21st Century Business Herald reporter Tang Jing reported in Beijing

The event that attracts the most market attention this week is that the Federal Reserve will announce the Fed’s interest rate decision in the early morning of September 22 (Thursday) Beijing time, as well as a dot plot of interest rates and forecasts for future economic and employment data. Considering that the overall U.S. inflation data in August fell, but the increase still exceeded expectations, while employment, consumption and other data were still strong, the market generally expects the Fed to raise interest rates for the third consecutive time this week by 75 basis points.

Fed funds futures show an 82% chance of a 75 basis point rate hike in September and an 18% chance of a 100 basis point hike. Taking into account that the market has fully priced the Fed’s 75 basis points, the rate hike tomorrow is not the focus of this meeting.

Bai Xue, an analyst at the Research and Development Department of Oriental Jincheng, told the 21st Century Business Herald reporter that the focus of this interest rate meeting is the median interest rate implied by the interest rate dot plot released after the meeting and the rhythm of future interest rate hikes. According to the planned schedule, the Fed only releases the latest economic data outlook for Fed policymakers after the four meetings at the end of the quarter, in March, June, September and December, as well as a dot plot representing their respective expectations for the level of interest rates in the next few years. .

Fed expected to remain hawkish

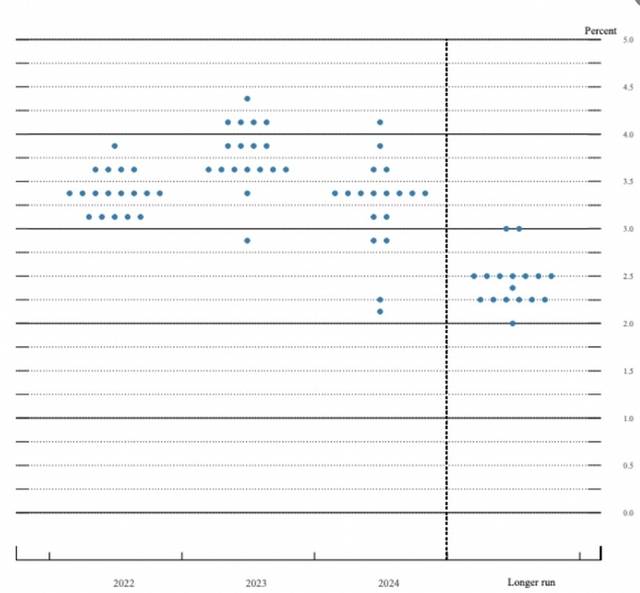

It is reported that the dot plot is a map of the Fed’s prediction of future interest rate hikes or interest rate cuts, and it is a kind of forward-looking information. The dot plot was published because the Fed felt that it communicated too little with the market and that the market sometimes did not understand its message. Therefore, the Fed hopes to strengthen communication with the market by publishing the dot plot.

Each filled dot on the dot plot represents a Fed member’s forecast for future interest rates. When the Fed publishes a dot plot, it publishes the median rate, which represents the Fed’s future forward-looking rates. In addition to forecasting the interest rate at the end of the year, members also need to forecast the interest rate in the next few years and long-term, so the dot plot is a window for the market to see the Fed’s future monetary policy path to a certain extent.

Fed June Dot Plot

Bai Xue believes that considering that the Fed has chosen to return to a hawkish stance after August in order to quickly stabilize inflation expectations, the September meeting may further dilute the market’s expectations for “the end of interest rate hikes” to consolidate monetary policy tightening signals. The “inflation reduction effect” brought about, for example, may use more expressions similar to “the interest rate hike has not reached the end”.

She also expects that the median projection for the federal funds rate in late 2022 and 2023 in the September dot plot should rise further than in June. The June meeting’s median expectations for interest rates at the end of 2022 and 2023 were 3.25%-3.5% and 3.5%-3.75%, respectively. The meeting may raise the median interest rate forecast to around 4% and 4.5% by the end of 2022 and 2023, respectively.

Regarding the forecast of a 100 basis point interest rate increase in the market, Bai Xue believes that a 100 basis point interest rate hike is an unexpected and super-intensive interest rate increase. Considering the communication between the Fed and the market before the interest rate meeting, it should not be at the Fed’s current meeting. Interest rate hikes are considered.

Zhou Junzhi, chief macro of Minsheng Securities, believes that the Fed’s September interest rate meeting is expected to significantly adjust the dot plot, which will also mark the end of the Fed’s correction of market interest rate hike expectations, and the Fed may resume leading the market interest rate curve. From a longer-term perspective, in the process of US CPI data peaking and falling, the Fed is more pursuing the continuity of interest rate hikes. A single rate hike that exceeds market expectations is no longer an appropriate choice, because it goes against the Fed’s repeated emphasis on “fighting inflation more firmly and for a longer time to achieve a soft landing of the economy”.

In Bai Xue’s view, although the current CPI has begun to fall, the absolute level is still far beyond the “comfort zone” of the Federal Reserve. The core service inflation represented by housing rents may still be sticky, and the US inflation may still be in the process of grinding the top in the third quarter. Although the downward trend of overall inflation year-on-year this year is relatively certain, it is difficult for it to drop significantly. We expect this to increase the pressure on the Fed not to ease the pace of tightening in the near term. In November, December, and even the first half of next year, the pace of interest rate hikes may not stop until inflation has trended down.

U.S. debt begins to gradually have long-term allocation value

Recently, driven by the gathering of hawkish interest rate hike expectations, U.S. bond yields have continued to rise strongly. As of September 20, the 10-year U.S. bond yield has exceeded 3.5% and surged to an 11-year high of 3.57%.

Zhang Jiqiang of Huatai Securities believes that the yield of U.S. bonds has continued to rise recently, and the 10-year term has once again exceeded 3.5%. Under the logic of global ratio difference, U.S. bonds have begun to have allocation value. From a horizontal comparison, the yield of the 10-year Treasury bond is clearly superior among traditional safe assets, even surpassing the high-grade credit bonds of some countries; from a historical vertical comparison, the 10-year U.S. Treasury bond is at a relatively high level in both nominal and real interest rates. high level. However, the Fed’s continued interest rate hikes are still the most important upside risk for US bond yields. The Fed’s policy rate may reach 4.5% or even higher, and the liquidity of the US bond market will continue to deteriorate under the acceleration of the shrinking balance sheet. It is not ruled out In the short to medium term, there is a possibility of further agitation.

Bai Xue pointed out to reporters that in terms of US debt, in the short and medium term, the market expects the Fed’s “interest rate hike cycle will continue for a longer period and the policy interest rate end point will be higher”. U.S. bond yields are still likely to rise further, and U.S. bond prices have yet to bottom out.

However, in the long run, as the fundamentals of the U.S. economy weaken and inflation gradually falls, it is more certain that the pricing of interest rate hikes will also decline. The safe-haven advantage of 10-year U.S. bonds as a traditional safe asset will be further highlighted. The 10-year U.S. bond yield even exceeds that of high-grade credit bonds in some countries, and U.S. bonds will have a higher allocation value. In addition, from the historical level, the 10-year U.S. bond yield is at a relatively high level in both nominal and real interest rates, which is also an angle that supports the long-term configuration value of U.S. bonds.

According to the 21st Century Business Herald reporter previously quoted Xia Chun, chief economist of Yinke Holdings, “The timing and investment strategy of China’s increase in U.S. debt holdings in July are quite well grasped. On the one hand, the dollar index continues to strengthen, which makes the exchange rate of increased holdings of U.S. debt soar. , the demand for safe-haven allocation of U.S. bonds has begun to increase, and the price of U.S. bonds is expected to rebound. More importantly, the current US treasury bond yields have clearly deviated from the long-term trend, and the signs of oversold are becoming more and more obvious. “

Wu Zhaoyin, director of macro strategy of AVIC Trust, analyzed to reporters that the current bear market of U.S. bonds has not ended, but the allocation time is indeed approaching. According to the Fed’s statement, the future US inflation rate (measured by CPI) will drop from the current 8-9% to 2%, then the future US benchmark interest rate will rise to 4-5%, while the current federal benchmark interest rate is 2.25% -2.5%, it can be said that the US interest rate hike has entered the middle stage, and it is also the most difficult stage. The rate of interest rate hikes in the next few times will be very large, and with the rapid rise of interest rates, the impact of interest rate hikes on the economy and the capital market will be increasing.

Wu Zhaoyin pointed out that according to the relationship between the US Treasury bond yield and the federal benchmark interest rate during the historical US interest rate hike process, the Treasury bond yield will lead the change in the federal benchmark interest rate. Well, the current US federal benchmark interest rate has entered the mid-term stage, and the corresponding US Treasury bond yield has risen to the mid-to-late stage, but it has not peaked. Therefore, the bear market of the U.S. Treasury bond market has not yet ended, and it has not fully entered the configurable stage.

For more information, please download the 21 Finance APPReturn to Sohu, see more

Editor:

Statement: The opinions of this article only represent the author himself, Sohu is an information publishing platform, and Sohu only provides information storage space services.