August 23,JA Technology(002459.SZ) released the 2021 non-public issuance plan, showing that the company intends to provide no more than 35 specialFixed investmentThe number of non-public shares issued by investors does not exceed 479,507,127 shares, and the total amount of funds raised is expected to not exceed 5 billion yuan.

JA TechnologySaid that this fixed increase will increase the company’s silicon ingot/wafer production capacity, reduce costs, improve the company’s vertically integrated industrial chain, and enhance the company’s profitability and industry competitiveness.

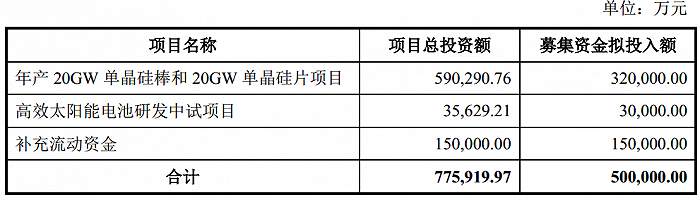

Specifically, of the company’s fixed increase in capital raising, 3.2 billion yuan will be used for projects with an annual output of 20GW monocrystalline silicon rods and 20GW monocrystalline silicon wafers, and 300 million yuan will be invested in high-efficiencySolar energyFor the battery research and development pilot project, the remaining 1.5 billion yuan will be used to supplement working capital.

Picture source:JA Technology2021 non-public stock offering plan

Among them, for the annual production of 20GW monocrystalline silicon rods and 20GW monocrystalline silicon wafer projects, JA Solar believes that the implementation of this project will accelerate the company’s advantageous capacity expansion, match its own downstream cell/module production capacity, and enhance the company’s integrated profitability. The overall construction period of the project is tentatively set for 2 years, and it is planned to be put into production gradually in the second year of the construction period; after calculation, the project’s internal rate of return (after tax) is 18.61%, and the static investment payback period (including the construction period) is 5.61 years.

JA Tech also pointed out that high-efficiencySolar energyThe battery research and development pilot project is the company’s new generation of high-efficiencySolar energyThe strategic layout in the battery field is conducive to getting through the key links of R&D and production, laying a solid foundation for future large-scale production, and continuing to lead the development of the industry. The overall construction period of the project is expected to be 18 months.

In addition, JA Tech admits that the non-public offering of funds will also reduce the company’s debt-to-asset ratio after the non-public issuance is in place. However, in extreme cases, the company still has a high debt-to-asset ratio and greater pressure to repay the debt principal and interest, which leads to tight cash flow. Risk. The data shows that at the end of 2019, 2020 and June 2021, the company’s combined asset-liability ratio was 70.92%, 60.21% and 67.10%, respectively.

Public information shows that JA Solar’s main business is the research and development, production and sales of solar photovoltaic silicon wafers, cells and modules, as well as the development, construction and operation of solar photovoltaic power plants.

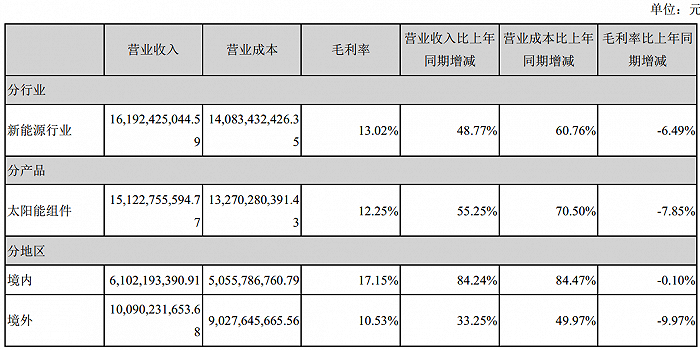

The 2021 semi-annual report released on August 23 shows that in the first half of this year, JA SolarOperating income16.192 billion yuan, an increase of 48.77% over the same period of the previous year; to be attributable to listed companiesShareholdersOfNet profitIt was 713 million yuan, an increase of 1.78% over the same period last year; but after deducting non-recurring gains and losses, the company’s net profit attributable to the parent was 540 million yuan, a year-on-year drop of 27.95%.

Among them, in the first quarter of 2021, JA Solar’s operating income increased by 51.52% year-on-year to 6.956 billion yuan, and the net profit attributable to shareholders of listed companies fell 45.11% year-on-year to 157 million yuan. After deducting non-recurring gains and losses, its parent net profit was It fell 82.7% to 59,321,200 yuan. Based on this estimate, in the second quarter, the company achieved a single-quarter operating income and net profit of 9.236 billion yuan and 556 million yuan respectively, an increase of 46.77% and 33.98% over the same period last year, and an increase of 32.78% and 254.14% respectively from the previous quarter.

According to PVInfoLink’s statistics, the company’s module shipments in the first half of 2021 ranked third in the world. During the reporting period, JA Solar’s battery module shipments were 10.12GW, of which overseas shipments accounted for 63%, and domestic shipments accounted for 37%. Among them, compared with the first quarter, the company’s domestic sales in the second quarter The volume of goods remained at 33%, and the sales price increased; the proportion of shipments in the European region increased by 7% to 27%.

In terms of production capacity, in accordance with the plan disclosed in JA Solar’s 2020 annual report, the company will further cultivate the global market in 2021. The company’s battery module shipment target is 25-30GW (including self-use); the company expects that the module production capacity will be increased by the end of 2021. Over 40GW, the production capacity of silicon wafers and cells reaches about 80% of the production capacity of modules. In terms of projects, as of the end of 2020, the company’s module production capacity was 23GW, and the silicon wafer and battery production capacity was approximately 80% of the module production capacity. During the reporting period, new and reconstruction projects such as Ningjin 4GW battery, Vietnam 3.5GW module, and Yiwu 5GW module were successfully put into production, and the production capacity of each link increased in an orderly manner. Projects such as Qujing 20GW crystal pulling and slicing, Baotou 20GW crystal pulling and slicing, Vietnam 3.5GW battery, Yangzhou 6GW battery and 6GW module projects are progressing as planned.

Previously, JA Technology acceptedInstitutional researchAccording to the report, orders in July this year were basically filled, and orders after August are still under control; “the annual shipment target has not been adjusted, and the company is confident to complete the target.”

It is worth noting that the company’s main raw materials are polysilicon materials. Since 2021, due to the inability of supply to meet the rapidly growing market demand, the market price of crystalline silicon materials has risen sharply, from about 90 yuan/kg at the beginning of the year to a maximum of 200 yuan/kg.JA Solar said frankly that this is important for the company and the photovoltaic industryPerformanceCaused certain adverse effects; the company has controlled the quantity of raw materials and inventory products in the past two years, and has participated in the upstream polysilicon production enterprises to reduce the risk of price fluctuations. However, when the price of raw materials fluctuates sharply, the company still has grossInterest rateThe risk of volatility.

The 2021 semi-annual report shows that JA Solar’s operating costs in the first half of 2021 increased by 60.76% year-on-year to 14.083 billion yuan, due to “increased shipments, expanded sales, and increased raw material prices.”During the reporting period, the company’s overall grossInterest rateIt was down 6.49% to 13.02% from the same period last year, of which the gross profit margin of solar module products fell 7.85% to 12.25% year-on-year.

Image source: JA Solar’s 2021 semi-annual report

The gross profit margin of overseas business, which brings 62.31% of operating income to JA Solar, dropped 9.97% to 10.53%. The company has a relatively large proportion of overseas business. From 2018 to the first half of 2021, the company’s overseas sales ratio was 57.37%, 71.72%, 68.83% and 62.31%, respectively.The company frankly stated that since the scope of the final development of the new crown pneumonia epidemic and the final end time are still unpredictable, the impact on the macroeconomic andInternational tradeThe final impact cannot be accurately predicted. “If the new crown pneumonia epidemic cannot be effectively controlled, it will have an adverse impact on the company’s overall operating performance.”

Another concern is that in November 2020, Jin Baofang, the actual controller, chairman and general manager of JA Solar, was investigated and detained by the Pingdu Supervisory Committee in accordance with the Supervision Law of the People’s Republic of China.During this period, Jin Baofang even failed to attend the board meeting on March 29, 2021 to review important proposals such as the 2020 annual report; until the quarterly report of the board of directors resolutions announced on April 28AnnouncementIt was revealed that Jin Baofang appeared and presided over the meeting.

The above-mentioned matters have a considerable impact on JA Tech’s share price. From November 2020 to the end of April 2021, the company’s stock price fell more than 20%. However, since May of this year, JA Solar’s stock price has begun to rise rapidly, from RMB 24.91 per share on May 11 to RMB 58.87 per share on August 24, an increase of about 130%. On August 23, the company’s stock price continued to rise 7.62%.

(Article Source: Interface News)

Article source: interface news

Original title: Photovoltaic giant JA Solar plans to increase production by 5 billion yuan, gross profit margin of raw material price increases, and revenue growth in the first half of the year does not increase profits

Disclaimer: Oriental Fortune released this content to spread more information, it has nothing to do with this stand, and does not constitute investment advice. According to this operation, at your own risk.

.