new shares“Break wave” haze once dissipated, in Mayhit newThe money-making effect has returned strongly again. A number of new stocks made a single sign profit of more than 10,000 yuan, and the most violent first day of listing soared by 141.96%, and even one sign in the 9 consecutive boards made a big profit of 20,500 yuan.

Data show that in May this year, a total of 18 new shares were listed on the A-share market, including 5 on the Main Board, 5 on the ChiNext, 4 on the Science and Technology Innovation Board, and 4 on the Beijing Stock Exchange. Among them, only 2 broke on the first day, accounting for 11%. It is worth noting that the Beijing Stock Exchange “transfers the first share”Guandian DefenseIt was listed through a transfer rather than an IPO. It did not issue new shares to raise funds, nor did it involve new listings. It landed on the Science and Technology Innovation Board on May 25 and fell 23.63%.

In addition, the removal of theGuandian Defensethe average increase of IPOs on the first day of listing in May was as high as 49.64%, which was the best month since May 31 this year. In contrast, a total of 36 IPOs were listed in April, of which 17 broke, accounting for as much as 47%, and the average increase on the first day was only 8.3%.

“Close your eyes and start new” is out of date

The “big meat stick” that performed best in May was a new stock on the main boardJiangsu Huachen. On the first day of listing on May 12, the closing price rose 43.96%, and there were 9 consecutive one-word boards. According to the highest price, the first lottery made a big profit of 20,500 yuan; secondly, it wasLianxiang sharesOn May 20, the first day of listing rose 43.99%, winning 6 consecutive boards, and winning the first lottery can earn 20,400 yuan; Beijing Stock Exchange Science and Technology Innovation Materials and Growth Enterprise MarketYuxin ElectronicsThe biggest increase, the first day of listing soared by 141.96% and 114.86% respectively; while 5 new stocks on the main boardJiahuan Technology、Jiangsu Huachen、Mingke Precision Technology、Lianxiang shares、Sunshine Dairythe first day of listing is 44% top limit.

And just in the first 4 months of this year, A-shares just experienced a round of “breaking wave”.according toChoice dataAccording to statistics, there were 122 new stocks in the first 4 months, of which 88 had broken hair since their listing, with a break rate of 72%. Breaking hair, abandoning purchases, and winning the lottery have become a major focus of the A-share market.

As the “invincible myth” of the new shares was shattered, the new army retreated. During the peak period, the number of new listings on the ChiNext board exceeded 15 million, and the number of participants is now nearly 5 million fewer; the number of new listings on the Science and Technology Innovation Board exceeded 6 million during the peak period, and the current number of people is about 3 million, a record low in three years. Before April, the average effective subscription of the Science and Technology Innovation Board was about 4.4 million, and in just over a month, more than 1 million people were “scared away”.

Not only retail investors, but institutions are also fleeing. There are currently only more than 250 institutions participating in the price inquiry offline on the Science and Technology Innovation Board. The previous peak exceeded 500, and the number has almost halved.

In an interview with a reporter from China Times, Wu Zhongyan, an insider in the financial system, said that the recent online quotations for new shares have become more rational, and the issue price-earnings ratio has dropped compared with the industry’s price-earnings ratio. The previous wave of successive break points has not been staged again.

Wu Zhongyan believes that despite this, investors still need to participate rationallyIPO subscriptionbecause under the background of the imminent full implementation of the registration system, the scarcity of new shares will decrease, the supply will increase, and the industry attribute prospects and company fundamentals will vary widely. Pay attention to whether a company, especially a company with a high price-earnings ratio, high issue price, and over-funded fundraising, has the ability to continue to grow, from the development trend of the company’s industry, the company’s position in the industry, the core technology it has, and its business model. analyze.

What’s going on behind the break?

In addition to the sluggish A-share market environment, the company has been losing money year after year, bloody listing and other factors, analysts believe that there are two main reasons: First, the scale of over-raising is too large, and some companies have raised too much IPO funds, taking excess funds. go buyfinancial managementand even more to buy a house in Beijing.

Nano Core MicroApril 26announcementSaid that it will use the super-raised funds of no more than 4.8 billion yuan to purchase financial products. As soon as the news came out, investors were in an uproar.Coincidentally, last DecemberCITIC Securities“The most expensive IPO in history” underwrittenHemai Co., Ltd., 557.8 yuan per share, originally only planned to raise 580 million yuan, but in the end it was 10 times over-raised. As a result, 4.5 billion yuan was taken out of the 5.578 billion yuan raised to finance management.If annualized by 3%interest rateRoughly calculated, the annual wealth management income is nearly 135 million yuan, exceedingHemai Co., Ltd.2020net profit。

After the over-raise, more companies are preparing to buy a house in Beijing. April 12,Pulian SoftwareThe announcement stated that it intends to use no more than 130 million yuan to purchase real estate in Beijing, of which 73 million yuan is IPO over-raised funds.

The second is that the issue price is extremely high, and the issuance of new shares at a high price has become a “meat grinder”. A shares have witnessed history again, and the worst new shares in the past 10 years have been born. Aojie Technology, a new stock listed on the Science and Technology Innovation Board, broke at the opening of the first day of listing, and there was no rebound throughout the day. Due to the high issue price, the first lottery suffered a direct loss of 27,700 yuan. As of May 31, it closed at 65 yuan, which is 60% lower than the issue price.

In addition, Aojie Technology raised more than 4.2 billion yuan,Haitong SecuritiesSponsor and underwriting fees made a huge profit of 300 million yuan. The company has lost nearly 4.5 billion yuan in 4 years, and plummeted by 35% on the first day of listing. How did it price to 164.54 yuan, such an “outrageous” high-priced issue?with high sponsorship feesbrokerageIs it the “culprit”?

Brokerage loses blood while making money with his left hand

Sponsored brokerages are not guaranteed income from droughts and floods, retail investors abandon purchases in groups, and brokerages take over the quilt.

In the first quarter of this year,Brokerage performanceCalled bleak. The 41 A-share listed securities firms generated a total revenue of 96.268 billion yuan, down 30% year-on-year; net profit attributable to the parent was 22.921 billion yuan, down 45% year-on-year.performanceSignificant decline.

Although the brokerage investment bank is not a decisive factor in the pricing, the sponsorship business will rise with the tide and make a lot of money; on the other hand, the new shares are broken and the wave of abandoned purchases has intensified. New shares, bear the loss caused by the break.

With “Super Raising King”Nano Core MicroFor example, its IPO shocked the market and staged a rare scene of abandonment in 30 years. April 17,Nano Core MicroDisclosing the results of the issuance, the most expensive new shares during the year were abandoned by retail investors in a group of 778 million yuan, which means that nearly 40% of the retail investors who won the lottery online chose to abandon the purchase regardless of the punishment, breaking the 30-year record of A shares.

According to the science and technology innovation board underwriting system,Everbright SecuritiesIt had to pay 780 million yuan to underwrite the abandoned shares, plus the strategic placement of the subsidiary Everbright Fuzun of 116 million yuan, this order “smashed” nearly 900 million yuan. However, Naxinwei not only did not break, but rose by more than 8%. In addition, Nanochip Microchip raised 5 billion yuan,Everbright SecuritiesThe sponsorship and underwriting fees are as high as 203 million yuan, of which the sponsorship fee is 3 million yuan, and the underwriting fee is as high as 200 million yuan.

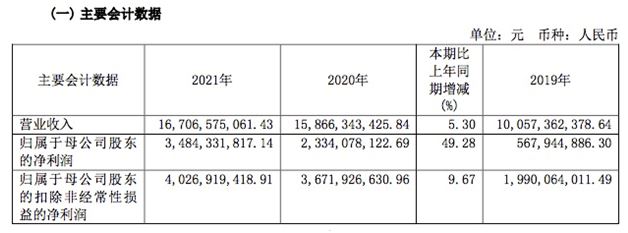

The annual report shows that in 2021Everbright SecuritiesThe total operating income was 16.707 billion yuan, a year-on-year increase of 5.3%; the attributable net profit was 3.484 billion yuan, a year-on-year increase of 49.28%. In terms of specific business,Everbright SecuritiesThe lead underwriting income was 640 million yuan, ranking 15th in the industry, of which the initial IPO income was 595 million yuan.

Everbright SecuritiesRelevant staff members of the Office of the Secretary of the Board of Directors told the “China Times” reporter that new shares frequently break,Everbright SecuritiesThe impact of income and performance is currently good, relatively stable, and there is no obvious impact. We are also concerned about the market situation, but our investment banking business is progressing normally and smoothly, and the latest performance will be disclosed in the semi-annual report.

The era of A-shares playing new and winning is long gone, and the concept of “closing your eyes and playing new” is not advisable. In May, the IPO market ushered in a profit-making effect. On the one hand, the entire A-share market picked up, prompting investors to have a high enthusiasm for new shares; on the other hand, the number of IPOs issued in May plummeted, the issue price gradually returned to a reasonable level, and the overall listing earnings ratio was low.

(Article source: China Times)