(Original title: How courageous! The controlling shareholder’s market value of about 700 million yuan was frozen by the judiciary, but he did not disclose it for a long time! The regulator has repeatedly urged and issued a letter)

On the evening of February 19, Vantone Development announced that it had recently received a notice from China Settlement Shanghai Branch that some of the company’s shares held by the company’s controlling shareholder, K. Wah Holdings, and its persons acting in concert with Vantone Holdings, had been frozen. A total of 106 million shares were frozen this time, accounting for 10.66% of its shares and 5.17% of the company’s total share capital.

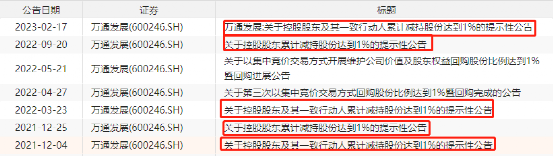

However, the above-mentioned shares were frozen as early as February 6, but the company has not disclosed it for a long time. During the period, the Shanghai Stock Exchange supervised and urged the company several times, and issued a supervisory work letter to the company on February 13, requiring verification of the relevant situation and timely performance of information disclosure obligations. However, the market still did not wait for the announcement to freeze the relevant situation. Instead, it waited for an announcement from Vantone Development on the evening of February 16, “About controlling shareholders and persons acting in concert to reduce their shareholding to 1% cumulatively”.

On February 17, the Shanghai Stock Exchange issued an inquiry letter to the company, requesting an explanation of “the reason why it has not disclosed to the public so far, knowing that the shares have been frozen and our Ministry has clearly urged the disclosure” and “whether there is any intentional delay in disclosing negative announcements” In order to cooperate with the relevant shareholders to reduce their shareholdings”. As of press time, the company has not responded to the inquiry letter.

106 million shares with a market value of approximately 700 million were frozen

According to the belated announcement of Wantong Development on the evening of February 19, the company “recently received the Notice on Equity Judicial Freeze and Judicial Transfer (2023 Si Dong 0206-1 No. )””, it was learned that some of the company’s shares held by the company’s controlling shareholder, K. Wah Holdings, and its person acting in concert, Vantone Holdings, were frozen.

Among them, 3.3 million shares of Jiahua Holdings were frozen, accounting for 0.51% of its total holdings and 0.16% of the company’s total share capital; 103 million shares of Wantong Holdings were frozen, accounting for 29.67% of its total holdings 5.01% of the total, the freeze applicants are all Zhongrong Trust. In this way, a total of 106 million shares of the two have been frozen, accounting for 5.17% of the company’s total share capital. Based on the latest price of 6.74 yuan per share, the market value of the frozen shares is about 700 million yuan.

As of the date of the announcement, plus the previously frozen shares, the accumulative number of judicially frozen shares of Vantone Development’s controlling shareholder and its persons acting in concert was 107.6 million shares, accounting for 10.8% of the shares held by it and 5.24% of the company’s total share capital. %.

The reason for the judicial freeze on the controlling shareholder of the company this time is that there was a contract dispute between K. Wah Holdings and Zhongrong Trust signed on May 31, 2018 in the “Contract on Transfer of Equity Income Rights and Repurchase” and “Contract on Stock Pledge”. Zhongrong Trust provided a loan of 1.408 billion yuan to K. Wah Holdings. For this reason, K. Wah Holdings and Vantone Holdings, the person acting in concert, provided Zhongrong Trust with land and house collateral with a market valuation of more than 1.5 billion yuan. In addition, Jiahua Holdings and its subsidiaries also provided pledge guarantees for about 85% of the shares held by Vantone Holdings, and provided a pledge of 64 million shares of Vantone Development held by Vantone Holdings.

At present, the total amount returned by K. Wah Holdings to Zhongrong Trust is 853 million yuan, repaying the loan principal of about 426 million yuan and repaying the interest of about 427 million yuan. In other words, K. Wah Holdings still has nearly 1 billion yuan in principal that has not been returned.

Still not disclosing and reducing holdings after regulatory supervision

However, it should be noted that the freezing of 106 million shares of Jiahua Holdings actually started on February 6, 2023. According to the principle of “timeliness” in relevant laws and regulations on information disclosure, the company should have done information disclosure long ago, and even the Shanghai Stock Exchange has urged it many times, and sent a supervisory work letter on February 13. But at present, the actual time for the release of the letter has been nearly half a month since the freezing occurred.

It should be noted that, according to data from the bulk platform of the Shanghai Stock Exchange, Vantone Development had a block transaction on February 15, involving 1 million shares and an amount of 6.39 million yuan. The sales department is Ping An Securities Henan Branch.

On the evening of February 16, Vantone Development announced that the controlling shareholder Jiahua Holdings and its person acting in concert Vantone Holdings had reduced their shareholding by 1%, and their combined shareholding ratio dropped from 49.56% to 48.53%. Judging from the date of the disclosed shareholding change, Vantone Holdings reduced its holdings on February 15, which is consistent with the bulk platform data of the Shanghai Stock Exchange.

The shares were frozen and not disclosed for a long time, but there was a reduction in holdings during the period, and the supervision took another shot. On February 17, the Shanghai Stock Exchange issued an inquiry letter to Vantone Development regarding matters related to the freezing and reduction of shares of the controlling shareholder and its persons acting in concert.

The SSE requires companies to:

1. To verify and explain to the relevant shareholders: the specific circumstances of the company’s controlling shareholder and its persons acting in concert with the frozen pledge or frozen shares, including but not limited to the specific background, reasons and progress of the disputes involved in the judicial freeze, the principal and interest of relevant debts The repayment situation, whether it has the ability to repay the relevant debts, whether the relevant shares are at risk of being enforced by the judiciary, and the possible impact on listed companies. At the same time, knowing that the shares were frozen and being clearly urged to disclose, the reason for the delay in disclosing to the public.

2. Verify and explain to the relevant shareholders: In the case of failure to fulfill the disclosure of information on the freezing of shares, whether the controlling shareholder and its concerted parties have used the time window in which the above information has not been disclosed to conduct stock trading, and whether the company has intentionally delayed Disclose negative announcements to match the situation of relevant shareholders reducing their shareholdings, and explain the specific reasons respectively.

Almost 100% pledge debt of 7.3 billion

According to Vantone Development’s previous disclosure, its controlling shareholder’s debt and debt ratio are currently high, and all the company’s shares it holds have been pledged for financing.

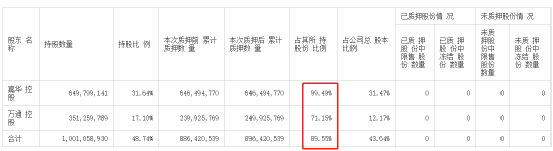

As of December 31, 2022, K. Wah Holdings held 650 million shares of Wantong Development, with a shareholding ratio of 31.64%, of which 646 million shares were pledged, accounting for 99.49% of its holdings. Vantone Holdings, the person acting in concert, holds 351 million shares, of which 250 million shares are pledged, with a pledge ratio of 71.15%.

In the next six months, K. Wah Holdings will have 3 debts corresponding to the pledged shares due, with a total amount of 316 million yuan.

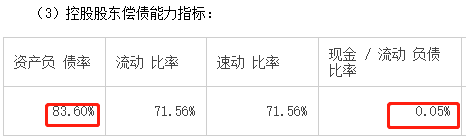

However, the solvency of K. Wah Holdings is worrying. The unaudited report data as of the end of the third quarter of 2022 shows that K. Wah Holdings has a debt amount of 7.329 billion yuan (including bank loans of 2 billion yuan), and a debt ratio of 83.6%. However, cash on the account is scarce, and the “cash/current liabilities” ratio is only 0.05%.

Starting from the end of 2021, K. Wah Holdings and its persons acting in concert have continued to reduce their shareholdings in listed companies through block transactions. In addition to the latest reduction of 1.03%, the cumulative reduction in shareholdings has reached 5.5%. The cash-out amount is conservatively estimated at 6 more than 100 million yuan.

Vantone Development’s main business is real estate development and real estate leasing, and it is also in trouble. In 2023, the company will release a pre-loss announcement on performance. It is estimated that the actual net profit attributable to shareholders of listed companies in 2022 will be -280 million yuan to -416 million yuan, and the net profit after deducting non-recurring gains and losses is expected to be -214 million yuan to -3.5 billion yuan. billion.

The company’s stock price fell by more than 40% in December last year, and has now rebounded. The latest stock price is 6.74 yuan, and the latest market value is 13.8 billion yuan.

Disclaimer: The Securities Times strives for truthful and accurate information, and the content mentioned in the article is for reference only and does not constitute substantive investment advice, so operate at your own risk

Download the “Securities Times” official APP, or follow the official WeChat public account, you can keep abreast of stock market trends, gain insights into policy information, and seize wealth opportunities.