[The Epoch Times, February 25, 2022](The Epoch Times reporter Zhou Yun compiled a report) After Russian President Vladimir Putin attacked military targets in Ukraine by sea, land and air in the name of “special military operation”, the bank is on whether to Buyers of Russian crude have become hesitant to offer letters of credit to pay for crude deals with Russia.

At least three buyers of Russian crude oil have been unable to open letters of credit from Western banks to pay for purchases, citing four trading sources in an exclusive report on Thursday (Feb 24), citing Russia’s invasion of Ukraine. , the market is uncertain.

Letter of credit is a standard practice for large-scale commodity transactions. Usually, the buyer will ask the bank to open a letter of credit to ensure that the buyer will pay the seller on time after receiving the goods.

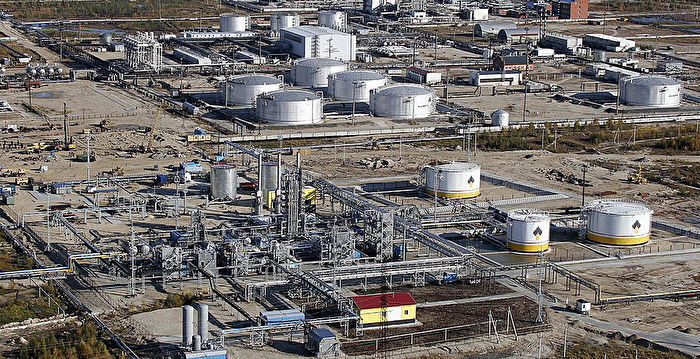

Russia has always been a major oil exporter, and its largest oil buyers include major Western oil giants such as BP and Shell, Italy’s ENI, TotalEnergies, Statoil Equinor, Chevron and Exxon Mobil, and traders such as Vitol, Glencore, Trafigura, Gunvor and Mercuria.

But the anonymous sources did not reveal which banks refused to issue letters of credit. According to current trading data, Russia exports up to 7.5 million barrels per day of crude oil and crude oil products, including the United States.

In November alone, 17.8 million barrels of Russian crude and petroleum products were shipped to the United States. On Thursday, the second wave of sanctions announced by U.S. President Joe Biden did not include Russian crude supplies. Moreover, Biden also said that he would cooperate with other countries to jointly release more oil from the global strategic crude oil reserve, which brought crude oil prices down from highs.

While futures pared gains after Biden’s speech on Thursday, the potential for a sharp rise in oil prices remains, said Ed Moya, senior market analyst for the Americas at Oanda. The fall in crude oil prices after the announcement of this round of sanctions did not change the possibility of a sharp rise in oil prices.

JPMorgan Chase also estimated that if Russia retaliated against Western sanctions, reducing or interrupting its energy exports to Europe and the United States for four months, if calculated on the basis of a reduction of 2.9 million barrels per day, crude oil prices may reach 115 in the second quarter of 2022. USD/barrel.

In addition, the international price of aluminum metal also rose because of the crisis in Russia and Ukraine, and hit another peak in 13 years. LME three-month aluminum was at $3,394.50 a tonne, up 3.1%, by the time of writing, while nickel prices rose as much as 5.4% to $25,705 a tonne, the highest since May 2011. Industrial metals such as zinc, lead and tin also rose. ◇

Responsible editor: Lin Yan#