April 6 marked the first anniversary of the merger of the Shenzhen Main Board and the SME Board. During this year, the group of companies listed on the new Shenzhen Main Board became more concentrated, the industry distribution became more diverse, and the profitability increased steadily. Flush iFinD data shows that as of the close of April 6, there were 1,486 listed companies on the Shenzhen main board, with a total market value of about 22.95 trillion yuan. At present, 393 companies have disclosed their 2021 annual reports, and more than 60% of the companies have achieved net profit growth. During the year, 28 companies were listed on the main board of Shenzhen Stock Exchange through IPO, with a total fund-raising amount of about 23.297 billion yuan. According to industry insiders, the merger of the Shenzhen Stock Exchange and the Shenzhen Stock Exchange is an important measure for the reform of the capital market, and the regulatory capacity and regulatory efficiency have been further strengthened.

37 stocks with a market value of 100 billion yuan have been nurtured

After the merger of the main board and the SME board, the Shenzhen Stock Exchange has formed a market structure dominated by the main board and the ChiNext. Flush iFinD data shows that as of the close of April 6, there were 1,486 listed companies on the Shenzhen main board, with a total market value of about 22.95 trillion yuan, giving birth to 37 stocks with a market value of 100 billion yuan, including BYD and Wuliangye.

It is understood that the main board of Shenzhen Stock Exchange focuses on supporting the financing development of relatively mature companies, making them better and stronger, and has cultivated a number of industry-leading enterprises, becoming a gathering place for market-oriented blue-chip stocks. Among them, BYD is the stock with the highest total market value on the Shenzhen main board. As of the close of April 6, BYD’s total market value is about 704.2 billion yuan, ranking 12th in the A-share market. Wuliangye, Midea Group, Hikvision, Ping An Bank, Muyuan Co., Ltd., Luzhou Laojiao and other stocks followed closely with a total market value of about 621.1 billion yuan, 408.5 billion yuan, 386.2 billion yuan, 318.1 billion yuan, and 298.3 billion yuan respectively. , 275.9 billion yuan.

After the merger of the main board and the small and medium-sized board, the group of companies listed on the Shenzhen main board will be more concentrated, the industry distribution will be more diversified, the industry chain ecology will be more complete, the plate resilience will continue to be highlighted, and the profitability will increase steadily. Flush iFinD data shows that at present, 393 companies on the Shenzhen main board have disclosed their 2021 annual reports, of which 260 companies will achieve a year-on-year increase in attributable net profit in 2021, accounting for more than 66%.

Among them, Yuanxing Energy and Tianji Co., Ltd. will have the largest increase in attributable net profit in 2021, both exceeding 70 times. Taking Yuanxing Energy as an example, in 2021, Yuanxing Energy will achieve an operating income of about 12.149 billion yuan, a year-on-year increase of 57.81%; the corresponding attributable net profit achieved is about 4.951 billion yuan, a year-on-year increase of 7171.11%.

According to the data, Yuanxing Energy is a leading enterprise of trona and baking soda in China, mainly engaged in the production and sales of soda ash produced by trona method, baking soda, coal-made urea and other products. Yuanxing Energy said that during the reporting period, the company’s soda ash and urea segment production units were operating efficiently, and the average selling price of leading products rose sharply over the previous year; the coal segment’s contribution to the company’s profits increased significantly over the previous year.

In addition, the net profit growth of Landai Technology, Shengxin Lithium Energy, Polyfluoride, Zhongtai Chemical, Potassium International, Lisheng Pharmaceutical and other stocks will all increase by more than 1000% in 2021.

28 companies listed on the main board

In the year of the merger of the two boards, the Shenzhen main board has been continuously recruiting new products. Flush iFinD data shows that in this year, 30 companies have landed on the Shenzhen main board. In addition to the listed Huilv Ecology, 28 companies have gone public through IPOs.

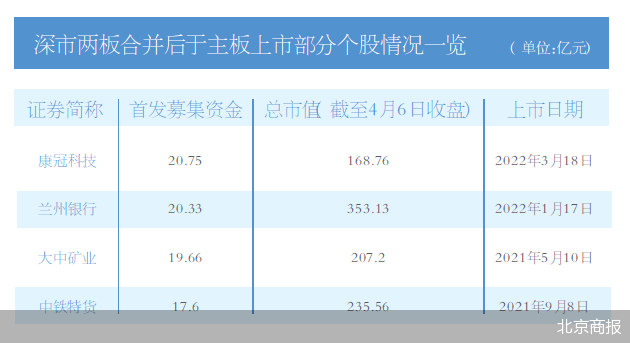

Flush iFinD data shows that these 28 companies raised a total of about 23.297 billion yuan in their initial offerings, of which KTC, Lanzhou Bank, and Dawnrays all raised more than 2 billion yuan in their initial offerings, about 2.075 billion yuan, 2.033 billion yuan and 2.007 billion yuan.

KTC Technology is also the smallest stock with the smallest “stock age” on the Shenzhen Main Board. According to the data, KTC Technology was listed on March 18. It is a design and production enterprise focusing on the field of intelligent display. Its main business is the research and development, production and sales of intelligent display products. The main products include intelligent interactive display products in the commercial field, household smart TVs in the field. As of the close on April 6, KTC reported 41.93 yuan per share, with a total market value of 16.88 billion yuan.

In addition, as of the close on April 6, among the 28 new stocks, the total market value of Lanzhou Bank, China Railway Special Cargo, Dazhong Mining, and Guangdong Feed was also over 10 billion yuan, 35.313 billion yuan, 23.556 billion yuan, and 20.72 billion yuan respectively. yuan, 10.472 billion yuan.

At present, among these 28 companies, 6 companies including Dazhong Mining, KTC Technology, and Shenghang Co., Ltd. have disclosed their performance in 2021. Among them, except for Lichen Industrial, the net profit attributable to the other 5 companies has achieved year-on-year growth. . Financial data shows that in 2021, Lichen Industrial will achieve an attributable net profit of about 179 million yuan, a year-on-year decrease of 19.57%.

Economist Song Qinghui said in an interview with a reporter from Beijing Business Daily that the new main board in Shenzhen has achieved great results. On the one hand, the market structure of Shenzhen Stock Exchange tends to be enriched and perfected, and its functions are also more complete. On the other hand, the Shenzhen market has been pushed into the deep water area of reform and development, which has formed a new market structure and provided a steady stream of impetus for the long-term and stable development of China’s economy.

In the view of Wang Peng, an associate professor at Renmin University of China, the merger of the Shenzhen Stock Exchange’s main board and small and medium-sized board has played a good demonstration role in the capital market. Wang Peng said that at present, the main board of Shenzhen Stock Exchange is more aimed at mature enterprises, while the ChiNext board is more of service-oriented and growth-oriented enterprises. Structurally, the functional positioning of each sector is clear, and each sector performs its own duties and achieves remarkable results. From the perspective of future development, the merger of the two boards will play a good demonstration role in the formation of a multi-level capital market.

Beijing Business Daily reporter Dong Liang Ding NingReturn to Sohu, see more

Editor:

Disclaimer: The opinions of this article only represent the author himself, Sohu is an information publishing platform, and Sohu only provides information storage space services.