“Sauce”Haitian Flavor Industry(603288.SH) disclosed the 2021 financial report data on March 25. Can the product price increase in the fourth quarter of last year resolve the cost pressure, which will affect the company’s gross profit.interest rateHow much improvement can be found in it.

“In the short term, it is still difficult for price hikes to fully cover the increase in costs.”Haitian Flavor IndustryChairman Pang Kang at theperformanceconfessed at the meeting. The annual report shows,Haitian Flavor Industrylast yearOperating incomeand attributable to listed companiesshareholderofnet profitThe year-on-year growth rate has all dropped to less than 10%, which is the first time the company has dropped to single digits since its listing.

Entering 2022,HaitianPrices of major raw materials such as soybeans in the flavor industry remain high. What is the cost pressure this year?HaitianWhether the taste industry will continue to raise prices has attracted much attention.

Facing the pressure of further rising costs, Pang Kang responded: “The company has no plans to raise prices further.”

After the market value evaporated by 330 billion yuan,HaitianThe taste industry also revealed that “there is norepoplan”.

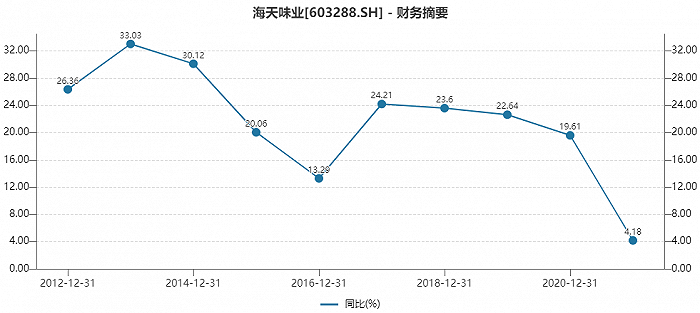

Haitian Flavor Industry’s net profit growth rate attributable to the parent is “extremely difficult year”, and the performance growth rate hits a record low

Haitian Flavor Industry was listed in 2014. In the seven years from the listing year to 2020, except for 2016, the company’s operating income growth rate exceeded 15%, and the net profit growth rate attributable to shareholders of the listed company after deductions exceeded 20%. The myth of uniform growth in 2021 has been busted.

The annual report of Haitian Flavor Industry shows that the growth rate of revenue and net profit has dropped to single digits. In 2021, the company will achieve an operating income of 25.004 billion yuan, a year-on-year increase of 9.71%; the net profit attributable to shareholders of the listed company is 6.671 billion yuan, a year-on-year increase of 4.18%; the net profit attributable to the parent after deduction is 6.430 billion yuan, a year-on-year increase of 4.09%; basic Earnings per share were 1.58 yuan.

Haitian Flavor IndustryDividendAlthough the plan is not as good as the dividend payout ratio of more than half of previous years, it is still generous. The company plans to distribute a cash dividend of 7.60 yuan (tax included) for every 10 shares, for a total of 3.202 billion yuan in cash dividends.

In its annual report, Haitian Flavor Industry described last year as an “extremely difficult year”, “the aftermath of the new crown epidemic, weak consumer demand, rising prices of various raw materials, vicious competition in community group purchases, and tight supply due to power and production restrictions, etc. The business environment is complex and severe, and the company faces unprecedented challenges.”

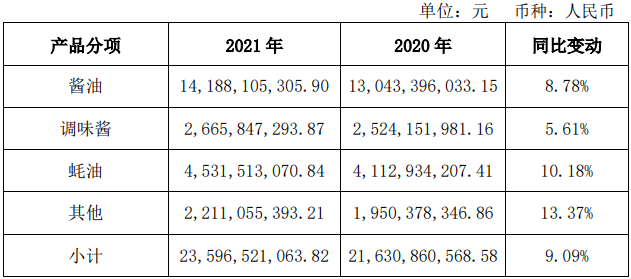

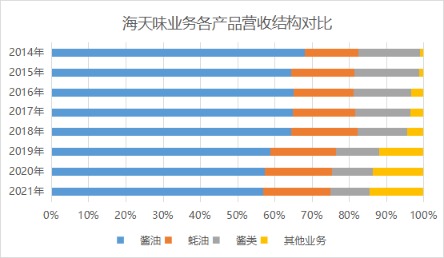

Haitian Flavor has three core products: soy sauce, oyster sauce and seasoning sauce. According to the annual report, the revenue of soy sauce was 14.188 billion yuan, an increase of 8.78%; the revenue of oyster sauce was 4.532 billion yuan, an increase of 10.18%; the revenue of seasoning sauce was 2.666 billion yuan, an increase of 5.61%.

Revenue of Haitian Flavor by Product

Among them, 56.74% of the revenue of soy sauce is still more than half, but it is a new low since the listing. The proportion of seasoning sauce revenue also fell to a new low.

The bright spot is oyster sauce and other products, both of which have a revenue growth rate of more than 10%.oyster sauceinterest rateRelatively strong, while the gross profit margin of soy sauce and seasoning sauce both decreased by more than 4.4 percentage points, the gross profit margin of oyster sauce decreased by only 0.75 percentage points. The proportion of oyster sauce revenue also rose to a new high of 18.12%, becoming a new profit growth point.

“It shows that oyster sauce is effective from catering to residents, and from the coast to the inland.” Guan Jianghua, vice president and financial director of Haitian Flavor Industry, said. In addition, high-end soy sauce accounts for more than 40% of soy sauce.

The same is true for other products, with the proportion of operating income rising to 14.47%. Other products of Haitian Flavor Industry include vinegar, cooking wine, etc.

“Vinegar, cooking wine and other products have begun to take shape, with a revenue scale of more than 1.2 billion yuan. The company is accelerating the development of these two categories and building new growth points.” Guan Jianghua said.

Graphics: Zhang Yi

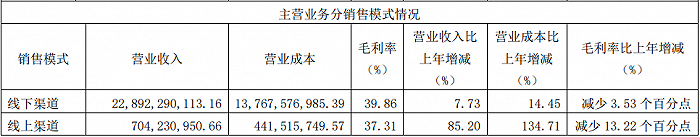

In terms of channels, the growth rate of Haitian Flavor’s online channels far exceeds that of offline channels. Online channels increased by 85.2% year-on-year, while offline channels increased by 7.73% year-on-year. Despite this, the overall revenue of online channels still accounts for no more than 3%, and its high growth rate is mainly due to the base number being too low. Notably,Online gross profit margin drops significantly, last year’s gross profit margin decreased by 13.22 percentage points year-on-year to 37.31%, which has lagged behind offline channels. The company said that this was due to increased market investment in online expansion.

Haitian Flavor has sold products through live broadcast studio anchors many times last year, which also shows from another perspective that the live broadcast channel has a strong ability to devour the profits of physical enterprises.

Haitian Flavor Industry’s revenue from various channels is “unprecedented cost pressure”, and there is no new round of price increase plans

“The condiment industry has experienced unprecedented cost pressures last year.” Guan Jianghua, vice president and financial director of Haitian Flavor Industry, said at the performance exchange meeting. The biggest problem faced by Haitian Flavour last year was the rise in raw materials, and the resulting sharp drop in gross profit margin.

Haitian Flavor’s overall gross profit margin in 2021 will decrease by 3.73 percentage points to 39.78%; the overall net profit margin will be 26.68%, a year-on-year decrease of 1.44 percentage points.

Graphics: Zhang Yi

“Last year, the overall procurement cost increased by more than 10%. Through various measures to reduce costs and increase efficiency, nearly 30% of the growth costs were indirectly absorbed.” Guan Jianghua revealed.

This means that 70% of the cost still needs to be borne by Haitian Flavor Industry and downstream distributors and consumers.

Due to the pressure of rising raw material prices, from October 25, 2021, Haitian Flavor will adjust the ex-factory prices of some products such as soy sauce, oyster sauce, and sauces by 3%-7%. The last price hike happened five years ago.

Jiemian News found that the price increase did help Haitian Flavor’s gross profit margin, but it was very limited.

From a single quarter perspective, the gross profit margins for the four quarters of 2021 are 40.94%, 37.06%, 37.91% and 38.13%, respectively. It can be seen that the gross profit margin of Haitian Flavor in the fourth quarter only increased by 0.22 percentage points from the third quarter, and still fell by 3.73 percentage points year-on-year.

In this regard, Zhang Xin, secretary of the board of Haitian Flavor Industry, explained that the price increase was implemented at about the end of October, and the shipment of products after the price increase accounted for a small proportion. In addition, after October, raw materials have risen sharply, and power curtailment has been limited. Production, etc. also have an impact on profits. “In addition to considering costs, the market needs to be taken into account when raising prices. At present, consumer demand is weak, and costs cannot be transferred to consumers indefinitely.”

Entering 2022, the prices of raw materials such as packaging materials and soybeans are still at a high level. How can Haitian Flavor resolve the cost pressure this year?

“In the long run, the price increase is expected to have a certain promotion effect on the company, but it is still difficult to fully cover the increase in costs in the short term.” Chairman Pang Kang said that in the face of the pressure of rising costs, the company will continue to tap the potential to control costs and maximize costs. Digest the pressure of rising costs,The price increase will comprehensively consider various factors such as cost changes, sales strategies, and sustainable development of the company. The company has no further price increase plans.

This year’s goal: both revenue and net profit increase by 12%

In the annual report, Haitian Flavor has set a target for 2022 – the company plans to have an operating income of 28 billion yuan and a profit of 7.47 billion yuan.

“The target is to increase revenue by 12% and profit by 12%. This target is not high compared with previous years, but in the face of current difficulties and challenges, this target is not low.” Guan Jianghua said.

Guan Jianghua believes that the company’s stable and positive fundamentals have not changed, and the condiment industry has shown the characteristics of anti-cycle and anti-pressure. “From the perspective of the sales side, the main pressure is still the weakening of consumer demand, which restricts the growth of sales. In particular, the repeated epidemics have restrained consumption such as catering. However, we believe that the positive trend will not change in the future. It will gradually return to normal growth levels in the next few years.”

In terms of growth points, oyster sauce, vinegar and cooking wine that performed well last year can all be expected.

“Vinegar, cooking wine, compound seasonings, etc. are all categories with large capacity space,” Guan Jianghua said. The current competition pattern has not yet been finalized, and the company is accelerating the development of new categories and building new growth points.

According to interface news statistics,Haitian Flavor Industry will establish a total of 18 new subsidiaries during 2021, with a registered capital ranging from RMB 10 million to RMB 300 million. Judging from the company names, three companies have the word “oyster sauce” in their names, and four companies have “vinegar” in their names.

Haitian Flavor Industry also revealed that the company will develop new business categories to open up room for growth.Guan Jianghua said that it will speed upCreate an upstream and downstream compatible ecosystem, such as the development of some new business categories such as grain, oil, rice noodles, hot pot base, compound seasoning, and central kitchen.This move may mean that in the future, Haitian Flavor Industry will cooperate with “youcao”Arowana(300999.SZ) went head to head.

In addition, Zhang Xin said that the field of prepared dishes is highly related to condiments, and the company is also activelyresearchmiddle.

In terms of production capacity, the overall capacity utilization rate of Haitian Flavor Industry exceeded 95% last year. Last year, the original production bases such as Gaoming and Suqian increased production. The annual production capacity of soy sauce, sauce and other products in Gaoming base increased by 300,000 tons; the annual production capacity of oyster sauce and vinegar in Suqian base increased by 200,000 tons.

The company said that many production bases across the country have started design and construction, and the production capacity of the new production base will be gradually released in 2022.

Recently,ArowanaLuhua and other grain and oil industry giants expand their production capacity and deploy the condiment industry, which is bound to have a certain impact on Haitian Flavor Industry.

Pang Kang responded that new entrants will bring certain competitive pressure to Haitian, but at the same time, they will also bring innovations in products, channels and technologies to the industry.

In the secondary market, the share price of Haitian Flavor has started to fall since hitting a new high of 168.12 yuan per share in January 2021. On the day of the performance disclosure, the share price of Haitian Flavor opened flat in early trading, fell 2.13%, and closed at 88.08 yuan per share.

The total market value of Haitian Flavor was over 700 billion yuan at its peak, and the latest market value is 370 billion yuan. After the market value has evaporated by 330 billion yuan, the latest price-earnings ratio of Haitian Flavor Industry is still around 60 times.

As for whether there is a repurchase plan, Haitian Flavor also responded on March 25 that the company has no repurchase plan.

Since the beginning of this year, Haitian Flavor Industry has announced the internal transfer of shares for four consecutive times.announcement. The transferor includes Pang Kang and Chen Junyang, the actual controllers, Guan Jianghua, the vice president and financial controller, Zhang Xin, the secretary of the board of directors, and Wen Zhizhou, the director. It is planned to transfer shares, with a total transfer of 9.2675 million shares. Calculated at the transfer price, the cumulative transfer amount is 855 million yuan.

(Article source: Interface News)