Peasant families from Cesar received property titles

The National Land Agency – ANT – delivered rural property titles to peasant families from three municipalities

Celtic beat Hibernian to take SWPL top spot as Rangers lose at Hearts

Caitlin Hayes’ header was the only goal Celtic narrowly defeated Hibernian to move top of the SWPL

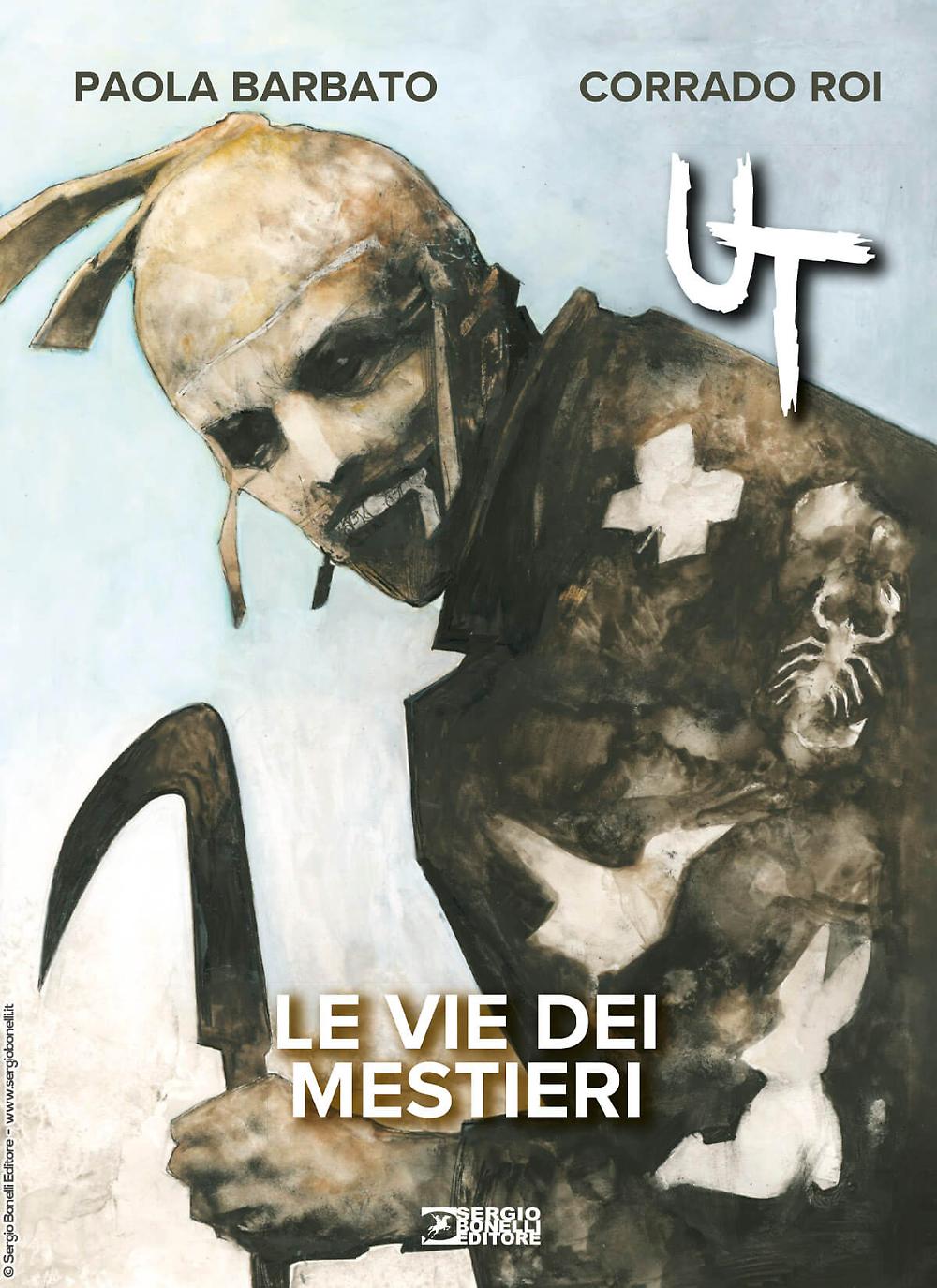

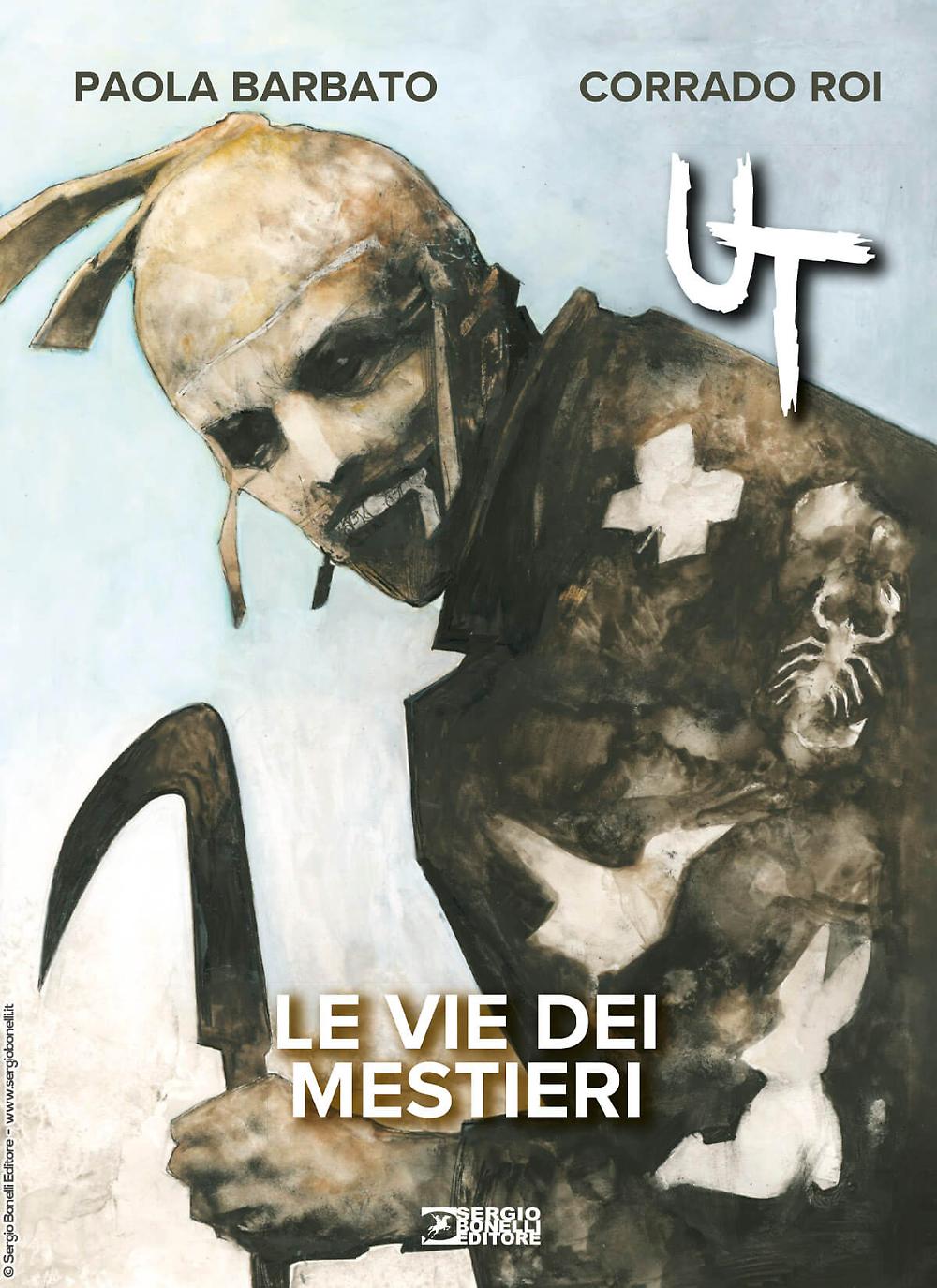

Sergio Bonelli Editore presents “UT. THE VIE DEI MESTIERI” by Paola Barbato and Corrado Roi

SERGIO BONELLI EDITOR presents THE ROUTES OF THE CRAFTS From April 26th it arrives in bookstores and

Popular Stories

Operation Praetorian: MP requests preventive detention for Madureira and “Polaco” | public ministry

This Tuesday, the Public Prosecutor’s Office (MP) requested preventive detention for Fernando Madureira, leader of the Super

Peasant families from Cesar received property titles

The National Land Agency – ANT – delivered rural property titles to peasant families from three municipalities

Celtic beat Hibernian to take SWPL top spot as Rangers lose at Hearts

Caitlin Hayes’ header was the only goal Celtic narrowly defeated Hibernian to move top of the SWPL

Sergio Bonelli Editore presents “UT. THE VIE DEI MESTIERI” by Paola Barbato and Corrado Roi

SERGIO BONELLI EDITOR presents THE ROUTES OF THE CRAFTS From April 26th it arrives in bookstores and

Travel & Explore the world

Operation Praetorian: MP requests preventive detention for Madureira and “Polaco” | public ministry

This Tuesday, the Public Prosecutor’s Office (MP) requested preventive detention for Fernando Madureira, leader of the Super

Peasant families from Cesar received property titles

The National Land Agency – ANT – delivered rural property titles to peasant families from three municipalities

Celtic beat Hibernian to take SWPL top spot as Rangers lose at Hearts

Caitlin Hayes’ header was the only goal Celtic narrowly defeated Hibernian to move top of the SWPL

Sergio Bonelli Editore presents “UT. THE VIE DEI MESTIERI” by Paola Barbato and Corrado Roi

SERGIO BONELLI EDITOR presents THE ROUTES OF THE CRAFTS From April 26th it arrives in bookstores and

Morocco: objectives to modernize the mining sector

by: Celine Camoin | April 17, 2024 In Morocco, the Ministry of Energy Transition and Sustainable Development

Little yogis grow up. Well – the Republic

To each their own yoga, including children and adolescents. In a dynamic and creative form for the

A-Lin Strikes Gold Again with “Best Friend” Performance on THE FIRST TAKE

(Taoyuan Post, April 17, 2024) A-Lin, the acclaimed song queen, recently made a stunning appearance on the

Explore and travel the world

Complaint from DAZN: DFL stops auction of TV rights

Social networks: an illusion of success – AFROPTIMISTE