Lei Jianping reported on August 4

Shenzhen Water Planning and Design Institute Co., Ltd. (stock code: 301038, abbreviated as “Shenzhen Institute of Planning”) was listed on the Shenzhen Stock Exchange today.

The Deep Water Regulatory Institute issued 33 million shares at an issue price of 6.68 yuan and raised 220 million yuan.

The opening price of the Deepwater Regulation Institute was 27 yuan, a 304% increase from the issue price; the closing price was 23.87 yuan, an increase of 257.34% from the issue price; based on the closing price, the market value of the Deepwater Regulation Institute was 3.151 billion yuan.

Company accounts receivable 738 million yuan

The Deepwater Planning Institute is mainly engaged in providing professional technical services such as survey and design, planning consulting, and project operation for water construction projects and supporting projects.

According to the prospectus, the Shenzhen Institute of Planning and Design has revenues of 517 million yuan, 715 million yuan, and 864 million yuan in 2018, 2019, and 2020, respectively; net profits are 51,613,900, 70,575,900, and 93.46 million, respectively.

The business of the Deepwater Planning Institute is mainly concentrated in the Shenzhen market. In each period of the reporting period, the revenue realized in Shenzhen accounted for 55.87%, 68.82% and 68.26% respectively.

At the end of 2018, 2019, and 2020, the company’s net accounts receivable (including contract assets) of the Deepwater Regulatory Institute were 540 million, 610 million, and 738 million, respectively, accounting for 56.93%, 60.59%, and 62.08 of current assets, respectively. %.

In 2020, the Deepwater Regulatory Institute achieved operating income of 863,854,800 yuan, a year-on-year increase of 20.86%; net profit attributable to the company’s ordinary shareholders after deducting non-recurring gains and losses was 90,886,700 yuan, a year-on-year increase of 16.87%. The increase in performance in 2020 is mainly due to the issuer’s recognition of revenue in some large-value contracts in 2020, and the relevant influencing factors are not sustainable.

From January to March in 2021, the Deep Water Regulatory Institute’s operating income was 222 million yuan; the net profit was 2.153 million yuan, and the net profit attributable to the owners of the parent company after deducting non-recurring gains and losses was 1,258,700 yuan.

The Deepwater Planning Institute expects revenue from January to June 2021 to be between 465 million and 520 million, a year-on-year increase of 18% to 32% from January to June 2020; net profit attributable to owners of the parent company is between 43 million and 49 million, a year-on-year increase 16.86% to 33.16%; net profit attributable to owners of the parent company after deducting non-recurring gains and losses was 40.5 million to 46.5 million yuan, a year-on-year increase of 12.11% to 28.71%.

Shenzhen Investment Holdings as a major shareholder

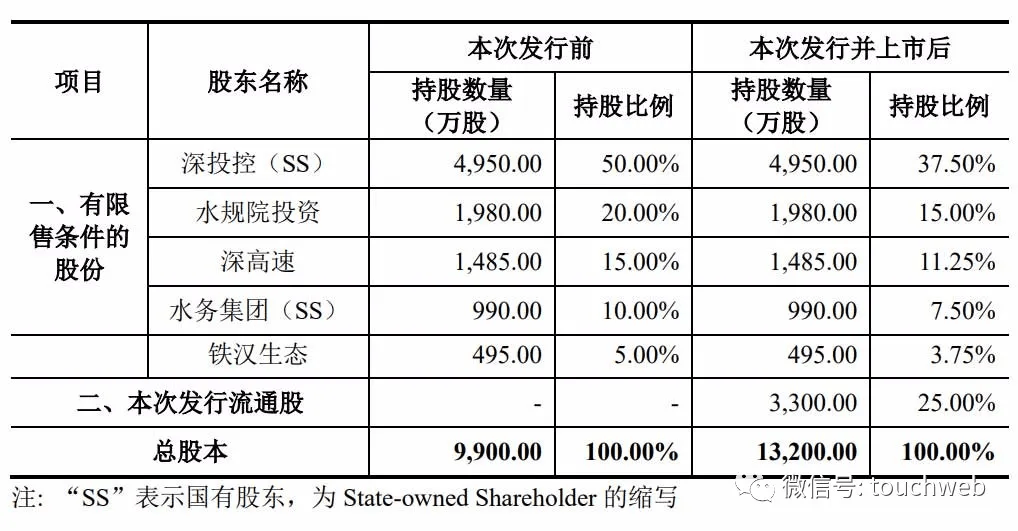

Before the IPO, Shenzhen Investment Holdings held 50% of the company’s shares, Shenzhen Expressway held 15% of the company’s shares, and Water Affairs Group held 10% of the company’s shares. Shenzhen Investment Holdings, Shenzhen Expressway, and Water Affairs Group were ultimately controlled by the Shenzhen State-owned Assets Supervision and Administration Commission.

In addition, the Water Regulation Institute has an investment holding of 20%, and Tiehan Ecological holdings of 5%.

After the IPO, Shenzhen Investment Holdings holds 37.5%, Water Regulation Institute holds 15%, Shenzhen Express holds 11.25%, Water Group holds 7.5%, and Tiehan Eco holds 3.75%.

———————————————

Lei Di was founded by Lei Jianping, a senior media person. If reprinted, please indicate the source.Return to Sohu to see more

Editor:

Disclaimer: The opinions of this article only represent the author himself. Sohu is an information publishing platform. Sohu only provides information storage space services.

.