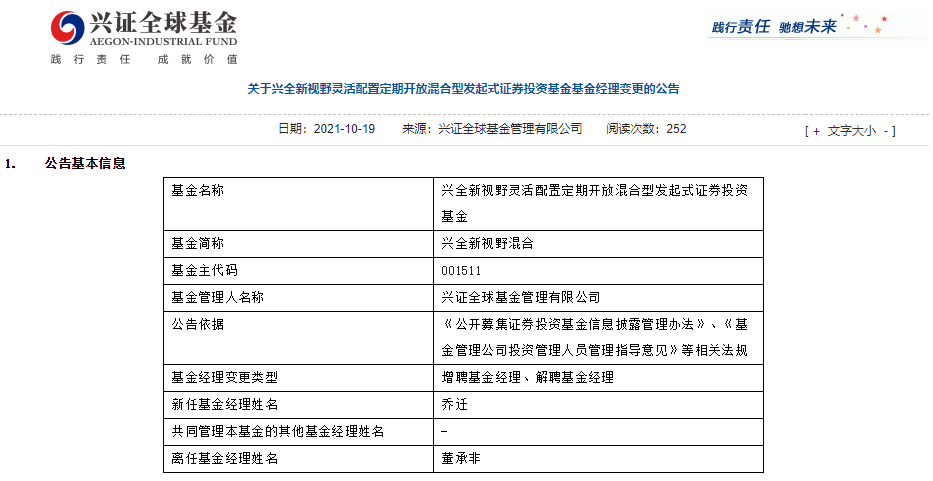

China Industrial SecuritiesfundDeputy General Manager Dong Chengfei will officially leave the position of fund manager of Xingquan Trend and Xingxin Vision Fund. Who will take over these two large-scale products has become the focus of the most attention of the foundation. It is reported that the fund manager who succeeded Dong Chengfei to manage the new vision of Xingxing was moved. Xingquan Trends hired Xie Zhiyu and Dong Li to manage with Tong Lan.

Today, aannouncementShocked the entire public fundraising community.

In charge of 60 billion public funds, nearly 15 yearsStock investmentThe experienced “veteran” Dong Chengfei stepped down from all the funds under his management-Xingxinwang set up a mixed and Xingquan trend investment mixed fund manager position.

According to the announcement issued by China Industrial Securities Global Fund on October 19, Dong Chengfei left the position of fund manager of the above two funds due to personal reasons and continued to serve as the company’s deputy general manager and director of the research department.

Xingquan Trends hired fund managers Xie Zhiyu and Dong Li to co-manage them with Tong Lan. Xing Xin Horizons new fund manager is the housewarming.

Dong Chengfei mentioned in a letter to fund holders that day: “As the company’s investment and research team becomes mature and stable, and a relatively complete talent team has formed, I also want to make some changes and say goodbye to the fund temporarily. Management work, spend more time on precipitation and growth, and try to make some new explorations in investment.”

Although Dong Chengfei has not resigned from the company, there have been many rumors about the next stop of his career, among which there are more news about “being private”.

At this point, the “Xingquan Wujue” led by the former general manager Yang Dong will become a public fund manager in the past. Among the fund managers who succeeded Dong Chengfei, Xie Zhiyu and Qiao Qian have both worked in the company for more than ten years. Both are also highly expected by the market and the company. .

15-year veteran resigns as fund manager

As early as last year, the market had heard the news that Dong Chengfei would be leaving as a fund manager, and now the news is completely confirmed. According to the announcement issued by China Industrial Securities Global Fund on October 19, Dong Chengfei’s two funds, Xingxin Vision and Xingquan Trend, totaled 60.615 billion yuan at the end of the second quarter of this year.The number of public offering funds managed by Dong Chengfei is not large, but they are all excellent in the industry.Performance, Are at the leading level in the industry.

The fund manager who replaced Dong Chengfei’s management with a new vision is the move, and the trend of Xingquan recruits Xie Zhiyu and Dong Li to co-manage with Tong Lan.

Public information shows that Dong Chengfei is a master of science from Shanghai Jiaotong University and joined in 2003Industrial Global Fund(Current name: China Industrial Securities Global Fund), has served as industry researcher, fund manager assistant, deputy director of fund management department, fund manager and other positions. He began to manage public funds in 2007 and has managed the social responsibility of Xingquan, a new vision, and All trends, Xingquan business model optimization, Xingquan Global Vision Fund. After resigning as fund manager for personal reasons, Dong Chengfei continued to serve as deputy general manager and research director of China Industrial Securities Global Fund.

“International Finance News” reporter learned that Dong Chengfei published a letter to fund holders on the same day.

Dong Chengfei said: “This letter is written first of all thanks to Xingquan Trends, Xingquan New Vision, and the Xingquan Global Vision, Xingquan Business Model, and Xingquan Social Responsibility Fund that I have managed. Someone, thank you for your trust and support for me and our company. In this booming era, I am fortunate to have won the love of many holders to engage in a career that I love. I am deeply fortunate and I am sincerely grateful. “

In Dong Chengfei’s nearly fifteen years of public fund investment management career, he has experienced multiple rounds of bull and bear market switching, experienced the fluctuations of the macroeconomic environment from 2007 to 2009, and the period of low return for consecutive years from 2010 to 2013. , The explosive market from 2014 to 2015, and the more open and mature A-share market since 2016. Dong Chengfei sighed in the letter: “Along the way, gains and losses have been a rare accumulation and growth. There is a lot of emotion and a lot of gains.”

China Industrial Securities Global Fund is the first company in which Dong Chengfei entered the society. He mentioned in the letter: “As the company’s investment and research team becomes mature and stable, a relatively complete talent echelon has been formed, and I also want to make Some changes, say goodbye to fund management for the time being, spend more time on precipitation and growth, and try to make some new explorations in investment. It is the company’s very good colleagues who take over the investment management of related funds, and we will make work arrangements. Ensure a smooth transition.”

Stick to a balanced style for a long time

After Dong Chengfei stepped down as a fund manager, he left the Xingquan trend of RMB 38.419 billion and the new horizon of Xing of RMB 22.196 billion, as well as 3.0252 million and 385,200 fund holders. The former individual investors hold the proportion. 86.06%, the latter individual investors hold 99.33%.

Judging from the above data, the two funds are obviously favored by individual investors. The reason why many individual investors buy is inseparable from the company’s reputation and Dong Chengfei’s personal investment philosophy. The market volatility has intensified this year.Fund net worthAt the same time, it also affected the mood of individual investors.

Oriental wealthChoice dataIt shows that as of October 18th, Xingquan Trend and Xingxin Vision have increased their net worth by -1.22% and -4.37% respectively this year. Compared with their counterparts, their performance this year is not outstanding, and the current rankings are already low. Location. However, the abnormality of short-term performance may lie in that the style of the market does not match its investment strategy. From the perspective of long-term performance, Dong Chengfei’s investment philosophy is more balanced. Although the offensive market is not a top genre in the bull market, it can also be controlled in the bear market. risk. Data show that Dong Chengfei’s Xingquan trend job return rate reached 326.25%, and the annualized return rate reached 19.84%.

Dong Chengfei, who has always adhered to a balanced investment style, failed to bring steady returns to the above two funds this year. In order to control volatility, Dong Chengfei lowered the stock position this year, but this move has been questioned by some Christians.

According to the data in the second quarterly report, the stock positions of Xingquan Trend and Xingxin Vision were 63.22% and 57.07%, respectively. In fact, the reduction of positions did not start this year. As early as the end of the third quarter of last year, Dong Chengfei began to reduce positions every quarter. While reducing positions,BankThe proportion of deposits in fund assets continues to increase. The two are the latestBankDeposits accounted for 36.52% and 42.77% of the total fund assets.

Dong Chengfei’s neutral and cautious view of the market this year has also caused the funds he manages to miss the benefits of the booming industry. He mentioned in the interim report, “At the beginning of this year, when the market was hot, the fund manager reduced the proportion of equity allocation based on concerns about market valuation and the continuity of the company’s high profitability, and has maintained a relative peer Low equity positions. Looking back half a year, it should be said that this operation is generally in the right direction. However, what far exceeds the manager’s expectations is the market’s pursuit of prosperous industries, and the Fund has very little involvement in this regard.”

Although the performance of funds under management this year is not good, Dong Chengfei still adheres to the investment style. He once said in the interim report that whether the subsequent market will move in a more extreme direction or will gradually show a return of value, which requires further observation.

After Dong Chengfei stepped down as the manager of Xingquan Trend and Xing New Vision Fund, he assigned the responsibility of managing these two giant funds to Xie Zhiyu, Dong Li and Qiao Qian who also have strong investment and research capabilities.

According to data, Xie Zhiyu joined China Industrial Securities Global Fund in 2007 and has 14 years of experience in the securities industry, serving as a researcher, investment manager, and fund manager successively. He is currently assistant to the general manager, investment director of the fund management department, and fund manager. Currently manages Xingquan Herun, Xingquan Heyi and Xingquan Social Value for three years.

Dong Li joined China Industrial Securities Global Fund in 2017 and has 13 years of experience in the securities industry. He is currently the deputy director of the research department and fund manager. Currently managing Xingquan Light Assets.

Housewarming joined China Industrial Securities Global Fund in 2008 and has 13 years of securities business experience. Currently managing the optimization of Xingquan’s business model.

“Xingquan Wujue” has become a memory of the past

After Dong Chengfei no longer manages public funds, the “Xingquan Five” created by Yang Dong, the former general manager of China Industrial Securities Global Fund, will also become memories of public offerings. The five people are Wang Xiaoming, Dong Chengfei, Fu Pengbo, Du Changyong, and Yang Dong.

Among them, Yang Dong left his post in 2017 and created a tens of billions of private equity Ningquan assets. Fu Pengbo left in 2018 and co-founded the personal public fundraising Ruiyuan Fund with Chen Guangming. Wang Xiaoming and Du Changyong went private successively, and the private equity established by the two merged in July last year.

Although Dong Chengfei is still holding an important position in China Industrial Securities Global, there are many rumors in the market about where his career will go next. Private equity may be his first choice after leaving public equity in the future. After Dong Chengfei no longer manages the fund, Xie Zhiyu, another “top class” of China Industrial Securities Global Fund, will attract more attention from the industry.

Oriental wealthChoiceAccording to the data, as of the end of the second quarter of this year, the scale of public offering funds under China Industrial Securities Global Fund reached 527.95 billion yuan, of which non-currencyThe scale exceeds 300 billion yuan.

(Source: International Finance News)

(Original title: Public offering blockbuster! 15-year veteran Dong Chengfei stepped down as fund manager, why?)

(Editor in charge: DF372)

.