Original title: Swipe the screen! Suning Appliance was forced to execute more than 3 billion yuan, and Zhang Jindong was listed as the executor? The company’s latest response is coming…

Summary

[Swipe the screen! Suning Appliance was forced to execute more than 3 billion pieces of Jindong listed as the executor? The company’s latest response]On June 9, a news about Suning attracted market attention! Suning Appliance Group added a piece of information about the person to be executed, with the execution target exceeding 3.082 billion yuan. The person to be executed in the case number also includes Suning Real Estate Group, Suning Tesco Chairman Zhang Jindong and Liu Yuping. In response to the above issues, Suning Holdings responded to the brokerage China reporter: “Currently, it is only the implementation stage. We have formally filed an execution objection to the Beijing Second Intermediate People’s Court.” (Broker China)

On June 9, a news about Suning attracted market attention!

Suning Appliance Group has added a piece of information about the person subject to execution, with the execution target exceeding RMB 3.082 billion. The person subject to execution of the case number also includes Suning Real Estate Group,Suning Online MarketChairman Zhang Jindong and Liu Yuping.

In response to the above matters, Suning Holdings respondedBrokerageChinese reporter: “Currently, it is only at the stage of enforcing the case. We have formally filed an enforcement objection to the Beijing Second Intermediate People’s Court.”

It is worth noting that Suning has been making big moves recently.First, Shenzhen State-owned Assets Management plans to invest 14.8 billion yuan into a listed companySuning Online Market, Immediately afterwards, Jiangsu state-owned assets plan to acquire another 3.2 billion yuanSuning Online Market5.59% equity.

Suning Appliance was enforced over 3 billion?

On June 9th, Tianyancha APP showed that Suning Appliance Group added a new piece of information about the person subject to execution, the case number is (2021) Jing 02 Zhi No. 837, the execution subject is over 3.082 billion yuan, and the execution court is the Second Intermediate People of Beijing. Court.

In addition, the defendants of the case number also include Suning Real Estate Group Co., Ltd., Zhang Jindong, and Liu Yuping.

According to Tianyancha APP, Liu Yuping is the legal representative of Jiangsu Suning Goodbuy Supermarket Co., Ltd. and Nanjing Suning Galaxy International Shopping Plaza Co., Ltd.

(Data source: Tianyancha)

(Data source: China Executive Information Disclosure Network)

In response to the above-mentioned cases, Suning Holdings responded to the Chinese reporters of the brokerage firm. Currently, it is only at the stage of implementing the case and has formally filed an execution objection to the Beijing No.

According to the data, Suning Appliance Group was established in November 1999 with a registered capital of 1.714 billion yuan and its legal representative is Bu Yang. Its business scope includes the manufacture, sales and after-sales service of household appliances and accessories, industrial investment, hotel management, electronic product sales, etc. .

Jiangsu state-owned assets transfer 5.59% of Suning Tesco, Zhang Jindong will buy back next year

It is worth noting that after Suning recently obtained a huge investment of 14.8 billion yuan from Shenzhen’s state-owned assets, the listed company Suning Tesco introduced Jiangsu State-owned assets as ashareholder。

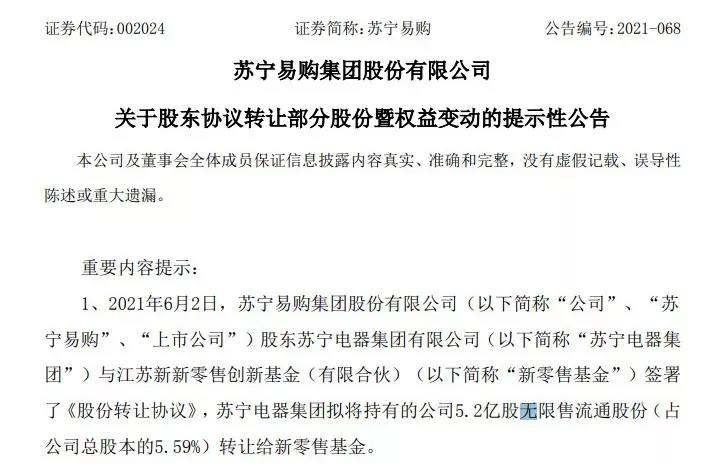

On the evening of June 2, Suning.com (002024) releasedannouncementSaid that on the same day, the company’s shareholder Suning Appliance Group and New RetailfundSigning the “Share Transfer Agreement”, Suning Appliance Group plans to transfer the company’s 520 million shares (accounting for 5.59% of the company’s total share capital) to the new retail fund.

The total transfer price of the above transaction is 3.182 billion yuan, and the transfer price per share is 6.12 yuan/share. It is understood that the purpose of the new retail fund’s transfer of 5.59% of Suning Tesco’s equity is to provide liquidity support for Suning Appliance Group.Before April 1 next year, Zhang Jindong will be in the hands of the New Retail FundRepurchaseThe above-mentioned equity.

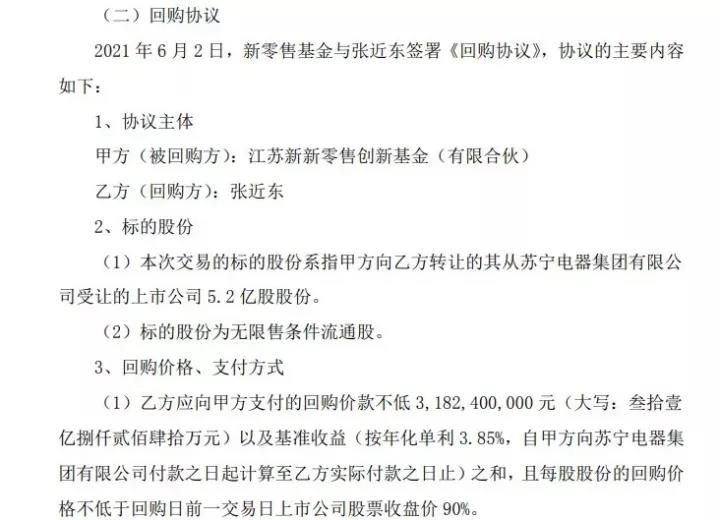

On June 2, New Retail Fund also signed a “Repurchase Agreement” with Zhang Jindong. According to the agreement, Zhang Jindong will pay the repurchase price to the new retail fund before April 1, 2022 to complete the repurchase of the transferred shares. The repurchase price shall not be less than 3.182 billion yuan and the benchmark income (annualized simple interest rate). 3.85%), and not less than 90% of the closing price on the trading day before the repurchase date.

Zhang Jindong used his 1 billion restricted tradable shares of a listed company (accounting for 10.74% of the company’s total share capital) to provide him withPledgeGuarantee, and the pledge procedures have been completed.

The progress of the share transfer was amazing, and it only took 2 days to complete the transfer procedures.

According to the “Confirmation of Securities Transfer and Registration of China Securities Depository and Clearing Co., Ltd.”, the transfer of the above-mentioned agreement was completed on June 4th. After the transfer of shares, Suning Appliance Group holds 14.08% of Suning Tesco’s shares, and New Retail Fund holds 5.59% of Suning Tesco’s shares.

The announcement shows that the new retail fund was established on May 28 this year, with a registered capital of 3.5 billion yuan, and its business scope is equity investment. The shareholders include Jiangsu Guoxin Group Co., Ltd., Jiangsu Transportation Holding Co., Ltd., Jiangsu Nongken Group Co., Ltd., and Jiangsu High Investment Property Management Co., Ltd. Judging from the equity penetration chart, the actual controllers of the above four shareholders are the People’s Government of Jiangsu Province. This also means that the actual controller of the new retail fund is also the People’s Government of Jiangsu Province.

Brokerage China reporter noted that the above-mentioned share transfer originated from the agreement signed between Suning and the Jiangsu State-owned Assets Supervision and Administration Commission. On May 6, in order to support Suning in adjusting and optimizing its structure, revitalizing high-quality assets, and achieving transformational development, Jiangsu State-owned Assets, Nanjing Municipal State-owned Assets and Suning signed a framework agreement for the establishment of a new retail development fund.

The New Retail Development Fund is jointly funded by Jiangsu Province, Nanjing State-owned Assets, Suning, and Social Capital, with a total scale of 20 billion yuan. The fund will adopt the methods of investing in Suning’s high-quality assets and high-quality businesses to further leverage the leading role of Suning’s leading modern commercial and trade circulation enterprises, and realize the complementation of state-owned and private-owned resources and win-win cooperation.

Shenzhen state-owned assets intends to invest 14.8 billion yuan in Suning.com

Before Jiangsu State-owned Assets took a stake in Suning Tesco, Zhang Jindong and Suning Appliance Group had signed an agreement with Shenzhen State-owned Assets, and the latter planned to invest a huge amount of 14.8 billion yuan in Suning Tesco. At present, Shenzhen’s state-owned equity investment is still in progress.

On the evening of February 28, Suning.com issued an announcement stating that Zhang Jindong, the controlling shareholder and actual controller of the company, and Suning Holding Group, the person acting in concert in concert, and Suning Appliance Group, Tibet Trust (hereinafter collectively referred to as the “transferor”) On 28th, Shenzhen International and Kunpeng Capital signed the “Share Transfer Framework Agreement”. The transferor intends to transfer a total of 23% of the company’s shares to Shenzhen International and Kunpeng Capital. The transfer price is 6.92 yuan per share, and the transaction amount is approximately 14.8 billion yuan. .

If the implementation of this share transfer is completed, Zhang Jindong, the original controlling shareholder and actual controller of the listed company, and Suning Holding Group, the person acting in concert, will hold 16.38% of the shares, Suning Appliance Group holds 5.45%, and Taobao China holds shares. 19.99%, Kunpeng Capital’s shareholding ratio is 15%, and Shenzhen International’s shareholding ratio is 8%. Suning.com will have no controlling shareholder and no actual controller.

According to the data, Shenzhen International isShenzhen InternationalThe latter is listed on the main board of the Hong Kong Stock Exchange and indirectly held by the Shenzhen Municipal State-owned Assets Supervision and Administration CommissionShenzhen InternationalApproximately 43% equity.Shenzhen InternationalIt is an enterprise focusing on logistics and toll roads. Through investmentM&A、ReorganizationAnd integration, focusing on the investment, construction and operation of logistics infrastructure such as urban integrated logistics ports and toll roads, and expanding its business areas to multiple market segments such as comprehensive development of land related to the logistics industry.

Kunpeng Capital is a strategic fund management platform with equity investment management as its main business. It is committed to integrating high-quality resources through parent-child fund linkage to promote the optimization and coordinated development of Shenzhen’s industrial layout. Shenzhen State-owned Assets Supervision and Administration Commission directly and indirectly holds 100% equity of Kunpeng Capital.

Shenzhen’s state-owned assets behind Shenzhen International and Kunpeng Capital are strong. As of the end of December 2020, the total assets of Shenzhen’s state-owned state-owned enterprises were 4.11 trillion yuan. Since the establishment of the Shenzhen Special Economic Zone, Shenzhen’s state-owned economy has grown at an average annual rate of 28.9%, and its total assets have increased by 26,400 times.Public information shows that Shenzhen’s state-owned investment targets in recent years includeVanke A, Evergrande Real Estate,CIMC, Suning.com, Glory, etc.

Suning.com said that after the completion of the share transfer, Shenzhen International and Kunpeng Capital, as Suning.com’s industrial investors, will work with other related parties to focus on the commodity supply chain, e-commerce, technology, logistics, and tax-free business. Carry out comprehensive empowerment; promote related parties to provide necessary policy, taxation, and financial support for the company and its business development.

Tianfeng SecuritiesPointed out that Suning.com is the leading comprehensive retailer nationwide.Online and offlineIntegrated omni-channel development. After the state-owned assets take over, the financial and governance structure are expected to improve, and the new development goals are expected to be achieved.

Suning Tesco lost 4.275 billion yuan last year

On the evening of April 23, Suning.com disclosed its annual report. For the whole year of 2020, the company achievedOperating income252.296 billion yuan, down 6.29% year-on-year;Net profitA loss of 4.275 billion yuan and a profit of 9.84 billion yuan in the same period last year.

The company’s merchandise sales volume in 2020 was 416.3 billion yuan, a year-on-year increase of 9.92%, of which online platform merchandise sales volume was 290.3 billion yuan, a year-on-year increase of 21.60%, and online sales accounted for nearly 70%.

In quarterly terms, in the first quarter, second quarter, third quarter, and fourth quarter of 2020, Suning.com’s net profit was -551 million yuan, 384 million yuan, 714 million yuan, and -4.822 billion yuan, respectively. Regarding the huge loss in the fourth quarter, Suning.com stated that it has conducted asset impairment tests on long-term assets formed by various businesses including Tiantian Express, department stores, maternal and infants, and supermarkets, and made provision for impairment; for investment and equity participation The company’s business development plan was carefully evaluated, which resulted in a part of the investment loss corresponding to the long-term investment. The aforementioned total impact on the net profit attributable to the parent during the reporting period was 2.138 billion yuan.

The company’s revenue has shown an upward trend quarter by quarter. In 2020, Suning.com’s operating income in the first quarter will be 57.839 billion yuan, in the second quarter it will be 60.585 billion yuan, in the third quarter it will be 62.438 billion yuan, and in the fourth quarter it will be 71.434 billion yuan.

Suning.com disclosed in its annual report that in terms of online business, the company has determined the independent development strategy of Yunwangwandian, comprehensively benchmarked the top Internet retail platform, integrated online business and introduced strategic investment, and plans to increase employee equity incentives. Explore independent listing.

On the evening of April 29, Suning.com disclosed its report for the first quarter of 2021. In the first quarter, Suning.com achieved operating income of 54.05 billion yuan, a year-on-year decrease of 6.63%; net profit was 456 million yuan, with a loss of 550 million yuan in the same period last year; net profit loss after deduction was 938 million yuan, compared with a loss of 500 million yuan in the same period last year . The net cash flow from operating activities was 468 million yuan, compared with -3.925 billion yuan in the same period last year.

Suning.com said that in 2021, the company will further focus on the improvement of core business, the improvement of aggregate profitability, and the improvement of various efficiencies. The Internet business pursues quality development, gradually changes the rough and one-sided pursuit of the number of users, the development method of GMV, pays more attention to the input and output of advertising and marketing and the conversion and retention of users, and improves profitability.

On February 19, the eighth day of the Lunar New Year, Zhang Jindong said that Suning will make drastic changes in its business this year, targeting those who are not on the main retail track, what should be cut off and what should be cut.

It is understood that in 2021, Suning will make drastic changes in business, accelerate opening and empowerment, optimize offline store structure, promote the integration of large-scale fast-moving consumer supply chain, and promote the structural adjustment of logistics network; it will focus on home appliances, independent products, inefficient business adjustments and adjustments. Various types of expenses control four profit points, and strengthen the four growth sources of Suning.com’s main website, retail cloud, B2B platform, and Maoning.

Zhang Jindong emphasized that it is necessary to focus on the main retail channel and main battlefield from top to bottom, dig deep into the moat of supply chain, full-scenario operation, user service, and retail technology, and highlight the distinctive advantages of the regional management network. If it is true, it is necessary to take the initiative to subtract and shrink the front line, the level that should be closed, the cut that should be cut.”

Regarding Suning’s strategic focus, Zhang Jindong vividly summed up: “When the middle road opens a group, don’t split the road and lead the line. Only by knowing how to concentrate firepower to strengthen the offensive, Suning can achieve a breakthrough in the core battlefield.”

(Source: Brokerage China)

(Editor in charge: DF407)

Solemnly declare: The purpose of this information is to spread more information, and it has nothing to do with this stand.

.