Today, a total of 52 shares have their daily limit, and 18 shares have failed to close, with a closing rate of 74%;Jiu’an Medical4 connecting plates,Yujing shares7 days 6 board, GEMZhongjie Precision2 connected boards. On the disk, 1277 stocks closed up, 3151 stocks closed down. Salt Lake Lithium, Military Industry,Non-ferrous metalsThe gains were among the top gains, followed by Yuan Universe, home appliances, and medicine and medical treatment.

CICCIt is mentioned that in the future, policy expectations may still be a key factor affecting the market. The short-term steady growth may not be significant, and the short-term market path may still have twists and turns, but there is no need to be overly pessimistic. Since the end of September, the policy has been gradually changing. The change in the direction of “stabilizing growth and safeguarding people’s livelihood” may be an important observation window for policy development in the first quarter of next year, and the index may also show performance after steady growth is strengthened.

Market overview

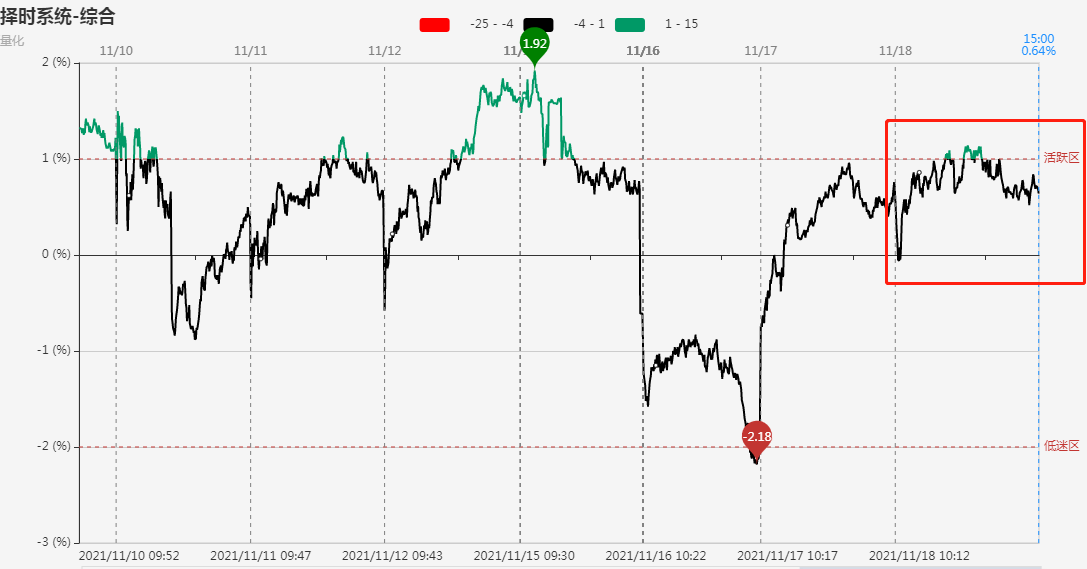

Indicators show that the short-term sentiment of the market dropped to near the 0 axis at the opening, and then quickly rebounded to the lower edge of the active zone. The intraday mainly oscillated near the active zone.

In terms of individual stocks,Rongtai sharesBroken board,Huguang sharesUnpacking failed,Jiu’an Medical4 connecting plates,Yujing shares7 days 6 board, GEMZhongjie Precision2 connected boards.

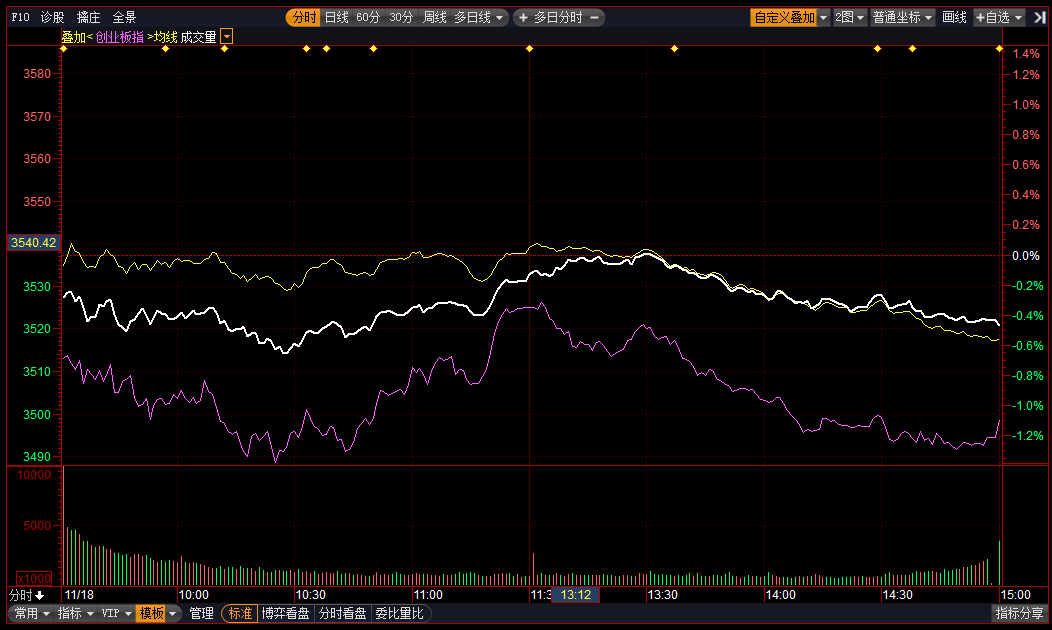

In terms of index,Shanghai IndexwithGrowth Enterprise Market IndexThroughout the day, it mainly oscillated below the flat line, with little intraday volatility. The CSI 1000 index turned green in late trading and closed down 0.13%. The turnover of the two cities has increased compared with yesterday, with a total turnover of 1,124.3 billion yuan.

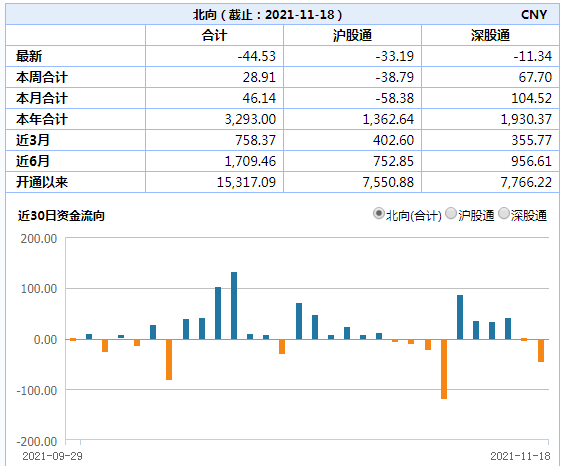

Northbound funds sold a total of 4.453 billion yuan today. Among them, the Shanghai stock market net sales were 3.319 billion yuan, and the Shenzhen stock market net sales were 1.134 billion yuan.

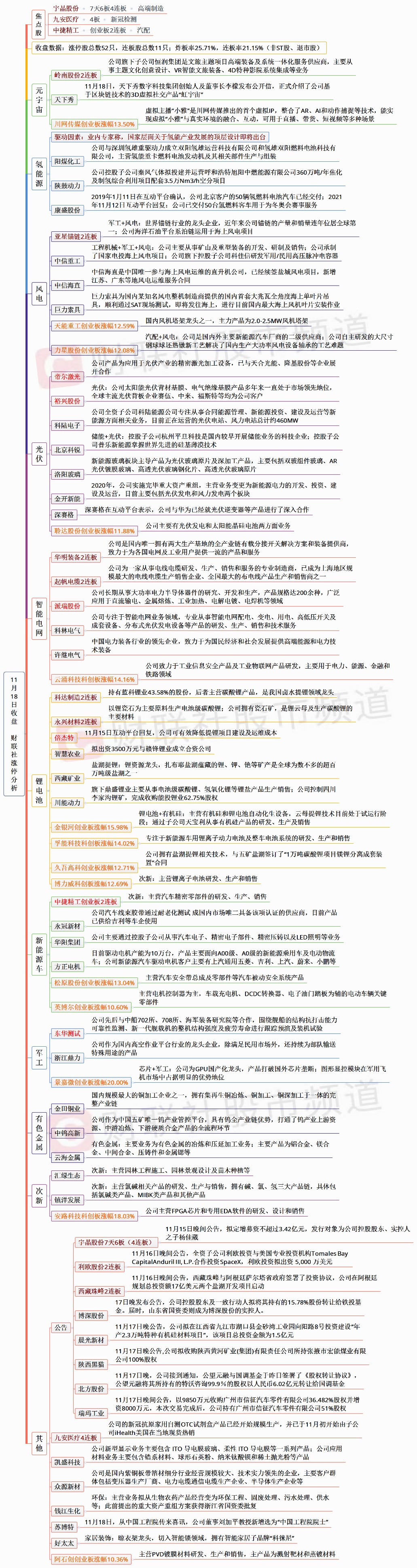

Focus sectors and individual stocks

The fuel cell opened stronger due to the positive stimulation,Yangmei Chemical、Shaangu Power、Kangsheng sharesDaily limit,Zhongtai shares、Meijin Energy、Vision sharesKeep going high and low. On the news, industry experts said that the top-level design for the development of the hydrogen energy industry at the national level will also be introduced. The equity of the sector is relatively poor, and most of the positives in the past year have been open up and down. There will be no quantitative changes in the industry in the short term, and there is not much participation value.

In terms of photovoltaics,Deer Laser、Yuxing shares、Kelu Electronics、Beijing Cree、Luoyang Glass、Jinkai Xinneng、Deep SEGDaily limit,Zhongli Group、Akcome TechnologyFell more than 9%. According to the agency, this year’s installed capacity is small, which is the year when the photovoltaic policy for large bases and the whole county is introduced. There is not much time for installation, and next year will be very fast. Therefore, next year will be a big year for growth, and there will be a growth of more than 30%. This year, the installation opportunity will be 50GW. about.

In terms of smart grids,Huaming Equipment、Sailing cable2 connecting plates,Perry shares、Colin Electric、Xu Ji ElectricDaily limit. The recent performance of this direction has been strong, and China Southern Network has given a plan that exceeds expectations. The next stage will focus on the planning data of the State Grid.

The lithium battery sector represented by lithium mines,Mount Everest, Tibet、Kodak Manufacturing、Yongxing Materials2 connecting plates,Bejet、Smart agriculture、Tibet Mining、Chuaneng PowerDaily limit,Jin Yinhe、Funeng Technology、Jiugo Hi-Tech、BoliweiBranch rose more than 12%. Funds ran away in the afternoon in this direction,Tibet Urban Investment、Jiangte MotorSome other core targets have also fallen sharply.This wave of lithium mining market is mainly viewed as anti-scaling. The strong opening yesterday was mainly a game of emotional switching. Meta universe concept stocks in the afternoon todayHideshi TenkaPulling up the sealing board, the chips of lithium mining stocks began to loosen, and the seesaw effect was obvious.

On the whole, the current market has entered a low position represented by Yuan universe, auto parts, and second-newthemeThe dual-core state of the new energy track represented by wind and solar lithium storage. Near the trillion yuan of turnover, the index is not very interesting, and the opportunity mainly comes from the rotation between the theme sectors. The subject matter speculation mood is still in a good state, you can pay more attention to the mining opportunities of low-level stocks.

Today’s daily limit analysis chart:

(Article source: Financial Association Press)

.