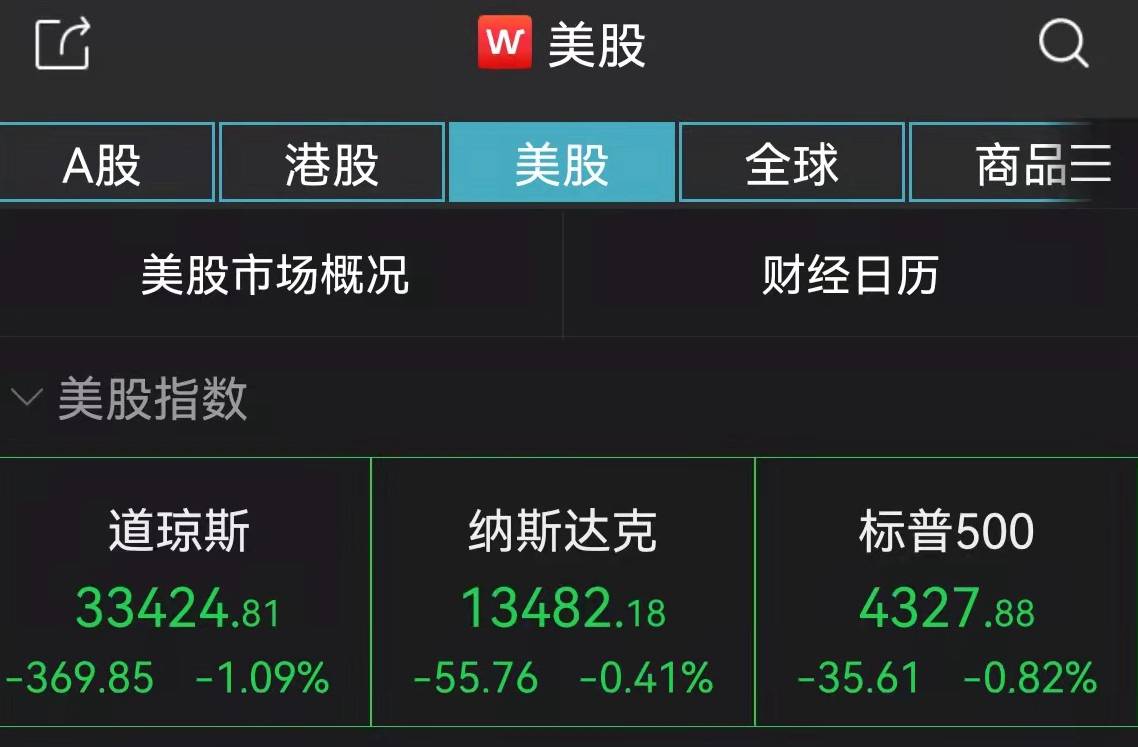

China-Singapore Jingwei, March 4th. On the evening of the 4th, Beijing time, US stocks continued to decline, and the Dow fell more than 1%. As of press time, the Dow fell 1.09%, the Nasdaq fell 0.41%, and the S&P 500 fell 0.82%.

Source: Wind

Bank and airline stocks fell sharply, with Deutsche Bank down more than 8%.

The performance of popular Chinese concept stocks was sluggish. Bilibili and TAL both fell by more than 4%, Pinduoduo fell by more than 2%, and NetEase and Alibaba fell by more than 1%.

In terms of individual stocks, Ocugen fell by more than 24%, and the EUA application for the new crown vaccine was rejected by the FDA; GAP rose by more than 8%, and its 2022 performance guidance exceeded expectations.

On the news, data show that the non-agricultural employment population of the United States increased by 678,000 after seasonal adjustment in February, the largest increase since July last year, and is expected to increase by 400,000, compared with an increase of 467,000 from the previous value; the unemployment rate in February was 3.8%, a record high. The new low since February 2020, the expected 3.9%, the previous value of 4%.

Fed’s focus on risk management amid uncertainty; upside risks to inflation amid strong economy; supply chain issues and labor shortages lasting much longer than expected; demand for goods and housing, Fed’s Williams said Continued strong; inflation is much higher than expected, the Fed will contain it, and the Fed has pledged to do what is necessary to bring it back to 2%; the situation is certainly not stagflation, and long-term inflation expectations haven’t changed much.

In terms of international oil prices, as of press time, the May contract of Brent oil has risen by 4% on the day, and is now at $114.82 per barrel; the April contract of U.S. oil has risen by 4.49%, and is now reported at $112.88 per barrel. (Sino-Singapore Jingwei APP)

For more exciting content, please pay attention to the official WeChat account of jwview. Return to Sohu, see more

Editor:

Disclaimer: The opinions of this article only represent the author himself, Sohu is an information publishing platform, and Sohu only provides information storage space services.