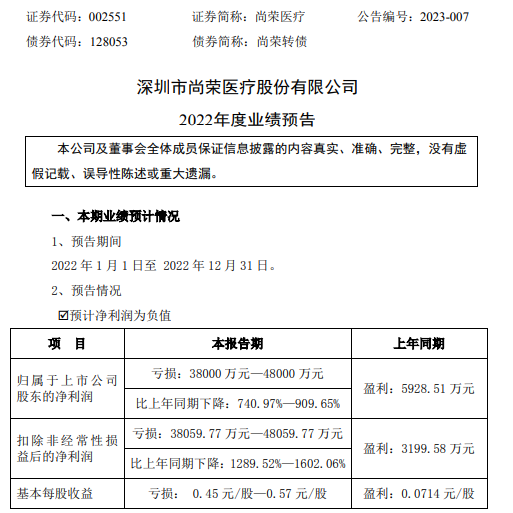

On January 20th, Shangrong Medical (002551) recently released the 2022 annual performance forecast. During the reporting period, the net profit loss attributable to shareholders of listed companies was 380 million to 480 million yuan, turning from profit to loss compared with the same period last year. ; Basic earnings per share loss of 0.45 yuan / share – 0.57 yuan / share.

During the reporting period, the main products of the company’s holding subsidiaries Hefei Purd Medical Products Co., Ltd. (hereinafter referred to as “Puld Medical”) and Purdd Holdings Co., Ltd. Disposable medical consumable products. Affected by the epidemic, some domestic factories and foreign factories of Pulder Medical have shut down, which has affected the scheduling of orders; At the same time, the supply of domestic protective products tends to be balanced, and the gross profit margin of protective products further declines, resulting in a sharp drop in sales and profits of Purdue Medical and Purdue Holdings during the reporting period.

According to the “Accounting Standards for Business Enterprises No. 8 – Asset Impairment” and related accounting policies, combined with the company’s actual operating conditions and the operation and financial status of the company’s various assets at the end of the reporting period, based on the principle of prudence, the company’s Relevant assets that show signs of impairment (decrease in price) undergo a preliminary impairment test, and it is estimated that a total of about 383.2688 million yuan in asset impairment and credit impairment provisions will be accrued (the final data is subject to the audit report, the same explanation below). Main accrual items: (1) Due to the sharp year-on-year decrease in the net profit of Purdue Holdings, after preliminary testing, it is proposed to make an impairment provision of about 60 million yuan for the goodwill of Purdue Holdings; (2) for the Xuchang Second Hospital project For accounts receivable, because the progress of bankruptcy reorganization is not as expected, the difficulty and uncertainty of reorganization have increased. After the preliminary individual impairment test, it is planned to make a credit impairment provision of about 129.1628 million yuan during the reporting period; (3) For the PPP project investment held by the company – Fuping project, on the basis of the preliminary evaluation by the evaluation agency, it is planned to make an asset impairment provision of 19.3696 million yuan; and to make a bad debt provision of 19.9665 million yuan for the unrecovered project hospital arrears; (4 ) The company’s holding subsidiary’s investment in Suzhou Kangli Orthopedic Medical Devices Co., Ltd., due to the influence of the national centralized procurement of orthopedic consumables industry, product sales prices have been greatly reduced, and profits have fallen sharply; During the reporting period, it is planned to make an investment impairment provision of 125.7259 million yuan.

During the reporting period, the company cleaned up pending litigation or arbitration matters one by one, and proposed to accrue estimated liabilities of RMB 67.7399 million for projects that may cause losses.

Due to the continuous adverse impact of the epidemic, the implementation progress of the company’s professional medical engineering projects has generally been extended, and labor costs and management costs have increased, resulting in a relatively large decline in the gross profit margin of the engineering service business during the reporting period.

According to the data of Qubei.com, Shangrong Medical has built a medical platform covering the three major business segments of medical products, medical services and health industry.