the elections for the new President of the Republic, made even more important due to the potential links with the holding of the current Draghi government, are watched very closely in terms of reflections on the BTP / Bund spread and on Piazza Affari.

Banking is certainly one of the sectors that look with the greatest interest at the developments that will emerge from the match for the Quirinale. Credit Suisse analysts focused in particular on the two main banks: Unicredit and Intesa Sanpaolo.

The Quirinal situation is very uncertain and various scenarios are opening up on the horizon that could more or less be appreciated by the financial markets. In recent weeks, the name of Mario Draghi as papable president of the Republic, but the situation is far from clear. If current Prime Minister Mario Draghi resigns and moves to presidential office, current coalition partners could agree to replace him with a technocratic candidate to push Draghi’s agenda forward; alternatively, early elections could be launched, certainly an unwelcome scenario to the markets. The game of the Quirinale is therefore still open and remains closely linked to that of the government and therefore to the search for possible solutions in the event that Prime Minister Draghi were to move to the Colle.

Spread and potential impact on Intesa and Unicredit

The uncertainty about the outcome of the presidential elections is also reflected in the BTP-Bund spread; with the approach of the appointment with the election of the President of the Republic, the yield differential between the 10-year BTP and the German bund has gradually widened, also thanks to the expectation of a less accommodating ECB in the near future. The spread is now around 45 basis points higher than in February 2021, when Draghi was named Prime Minister.

The analysts of Swiss credit they focused on national sovereign debt exposures for Italian banks and on capital sensitivity to changes in the spread. According to analysts, a further widening of the spread could have a negative, albeit limited, impact on the capital levels of Italian banks.

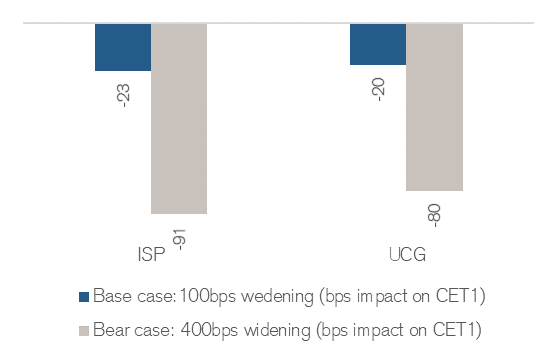

Among all the financial statement indicators that in a synthetic and immediate way express the solidity of a banking institution, the most important of all is the CET1. Credit Suisse highlights that with respect to the CET1 solidity targets, Italian banks should maintain their excess capital option. In the first half of 2021, Italian sovereign exposures amounted to approximately 90% of CET1 for both Unicredit and Intesa Sanpaolo. In Unicredit, almost 48% of this exposure is accounted for at fair value, while in Intesa Sanpaolo at 60%. The Swiss bank therefore expects a relatively greater impact on Intesa Sanpaolo’s capital levels than an increase in volatility in the Italian sovereign spread and estimates that a 100 bp widening of the spreads would remove around 20 bps in CET1 levels for Unicredit and 23 bps for Intesa.

The worst case scenario

The more bearish scenario, namely that of a government crisis with early elections, could lead to a more prominent role by the Eurosceptic Brothers of Italy party led by Giorgia Meloni, affecting Italy’s political agenda and the use of EU funds, as well as long-term relations with the EU. “To understand the risk inherent in this scenario, we estimate that a potential widening of Italian sovereign spreads ai debt crisis levels seen in 2012 (+400 bps), that it would subtract 81 bps from CET1 for Unicredit and 92 bps from Intesa Sanpaolo.

The last 12 months ahead of everything for the banks

The performance of the European banking sector has been very positive throughout 2021, theEuro Stoxx Banks has achieved + 50% in the last 52 weeks. The increases for the Italian banking sector were on average more contained but among the outperformers Unicredit once again stood out with a + 83% in the last year and Intesa Sanpaolo (+ 40%), which are confirmed as top players in the sector.

In the coming weeks, investors’ eyes will be on Intesa Sanpaolo which the February 4 will present the new business plan.