(Original title: Tesla received the strongest orders in history, the stock price rebounded more than 70% from the bottom, the leader of the A-share industry chain soared rarely, and the list of high performance growth was released)

Orders nearly doubled production capacity in January after Tesla announced price cuts.

On the first trading day of the Spring Festival of the Year of the Rabbit, the A-share market generally opened higher, and the Shanghai Composite Index broke through 3300 points in the intraday session. According to statistics from Securities Times·Databao, the turnover of A-shares throughout the day exceeded one trillion yuan, and CATL, BYD, and Wuliangye ranked the top three in terms of turnover.

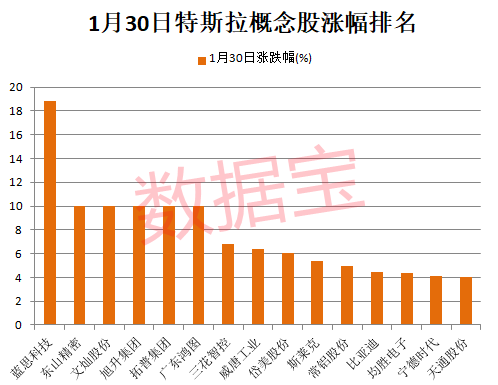

On the disk, car-related themes rose sharply, and many Tesla concept stocks rose by their daily limit. The most eye-catching performance is Lens Technology. The stock achieved a daily limit of 20cm, the largest single-day increase in the history of the stock (excluding the first day of listing). The stock market value reached 66.6 billion yuan.

After experiencing a trough for nearly a year, Lens Technology‘s performance in 2022 will “turn over”. On the evening of January 29, Lens Technology released a performance forecast, predicting that the net profit in 2022 will be 2.422 billion to 2.526 billion yuan, a year-on-year increase of 17% to 22%. In addition, about 516 million yuan of impairment provision was made in this period. From the perspective of splitting the annual performance, the company’s profit in each quarter of 2022 will continue to improve. The net profit in the fourth quarter is expected to be 1.663 billion to 1.767 billion yuan, an increase of more than 56% from the third quarter.

As of the close of trading on January 30, Dongshan Precision, Tuopu Group, Xusheng Group, Wencan Co., Ltd., Guangdong Hongtu, etc. had the highest gains in Tesla concept stocks today.

Tesla receives strongest orders in history

Demand rises after price cuts

During the Spring Festival, Tesla announced the report card for the fourth quarter and full year of 2022. Data show that Tesla’s revenue in the fourth quarter was US$24.318 billion, a year-on-year increase of 37%, and net profit attributable to common shareholders was US$3.687 billion, a year-on-year increase of 59%. Throughout 2022, Tesla will deliver more than 1.31 million electric vehicles.

Tesla’s official Weibo post stated that the fourth quarter of 2022 is a record-breaking quarter, and 2022 is also a record-breaking year. In 2022, total revenue increased by 51% year-on-year to US$81.5 billion; GAAP net profit more than doubled year-on-year to US$12.6 billion.

Since September 2022, Tesla’s stock price has been declining. In January this year, it hit a stage low of 101.81 US dollars per share. After that, the stock price continued to rebound, and the rebound rate has reached 74.74% so far. Behind the stock price reversal is not unrelated to the increase in demand after the price cut.

In January of this year, Tesla took the lead in launching a substantial price cut. Industry insiders said that the primary purpose of Tesla’s price reduction is to win orders and expand its market sales and market share, so that Tesla’s brand awareness can be further improved.

Tesla’s price cuts had an immediate effect, bringing it a large number of orders. On January 26, in the earnings conference call for the fourth quarter of 2022, Tesla CEO Elon Musk said that although the auto market may be shrinking, the current demand for Tesla has increased significantly. He revealed that in January this year, Tesla’s order volume almost doubled its production capacity. In the earnings report, Tesla expects to deliver 1.8 million vehicles in 2023, a 37% increase from 2022.

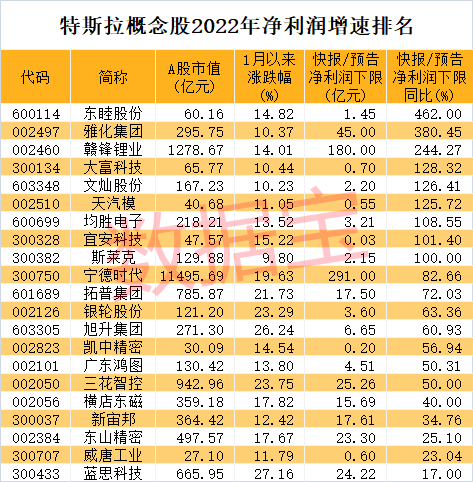

More than 90% of Tesla’s concept stocks are expected to increase in performance

In the A-share market, there are many listed companies belonging to the Tesla industry chain. Recently, with the recovery of Tesla’s stock price, the market for concept stocks has picked up. According to the statistics of Databao, as of the close on January 30, since January, Tesla concept stocks have increased by an average of 12.54%, which is significantly ahead of the Shanghai Composite Index during the same period.

Driven by the high prosperity of the new energy automobile industry, the overall performance of Tesla concept stocks in 2022 will be good. Calculated according to the performance bulletin and the lower limit of net profit in the forecast, among the 22 concept stocks that have released relevant data, 21 of them are in a state of growth in net profit, accounting for as high as 95.45%. The net profit of 9 stocks is expected to double, including Dongmu Co., Ltd., Yahua Group, Ganfeng Lithium Industry, Dafu Technology, Wencan Co., Ltd., etc.

Dongmu ranks first in the expected increase in net profit. During the reporting period, it firmly grasped the development opportunities of the new energy industry and achieved a sustained and rapid growth in sales revenue of new energy soft magnetic composite materials SMC. The company expects its net profit in 2022 to be 145 million yuan to 165 million yuan, a year-on-year increase of 4.62 times to 5.39 times.

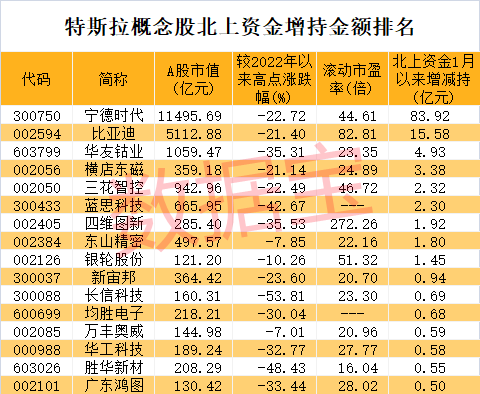

Since the beginning of this year, Beishang Capital has continued to increase its position in A shares, and many subdivided leaders in Tesla concept stocks have increased their positions. According to the statistics of Databao, calculated based on the average transaction price of the interval, since January, there have been 9 companies that have increased their capital holdings by more than 100 million yuan, such as Ningde Times, BYD, Huayou Cobalt, Hengdian DMEGC, and Sanhua Zhikong. Ningde Times ranked first with an increase of 8.392 billion yuan. The stock rose sharply on the first trading day of the Year of the Rabbit, with an intraday high of 8.53%. The stock price fell back at the close, and the latest A-share market value approached 1.15 trillion.

Disclaimer: The Securities Times strives for truthful and accurate information, and the content mentioned in the article is for reference only and does not constitute substantive investment advice, so operate at your own risk

Download the official app of “Securities Times”, or follow the official WeChat public account, you can keep abreast of stock market trends, gain insight into policy information, and seize wealth opportunities.