That the future of cars is electric is now well established. While the global auto market 2020 was an annus horribilis due to the pandemic, sales of electric vehicles marked an incredible + 40% to exceed three million units. If 46% of sales come from Europe, China immediately follows with 39%, while North America represents only 12%. “Players along the mobility chain who want to thrive in the next normal will have to consider targeting their investments in these areas and at the same time educating consumers on their benefits – note the McKinsey experts -. Such efforts will be particularly important for autonomous driving, as many people are still reluctant to use these vehicles in the future ”.

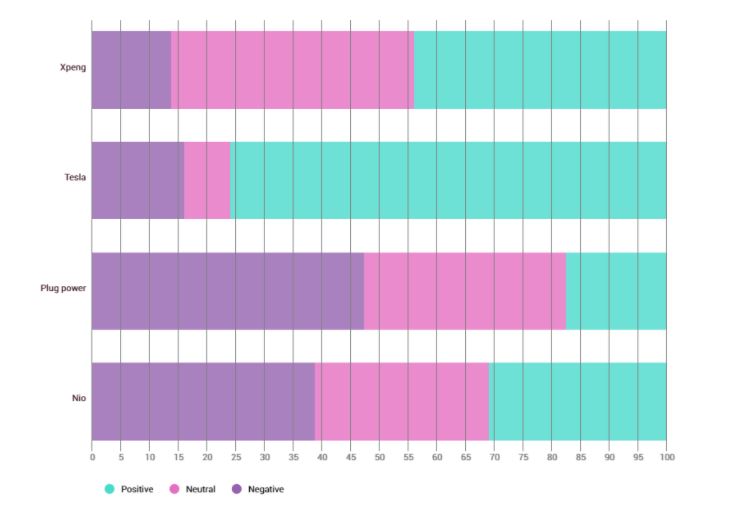

The online survey carried out by FinanzaOnline with T-Voice, a company that deals with opinion mining, sentiment analysis and topic discovery and uses supervised artificial intelligence algorithms with the aim of offering a precise overview of opinions and feelings shared via the web and social networks.

The analyzes were conducted on more than 31,000 texts in Italian concerning the tema “EV stocks” present on the web and on the main social networks for the period from 1 January to 15 March 2021. It should be noted that all the results are presented net of “off-topic”, that is, without considering those texts that do not contain the topic of interest.

The most popular EV stocks on the web

Tesla is the most discussed car company on the web (34.30%), followed by Xpeng (30,23%) e Plug Power (28.16%). Nio is behind the three with 7.32% of the discussions.

Tesla is undoubtedly the queen in the world of electric vehicles. Led by histrionic Elon Musk, Tesla in 2020 was the automaker that sold more electric cars all over the world thanks to Model 3, the best-selling electric ever. And the future is bright for Palo Alto. And Ives, l’analista on Wedbush, which has always had a bullish view on the electric car giant, he specified that investors looking for “a huge buying opportunity” should look to Tesla. Where can it go? According to Ives, Elon Musk’s creature could reach a stock market value of $ 1 trillion before the end of the year.

But Tesla is not alone and they are pushing other companies to excel. Renamed the Chinese Tesla, Nio is the electric car startup made in China, come to be worth more than a historical giant such as GM and currently China’s largest electric car manufacturer. Positive indications from analysts such as Goldman Sachs which estimate sales per NIO of 800,000 units in 2030 and 3.2 million in 2050.

In the list of competitors of Tesla for the EV another Chinese protagonist has been added, Xpeng Motors, in which he recently invested with a loan from 500 million yuan ($ 76.9 million) on Guangdong Yuecai Investment Holdings Co., which is the financial arm of the government of the Chinese province.

Plug Power, instead, it is a leading supplier of hydrogen engines and power solutions for electric mobility. Plug Power products provide fuel for small vehicles (warehouse forklifts) and large vehicles (delivery vans and airport security equipment). Plug Power, which in January signed a partnership con Renault for the construction of a joint venture aimed at the construction of hydrogen commercial vehicles, it has implemented over 40,000 fuel cell systems for electric mobility, more than anyone else in the world, and has become the largest buyer of liquid hydrogen, having built and operated a hydrogen highway in North America. On Wall Street, the Plug Power stock reached + 1,500% compared to the levels of the beginning of 2020 before the full track of the last few weeks.

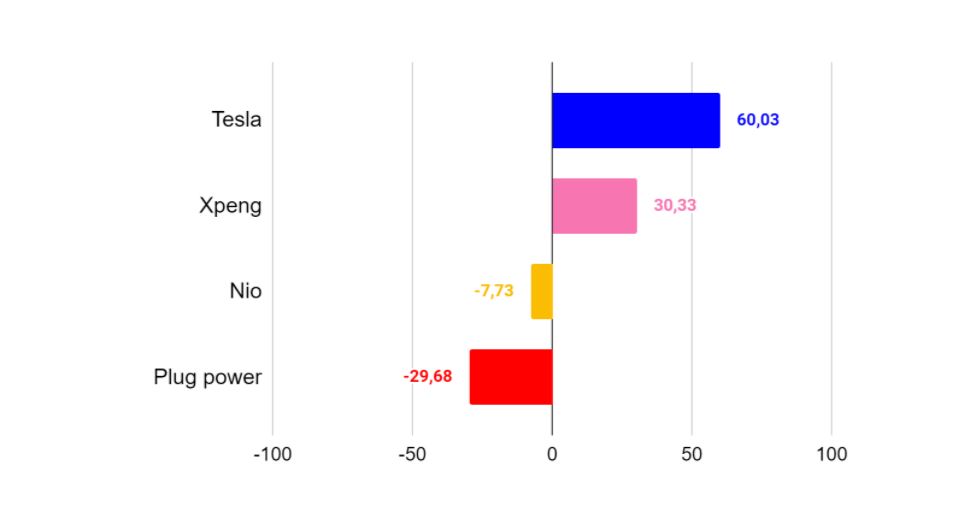

Tesla in front of everyone for detachment

But in addition to being the most talked about, Tesla is also the world‘s EV company with the highest frequency of positive opinion, closely followed by Xpeng.

Absolute primacy always for Tesla as regards the level of preference among the main world EV companies.