have a risk profile of 6.

Furthermore also i management costs they are not the lowest, settling on 0.80% all of them.

My advice is, however, to define the strategy well upstream and to allocate a not too high part of your money to this country to protect you from setbacks that can come cyclically and that in markets like this can be tougher than in more mature areas such as the western ones.

Before saying goodbye, I also want to leave you some resources that refer to theinvestment in ETFs:

I also leave you these guides which could prove to be very useful for starting your investment journey in general:

Good investments!

Find out which Investor You are

I have created a short questionnaire to help you understand what kind of investor you are. At the end, I will guide you towards the best contents selected according to your starting situation:

>> Start Now <