Original title: Sales will fall off the cliff! In a word from the chairman, the billion-dollar milk powder giant plunged 8%! Urgently smashed $200 million in repurchase, fund managers think so!

Summary

[Sales will fall off the cliff! Chairman’s word 100 billion milk powder giant plunges 8%]The domestic milk powder giant China Feihe saw a thrilling trend today, plummeting more than 8% in early trading; at noon the company announced that it intends to use no more than 200 million US dollars to buy back shares; the afternoon decline shrinks Narrow, but still fell 6.60% to the close, the stock price fell for four consecutive times. According to media reports, at the 2021 Yabuli China Entrepreneurs Forum held on June 8, Leng Youbin, chairman of China Feihe, said that because of the impact of the vaccine, many mothers and fathers cannot become pregnant within 6 months. Milk powder sales will see a cliff-like decline in the next year or two. (China Fund News)

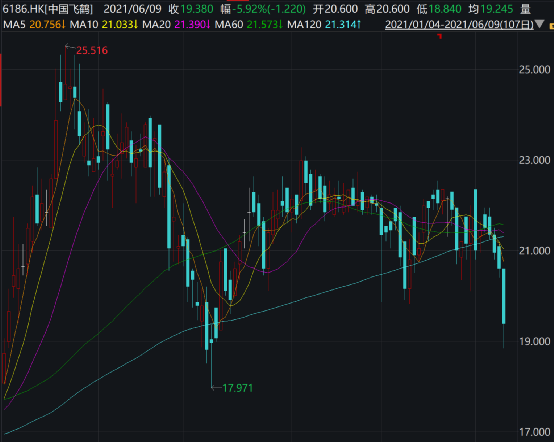

Domestic milk powder giantChinese Flying CraneToday’s trend can be described as thrilling, with a plunge of over 8% in the early trading; the company announced at noon that it intends to use no more than 200 million US dollars to buy back shares; the decline narrowed in the afternoon, but it still fell 6.60% to the close, and the stock price fell for four consecutive times.

On June 9, Hong Kong dairy stocks plunged across the board. What is the reason?fundWhat does the manager think of this timeRepurchaseWhat do you think of the company’s future prospects? Let’s take a look at the fund.

Hong Kong dairy stocks plummeted across the board

Chinese Flying CraneRepurchase shares

Hong Kong dairy stocks plunged across the board on June 9, early tradingChinese Flying CraneIt fell all the way, once fell by more than 8%, and then in the afternoonCompany AnnouncementRepurchase, the stock price rebounded, the decline narrowed, as of the close, it fell 6.60% to 19.24 Hong Kong dollars per share.

In addition to Feihe, the dairy stocks of Hong Kong stocks suffered a severe setback across the board.Original ecological animal husbandryFell 3.28% to HK$0.59;Modern animal husbandryFell 4.81% to HK$1.78;AusnutriaFell 3.80% to 11.14 Hong Kong dollars.

According to media reports, at the 2021 Yabuli China Entrepreneurs Forum held on June 8, Leng Youbin, chairman of China Feihe, said that because of the impact of the vaccine, many mothers and fathers cannot become pregnant within 6 months. Milk powder sales will see a cliff-like decline in the next year or two.

In fact, after seeing the stage high of 25.516 Hong Kong dollars per share in January this year, China Feihe’s stock price fluctuated very strongly. It first fell all the way to 17.971 Hong Kong dollars per share in early March, and then rebounded, but recently it has fallen more sharply. , Has fallen for four consecutive trading days, as of the latest closing price of 19.24 Hong Kong dollars per share, down about 24% from the previous high, the latest total market value of 171.9 billion Hong Kong dollars.

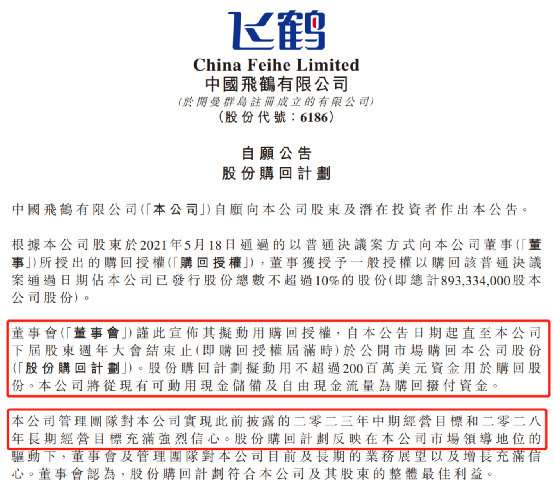

Just after 12 noon on June 9, China Feihe issued a share repurchase plan, and the company intends to use the repurchase authorization from June 9, 2021 until the company’s next session.shareholderThe company’s shares will be repurchased in the open market until the end of the annual general meeting (that is, when the repurchase authorization expires). The share repurchase plan intends to use no more than US$200 million in funds to repurchase shares. The company will allocate funds for the repurchase from the existing available cash reserves and free cash flow.

China Feihe stated that the company’s management team has strong confidence in the company’s previously disclosed mid-term business goals for 2023 and long-term business goals for 2028. The share repurchase plan reflects that driven by the company’s market leadership, the board of directors and management team have full confidence in the company’s current and long-term business prospects and growth.

Fund managers: repurchase releases positive signals

Corporate fundamentals are relatively strong

The fund manager interviewed a fund manager who invested in Hong Kong stocks. He said that FeihefaannouncementIt is a positive sign that they want to buy backPerformanceVery confident. “From the chairman’s speech, some people may have to postpone the birth of a baby after the vaccine is given, but this does not mean that they have not given birth. So in the short term, it may have an impact on the company’s performance data in the second half of this year and the first half of next year. But in the long run, there is no impact. And because of the accumulation of demand in the future, the release may be accelerated. There is also the impact of the three-child policy. We think that extending the dimension for a few years will not have any impact on the value of the company. This is similar to the first quarter of last year. When the epidemic occurs, consumer products such as liquor will be affected in the short-term, but it will not affect the long-term value of the company.”

The fund manager believes that Feihe’s current valuation is still relatively cheap, and the stock price has become cheaper these days. “Although Feihe’s stock price has risen a lot before, its performance has grown rapidly every year, and it may also increase this year. More than 30%, so the valuation is not expensive. From a fundamental point of view, this company is relatively good. Although the birth rate is going down and the total milk powder industry has not grown, the industry structure is upgrading. Children pay more attention to it, the trend of consumption upgrade is obvious, and high-end products will get better and better.”

He also told the fund manager that although Feihe’s stock price has fluctuated sharply recently, they have not reduced their holdings. “In the short term, it may have some impact, but from a five-year perspective, it doesn’t matter. The core point is that the market share of domestic milk powder is constantly increasing. Milk powder is more suitable for the physique of Chinese babies, and its channel layout capabilities are also very strong, and its market share continues to increase. And now young people are becoming more and more recognized by domestic brands. Overseas affected by the epidemic, imported milk powder is no longer so fragrant.”

Chairman Leng Youbin:

Domestic milk powder continues to boost consumer confidence in domestic products

Let’s take a look at yesterday’s speech. According to reports from Sina Finance and China-Singapore Jingwei, on the evening of June 8, at the opening ceremony of the 21st Annual Meeting of the Yabuli China Entrepreneurs Forum in 2021, the chairman of the milk powder brand China Feihe Leng Youbin made a speech.

Leng Youbin said that consumers’ perception of brands was originally to recognize and choose foreign brands, but now they are gradually turning into Chinese brands. Feihe’s growing market share is enough to prove that there are good Chinese brands in an industry. Under the premise of, consumers must gradually believeM&ABuy domestic brands, and then cultivate their own new domestic products.

according toNielsenAccording to statistics, as of the first quarter of 2021, Feihe’s domestic market share has won the first place, reaching 18.5%.In April this year, after the international authorityResearchCertified by Frost & Sullivan, Feihe milk powder has achieved the important achievement of No. 1 sales in the Beijing infant formula milk powder market in 2020. The achievement of “No. 1 sales in the Beijing market” has further boosted Chinese consumers’ preference for domestic milk powder. Consumer confidence.

Regarding the impact of the epidemic, Leng Youbin said that during the epidemic, Feihe was also tested by rising costs, epidemic risks, insufficient milk sources, and changes in channels. The killer of Feihe in the past was “ground activities” because the cause of the epidemic was also basic. Stopped, “Regardless of whether our team will do live broadcasts or online events, we decided to move online.” He said that the company’s previous more than 60,000 people on the ground are participating in online activities. .

He also pointed out that the decline in the birth rate of infants is a more serious test for companies that make infant milk powder, so they have made a lot of scientific research and product development in the product life cycle. “It turns out that our consumers are 0-3 years old, but now we are 3-6 years old, 6-7 years old, and from 7 years old to 100 years old.”

He said that it is now expanding to infant milk powder, children’s milk powder, maternal milk powder, and adult functional milk powder. The goal is also to produce and create more organic, more ecological and safer food for the 400 million middle class in China, the elite of China, which is actually 15,000 families, and form a large ecological cycle.

Regarding the advantages of Feihe, Leng Youbin said that the area where Feihe milk powder is located is Qiqihar, Heilongjiang, and the latitude is “47 degrees north latitude”. He emphasized that this latitude is similar to Hokkaido in Japan, Ireland and the Netherlands in Europe. The same is called the golden bull belt of the world. Because it is found that the world‘s best dairy cows, the best milk producing areas where cows are most suitable for living and growing are all in this latitude zone. He said that Feihe made a strategy of moving north from 2011 to 2013, selling and shutting down all factories in the south, and moving the entire industrial chain of the production base to 47 degrees north latitude. He also pointed out, “Our sales company is in Beijing. There is smog in Beijing. The cattle are also afraid of the smog. The cattle are also willing to eat safer, more ecological and more organic forage feed. Therefore, we build Feihe on this latitude zone. Own industrial base.”

Feihe’s 2020 revenue growth rate is 35.5%

Institutions are optimistic about the dividends of the three-child policy

Previously, China Feihe’s 2020 financial report also showed that Feihe will achieveOperating income18.592 billion yuan, a year-on-year increase of 35.5%. Among them, the company achieved revenue of 17.673 billion in infant formula products, a year-on-year increase of 41%. The company’s revenue growth rate ranks first in the industry, and its market share has further expanded.

Kaiyuan Securities believes that with the decline in the infant birth rate, the volume of my country’s milk powder industry has fallen and prices have risen. According to Frost & Sullivan data, the sales volume of infant powder in my country has declined since 2019 and is expected to fall to 765,000 tons in 2025. The compound growth rate of infant powder sales from 2020 to 2025 is about -4.1%. However, with the increase of residents’ disposable income, the increase of urbanization rate, the increase of brand awareness, and the increasing emphasis on product nutrition and quality, the price of China’s infant formula will continue to rise, and it will be the main driving force for the future development of the milk powder industry. With the liberalization of the three-child policy, the birth rate can be supported to a certain extent. The overall sales of the infant formula milk powder industry will become more stable, and the milk powder industry can enjoy the dividends of the liberalization of the three-child policy as the average price continues to increase. In addition, in recent years, the acceptance of domestic milk powder brands has increased, maternal and child channels have emerged, and favorable policies have been released, and domestic brands have great potential for development.

The agency believes that China Feihe is the leader in domestic milk powder with strong channel power, brand power, and product power. In the short term, we can continue to intensively cultivate the infant formula industry, stabilize the leading position in strong regions, explore weak regions, and continue to increase market share; in the long term, we will deploy the second growth curve of children’s milk powder and adult milk powder, with broad development space.

China Merchants SecuritiesIt is believed that the rapid penetration of first- and second-tier cities is optimistic about the increase in Feihe’s market share, aiming at the medium-term growth target. Feihe currently has the largest market share in Beijing, and sales in Shenzhen, Guangzhou, Shanghai and other places approximately doubled last year, continuing to seize the share of foreign investment.

(Source: China Fund News)

(Editor in charge: DF398)

Solemnly declare: The purpose of this information released by Oriental Fortune.com is to spread more information and has nothing to do with this stand.

.