Dong Chengfei, who made his first appearance after “running away” a week ago, reappeared on the live broadcast platform on March 31 to communicate with investors.

In the previous roadshow, Dong Chengfei made an outlook on this year’s market and analyzed investment opportunities in hard technology, Hong Kong stocks and other sectors. In this exchange, Dong Chengfei reviewed the A-share market he has experienced in his career, analyzed the main line of the market in the past five years, and shared his advice for investors.

He believes that there is no way to judge the market 90% of the time, and there may only be a clear point of view less than 10% of the time, but unfortunately, the current market situation is in the 90% range, and it is difficult to make a detailed direction. sexual judgment.

However, he also said that the mid-winter has passed, and the market has actually already priced many negative factors into the stock price. There must be uncertainties, and everyone can still feel the cold spring. But he feels that in the future, there will be a long or short bottleneck period like the large-scale capital entry in 2016 and 2017, and the market will gradually enter this situation.

Core assets are the main line of this round of market

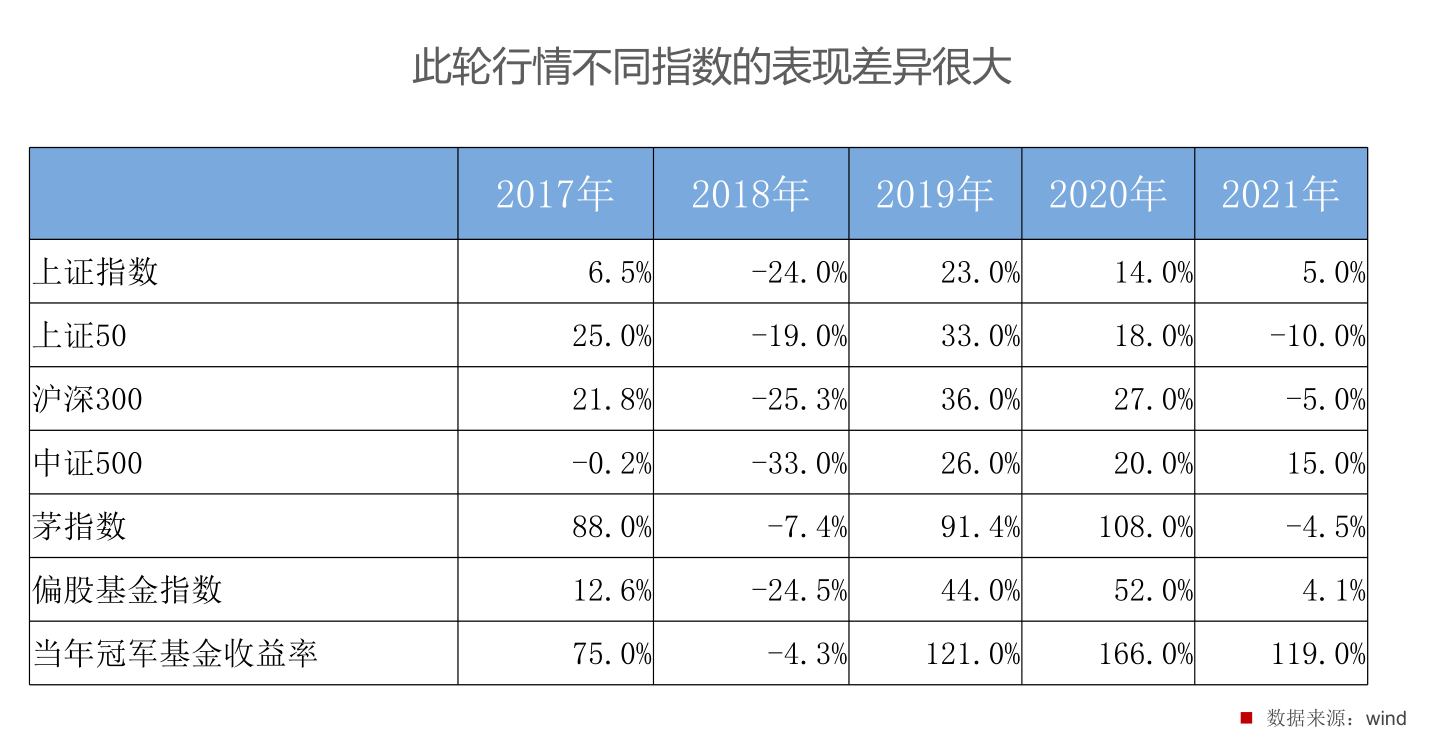

In Dong Chengfei’s view, the current round of the market started in 2017. Before that, A-shares were both rising and falling at the same time. However, in this round of market, companies with different textures and different market values are very different.

for exampleThe Shanghai Composite IndexIn 2007, it was 3,000 points. After 15 years, the Shanghai Composite Index is still only 3,200 points, which is relatively weak. The CSI 500 Index, which represents the small and medium-sized board, started the latest round of the market and did not perform well.

In Dong Chengfei’s view, the performance of different indices at different stages is very different. What index is used to measure the market is also very important.

He is judging whether the market is good or bad, mainly using biasstock baseGold index, judged by this indexfundCan you make money for the owner as a whole?This round of the index andCSI 300The index is relatively close, it is all stocks and partial stockshybrid fundThe median or weighted average benefit is such a concept.

The index that Dong Chengfei often looks at also has the Mao index, which is an index obtained by equal weighting of the 42 best companies in the Shanghai and Shenzhen stock markets. He pointed out that this index is very eye-catching in this market, with an 88% return in 2017, a slight retracement in 2018, a nearly doubled return in 2019 and 2020, and a slight retracement of 5% in 2021. Bibian Fund Index, CSI 500, CSI 300SSE 50are strong.

Therefore, Dong Chengfei believes that the main line of the entire market in the past five years is very clear, which is the core asset, and high-quality + large market is the main feature.

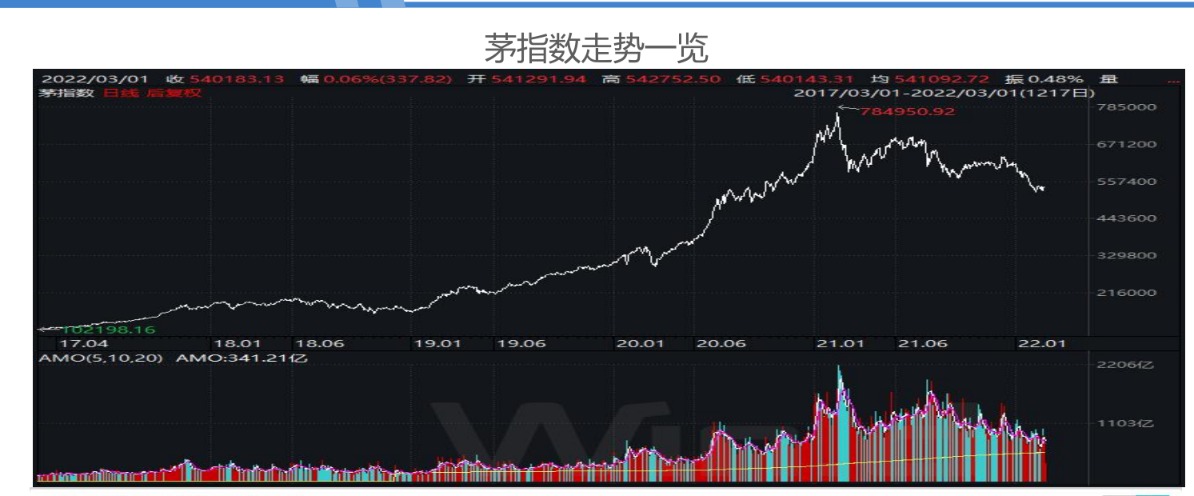

The Mao index has not retreated much

Dong Chengfei more intuitively showed the strong trend of the Mao Index in the past five years through a graph. At the beginning of 2017, it was around 100,000 points, and the highest point in January 2021 was 780,000 points. This increase is very amazing. In the adjustment in 2018, the CSI 300 adjusted by more than 20%, but the Mao index was basically a horizontal line in 2018. Therefore, he believes that the adjustment in 2018 is just a break in the overall upward market, because the entire main line has not changed and is very clear.

The financial performance of the Mao Index is also very good. Since 2017, the Mao Index’s performance in the past five years hasperformanceThe growth rate is much higher than that of the CSI 300 constituent stocks, especially in 2020, China has enjoyed a very large epidemic dividend.

Throughout 2020, the total performance growth rate of the 42 constituent stocks of the Mao Index is 77%, which is significantly higher than the stage before the epidemic. Before the epidemic, the fluctuation of the Mao index was around 20%, but from the data of the first three quarters of 2021, the growth rate of the Mao index is still close to 30%. Therefore, the constituent stocks of the Mao Index are indeed excellent, and their performance in the past five years has also been outstanding.

It can be seen that at the beginning of the market in 2017, the PE of the Mao Index was about 15 times, and by 2021, it will reach a maximum of 40 times the valuation, and the valuation level of the entire sector has been greatly improved. The current situation is that the index has retraced about 30% from its high point, and its valuation is about 27 times. This level is slightly higher than the index’s average over the past five years, which is more than 24 times the average.

It can be said that in the current market, the valuation of this index is still high, of course not the highest.GEM refers toThe valuation will be higher.

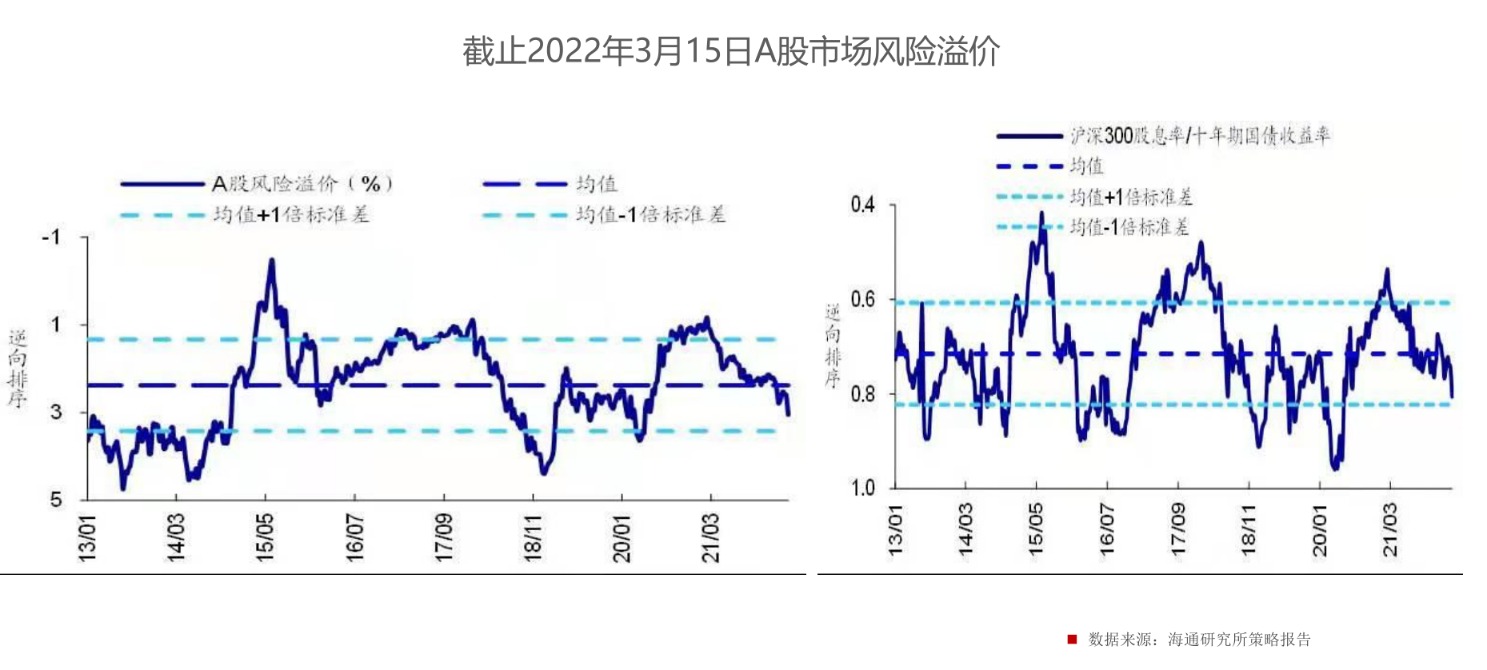

fromHaitong SecuritiesIn terms of statistics, basically in terms of the distribution of PE, PB and many other industries, the entire A shares, relatively speaking, the CSI 300 is already at a historically low valuation level, as can be seen from the data , many industries are also in a position below the center since 2013. Therefore, although the Mao index has not retreated much, other indexes have retreated to the water level of low valuation.

Funds have not left the market so far

From the perspective of capital, Dong Chengfei believes that this round of market has entered the market through the large expansion of public and private funds. At present, the scale of public funds is 10 trillion, and the scale of private funds is also 7 or 8 trillion. Although he has also encountered the expansion of public and private funds in history, the scale in the early years can be said to be insignificant compared to the present.

Behind the expansion of the market, openness and interoperability are an important driver. Foreign capital flows into A-shares through the land-port connection, which is completely different from entering the market through leverage in 2013-2015.

Another big background is that the past five years have been accompanied by a unilateral decline in China’s “risk-free rate of return”.Bankfinancial managementEarnings can reach a yield of 6-7%, which turned out to be a constraint on the stock market. In the process of breaking the just exchange in the past five years, if there is the aforementioned rate of return, we must bear certain risks.

The last point is actually an accident. In 2021, China’s manufacturing industry will enjoy the dividends of the epidemic, especially leading listed companies. The US government’s assistance is very strong, and many people in the United States may get more money at home than work during the epidemic. This has formed a situation of American consumption and Chinese manufacturing, and this kind of benefit has been enjoyed by leading companies in various industries.

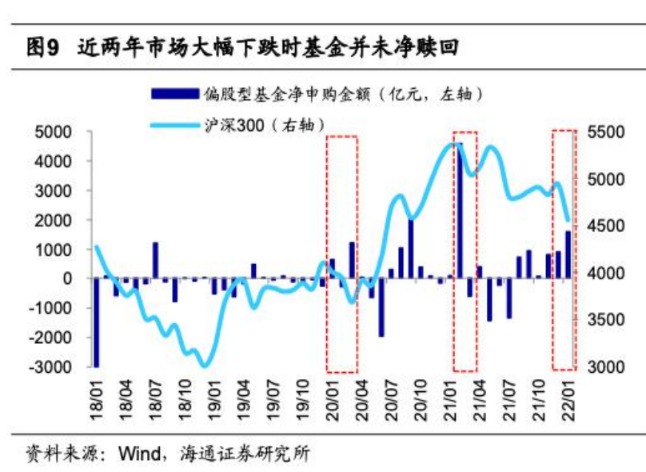

Dong Chengfei believes that so far, these funds have not left the market.

Judging from the public offering data, there are still net subscriptions in January and February, and the inflow of northbound funds has been very large in the past five years. As of the beginning of March in 2022, there will be a slight reverse outflow from the north, but the ratio of this reverse outflow to the inflow in previous years is almost negligible, and northbound funds can be regarded as a stable situation.

In addition, the risk-free rate of return of China’s current investable channels has dropped a lot, and the real risk-free rate of return is less than 3 points, and there is a lack of over-the-counter investment opportunities. Therefore, funds have not left the market so far.

Performance is the most important factor affecting the market

Dong Chengfei said that looking back, there are many factors affecting the market, including policy and capital.fromGF SecuritiesAs can be seen in the figure, since 2006, the profit growth of the Wind All A Index and A shares after deducting the financial profits. Most of the time, these two lines are synchronized, but the rhythm is all different. Sometimes the stock market Go a little ahead of the performance, and sometimes the performance is a little bit ahead of the stock market. The only big exception is the market in 2013-2015. These two lines are split and go in two directions. Looking back, the market in 2013-2015 was actually not supported by macro fundamentals.

Based on many factors in the above analysis, Dong Chengfei believes that looking at performance in the future is a very important variable.

In his view, the overall trend of performance in 2022 is definitely going down, but what will happen in particular, every professional investor is constantly adjusting his expectations. In fact, everyone has been prepared for the decline in performance growth in all aspects this year, but to what extent is the decline, everyone is not low, and in Dong Chengfei’s view, the most important factor affecting the subsequent market is performance.

He listed several current market concerns, such as real estate, the data in January and February were not very good; and the epidemic, but he believed that the impact of the epidemic on performance was relatively short. The impact of the epidemic on performance can be regarded as a one-time impact, and more emphasis is placed on long-term performance.

andoil price, oil prices, as the anchor for the pricing of many things, represent everyone’s concerns about inflation. Having just experienced negative oil prices, and now back to more than 100 yuan, market views will also change dramatically. He believes that new energy is the general trend, and the price of energy may depend on the speed of development of new energy. Before reaching the business point, it may remain at a relatively high position.

Dong Chengfei said that there is no clear conclusion to the factors listed above for market concerns, but what is more important is what the stock market reflects.

He cited a risk premium concept developed by Dr. Xun Yugen’s team. Now, what he needs to see is how much risk is price in the market’s valuation.He showed tworesearch reportIn the picture, the cut-off time is March 15, which is the most pessimistic day. Compared with the history, the entire risk premium is below the average.

Dong Chengfei said that the mid-winter has passed, and the market has already priced in many negative factors in the stock price. But there are definitely still uncertain factors, and everyone can still feel the cold spring. In the future, it will be like a long or short bottleneck period after the large-scale capital entry in 2016 and 2017. He feels that the market has gradually entered this state.

It is not recommended for non-professional investors to sell at this time

At the end of the exchange, Dong Chengfei also gave investors a suggestion that non-professional investors do not recommend selling at this time.

He believes that every professional investor has its own framework and system, has a very clear understanding of these factors, and also has an error correction system. The most important thing is that professional investors spend a lot of time and energy in the market, so they will have a clear reflection and perceive market changes. Non-professional investors do not have the energy to keep an eye on the market, and there is no way to be so close to the market. It takes half a year to a year for information to reach the ears of non-professional investors.

He took this round of market as an example. This round of market started in 2017, but many non-professional investors began to enter the market in 2020. Non-professional investors understand that there is a time lag in the market.

Statistics show that the timing for a large number of investors to enter the market is not very good. When people bought funds, they saw that the income in the past few years was stable and happy, but they fell into the pit. However, equity investment is characterized by great volatility. . Therefore, he does not recommend selling at this time. The most taboo in investing is to buy high and sell low. At this time, investors must manage their emotions, otherwise they may be chopped in the pit.

Finally, Dong Chengfei shared a short story with you. “After the outbreak of the epidemic in 2020, the index fell very sharply on the first day of the Chinese New Year’s opening. I bought a lot on that day. Our understanding of the epidemic is still on SARS, and we think it is a short-term thing, so the impact of the epidemic on valuations It can be ignored. But looking back, our understanding and view of the epidemic at that time were completely wrong, but my actions were right at that time. Manufacturing has a wave of dividends, etc., so there are always many uncertainties in the market. As my favorite movie “Forrest Gump” said, life is like a piece of chocolate, you never know what you will get surprise.”

“So, the equity market will face uncertainty, and the most important thing for professional investors is to deal with this uncertainty, and we will remain in awe of this uncertainty.” Dong Chengfei concluded.

Related reports

10,000-word long text!Zhang Kun, Liu Yanchun, Liu Gesong, Fu Pengbo and other top ten fund managers’ annual reports

Zhang Kun’s holdings of 100 billion top streamers exposed that these stocks were increased! How do you view corporate valuations in the different ways of A shares and Hong Kong shares?

Xie Zhiyu: Many companies have become very worthwhile to start. There is no particular risk in the current market (with the latest positions)

(Article source: Financial Associated Press)