March 29 local time,The 2-year and 10-year U.S. Treasury yield curves inverted for the first time since August 2019.According to past experience, the 10-year U.S. Treasury yield fell below the 2-year U.S. Treasury yield, which is widely regarded as a harbinger of economic recession.

Market data showed that the yield gap between 2-year and 10-year U.S. Treasury bonds hit negative 3 basis points at one point in overnight trading, and was up 2.3 basis points in late trading. The 2-year U.S. Treasury yield finally rose 3.7 basis points to 2.377% on the day, while the 10-year U.S. Treasury yield fell 6.4 basis points to 2.401%.

Earlier, on March 28, local time, the yield on the 5-year U.S. Treasury bond climbed 9 basis points to 2.63%, higher than the yield on the 30-year U.S. Treasury bond, the first inversion since 2006. As of press time, the 5-year and 30-year U.S. Treasury yields have been inverted for two consecutive days.

At the same time, Fed Chairman Powell continued to release hawkish signals in his speech. Jeffrey Young, former head of foreign exchange at Citigroup and co-founder and CEO of DeepMacro, said in an interview with the “Daily Economic News” reporter that although the Fed’s interest rate hikes are still being criticized by the market . “But this flattening of the yield curve, combined with a stable level of longer-term inflation expectations, means the Fed’s new policy stance is credible.”

A harbinger of recession?

Short-dated bonds have been selling faster than longer-dated ones this year and the U.S. yield curve is flattening as investors bet that the Federal Reserve will quickly tighten policy at the risk of a prolonged slowdown in economic growth.

At the same time, the bond market has been warning that the Fed’s tightening signal to curb inflation, the Russia-Ukrainian conflict and soaring oil prices have raised the risk of slowing economic growth. According to a Reuters report, long-term U.S. bond yields fell below short-term U.S. bond yields.It shows that investors lack confidence in future economic growth, and the 10-year U.S. Treasury yield fell below the 2-year U.S. Treasury yield, which is widely regarded as a harbinger of economic recession.

According to a 2018 report by the Federal Reserve Bank of San Francisco, the 2-year and 10-year U.S. Treasury yield curves have inverted before every recession since 1955, with recessions occurring roughly at 6-24 inversions. month later. During this long period of time, U.S. bond yields have only signaled a false inversion once.

Similar statistics are also mentioned in a recent study by Jim Reid, chief credit strategist at Deutsche Bank. Reid found that while not every Fed rate hike cycle will lead to a recession, all rate hikes that invert the yield curve will trigger a recession within 1 to 3 years.

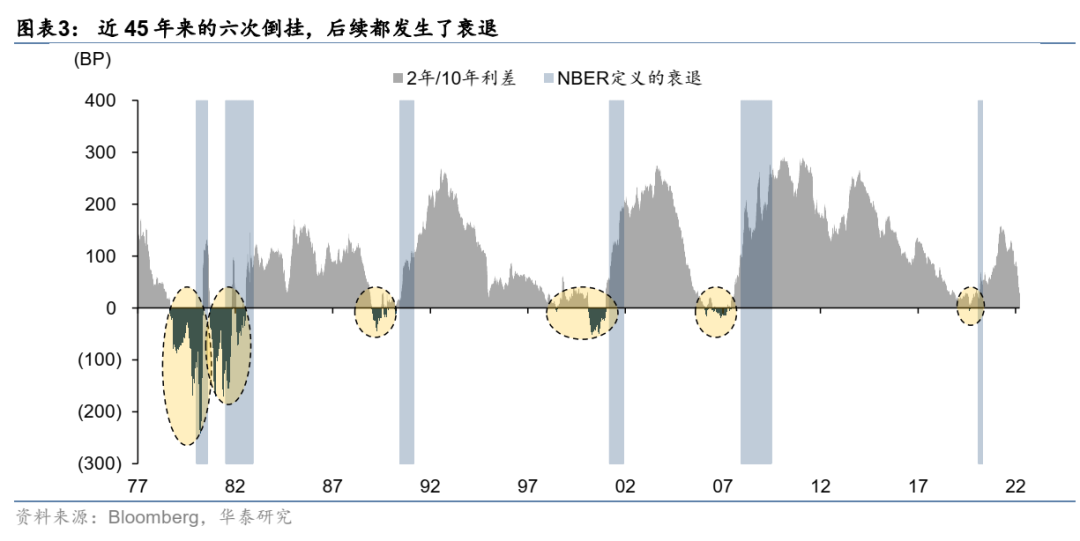

Huatai Securities said in a recent research report, “Since 1977, the 2-year/10-year interest rate spread of U.S. Treasury bonds has experienced six rounds of inversions, and subsequent recessions have occurred, but the causes of recessions are different: one cause It is high inflation that damages the medium-term growth potential, and the Fed raises interest rates ahead of time to eliminate risks and avoid further hidden dangers of crises. Another reason is that low interest rates and low volatility fuel speculation, and the Fed’s tightening has triggered large fluctuations in the financial market and backfired on the balance sheets of various economic entities. In terms of rhythm, the timing of rate hike → inversion → recession is uncertain, but in general, faster rate hikes will speed up the process, and slow rate hikes will do the opposite.”

Image source: Huatai Securities

The “Daily Economic News” reporter noticed that the last time the 2-year and 10-year U.S. Treasury yield curves inverted was in 2019, and the following year, the U.S. economy experienced a recession due to the new crown pneumonia pandemic.

However, not all institutions believe that this inversion of U.S. Treasury yields will inevitably lead to a recession as before. Goldman Sachs last week predicted that the 2-year and 10-year U.S. Treasury yield curves would invert in the second quarter of this year for three years, but without any dire economic consequences. But Goldman also noted that core recession indicators, with few exceptions for 70 years, “may be different this time.”

JPMorgan strategist Marko Kolanovic also pointed out that while the hawkish Fed and the inverted U.S. Treasury yield curve spooked investors, stocks could continue to rise. According to JPMorgan’s statistics, the S&P 500 will peak and decline after an average of 11 months when the 2-year and 10-year yield curves are inverted, and the average trigger point of a recession is 16 months later. month later.

Why does “upside down” appear?

Huatai Securities added in the above-mentioned research report, “This round of (US bond yields) inversion risk stems from inflation. Under the influence of supply and demand, the persistence and magnitude of inflation have exceeded the Fed’s previous ‘temporary’ expectations. As a result, the rate hike was relatively late, allowing inflation to rise, and this risk has not eased in the short term. The direct reason is that in the context of the (US) mid-term elections, US inflation is ‘politicized’, causing the Fed to raise interest rates from From ‘laggard curve’ to ‘catch-up overshoot’, the market’s expectation of ‘quick rate hike’ has been adjusted rapidly, resulting in a rapid bearish flattening of the yield curve. Instead, the market’s expectation of economic growth in the US this year has been revised downwards, restricting the long-term upside. In addition, another round of substantial Fed balance sheet expansion since the outbreak has further distorted the term premium of U.S. Treasuries.”

Jeffrey Yang pointed out in an interview with the “Daily Economic News” reporter: “Recently, another reason for the inversion of the short-term and long-term US bond yield curves is that the market may be saying that in addition to the demand-side suppression caused by high inflation , the Fed’s tightening will also slow economic growth. The Fed certainly wants to avoid that. The Fed’s FOMC “dot plot” this month assumes that U.S. economic growth will remain above its long-term trend and unemployment will also will remain very low, and inflation will fall. But in reality, unless economic growth also falls sharply, it seems unlikely that inflation will fall significantly.”

“The market believes that the Fed has finally woken up and understood the need to raise interest rates and fight inflation. In addition, the market believes that the Fed’s policy of raising interest rates to fight inflation will be successful. Of course, many experts and strategists believe that the Fed is already in this tightening. Lost my mind in the process. But it’s not the same as ‘market’. If we look at market pricing, average inflation expectations 5 to 10 years from now are in line with the Fed’s 2% target for the Personal Consumption Expenditure (PCE) deflator Very consistent. So, the Fed’s rate hikes are still being criticized by the market. But this flattening of the yield curve, combined with a stable level of long-term inflation expectations, means the Fed’s new policy stance is credible.” Frey Young added to every reporter.

The “Daily Economic News” reporter also noted that when the Fed raises interest rates, the market is now increasingly expecting the Fed to take more aggressive measures in its tightening cycle. Federal Reserve Chairman Jerome Powell said on Monday that “inflation is too high right now” and stressed that the Fed will continue to raise interest rates until inflation is under control.

Speaking to the National Economic Association (NABE) on Monday, Powell said, “If we think it’s appropriate to take a more aggressive approach at a rate meeting, which is to raise rates to more than 25 basis points in a single rate hike, We will do it.”

After Powell’s remarks, some market participants raised their expectations for the Fed’s next interest rate hike. For example, Goldman Sachs on Monday raised its forecast for a rate hike to 50 basis points at the Fed’s May and June meeting. In addition, Bank of America on Friday also expected the Fed to raise interest rates by 50 basis points at its June and July meetings, respectively, and by 25 basis points at all other meetings this year.

(Disclaimer: The content and data in this article are for reference only and do not constitute investment advice. Please verify before use. Operate accordingly at your own risk.)

Source of cover image: Photo Network-501187048