[The Epoch Times, August 15, 2022](The Epoch Times Special Report Reporter Jiang Feng Comprehensive Report) In the face of a historic loss of 23 billion US dollars, SoftBank sold 34 billion US dollars of Alibaba shares on August 12 in exchange for cash to fill deficit. In addition, investments in companies such as Didi, Shangtang, and Zhangmen Education have been lost, and Sun Zhengyi, the founder of SoftBank Group, has no regrets.

Japanese technology investment giant SoftBank Group announced on August 8 that it lost more than $23 billion in the three months to June as it was hit hard by a global sell-off in technology stocks. It was another huge loss after a loss of 1.7 trillion yen ($12.7 billion) in the previous quarter.

In SoftBank’s latest quarterly earnings report, Chinese technology company SenseTime brought SoftBank a loss of 235.9 billion yen (about 1.8 billion U.S. dollars). SenseTime is an artificial intelligence company that specializes in facial recognition technology.

In July 2018, SoftBank invested nearly $1 billion in SenseTime. However, on December 10 last year, just as SenseTime was preparing to go public in Hong Kong and investors were preparing to harvest, the US Treasury Department included the company on the list of “Chinese military-industrial complex enterprises”, accusing the facial recognition program it developed by the CCP. Used by the government to monitor Uyghurs. When applying for a patent, SenseTime also emphasized that its technology can identify Uyghurs with beards, sunglasses and masks. After SenseTime was finally listed, its shares plummeted by more than 50% in June this year, evaporating 90 billion Hong Kong dollars (about 11.5 billion U.S. dollars) in market value.

Compared with eight years ago when Alibaba went public in the United States and made Son the richest man in Japan, Sun’s mood today is a world of difference.

Alibaba was once SoftBank’s proudest investment. When Alibaba first started, Sun Zhengyi invested $20 million in Alibaba. After Alibaba was listed in the United States, Softbank received a huge return of more than 2,000 times.

Inspired by Alibaba’s success story, Masayoshi Son intends to achieve greater success in the Chinese market. The taxi app Didi Chuxing is another treasure he is betting on.

Investing in Didi Chuxing

In 2017, Masayoshi Son invested $8 billion in Didi. In September of the same year, SoftBank invested another $639 million to acquire Alibaba’s 5% stake in Didi. In 2020, Masayoshi Son invested another $500 million in Didi’s smart self-driving car. As of June this year, SoftBank Group has invested as much as $12 billion in Didi. According to Didi’s prospectus, SoftBank holds a total of 21% of Didi’s shares and is the largest shareholder of Didi.

However, this time SoftBank’s Chinese gold rush trip encountered Waterloo.

On June 30 last year, Didi ignored the warnings of the Chinese government and went public in New York as planned, successfully raising $4.4 billion at $14 per share. In order to punish Didi’s “disobedience”, the Cyberspace Administration of China launched a “network security” review on Didi and ordered Didi to remove the app and prohibit new users from registering on the grounds of “serious illegal collection and use of personal information”. . Didi’s share price has plummeted since then.

On June 10 this year, Didi was delisted from the New York Stock Exchange. On the day of the delisting, Didi’s American depositary receipts fell to $2.29 a share, down 84% from its IPO price of $14. SoftBank Group’s consolidated financial report for fiscal year 2021 released on May 12 this year shows that Didi Chuxing brought SoftBank a book loss of about 900 billion yen (about 6.7 billion US dollars).

Head Education was delisted

It is also the head education that makes SoftBank’s investment go to waste.

In September 2020, K12 online education brand Head Education received a new round of financing of over 400 million US dollars. The investors are SoftBank Vision Fund, Yuansheng Capital, Canadian Pension Fund Investment Company, International Finance Corporation under the World Bank and CMC Capital.

In June 2021, Head Education will be listed on the New York Stock Exchange as the “first online one-to-one share”. The issue price of Head Education was US$11.5. On the first day of listing, it rose 78% intraday, triggering a circuit breaker three times.

However, the good times did not last long. In July 2021, the State Council of the Communist Party of China launched the “double reduction” policy, which imposed restrictions on extracurricular tutoring for students in primary and junior high schools, and required all private education and training companies to transform and register as non-profit institutions. Subsequently, the K12 subject training industry underwent great changes, and many education companies suffered heavy losses.

The head of education was laid off by more than 1,000 people, and the headquarters was rented out. Misfortunes do not come singly. In November 2021, Robbins Geller Rudman & Dowd LLP, an American law firm, filed a class action lawsuit on behalf of shareholders, alleging that the head education was involved in fraud, including false advertising, forged teacher qualifications, exaggerated student performance and price gouging. The share price of Head Education plummeted to $0.6 per share, a 96% drop from the issue price.

In June 2022, just one year after its listing, Head Education was forcibly delisted from the New York Stock Exchange.

Masayoshi Son has no regrets

Faced with a historic loss of $23 billion, on August 12, SoftBank decided to sell its Alibaba shares for $34 billion in exchange for cash to fill the shortfall. That would reduce its stake in Alibaba to 14.6% from 23.7%.

At the SoftBank shareholder meeting in June this year, Sun Zhengyi said that “the degree of dependence on China has decreased” when talking about the issue of investing in China, and said that in the future, he will pay close attention to the policy of the CCP government and “invest under the premise of ensuring safety.” . will operate very carefully.”

On August 10 last year, at the SoftBank Group’s earnings conference, Sun Zhengyi said that SoftBank would suspend investment in China. At the time, SoftBank’s Vision Fund had 23 percent of its investments in China.

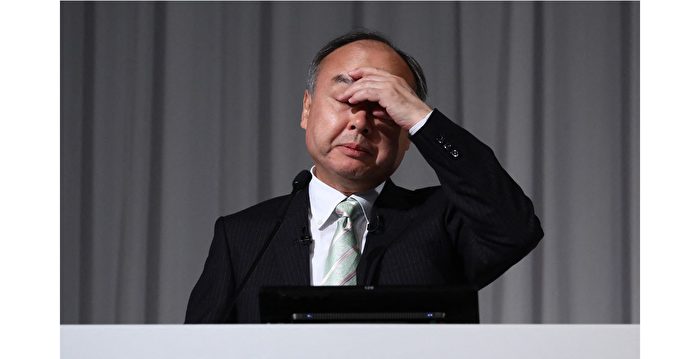

On August 8 this year, at the SoftBank Group’s performance conference, Sun Zhengyi said in a somber tone: “When we made huge profits, I became a little confused, and now looking back at myself, I feel quite Embarrassment and remorse.”

Responsible editor: Lian Shuhua #