On the evening of March 28, Shuanghui Development (000895, SZ) released its 2021 annual report. In 2021, Shuanghui Development achieved an operating income of about 66.7 billion yuan, a year-on-year decrease (after adjustment) of 9.72%; the net profit attributable to shareholders of the listed company was about 48.7%. 100 million yuan, a year-on-year decrease (after adjustment) of 22.21%.

The “Daily Economic News” reporter noticed that the decline in sales prices and the loss of asset impairment are important reasons for the decline in net profit of Shuanghui Development.

Shuanghui Development said that in 2021, its total foreign sales of meat products (including poultry products) will be 3.3 million tons, an increase of 8.3% year-on-year. However, due to the greater decline in pig and meat prices, operating income will decline.

Looking forward to 2022, Shuanghui Development said: “The domestic live pig price is on a downward trend, which will help the company reduce costs and participate in competition. In 2021, the domestic live pig production capacity will resume, and the live pig price will show a downward trend. It is expected that the live pig price will run at a low level in 2022, which is conducive to The corporate slaughtering industry expands and the meat industry reduces costs.”

Falling selling price drags down revenue

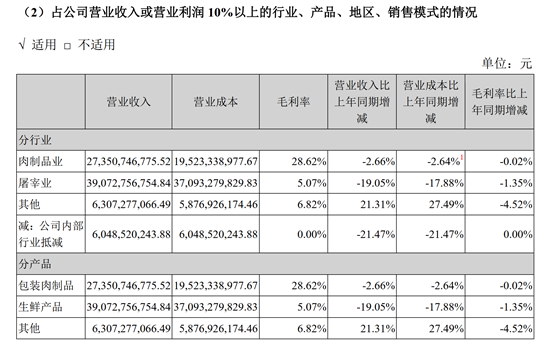

In 2021, Shuanghui Development’s packaged meat products achieved operating income of about 27.4 billion yuan, a year-on-year decrease of 2.66%; slaughtering achieved operating income of about 39.1 billion yuan, a year-on-year decrease of 19.05%; other operating income was about 6.3 billion yuan, a year-on-year increase of 21.31%.

Image source: Screenshot of Shuanghui Development’s 2021 Annual Report

It is worth noting that although the sales revenue of Shuanghui Development has declined, its sales volume has increased. In 2021, the sales volume of fresh products of Shuanghui Development was about 1.6325 million tons, a year-on-year increase of 18.24%; the sales volume of packaged meat products was about 1.5576 million tons, a slight decrease of 1.85% year-on-year; the sales volume of poultry products was 111,500 tons, a year-on-year increase. 37.32%.

In other words, the average prices of fresh products and packaged meat products of Shuanghui Development in 2021 will decline, dragging down the growth of operating income.

Shuanghui Development stated: “During the reporting period, due to the recovery of live pig production capacity and the increase in the supply of live pigs, the price of live pigs dropped significantly. The sales price of the Group’s fresh products fell by more than 30% year-on-year, which affected the Group’s operating income to drop by RMB 16.5 billion year-on-year, accounting for the same period of time. 22% of income.”

In addition, in terms of direct sales and distribution models, Shuanghui Development in 2021 will show a growth in dealers, but a decline in distribution revenue.

In 2021, the direct sales model of Shuanghui Development achieved revenue of about 12.3 billion yuan, a year-on-year decrease of 5.75%; the distribution model achieved operating income of about 54.4 billion yuan, a year-on-year decrease of 10.58%. “As of the end of 2021, the company has a total of 18,947 dealers, a net increase of 1,592 compared with the beginning of the year, an increase of 9.17%.” Shuanghui Development said.

Gross profit margin declines

“During the reporting period, the price of live pigs purchased by the Group decreased by 43.9% year-on-year, mainly due to the recovery of the production capacity of live pigs of breeding enterprises and the recovery of the slaughter volume to a normal level. As a result, the cost of raw materials for the Group’s fresh products and packaged meat products has dropped significantly, which has affected the Group’s overall operating costs by 19.3 billion yuan year-on-year, accounting for 31% of the operating costs in the same period.” Shuanghui Development said.

In 2021, along with the decline in operating income, the operating cost of Shuanghui Development is also decreasing, but the decrease in operating cost is smaller than that of operating income, which has led to a decline in the gross profit margin of Shuanghui Development. Wind data shows that the gross profit margin of Shuanghui Development in 2021 is about 15.35%, compared with 17.26% in the previous year.

“Due to the unexpected fluctuations of the live pig market in 2021, the Group’s grasp of the rhythm of frozen products has been deviated, resulting in losses of domestic frozen products and imported pork, resulting in a significant year-on-year decrease in operating profit of the fresh and frozen products business.” Shuanghui Development said.

It is worth noting that Shuanghui Development is also taking advantage of the decline in meat prices to increase product output as much as possible. Shuanghui Development said: “The production volume of fresh products increased by 57.73% year-on-year, mainly because during the reporting period, the Group seized the favorable opportunity of the rapid decline in pig and meat prices and the increasing market demand for domestic meat consumption to expand the market. , adjust the structure, and increase the scale of production and sales.”

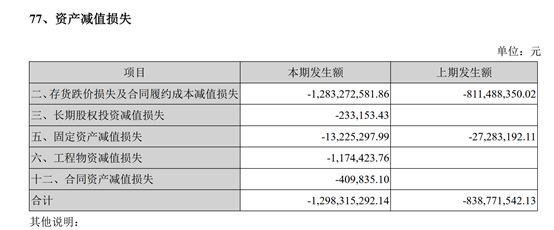

The “Daily Economic News” reporter noticed that another important reason for the decline in Shuanghui Development’s profits was much greater than the decline in revenue was asset impairment losses, which accounted for about 20.89% of Shuanghui Development’s total profits. In 2021, the asset impairment loss of Shuanghui Development was about 1.3 billion yuan, compared with about 840 million yuan in the previous year, an increase of 460 million yuan year-on-year.

Image source: Screenshot of Shuanghui Development’s 2021 Annual Report

From the breakdown of asset impairment losses, it is mainly caused by inventory depreciation losses and contract performance cost impairment losses. In 2021, the breakdown of this breakdown is about 1.28 billion yuan.

Shuanghui Development said: “It was mainly due to the provision for asset impairment losses of frozen product inventories during the reporting period. The reason for the large amount incurred in this period was that the price of pigs fluctuated greatly during the reporting period. At the low point, the accrued amount was relatively large. Later, with the sales of products, the inventory depreciation reserve was transferred to the operating cost. Due to the decline in pig prices in the second and third quarters and the rebound in the fourth quarter during the reporting period, the accumulated amount of asset impairment losses throughout the year was accrued. It is relatively large, but the amount of impact on the annual profit and loss is much smaller than the provision for asset impairment losses.”

Cover image source: Visual China