The chairman was arrested,*ST King KongA new situation has emerged from the protracted infighting, which is also a major reason for the daily limit today.

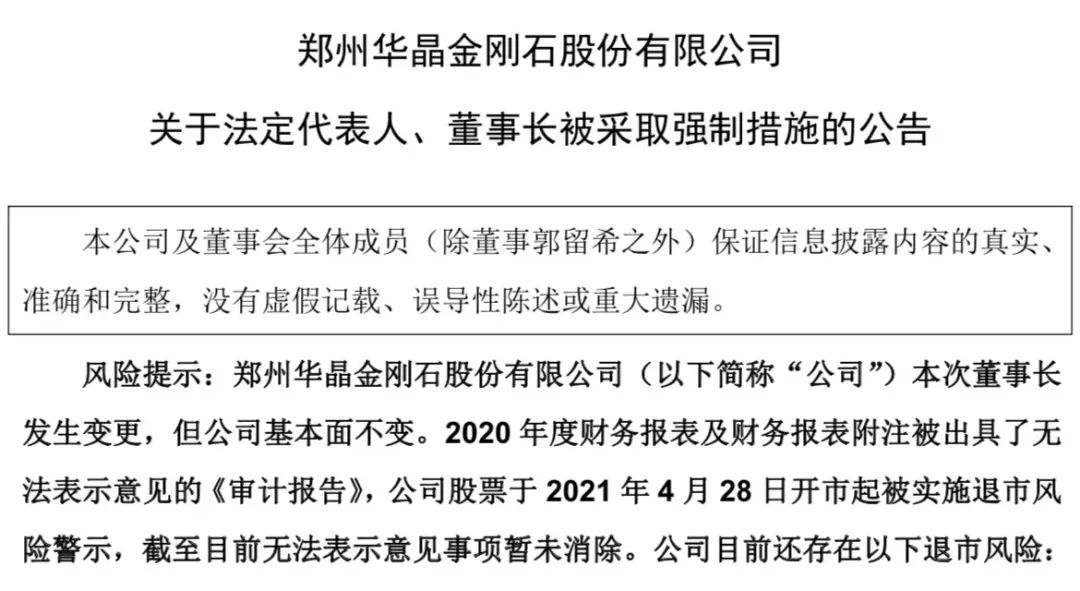

February 21,*ST King Kongannouncementthe company received a notice on February 18 that Guo Liuxi, the company’s legal representative and chairman of the board, was subject to compulsory measures by the public security organs in accordance with the law because of the crime of non-disclosure of important information in violation of regulations. The relevant matters are yet to be further investigated by the public security organs.

Unexpectedly, on February 21, intraday,*ST King KongThe daily limit of 20cm was staged, closing at 1.79 yuan per share, with a total market value of 2.158 billion yuan.

Board of Directors holds emergency meeting

On the night of February 18, *ST King Kong held an emergency meeting of the board of directors. The participating directors unanimously agreed to remove Chairman Guo Liuxi and no longer act as the secretary of the board of directors. Director Liu Miao was elected as the chairman of the board and acted as the secretary of the board of directors. Liu Miao, born in 1970, is currently the Deputy General Manager of Henan Agricultural Investment Financial Holding Co., Ltd. (hereinafter referred to as “Agricultural Investment Financial Holding”) and a director of *ST King Kong.Agricultural Investment Financial Holdings ranks fourth in *ST King Kong with a shareholding ratio of 7.42%.shareholderthe actual controller of Agricultural Investment Financial Holdings is the Henan Provincial Department of Finance.

Agricultural Investment Financial Holdings, a state-owned shareholder, has been trying to re-elect the board of directors of listed companies.Agricultural Investment Financial Holdings and Shanghai Xinghan Asset Management Co., Ltd. under Fujian State-owned Assets (hereinafter referred to as “Xinghan Asset Management”, representing Xinghan Asset Management-Xingkaiyuan No. 8 Single Client Special Asset Management Plan, holding 26.7% of *ST King Kong Shares, the largest shareholder), on November 5, November 16, and November 23, 2021, respectively, by email, mobile MMS, EMS express, on-site delivery, etc., to *ST King Kong’s board of directors and the board of supervisors. convene ad hocShareholders’ meeting, to consider the proposal on the general election of the board of directors and the board of supervisors. However, one month later, the company’s board of directors and board of supervisors failed to give corresponding feedback or notice within the specified time limit. Subsequently, the relevant materials were delivered to the Shenzhen Stock Exchange, and the Shenzhen Stock Exchange issued a letter of concern to *ST King Kong.

On the evening of December 13, 2021, “*ST King Kong” announced that the board of directors and the board of supervisors decided to suspend the consideration of the shareholders’ proposal to hold an extraordinary general meeting. At that time, the fourth board of directors and board of supervisors of *ST King Kong, who were elected in July 2017, has been in office for nearly one and a half years.

Why hold off? The reason given by the company is that the minority shareholder Xu Keqin has filed a lawsuit in October 2021, claiming that Agricultural Investment Financial Holdings and Xinghan Asset Management are acting in concert with each other, and Xinghan Asset Management did not disclose the company’s stock for the first time, so Buying stocks for the second time is an illegal act, and the illegally increased holdings do not have voting rights. Whether state-owned shareholders can reorganize the board of directors as they wish, there are still variables.

Intended to be banned from the market for life

As the founder and helm of *ST King Kong, Guo Liuxi has been the chairman of *ST King Kong since 2004. The company is mainly engaged in the research and development, production and sales of synthetic diamond and its raw and auxiliary materials, as well as the research and development of synthetic diamond synthesis equipment. Guo Liuxi is also known as “the king of man-made diamonds”.

Guo Liuxi has a solid technical background. The Tianyancha App shows that Guo Liuxi, born in 1963, has a university degree and is a senior engineer. He has presided over and participated in the application of 42 patents, including 1 invention patent. The 4 projects he participated in research and development have won the national torch project certificate, and 6 projects have won the provincial and municipal science and technology progress awards, including 5 first prizes and 1 second prize. He has been awarded the titles of “Excellent Entrepreneur of Zhengzhou City”, “Director of China Superhard Materials Association”, “Director of Henan High-tech Experts Association”, “Vice President of Henan Chamber of Commerce of China Chamber of International Commerce” and so on.

In fact, as early as last August, Guo Liuxi was banned from the market for life by the China Securities Regulatory Commission.At that time, the “Notice of Administrative Punishment and Market Prohibition” issued by the China Securities Regulatory Commission showed that it was found that *ST King Kong was suspected of fictitious sales transactions andEquity transfertransaction, inflatedOperating incomethe total profit, resulting in false records in the annual reports from 2017 to 2019; suspected of falsely increasing inventories, fixed assets, and non-current assets through fictitious procurement transactions, resulting in false records in the annual reports from 2016 to 2019 and other illegal acts.

The CSRC believes that Guo Liuxi, as the then chairman, secretary of the board of directors, and the actual controller of the company, made decisions and led the implementation of all the illegal matters involved in *ST King Kong. The China Securities Regulatory Commission plans to issue a warning to Guo Liuxi, impose a fine of 15 million yuan, and impose a lifetime market ban.

On November 12, 2021, Guo Liuxi was given disciplinary action by the Shenzhen Stock Exchange for being “unsuitable to serve as a director, supervisor or senior manager of a listed company within ten years”. Guo Liuxi once said in an interview with the media in August last year, “We want to keep the company now, we have plans to introduce strategic investment, and we have had in-depth communication with well-known domestic law firms. I leave my home and take over smoothly and smoothly.”

on the verge of delisting

*ST King Kong is on the verge of delisting. According to the fact that the China Securities Regulatory Commission found out the suspected illegality in August last year, *ST King Kong inflated its net assets by 1.856 billion yuan at the end of 2019, while the annual report showed that the company’s net assets at the end of 2019 were 1.721 billion yuan, and the loss in 2020 was 1.236 billion yuan. At the end of 2019, At the end of 2020, the retrospectively adjusted net assets may be negative, and the company’s shares may be delisted due to major violations of law.

In addition, the company expects that the owner’s equity attributable to shareholders of listed companies at the end of 2021 will be -1 billion yuan to -500 million yuan. If the audited net assets at the end of 2021 are negative, or if the net assets in 2021 are negative after retrospective restatement, the company’s shares will be terminated from listing.

*ST King Kong is also plagued with lawsuits. As of February 15, the company has involved a total of 89 litigation/arbitration cases with a total amount of 6.061 billion yuan, including 81 lawsuits involving the company and its controlled subsidiaries as defendants, with a case amount of 5.754 billion yuan.

January 29, *ST King Kong disclosedperformanceThe notice shows that it is expected to return to the mother in 2021net profitLosses of 1 billion to 1.5 billion yuan, deducting non-net profit losses of 380 million to 760 million yuan. It said that during the reporting period, the company, in accordance with relevant regulations, combined with the progress of litigation matters and judgments, accrued litigation losses and estimated liabilities included in non-operating expenses of about 650 million yuan, resulting in an increase in non-operating expenses compared with the same period of the previous year. .

(Article source: International Finance News)