UniCredit: maximum trepidation on the markets for the Piazza Gae Aulenti accounts, relating to the fourth quarter of 2022, which will be released next January 31st.

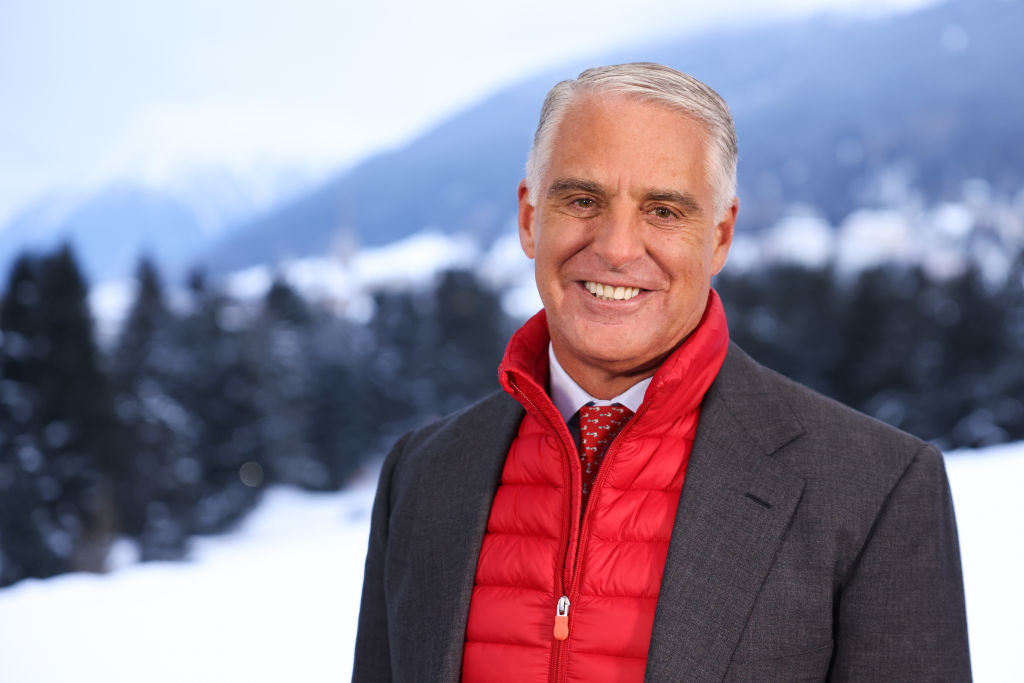

From the bank’s CEO Andrea Orcel good indications arrived last week, on the sidelines of the work of Davos, the protagonist of world finance with il World Economic Forum.

The CEO of UniCredit he was optimistic about it Pil dell’area euro despite the warnings repeatedly launched by some economists on the risk of a recession this year, due to the repeated rate hikes launched – and still to come – by Christine Lagarde’s ECB.

Orcel has shown optimism too on the issue of dividends.

A preview of UniCredit’s accounts was presented by ride yes which outlines a more than positive picture for the Italian bank.

Preview Equita SIM on fourth quarter accounts

“We expect a good quarter, led by an excellent performance of the NII supported by the rise in interest rates (EUR 3M +95bps QoQ), which – in terms of core revenues – will more than compensate for a slowdown in fees (in particular as regards investment fees)”.

“As for operating costs – reads the note from Equita – we expect a slight increase YoY (+3%), with inflationary pressures which will be at least partially compensated by the implementation of the planned initiatives. Overall we see the fourth quarter with a cost to income C/I still at excellent levels in the 50% area“.

It’s still:

“Under the operating line, the underlying CoR (cost of risk). – as indicated by recent statements by CEO Orcel – it should have remained at particularly low levels also in the fourth quarter. However we do not rule out that – in the light of the uncertainty on the evolution of the macro context and of the supervisory calls for prudence – UniCredit may have opted in the fourth quarter for higher provisions, aimed both at further covering positions in Russia and at increasing the stock of overlays (c. 1.3bn in 3Q23). So we expect a CoR in the 75bps area“.

In detail, here are the balance sheet items that the Milanese SIM estimates for UniCredit, relating to the fourth quarter of 2022:

- SO: 3.1 billion (+25% on a quarterly basis, +29% on an annual basis), consensus: 3.2bn

- Total revenue: 5 billion (+4% on a quarterly basis, +13% on an annual basis), consensus: 5.2bn

- Operational profit: 2.5 billion (+25% YoY), consensus: 2.6bn

- LLPs: -0.85 billion (76bps), consensus: -0.85bn

- Net Income (net profit): 0.8 billion, consensus: 1 billion

- Net Income ex Russia (net profit ex Russia): 0.9 billion, consensus: 1.1 billion

UniCredit and the Russia factor

Overall, with regard to the entire year, Equita SIM expects a net profit ex Russia of 4.9 billionconsistent with the guidance of profit > 4.8 billion“.

“At the capital level we estimate a post-distribution CET1 > 14.5%in linea con i target – concludes at SIM – Possible positive catalyst, partly anticipated by the CEO’s statements, it could be a remuneration higher than the 3.75 billion (c. 13% of market capitalization) distributed in 2022 (to which we are aligned)”.

“It is pointed out that the UniCredit “treat a evaluations that we continue to consider interesting (2023-24E P/TE = 0.44x-0.40x)”.

As for the statements that Andrea Orcel made last week from Davos, the bank’s CEO admitted that “we see uncertainty” is that “We all anticipate a potential shock.”

Said this, “The indicators are all positive. The stock of NPLs is falling and the cost of risk is still compressing“.

On the dividend front, it should be remembered that Orcel had already promised to hit the target of distributing a payout of more than 16 billion euros, over three years, even in the event of “a severe recession”. And that now, he is willing to give even more.

Maximum attention also to UniCredit strategy in Russia.

“Over the past 9 months – said the banker in mid-December – we have reduced our exposure to Russia by 50% across the border and we did it in a rational and calm way without giving value to anyone. This will continue, we will continue to move forward in this direction”.

“On local presence (in Russia) – said the CEO of UniCredit, presenting its view on 2023 – we have a bank that had more than 4,000 people. Today there are about 3,500 of them. We have also refocused the bank there, which is mainly corporate and has 1,500 customers of which 1,250 are European”.

So, “we do, we have a bank in Russia, but we are supporting disengagement, and all the challenges faced by 1,500 European customers who are also our customers in the countries where we are: we are accompanying this transition in the best way we know how”. had underlined the number one in Piazza Gae Aulenti.

Among the recent news concerning the bank, also keep an eye on the agreement on managed savings that UniCredit has caught up with Azimut‘.

Finally, the article that the Financial Times had dedicated to the Italian bank in early November, which referred to tensions between UCG and the ECB, when both Russia and the MPS case were cited as reasons for the friction.

The dividend issue was cited as another bone of contentiongiven Orcel’s commitment to remunerate the bank’s shareholders with a maxi gift of 16 billion euros.

It is no secret that the ECB has already invited euro area banks to review their strategic plans, primarily the impact they could have on their capital levels. But Orcel has been flaunting for months what can be considered as trump card of the institute.

The numbers of the previous quarter should be remembered, which they practically made the history of Piazza Gae Aulenti.