Investigation by the Federal Ministry of Food: Still too much fat, sugar and salt in finished products

Finished products in Germany still contain too much fat, sugar and salt. This was the result of

How to print double-sided

With the double-sided printing you can reduce the number of sheets of paper needed to print, for

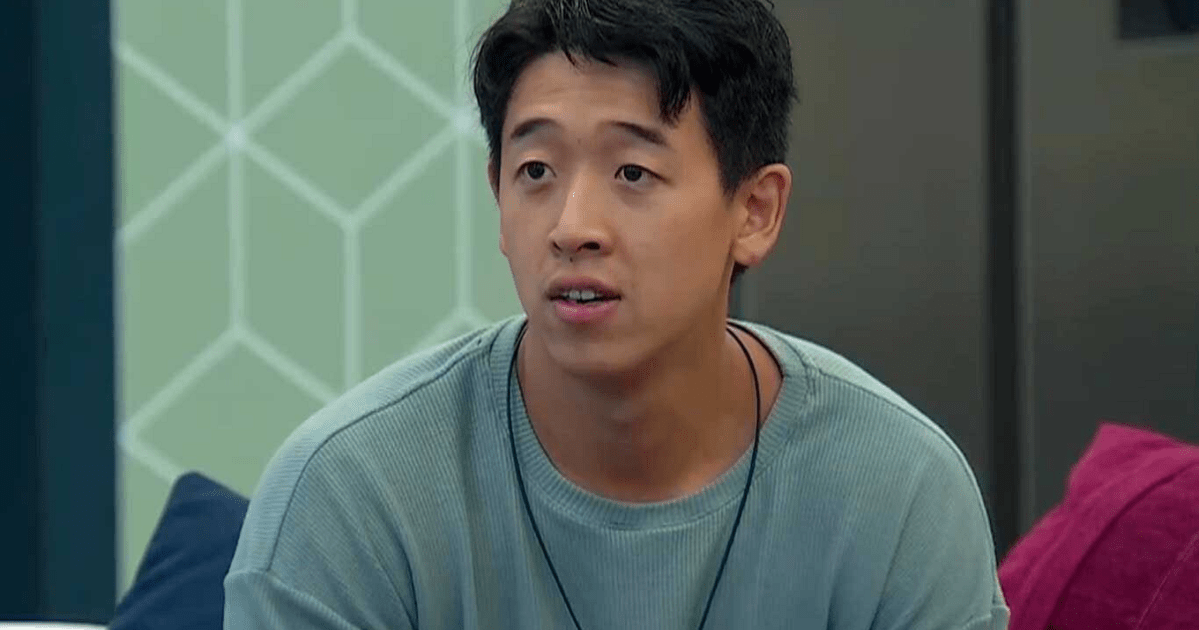

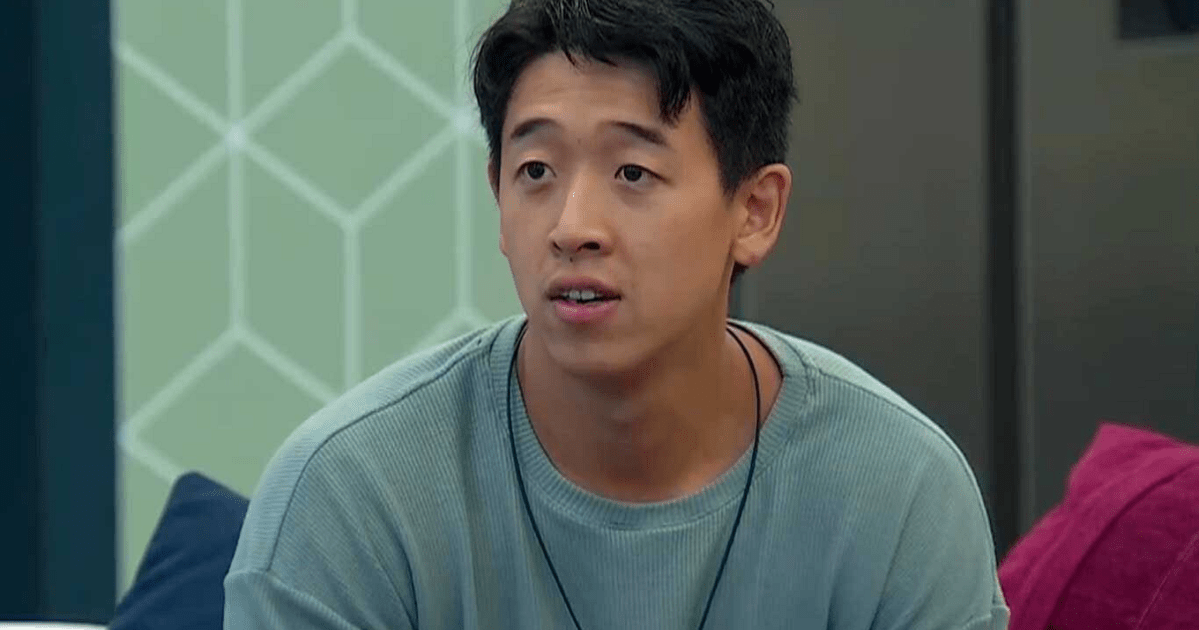

Martín Ku received an unpleasant insult from abroad and this is how he reacted

Martín Ku received an unpleasant scream from abroad and fears for his continuity in the Big Brother

Popular Stories

We bought Nvidia shares before the hype – that’s how rich we are today

The Slave Vlasic/Getty Images; Chelsea Jia Feng/BI Nvidia has been a cash cow for investors lucky enough

Investigation by the Federal Ministry of Food: Still too much fat, sugar and salt in finished products

Finished products in Germany still contain too much fat, sugar and salt. This was the result of

How to print double-sided

With the double-sided printing you can reduce the number of sheets of paper needed to print, for

Martín Ku received an unpleasant insult from abroad and this is how he reacted

Martín Ku received an unpleasant scream from abroad and fears for his continuity in the Big Brother

Travel & Explore the world

We bought Nvidia shares before the hype – that’s how rich we are today

The Slave Vlasic/Getty Images; Chelsea Jia Feng/BI Nvidia has been a cash cow for investors lucky enough

Investigation by the Federal Ministry of Food: Still too much fat, sugar and salt in finished products

Finished products in Germany still contain too much fat, sugar and salt. This was the result of

How to print double-sided

With the double-sided printing you can reduce the number of sheets of paper needed to print, for

Martín Ku received an unpleasant insult from abroad and this is how he reacted

Martín Ku received an unpleasant scream from abroad and fears for his continuity in the Big Brother

Inculmat toured the parishes of La Pica, Los Godos and Las Cocuizas with dance

The parishes of Maturín will dance until Saturday, April 27, with a special program promoted by the

US Senate also approves aid package for Ukraine: “Sending weapons and material this week”

The entire aid package that was approved is worth 95 billion, of which the largest part (61

Six apartments uninhabitable after heavy fire in Geel (Geel)

Yellow – A serious fire raged in a complex with social apartments in the Verbueckenstraat in Geel

:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/GP4HNXAVGVF7PCJBGC2SKZ2XNA.jpg)