(Original title: The performance report of the first batch of 5 brokerages! CITIC Securities’ net profit dropped slightly to 21.1 billion, but this one dropped by 80%…)

Broker No. 1 earned 21.1 billion yuan last year.

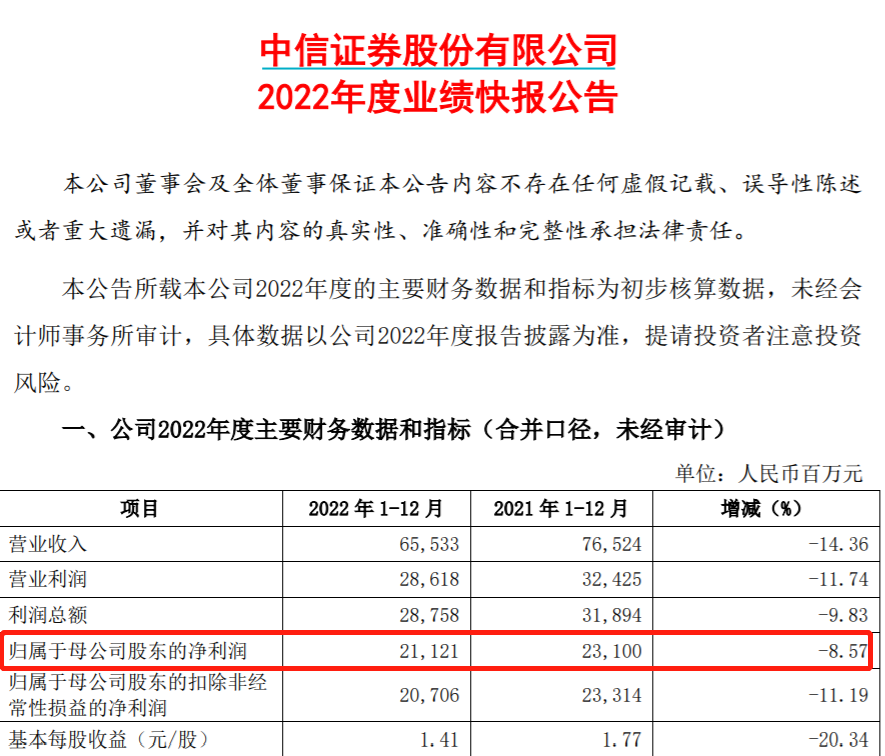

On the evening of January 12, CITIC Securities disclosed the 2022 annual performance bulletin announcement. The announcement shows that CITIC Securities is expected to achieve revenue of 65.533 billion yuan last year, a year-on-year decrease of 14.36%; it is expected to achieve a net profit of 21.121 billion yuan, a year-on-year decrease of 8.57%.

At the same time as CITIC Securities, Guoyuan Securities, Donghai Securities, Yingda Securities, and Netcom Securities also chose the first batch of disclosure of annual performance reports, and their overall performance has declined to varying degrees. However, looking forward to 2023, many institutions believe that the performance of brokerage firms will pick up, and brokerage stocks may perform to a certain extent.

The first batch of brokerages’ 2022 performance forecast released

Last night, CITIC Securities disclosed the 2022 annual performance express announcement. In 2022, CITIC Securities will achieve operating income of 65.533 billion yuan, a decrease of 14.36% compared with 2021; the net profit attributable to the parent company will be 21.121 billion yuan, a decrease of 8.57% compared with 2021. As of the end of 2022, the total assets of CITIC Securities will be 1,310.149 billion yuan, an increase of 2.46% compared with the end of 2021.

CITIC Securities said that in 2022, the company will strive to overcome the impact of factors such as the epidemic and market fluctuations, adhere to the business purpose of serving the real economy, develop steadily in various businesses, and continue to maintain industry-leading performance.

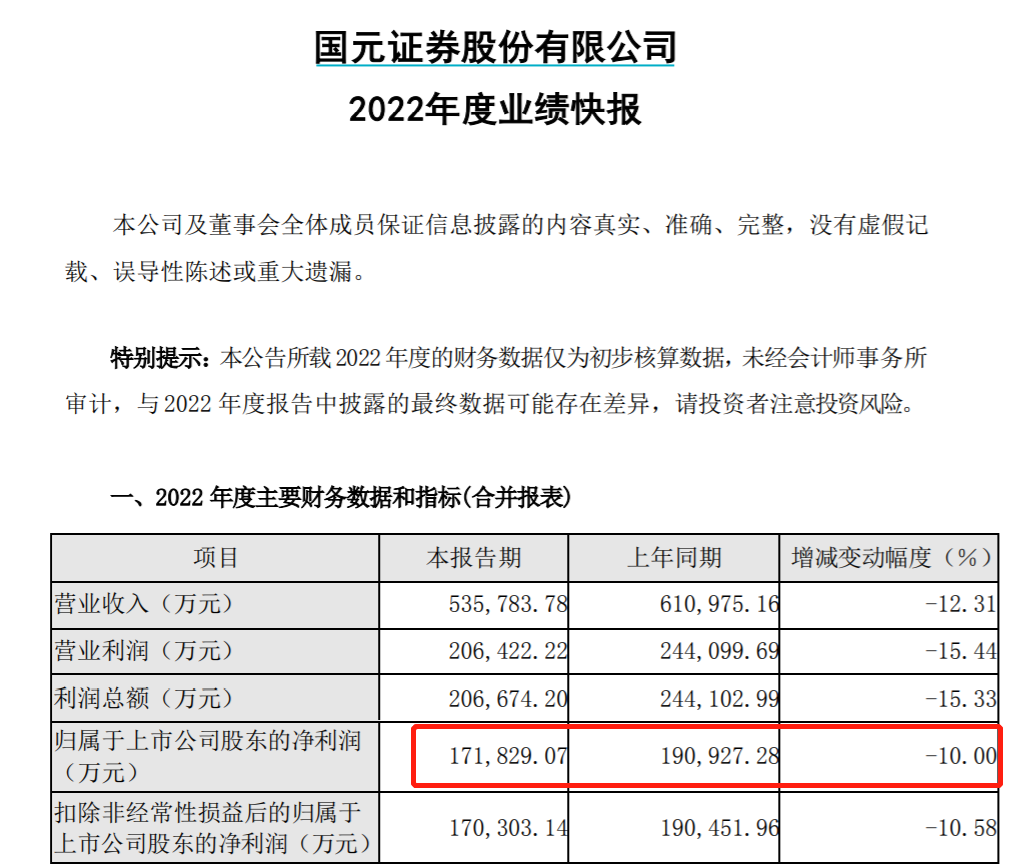

Guoyuan Securities also disclosed its performance report last night. In 2022, the company will achieve revenue of 5.358 billion yuan, a year-on-year decrease of 12.31%; net profit attributable to the parent company of 1.718 billion yuan, a year-on-year decrease of 10%.

Guoyuan Securities stated that in 2022, the company’s investment and financing scale will further expand, securities underwriting, capital intermediary, and fixed-income investment will develop steadily, and the operating performance of subsidiaries such as Guoyuan Innovation and Guoyuan Futures will continue to improve. However, equity investment was affected by the market and investment management capabilities, resulting in a large amount of losses, resulting in a 12.31% and 10% decrease in the company’s annual operating income and net profit attributable to shareholders of listed companies, respectively.

In addition, Donghai Securities, Yingda Securities and Netcom Securities also disclosed the 2022 unaudited financial statements of the parent company.

In 2022, Donghai Securities will achieve an operating income of 1.39 billion yuan, a year-on-year increase of 28.93%, and a net profit of 106 million yuan, a year-on-year decrease of 31.02%.

Yingda Securities achieved operating income of 580 million yuan and net profit of 71 million yuan, a year-on-year decrease of 40% and 80% respectively.

Netcom Securities achieved revenue of 63 million yuan, a year-on-year increase of 36.41%; net profit was 2.9 billion yuan (mainly non-operating income), turning losses into profits.

The general downturn in the securities industry

The 2022 annual performance forecasts disclosed by the first five securities firms are not ideal. In fact, in 2022, the performance of the entire securities industry is expected to decline. This has been reflected in the performance report for the first three quarters of 2022.

According to the China Securities Association, the unaudited financial statements of securities companies show that in the first three quarters of 2022, 140 securities companies achieved operating income of 304.242 billion yuan and net profit of 116.763 billion yuan, down 16.95% and 18.90% year-on-year respectively.

Among the main business income, only the net income from securities underwriting and sponsorship business and the net income from investment consulting business maintained positive growth. Among them, 140 securities firms will achieve a total net income of 44.603 billion yuan in securities underwriting and sponsorship business in the first three quarters of 2022, a year-on-year increase of 7.22%, which is the only business that has achieved positive growth among major businesses accounting for more than 10% of revenue; while investment Although the net income of the consulting business accounts for a small proportion, it has also achieved growth against the trend. In the first three quarters of 2022, it will be 4.225 billion yuan, a year-on-year increase of 14.81%.

Since the secondary market has fluctuated greatly since 2022, the overall decline in securities investment income (including changes in fair value) has become the main reason for dragging down the performance of securities firms. In the first three quarters of 2022, the securities investment income (including changes in fair value) of 140 securities firms was 56.049 billion yuan, which was almost halved compared with 106.404 billion yuan in the same period in 2021, and the decline rate reached 47.32%.

In addition, the income from agency trading securities business and asset management business has also declined to a certain extent. In the first three quarters of 2022, the net income of the 140 brokerages’ agency trading securities business (including the leasing of trading unit seats) was 87.711 billion yuan, a year-on-year decrease of 12.36%; the net income of asset management business was 20.195 billion yuan, a year-on-year decrease of 8.05%.

Net interest income and net income from financial advisory business decreased slightly. In the first three quarters of 2022, 140 securities firms realized a total net interest income of 47.335 billion yuan, a year-on-year decrease of 2.01%; the net income of financial advisory services was 4.622 billion yuan, a year-on-year decrease of 1.91%.

According to Wanhe Securities, the environment of the securities industry in 2022 can be roughly summarized as follows:

In terms of brokerage business, the turnover of stock funds continued to slump, and newly issued funds were cold;

In terms of investment banking business, the scale of IPOs increased year-on-year, and the scale of bond underwriting remained stable;

In terms of asset management business, the asset management scale and expense ratio of securities companies have both dropped, and the high concentration continues;

In terms of investment business, the downturn in market fluctuations affects the investment yield, and the investment differentiation of securities companies continues;

In terms of capital intermediary business, the scale of the two financings and stock pledges has declined, and the market decline has not affected the asset quality of securities companies.

Optimistic about the brokerage stock market in 2023

Looking forward to 2023, some institutions believe that the performance of brokerage stocks will pick up, and the market of brokerage stocks is also worth looking forward to.

Wanhe Securities stated that the factors affecting the brokerage sector market mainly include liquidity, risk appetite (policy), and profitability. The market situation of the sector is often the result of the resonance of three factors: in terms of liquidity, it is expected that the structural easing in 2023 is expected to continue; in terms of policy, it is expected that the capital market will usher in a new round of loosening cycle. At the same time, as the market picks up, the fundamentals of brokerage firms will accelerate recovery. At present, judging from the winning rate and odds of the brokerage sector allocation, the sector has allocation value, and the industry’s “outperform” rating is maintained.

Everbright Securities believes that the securities industry may usher in a wave of rising prices at the beginning of the year: First, from the perspective of economic recovery, various policies to stabilize economic growth in early 2023 are expected to be launched quickly, which will benefit the performance of major financial sectors such as securities; The loose monetary policy is expected to continue, and loose liquidity is the booster for the rise; third, from the perspective of capital market reform itself, the implementation of the comprehensive registration system, the establishment of a valuation system with Chinese characteristics and the promotion of opening up will all be in 2023. Accelerate the progress; Fourth, the performance of the capital market is expected to stabilize under favorable internal and external factors, which will benefit the fundamental performance and valuation of securities firms; Fifth, factors such as the comprehensive registration system and the regulatory environment will benefit leading securities firms, and the market share will further increase to leading securities firms The main listed securities companies are concentrated.

According to Guosen Securities, at present, the market-to-book ratio of securities companies is estimated at 1.27 times, which is at the historical level of 5.86% in the past ten years, and has a high margin of safety: In the short term, as the Fed’s interest rate hike expectations slow down, the real estate financing environment improves , the risk factors suppressing the market can be alleviated, market sentiment improves, and the securities business sector is expected to usher in a reversal effect; The bonus of the times.

Proofreading: Zhao Yan

Disclaimer: The Securities Times strives for truthful and accurate information, and the content mentioned in the article is for reference only and does not constitute substantive investment advice, so operate at your own risk

Download the “Securities Times” official APP, or follow the official WeChat public account, you can keep abreast of stock market trends, gain insights into policy information, and seize wealth opportunities.