Yellow Life 4 is the investment solution that aims to enhance capital over time and take care of your loved ones thanks to the typical advantages of a‘Life insurance.

Issued by GenertelLife, the Yellow Life multi-branch policy 4 combines the expertise of CheBanca!, the leadership of GenertelLife in the insurance world and the savings management expertise of Mediobanca SGR.

But now let’s see the characteristics of the policy.

This article talks about:

Two words about GenertelLife

Genertel is the direct insurance company of Generals Italy. Founded in 1994, today it is among the first direct insurance companies in Italy.

Genertellife is the first direct life and pension company in Italy and, together with Genertel, is the only direct Italian insurance company capable of providing all life, non-life and pension insurance services online and over the telephone.

Their mission is to build a trusting and long-term relationship with people, whether they are employees, customers or stakeholders, and improve the lives of their customers.

Investment policy

The investment provides 3 different souls, to offer you the most complete service possible.

Indeed, we have the separate management Glife Premium which allows you to benefit from returns over time thanks to prudent management that invests mainly in bonds. Every year, any certified return will increase the invested capital.

Then there is the component of domestic insurance funds which are based on the strategies developed by Mediobanca SGR (GTL Factor Rotation Strategy invests primarily in equity instruments to optimize return potential e GTL Defensive Strategyinvests mainly in bonds).

Finally, we find the life insurance component through which loved ones can be protected thanks to the important ancillary insurance coverage present.

3 ways of investing

You can choose between three investment methods that balance the different components according to your needs: the mode Life Cycle, Guided or Free.

Life cycle mode

The Lifecycle mode it is the combination of separate management and the two funds and changes according to the policyholder’s life cycle, adapting to investment needs which naturally change over time.

If the insured person has aunder the age of 55the equity component will be higher in order to maximize profits.

The more defensive component of the Separate Account will be limited and will increase every 10 years, as the need to protect capital increases.After 70 years the share component will account for only 20% and will be zeroed after 80 years.

Wizard mode

The Guided mode has five investment lines available, from the more defensive to the more dynamic, to identify an investment strategy in line with the client’s profile and objectives.

The 5 investment lines you can choose from are:

- cautious line;

- moderate line;

- balanced line;

- moderate aggressive line;

- aggressive line.

Free mode

The free mode builds the investment combination that best suits the customer’s needs, choosing the distribution of the different elements in compliance with specific parameters.

In fact, in this version, the distribution of the Separate Management and Internal Funds components must comply with two rules, namely:

And beneficiaries

The insurance component provides for the indication of one or more beneficiary to whom, in the event of the insured’s death, the capital due by the Company is liquidated.

When signing up for the policy, the contracting party must indicate the beneficiary who may be represented by the legitimate heirs or by people who are not part of the hereditary axis.

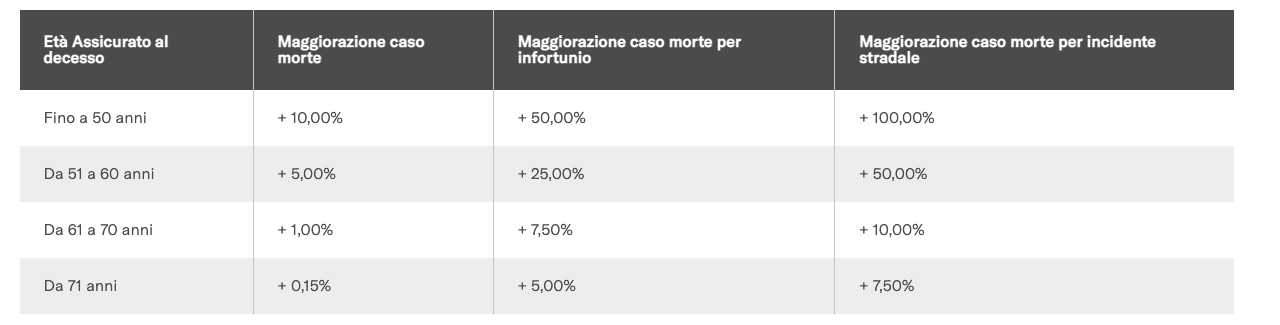

The basic coverage

Here I am attaching the basic shell:

The capital invested in Separate Management and Funds is revalued pro-rata temporis. The maximum amount of the surcharge is:

- Euro 25,000.00 in the event of death;

- Euro 50,000.00 in the event of death due to injury.

Premium coverage

In this case, the capital invested in Separate Management and Funds is revalued pro-rata temporis.

The maximum amount of the surcharge is:

- Euro 35,000.00 in the event of death;

- Euro 70,000.00 in the event of death due to injury;

- Euro 100,000.00 in the event of death from a road accident.

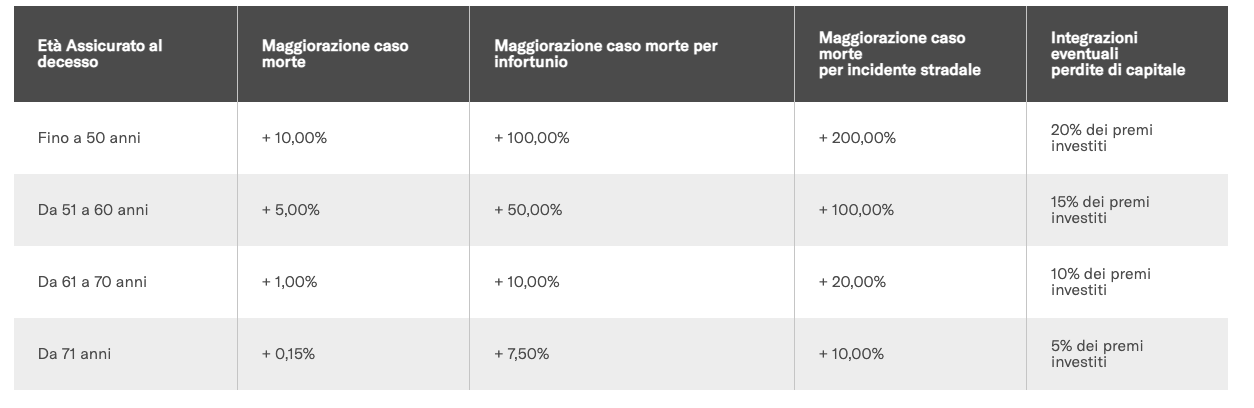

Coperture Top

Finally, here are the Top covers:

The capital invested in Separate Management and Funds is revalued pro-rata temporis. The maximum amount of the surcharge is as follows:

- Euro 35,000.00 in the event of death;

- Euro 100,000.00 in the event of death due to injury;

- Euro 150,000.00 in the event of death from a road accident;

- Euro 100,000.00 in the event of a capital loss.

Extra security: major illness option

The policy offers the possibility of adding the Major Diseases option to the package, a situation which involves a one-off liquidation up to a maximum of €30,000 for the management of cases of serious illnesses such as cancer, heart attack or stroke.

The benefit is paid on the onset of the illness under the conditions defined in the information booklet to which reference is made and varies according to the age of the insured person and the type of illness envisaged.

This option can be associated with all Yellow Life 4 coverages.

Risk and return profile

A more or less high risk and return profile is obtained based on the assets in which the fund invests. If the investment is more volatile and risky then the earning opportunities are higher.

The product (let’s talk about Yellow Life 4 single prize) was classified from level 2 to level 4 out of 7, which correspond to the low to medium risk class. This means that the potential losses due to the future performance of the product are rated as low to medium and it may be that poor market conditions affect our ability to pay you what is owed.

Expenses of Yellow Life 4 single premium

We arrive at the prospectus of costshere’s what they are:

- Contract issuing costs: 10 euros;

- Entrance fees: 0.19% – 0.33%%;

- Exit costs: 0.01% – 0.02%;

- Portfolio transaction costs: 0.12% – 0.38%;

- Annual fee for the GTL Factor Rotation Strategy fund: 2.15%;

- Annual fee for the GTL Defensive Strategy fund: 1.80%.

How to activate the policy

To subscribe to this policy, you must hold a CheBanca! and contact a consultant using the bank’s appropriate forms.

My Business Opinions

If you’ve come this far, it means that you’ve read the information and now you can think about the tool and try to figure out if the multiamo policy might interest you or not.

Il risk profile is medium-low, while i management costs are quite elevatedi, as is the case with almost all insurance products.

If you follow me or if you’ve already read some product reviews on my blog, you know my opinion on products of this type: they are safe, but essentially they ask you for various expenses and commissions and then you don’t get many benefits. Ne ho spoke Who.

However, not knowing what your financial situation is and not being able to know what you are looking for and which instruments you prefer, I cannot give you a definite answer: evaluate the pros and cons of the instrument, but always remember to read the KIID carefully and do the calculations, subtracting all the interest costs that you could earn… You will see for yourself that what is left in your pocket is no longer so attractive.

Then I am against adding investment with guardianship and protection: these are two antithetical concepts which, you will agree with me, clash!

If you want to invest, invest, and if you want to protect yourself… protect yourself! But with two tools designed for a specific action, not with one tool that mixes both components: after all, an investment involves a risk, which is exactly what insurance should protect you from.

Are you sure it’s a good tool, given the high management costs anyway?

Conclusions

If you want to learn how to invest in the most effective way, I leave you to read my practical guides for beginners:

See you soon.

Find out which Investor You are

I have created a short questionnaire to help you understand what kind of investor you are. At the end, I will guide you towards the best contents selected according to your starting situation:

>> Start Now <