Plane crashes into Alaska river: No survivors found

A commercial plane crashed into an Alaska river and caught fire, with no survivors found, according to

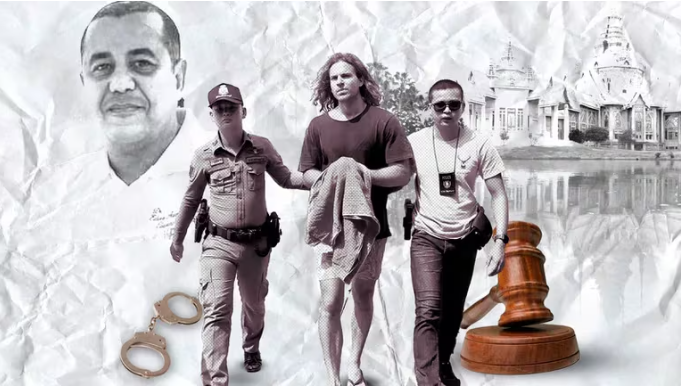

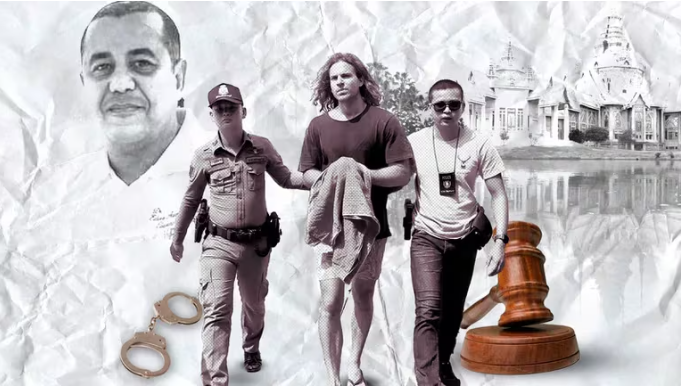

“He is not sorry,” Daniel Sancho’s interpreter exposed the secrets of the Spaniard

The trial against Spanish citizen Daniel Sancho for the death of Colombian surgeon Edwin Arrieta in Thailand

The Mexican Peso in 2024: A Look at Exchange Rates, Inflation, and Growth Forecasts

The US dollar closed at 16.96 pesos on Friday, marking a 1.04% decrease from the previous session’s

Popular Stories

PSG beat Barcelona 4-1 and qualified for the Champions League semi-finals

Paris Saint-Germain qualified for the semifinals of the Champions League by defeating in the stadium Olympic of

Plane crashes into Alaska river: No survivors found

A commercial plane crashed into an Alaska river and caught fire, with no survivors found, according to

“He is not sorry,” Daniel Sancho’s interpreter exposed the secrets of the Spaniard

The trial against Spanish citizen Daniel Sancho for the death of Colombian surgeon Edwin Arrieta in Thailand

The Mexican Peso in 2024: A Look at Exchange Rates, Inflation, and Growth Forecasts

The US dollar closed at 16.96 pesos on Friday, marking a 1.04% decrease from the previous session’s

Travel & Explore the world

PSG beat Barcelona 4-1 and qualified for the Champions League semi-finals

Paris Saint-Germain qualified for the semifinals of the Champions League by defeating in the stadium Olympic of

Plane crashes into Alaska river: No survivors found

A commercial plane crashed into an Alaska river and caught fire, with no survivors found, according to

“He is not sorry,” Daniel Sancho’s interpreter exposed the secrets of the Spaniard

The trial against Spanish citizen Daniel Sancho for the death of Colombian surgeon Edwin Arrieta in Thailand

The Mexican Peso in 2024: A Look at Exchange Rates, Inflation, and Growth Forecasts

The US dollar closed at 16.96 pesos on Friday, marking a 1.04% decrease from the previous session’s

WhatsApp April 2024: learn how to use the new video calling tool | SPORT-PLAY

WhatsApp Messenger continues to enhance its instant messaging service with each update, including features for calls and

Unwavering Protection: A Grandfather’s Promise to His Descendants

A Father’s Unwavering Promise: Protection and Support for His Child In a heartfelt statement, a father expressed

NBA Playoffs 2024 | Today’s matches, results and updated standings for April 23

The NBA Playoffs 2024 are in full swing, with several exciting matchups taking place on Tuesday, April