Summary

Market review:In terms of futures, LPG2111, the main contract of liquefied petroleum gas, fluctuated at a high level this week, and the price this Thursday increased by 1.50% compared to last Thursday. In terms of spot, most of the LPG spot prices in various regions rose this week. Among them, the spot price in North China rose the most, at 2.72%; the spot in East China rose the least, at 0.23%.

Supply and demand:This week, the output of domestic LPG refineries increased slightly from the previous month, and the arrival of cargoes increased greatly, and the supply side was generally bearish. Downstream demand has improved, the operating rate of alkylation and PDH devices has declined, the operating rate of MTBE has increased, and fuel demand has seen seasonal growth. The inventory ratio of refineries in various regions remained stable to increase, mostly below 30%, which was at a low level; the port inventory ratio decreased overall, of which the inventory ratio of East China ports increased by 1.81% to 54.14%, and the inventory ratio of South China ports fell by 10.77% to 40.12%. . On the whole, short-term LPG fundamentals are on the high side.

Operational recommendations:The short-term LPG fundamentals are too much. LPG production increased slightly this week, imports increased, downstream demand performed better, refinery inventory rates increased slightly, and port inventory rates decreased. Driven by cost support and peak season expectations, the price of LPG futures moved at a high level this week, reaching a record high of 5938 yuan/ton, but it quickly dropped after the new high. The pressure near 6000 in the short term is high, and the spot premium for LPG futures is still large. , It may drag down the upward momentum. It is recommended to lighten up or close out multiple orders in the early stage, and no participants will wait and see for the time being. In the medium term, the current market is still more optimistic about the peak season in the fourth quarter. There is still room above the LPG. Investors can continue to place more orders at 2112, 2201 on dips and strictly set stop losses.

Uncertain risk:Crude oil prices fell sharply; downstream demand fell short of expectations.

one

Market review

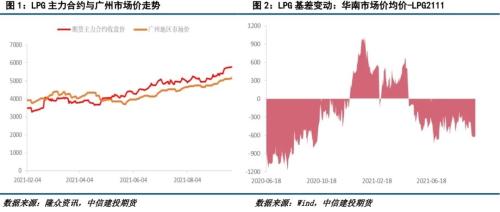

During the period from September 16 to September 23, LPG spot prices in various regions rose mostly, but the increase was limited. Specifically, this week, prices in North China only fell by 0.61%. Among the rising regions, the spot price in Northeast China rose the most, at 2.72%; in East China, the price rose the smallest, at 0.23%. In terms of futures, domestic LPG futures rose slightly. The main contract LPG2111 rose from last Thursday’s closing price of 5675 yuan/ton to this Thursday’s closing price of 5760 yuan/ton, an increase of 1.50%. In terms of basis, the basis was basically stable this week. The basis of the average spot price in South China and the main contract rose from -607 yuan/ton last Thursday to -604 yuan/ton, an increase of 3 yuan/ton.

two

Analysis of price influence factors

1. Supply analysis

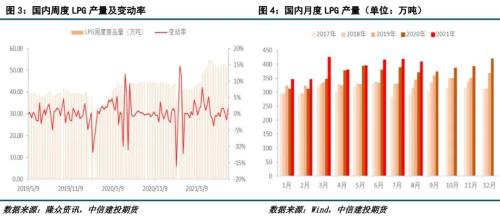

1.1 Domestic LPG production

According to statistics from Longzhong Information, the output of 160 liquefied petroleum gas manufacturers nationwide this week was 527,300 tons, a month-on-month increase of 8,500 tons or 1.64%. The current LPG production has fallen more than the high level during the year, but it is higher than the level of the same period last year. The maintenance plan of LPG refinery has increased slightly in the near future, and the output is expected to stabilize or decrease slightly in the later period.

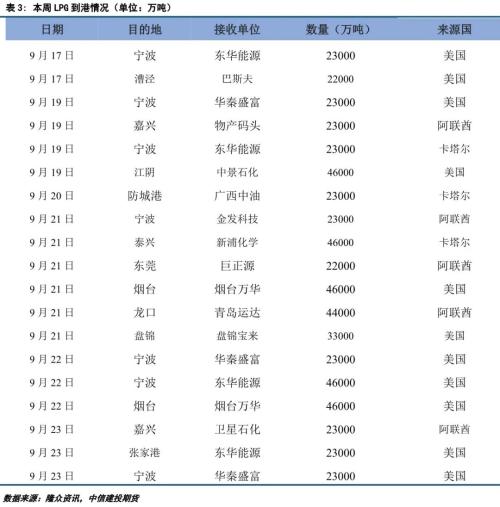

1.2 LPG imports

According to data from Longzhong Information, from September 16 to September 23, the number of ships arriving at the terminal increased significantly this week. According to statistics, the import shipment schedule is about 581 thousand tons, an increase of 346 thousand tons from the previous month. The import volume increased sharply this week, and the sources of goods previously affected by Typhoon “Santo” concentrated on arriving in Hong Kong this week. In terms of prices, Saudi CP is expected to rise slightly in October. As of September 23, Saudi propane CP is expected to be US$765/ton, up by US$17/ton from the previous month; butane CP is expected to be US$760/ton, up by US$12/ton from the previous month. . In September, Saudi Arabia’s CP hit a six-year high. In October, Saudi Arabia’s CP is expected to rise sharply again, which supports strong domestic spot prices in East China and South China. In the later period, domestic spot prices are expected to increase.

2. Demand analysis

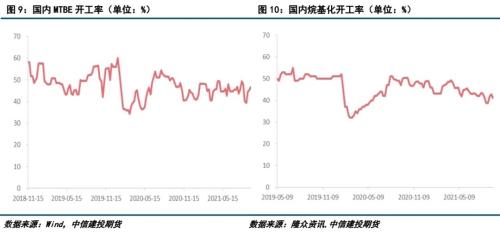

This week, the downstream demand of LPG remained stable, and the downstream operating rate dropped slightly. Specifically, this week’s alkylate operating rate was about 41.19%, down 1.51% month-on-month, lower than the same period last year. The MTBE operating rate was 46.67%, an increase of 1.44% month-on-month, close to the level of the same period last year. The operating rate of PDH installations was 62.74%, a decrease of 5.34% from the previous month, which was lower than the level of the same period last year. The downstream demand has improved in the short term. Fuel demand has gradually increased after the temperature drops, and the operating rate of the chemical industry has slightly decreased, which is generally positive for LPG prices. With the further decline in domestic temperature, it is expected that the demand for LPG is expected to increase in the later period, which will support LPG futures prices.

3. Inventory analysis

This week, the inventory of LPG refineries in various regions in China has stabilized to rise, and the overall inventory ratio has increased slightly. Specifically, the inventory ratio of refineries along the Yangtze River, North China, and Northeast China remained stable this week, while inventory ratios in other regions increased. Among them, the inventory ratio in East China increased by 2%, and the inventory ratio in Western and South China increased by 1%. As of this Thursday, most of the refinery inventory ratios in various regions are below 30%, which is at a low level. This week, the port inventory rate declined overall. The East China port inventory rate rose 1.81% to 54.14%, and the South China port inventory rate fell 10.77% to 40.12%. The recent port inventory rate has dropped significantly, forming a strong support for spot prices. LPG demand is expected to further improve in the later period, and the inventory ratio of refineries and ports is expected to continue to decline, which will significantly benefit the spot price.

three

Position analysis

From the perspective of position analysis, as of this Friday, LPG’s main contract LPG2111 unilaterally held 71,000 lots, an increase of 4,000 lots from the 67,000 lots last Friday. The amount of holdings increased slightly, and the popularity of fund participation increased slightly. This week, the LPG2111 contract trading volume averaged about 150,000 lots, and the activity was significantly improved. As of September 24, LPG2111 has 47,000 hands in the top twenty-odd orders, 62,000 hands in the top 20 short orders, and 15,000 hands in the top 20 net short orders. In terms of warehouse receipts, as of this Friday, the number of LPG warehouse receipts increased by 50 to 6,115, and the pressure on the disk increased slightly. From the perspective of only the number of positions and warehouse receipts, the current top 20 positions are relatively short, and the number of warehouse receipts is relatively high, which has a negative impact on futures prices.

Four

Market outlook and investment strategy

The short-term LPG fundamentals are too much. LPG production increased slightly this week, imports increased, downstream demand performed better, refinery inventory rates increased slightly, and port inventory rates decreased. Crude oil prices rose sharply this week, LPG cost support was strong, and futures prices ran at a high level, hitting a historical high of 5938 yuan/ton. However, the new high fell quickly after the new high. The pressure near 6000 in the short-term is relatively high, and the LPG futures premium is still relatively high. It may drag down the upward momentum. It is recommended to lighten up or close out multiple orders in the early stage, and no participants will wait and see for the time being. In the medium term, the current market is still relatively optimistic about the peak season in the fourth quarter. There may still be room for LPG. Investors can continue to place more orders at 2112, 2201 on dips and strictly set stop losses. In the later stage, it is necessary to pay close attention to the production progress of downstream PDH devices and changes in the cost side to prevent the risk of price drops caused by adverse changes.

appendix

Important chart

.