Source: CFC Metals Research

Summary

This week, the precious metal market showed a trend of opening low and moving high. Gold and silver rose sharply at the beginning of the week. The market once bet that the inflation data would drop significantly before the release of the US inflation data, but the actual inflation data still exceeded market expectations. Interest rate expectations rose, the US dollar index rose sharply again this week to stand at the 110 integer mark, asset prices generally fell, and gold also hit a recent low this week.

Data released by the US Department of Labor on the 13th showed that although the US CPI data in August was lower than 8.5% in July and 9.1% in June, it was still at a 40-year high. The core CPI, excluding energy and food, was 6.3%, which also exceeded market expectations. The pressure on the supply chain has eased, but the US Consumer News and Business Channel believes that the US CPI index has been above 4% for about three-quarters of this year, which reflects the long-term trend of inflation and refutes the fact that the White House and the Federal Reserve have been In the push for a “transient” inflation view.

The latest “terror data” in the United States has been released. According to the data of the US Department of Commerce, US retail sales in August increased by 0.3% month-on-month, which was expected by the market to be flat. The monthly rate of retail sales in July was revised down from 0.0% to a decrease of 0.4%. The year-on-year increase was 9.1%. Consumer spending accounts for more than two-thirds of the U.S. economy, and retail sales are seen as an important measure of consumer spending.

On the whole, the market still underestimates the stickiness of high inflation. From the perspective of each inflation sub-item, the future rent and food prices will still support inflation at a high level, which makes it difficult for the Fed to keep raising interest rates in the short term. Therefore, this has lengthened the tightening cycle of the entire financial market. Against the background of rising interest rate expectations, financial asset valuations have declined, and the decline in stocks and commodities has also dragged down inflation expectations. Precious metals are still negatively impacted on pricing.

Operation strategy:

Operationally, gold and silver range operations.

Uncertainty Risk:

Changes in the global epidemic, geopolitical risks, and changes in European and American fiscal and monetary policies

one

Quotes Review

London gold closed at $1,674/oz, down 2.42% from last week, and London silver closed at $19.553/oz, up 3.82% from last week. This week, the precious metal market showed a trend of opening low and moving high. Gold and silver rose sharply at the beginning of the week. The market once bet that the inflation data would drop significantly before the release of the US inflation data, but the actual inflation data still exceeded market expectations. Interest rate expectations rose, the US dollar index rose sharply again this week to stand at the 110 integer mark, asset prices generally fell, and gold also hit a recent low this week.

two

Analysis of factors affecting price

1. Macrofinance

Data released by the US Department of Labor on the 13th showed that although the US CPI data in August was lower than 8.5% in July and 9.1% in June, it was still at a 40-year high. The core CPI, excluding energy and food, was 6.3%, which also exceeded market expectations. The pressure on the supply chain has eased, but the US Consumer News and Business Channel believes that the US CPI index has been above 4% for about three-quarters of this year, which reflects the long-term trend of inflation and refutes the fact that the White House and the Federal Reserve have been In the push for a “transient” inflation view.

The latest “terror data” in the United States has been released. According to the data of the US Department of Commerce, US retail sales in August increased by 0.3% month-on-month, which was expected by the market to be flat. The monthly rate of retail sales in July was revised down from 0.0% to a decrease of 0.4%. The year-on-year increase was 9.1%. Consumer spending accounts for more than two-thirds of the U.S. economy, and retail sales are seen as an important measure of consumer spending.

The University of Michigan announced that the initial value of the consumer confidence index in September was 59.5, which was lower than the expected value of 60 and slightly higher than the final value of 58.2 in August. As energy prices continue to fall, median U.S. inflation is expected to fall to 4.6 percent in the coming year, the lowest level since last September.

According to data released by the German Center for European Economic Research (ZEW), the economic sentiment index of the euro zone in September was -60.70, down about 6 percentage points from the previous month. It shows that the European economic community is generally pessimistic about the prospects for the economic development of the euro zone.

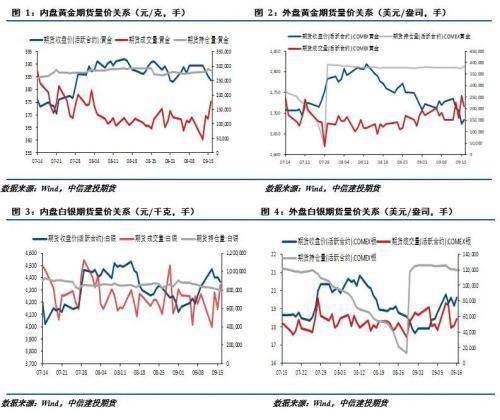

2. Position analysis

As of September 16, 2022, SPDR gold ETF holdings were 960.85 tons, a decrease of 5.79 tons from last week. As of September 13, 2022, COMEX gold non-commercial long net positions were 97344 contracts, a decrease of 6513 contracts from last week .

As of September 16, 2022, SLV silver ETF holdings were 14,859.34 tons, an increase of 299.48 tons from last week. As of September 13, 2022, COMEX silver non-commercial long net positions were -4640 contracts, an increase of 8144 from last week open.

Strategy

On the whole, the market still underestimates the stickiness of high inflation. From the perspective of each inflation sub-item, the future rent and food prices will still support inflation at a high level, which makes it difficult for the Fed to keep raising interest rates in the short term. Therefore, this has lengthened the tightening cycle of the entire financial market. Against the background of rising interest rate expectations, financial asset valuations have declined, and the decline in stocks and commodities has also dragged down inflation expectations. Precious metals are still negatively impacted on pricing.

The Shanghai Gold 2212 reference range is 382-392 yuan/gram, and the Shanghai Silver 2212 reference range is 4250-4550 yuan/kg. Operationally, gold and silver range operations.

three

Related Charts

Source: Finance WorldReturn to Sohu, see more

Editor:

Statement: The opinions of this article only represent the author himself, Sohu is an information publishing platform, and Sohu only provides information storage space services.