On May 15, the world‘s first “interconnection” mechanism for derivatives – “Swap Link” opened. The opening up of China’s financial market has ushered in a new milestone.According to Chinese peoplebankthe Hong Kong Securities Regulatory Commission, and the Hong Kong Monetary Authority jointlyannouncementIn the early stage, the “Northbound Swap Link” will be opened first, and foreign investors in Hong Kong and other countries and regions can participate in the mainland through the interconnection of infrastructure between the two places.bankIn the international financial derivatives market, the initial trading varieties areinterest rateexchange.

As the second largest bond market in the world – the attractiveness of China’s bond market in the world is steadily increasing.from Chinese peoplebankAccording to the data from the China Securities Regulatory Commission, as of the end of March 2023, the total scale of RMB bonds held by foreign institutional investors and individuals was about 3,271.7 billion yuan.With the increase in the amount of RMB bonds held by foreign investors, the management of RMBinterest rateRisk becomes an imperative. “Swap Link” is a “sharp tool” for overseas investors’ RMB interest rate risk management. Institutional figures believe that it will further enhance the attractiveness of RMB assets in the world.

open the gate!

Global electronic trading platforms Cuida Wanbo Tradeweb and Bloomberg are recognized overseas electronic trading platforms under the “Northbound Swap Link” that opened on May 15.

In order to welcome the opening of the “Exchange Link”, the two organizations have been making intensive preparations.

It is understood that Tradeweb has established a cross-departmental and transnational exchange working group within the company to provide decision-making suggestions for policy formulation and business planning of competent authorities and domestic partners.Cuida Wanbo Tradeweb worked with relevant departments in advance to conduct customer research on the product design of Huachangtongresearchand business negotiations. Before the launch, “the platform will be pushed to traders and users in more than 40 countries around the world in the form of a pop-up window at the first time, and at the same time, we will have a dialogue with them to understand customer needs.” Through online and offline roadshows, Tradeweb helps overseas clients understand China’s derivatives market and the swap mechanism.

Wang Dahai, President of Bloomberg Greater China, spoke to ChinafundThe newspaper said, “We and our customers are looking forward to” the “opening” of the exchange. He introduced, “In the past two weeks, we have maintained full communication with foreign investors, domestic quotation providers and the infrastructure providers of the “Swap Link”, and fully supported domestic and foreign market participants in accordance with the “Swap Link” management methods and transactions. Rules, and complete related work such as business activation application and agreement signing.”

Deutsche BankTao Yeqing, China Sales Director of Macro and Emerging Market Business, said that currentlyDeutsche BankReceived many inquiries, international investors want to participate in the swap link transactions in the first place.International investors are also looking to domesticrepurchaseFutures, options and other products are further opened up.

China’s financial market is open and innovative

Although the stock and bond markets in China’s financial market have been connected to each other before, institutions believe that “Swap Connect” is still a milestone event in the opening of China’s financial market. Behind the “Swap Link” is a major financial market innovation, and it is also the world‘s first derivatives interconnection mechanism.

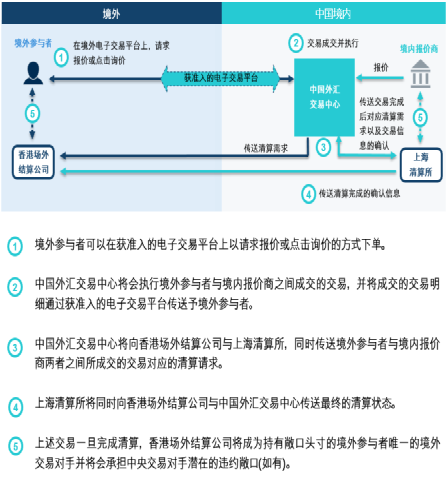

according toHKEXUnder the “Swap Link” arrangement, foreign investors only need to place an order on a recognized electronic trading platform to tradeBank of ChinaInterest rate swap products in the inter-market. Behind the convenient transaction is the full cooperation of the financial market infrastructures of Hong Kong and the Mainland. For example, after a foreign investor places an order, the China Foreign Exchange Trade System executes the transaction. The foreign exchange trading center will send a clearing request to Hong Kong OTC Clearing Company and Shanghai Clearing House. After the completion of the clearing, the Shanghai Clearing House transmits the clearing status to the Foreign Exchange Trade System and Hong Kong OTC Clearing Company.

“Exchange Link”, source: Hong Kong Stock Exchange website.

Hong Kong Stock Exchange CEO Au Guansheng said in a statement that “Swap Connect” is the latest chapter of the “Interconnection” mechanism that HKEx participates in. As the world’s first derivatives interconnection mechanism, it will enhance the connection between Hong Kong and the mainland capital markets, promote the development of the two places, and enhance Hong Kong’s status as an international financial center.

Sun Chen, President of Tradeweb Asia, explained that “Swap Link” is the integration of the Hong Kong and Mainland trading front desk and clearing back office. It is not easy to effectively integrate the trading front desk and clearing back office in the two places. For example, how to preserve Chinese characteristics while being compatible with international practices is an arduous and systematic project. “The cross-border transaction and clearing arrangement of the Exchange is a new breakthrough.”

Wang Dahai said that allowing foreign investors to participate in the inter-bank interest rate exchange market without changing existing trading habits and work procedures is one of the key features of the “Northbound Swap Link”.

Yang Jing, vice president of Standard Chartered Bank (China) Co., Ltd. and general manager of the financial market department, said: “Swap Express” is another milestone in the opening up of China’s financial market. The “Swap Link” will significantly enhance the ability of foreign investors to manage the interest rate risk of onshore RMB bonds, and at the same time give investors higher transaction flexibility, further enhance the willingness of international investors to hold RMB assets, and help promote the internationalization of RMB. change.

Global commercial banks, hedge funds or first

Asked which global investors might be interested in “Swap Connect”?

Fan Mingxi, deputy head of the UBS Global Financial Markets Department in China, introduced,bond fundsovereign investment institutions,Insurancecompany,pensionOverseas investors who have established a presence in China’s bond market are highly motivated to participate in the “Swap Connect” based on hedging considerations. In addition, investment banks,BrokersFinancial intermediaries that provide services for foreign investors to participate in the Chinese market will also actively participate in the “Swap Connect”. Although before the opening of the “swap link”, foreign investors could manage the interest rate risk of onshore bonds through derivatives in the offshore market, but the convenience is not the same as after the “swap link”. After the opening of the “Swap Link”, foreign investors can access the domestic interest rate derivatives market with greater liquidity than the offshore market, so as to obtain better quotations and achieve better position risk management.

Deutsche BankTao Yeqing, China Sales Director of Macro and Emerging Market Business, also said that the overseas investors of Swap Connect include commercial banks, funds, and sovereign institutions. In Tao Yeqing’s view, due to the maturity of its internal investment infrastructure, commercial banks and hedge funds may be the first to participate. On May 9, Deutsche Bank (China) Co., Ltd. announced that it has been officially approved to become the first batch of “Northbound Swap” quoters.CICCIt has also been announced that it has been approved as the first batch of “Northbound Interchange Link” quotation providers.

At present, foreign investors can already use CIBM (interbank bond market),QFII(Qualified Overseas Investment Institutions), Bond Connect, etc. to participate in the domestic bond market. After the opening of the “Swap Link”, what convenience will they get by investing in the domestic bond market for risk management? In response to this problem, Fan Mingxi introduced that, firstly, foreign investors can choose to use the “Swap Express” to directly conclude transactions with domestic banks that are qualified for exchange quotes and make settlements conveniently; secondly, they can also choose to continue to follow the The existing model deals with market intermediaries such as foreign investment banks. But what is different from before is that with the “Swap Link”, because financial intermediaries can participate in the “Swap Link”, it is believed that foreign investors can obtain better quotations indirectly, that is, without changing the original transaction form. In addition, it can also promote the efficiency of transactions.

The attractiveness of RMB assets may be further enhanced

Fan Mingxi introduced that for foreign banks, in addition to improving specific business, the signal significance of “Swap Link” may be more important. “Swap Link” is an important step in the opening up of China’s financial derivatives market. For overseas investors, with the opening of the “Swap Link”, they can access more onshore risk management tools from abroad, which is more conducive to their layout of the domestic market and risk management.

Tao Yeqing said that “interest rate swap” is an important supplement and hedging tool for fixed-income investment portfolios, and “swap link” is an important supplement to offshore non-deliverable interest rate swaps (NDIRS) commonly used overseas. There is a certain similarity in principle, but the Exchange Link incorporates more domestic transaction structures and elements, and is regarded as a product closer to the domestic interbank market. The launch of the swap link will link the domestic inter-bank market’s flat demand, and introduce richer and more diversified participants to the domestic inter-bank market, which will enrich the activity of the market and increase the transaction volume.

Yang Jing, vice president of Standard Chartered Bank (China) Co., Ltd. and general manager of the financial market department, said that the launch of the “Northbound Swap Link” is another milestone in the opening up of China’s financial market. The “Swap Link” will significantly enhance the ability of foreign investors to manage the interest rate risk of onshore RMB bonds, and at the same time give investors higher transaction flexibility, so it will further enhance the willingness of international investors to hold RMB assets and help promote RMB internationalization.

Tradeweb said that referring to the previous institutional arrangements, after the “Northbound Swap Link”, everyone can also look forward to the “Southbound Swap Link” planned to be launched in the future. I believe it will facilitate domestic institutions to participate in international finance through Hong Kong more smoothly. In the derivatives market, more products such as credit default swaps (CDS) are expected to be included in the product range of the “Southbound Swap” in the future.

What is an interest rate swap?

On May 15, the “Northbound Swap Link” was the first to open the trading product “Interest Rate Swap”. Li Zhifeng, a senior fixed-income investor, explained to China Fund News the role of derivatives such as “interest rate swaps” for fixed-income investors. In his view, for foreign investors, “Swap Connect” is of great significance. Since then, foreign investors can easily manage the interest rate risk of RMB-denominated bonds.

As a type of derivatives to manage interest rate risk, general investors are less exposed to interest rate swaps. Li Zhifeng, a senior fixed-income investor, explained that the most common thing is that investors use interest rate swaps to convert floating cash flows into definite cash flows. For example, companies use interest rate swaps to convert floating interest costs into fixed interest costs.

According to Li Zhifeng, generally speaking, investors can use interest rate swaps to achieve three functions: hedging, leverage, and enhanced returns. Specifically, the first is hedging. Overseas investors buy RMB-denominated bonds through Bond Connect, CIBM (Interbank Bond Market) or QFII (Qualified Foreign Investors). Once interest rates rise, bond prices fall, and investor returns suffer. Therefore, investors generally hedge the risk of rising interest rates, and interest rate swaps are an important tool for risk hedging. Through interest rate swaps, investors can lock in low interest rates at fixed costs.

The second is the role of leverage. Interest rate swap itself has a leverage effect, and investors only need to pay a margin to achieve investor returns matching the nominal principal. For example, under the condition of 50 times leverage, he (she) can use a deposit of 100,000 yuan to lock in the income corresponding to the investment of 5 million yuan.

The third is income enhancement, and interest rate swaps can be combined with many trading strategies. For example, through the swap of interest rate spreads between China and the United States to enhance the return of the portfolio. For another example, there is room for arbitrage between interest rate swaps with different maturities, which provides the possibility for the combination to enhance returns.

According to Li Zhifeng, the current inter-bank interest rate swap transactions mainly include online (CFETS system) transactions and offline transactions. Since the launch of the interest rate swap business in 2008, the interest rate swap targets and structures supported by the CFETS system have gradually increased, and more customized interest rate swap contracts are mainly traded offline.

He explained: For foreign investors, “Swap Connect” is of great significance. Since then, foreign investors can easily manage the interest rate risk of RMB-denominated bonds. With the advancement of RMB internationalization and the increase in the total amount of RMB bonds held by foreign investors, it is becoming more and more important to manage the interest rate risk of RMB-denominated bonds.

(Source of article: China Fund News)