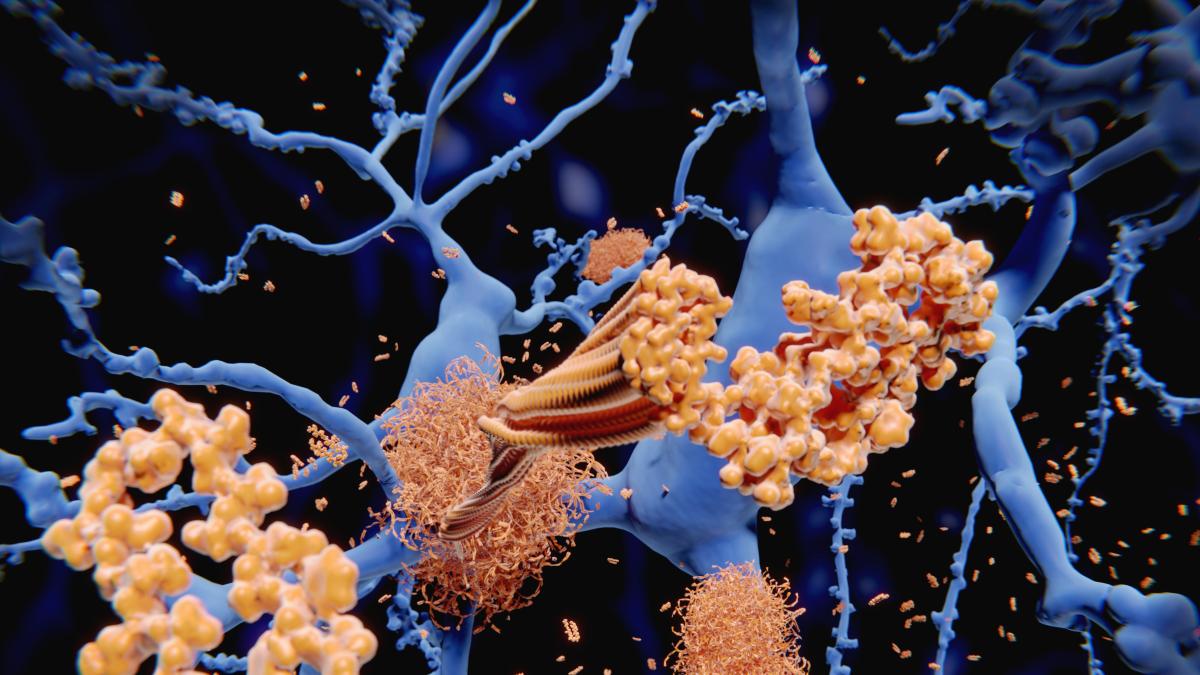

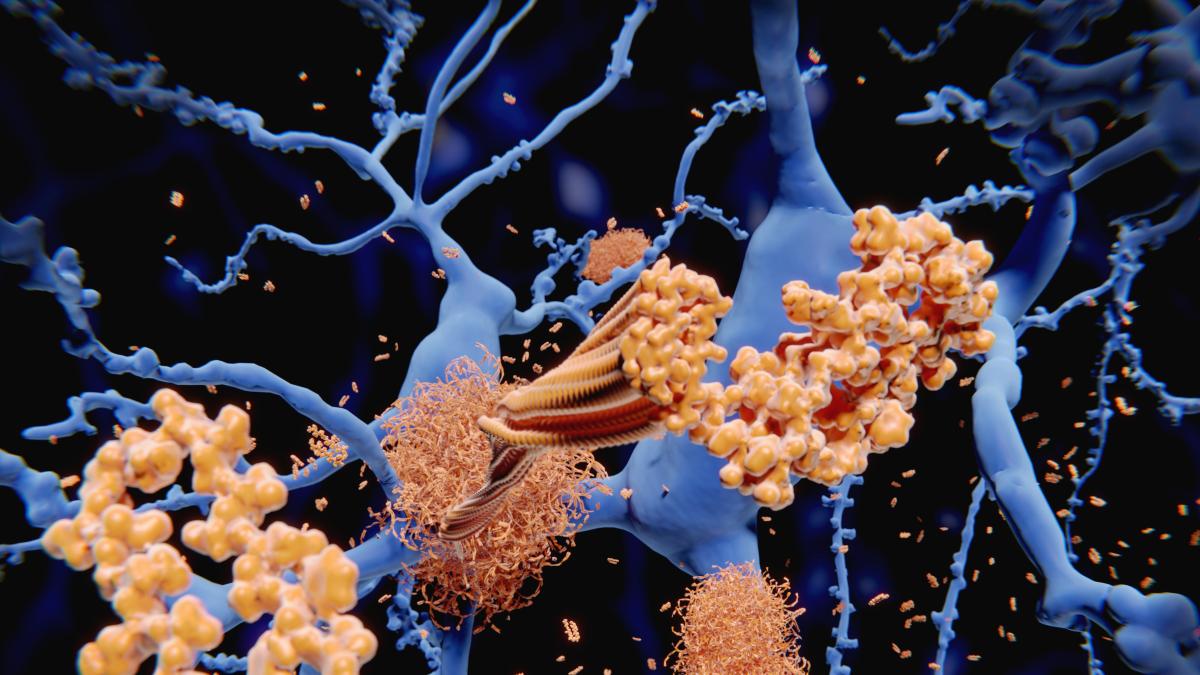

The gene that protects against Alzheimer’s: «It creates a barrier in the brain»

by Cristina Marrone The American study on eleven thousand people and on zebra fish. Scientists: in the

“Prevention, research and support: the 3 pillars against cyberbullying”

“Words hurt more than blows. What happened to me must never happen to anyone again”: this is

When the stranger is familiar: “Stranieri Ovunque” at the Venice Biennale

Listen to the audio version of the article Stranieri Ovunque – Foreigners Everywhere is the evocative title

Popular Stories

Auto, historic turning point for the US union: the Uaw enters a Volkswagen plant

MILANO – Important, historic victory for the powerful American auto union Uaw. The theme song secured entry

The gene that protects against Alzheimer’s: «It creates a barrier in the brain»

by Cristina Marrone The American study on eleven thousand people and on zebra fish. Scientists: in the

“Prevention, research and support: the 3 pillars against cyberbullying”

“Words hurt more than blows. What happened to me must never happen to anyone again”: this is

When the stranger is familiar: “Stranieri Ovunque” at the Venice Biennale

Listen to the audio version of the article Stranieri Ovunque – Foreigners Everywhere is the evocative title

Travel & Explore the world

Auto, historic turning point for the US union: the Uaw enters a Volkswagen plant

MILANO – Important, historic victory for the powerful American auto union Uaw. The theme song secured entry

The gene that protects against Alzheimer’s: «It creates a barrier in the brain»

by Cristina Marrone The American study on eleven thousand people and on zebra fish. Scientists: in the

“Prevention, research and support: the 3 pillars against cyberbullying”

“Words hurt more than blows. What happened to me must never happen to anyone again”: this is

When the stranger is familiar: “Stranieri Ovunque” at the Venice Biennale

Listen to the audio version of the article Stranieri Ovunque – Foreigners Everywhere is the evocative title

Budding Talent Flourishes at Beijing International Film Festival Job Fair with Over 500 Opportunities

Many Companies Unveil Over 500 Jobs and Internship Opportunities at Beijing Film Festival Job Fair Beijing –

Microsoft has more games in the top 25 of the PlayStation Store than Sony –

Microsoft Dominates Top 25 Most-Sold PlayStation Games with Seven Titles Microsoft’s presence in the gaming industry has

80-10-10 diet, lose weight healthily

The 80-10-10 diet has been gaining attention for its approach to weight loss without extreme restrictions. This