In October the Italian public debt has marked a new historical record rising to 2,771 billion in October, a value well above the previous estimates made by Mazziero Research. According to Maurizio Mazziero, public debt in October was pushed up by an increase in Treasury liquidity to limit government bond issues towards the end of the year.

However, after the leap forward achieved in October, in November we should once again see a decline in debt 2,760 billion, a decrease that should also continue in the last month of the year in a range that we currently estimate between 2,744 and 2,759 billion. It will then rise again from January, exceeding 2,800 billion before June. The graph below shows the official data published by the Bank of Italy with the red line, while in gray we have the public debt values estimated by Mazziero Research and, as we can see, the forecast trend shows an upward trend, with the value of the debt June 2023 could result in the fork 2,826 – 2,871 billion euros.

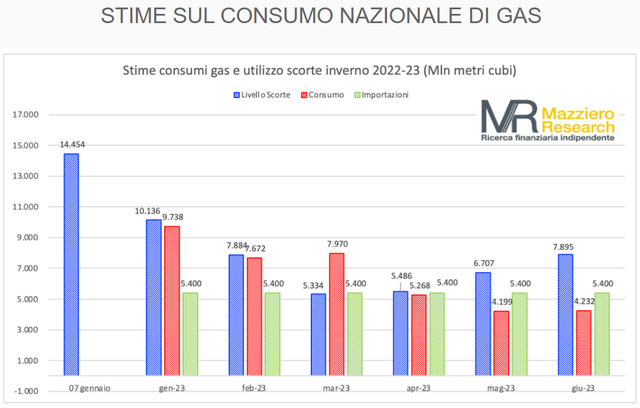

Sufficient gas stocks to get through the winter

Good news on the level of gas stocks, with Mazziero Research estimates confirming that they will be sufficient to face the winter. In this sense, below we have the histogram graph where the is highlighted in blue stock level, which tend to gradually decrease for use in the colder months. In red we find the consumption, which Mazziero Research placed equal to last year; while the level is indicated in green monthly importsestimated equal to that of last July, but eliminating the flow from Russia, which is currently still arriving to a small extent.

From the graph in question “it is possible to note that inventories would bottom out in March at 5.3 bcm, a level which constitutes a good safety margin. Once the winter has passed, the challenge will reopen with all the European governments running after the filling of stocks for next winter; however, at the end of the summer there could still be high gas prices, but probably below the threshold of 180 euros per megawatt hour, indicated by the European Commission as the Price Cap. However, the rates of LNG carriers will remain high, also influenced by waiting times for unloading due to insufficient regasification capacity in Europe.”