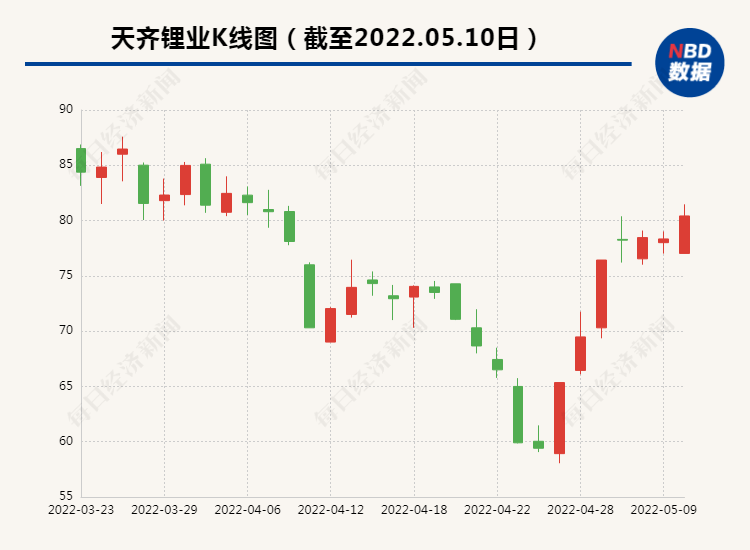

Original title: Tianqi Lithium Industry and AVIC Innovation signed a strategic agreement, and the resource leader will also be downstream?

Every reporter: Xu Shuai Every editor: Wen Duo

Tianqi Lithium Industry and China Innovation Airlines, two lithium battery giants in different segments, have to complete a cooperation. The two parties signed a strategic agreement on May 9, 2022, and will carry out joint investment, cooperative research and development and other fields of cooperation in the fields of cells and battery materials, new materials, lithium salts, and lithium mines. In previous investor interactions, Tianqi Lithium mentioned that the upstream and downstream of the industrial chain must cooperate, support and develop together.

Today (May 10), Lin Boqiang, Dean of the China Energy Policy Research Institute of Xiamen University, said in an interview with the “Daily Economic News” reporter WeChat that the current lithium battery market, the upstream lithium salt market and the downstream battery market are facing their own uncertainties. Sex, which is also one of the reasons for the cooperation of all parties.

Cooperation areas include cells and battery materials, new materials, lithium salts

Lithium battery giant Tianqi Lithium announced that the company signed the “Strategic Partnership Agreement” (hereinafter referred to as the “Strategic Agreement”) with China Innovation Aviation Technology Co., Ltd. (hereinafter referred to as “China Innovation Aviation”); the company’s wholly-owned subsidiary The company Chengdu Tianqi Lithium Industry Co., Ltd. (hereinafter referred to as “Chengdu Tianqi”) signed the “Lithium Carbonate Supply Framework Agreement” (hereinafter referred to as the “Supply Agreement” with China Innovation Airlines, which was combined with the “Strategic Agreement” and referred to as “the “Agreement”). “”).

The “Strategic Agreement” signed this time stipulates that Tianqi Lithium Industry and China Innovation Aviation have formed a deep strategic partnership. Co-investment, cooperative research and development and other fields of cooperation. The “Supply Agreement” signed this time stipulates that from June to December 2022, Chengdu Tianqi will sell battery-grade lithium carbonate to China Innovation Airlines. The sales quantity is stipulated in the “Supply Agreement”, and the seller will deliver it in batches according to the buyer’s needs. . The unit sales price shall be implemented in accordance with the pricing mechanism agreed upon by both parties.

Tianqi Lithium Industry stated that the signing of this agreement is to lock in certain battery-grade lithium carbonate products of Chengdu Tianqi. Chengdu Tianqi will perform and confirm revenue from June 2022 to December 2022. have a positive impact on business performance.

The “Daily Economic News” reporter noted that China Innovation Aviation is one of the three major power battery giants in China, and its main customers include Changan, GAC, Geely and other car companies. According to data from the China Automotive Power Battery Industry Innovation Alliance, from January to November 2021, China Innovation Airlines ranked third in the country in terms of power battery installations, with a market share of 5.8%, second only to CATL and BYD. Tianqi Lithium Industry is the upstream leader, and its business is concentrated in the links above lithium salt.

Upstream leading companies and downstream leading companies join hands. Will this combination be the future trend in the field of lithium batteries?

“The cooperation between upstream and downstream enterprises is mainly to reduce costs, improve efficiency, and reduce the uncertainty of market behavior.” Lin Boqiang, dean of the China Energy Policy Research Institute of Xiamen University, said in an interview with reporters on WeChat that the current lithium battery market, upstream lithium salt market and The downstream battery market is facing their own uncertainties, such as the downstream is worried about the price increase of upstream resources, and the upstream is worried about the lack of demand for downstream materials. The conflict is internalized.”

Tianqi Lithium expects tight lithium supply in the short to medium term

According to the announcement, Tianqi Lithium mentioned the cooperation of cells and battery materials. Does this mean that Tianqi Lithium Industry hopes to cut into the downstream through cooperation with leading battery factories? On May 10, the reporter of “Daily Economic News” also contacted relevant personnel of Tianqi Lithium Industry through WeChat, but the other party did not respond to the question.

However, Tianqi Lithium Industry stated in the announcement that the “Strategic Partnership Agreement” is a guiding document for future cooperation between the two parties and will take effect from the date when the legal representatives or authorized representatives of both parties sign and affix the official seal, and some terms are not legally binding. The legally binding rights and obligations of both parties to perform and execute the agreed transaction shall be stipulated in the formal transaction documents separately or further negotiated and signed by both parties. Except for the “Lithium Carbonate Supply Framework Agreement” signed on the same day, there are major uncertainties in the signing time, contract amount, and actual execution amount of the remaining possible transaction documents, and there is uncertainty about whether the approval procedures need to be performed or whether the conditions for entry into force can be met.

However, judging from the content of Tianqi Lithium’s previous annual report and performance briefing, it is a planned step to intervene in the field of downstream materials.

In the interaction between Tianqi Lithium and investors, it is mentioned that the upstream and downstream of the industrial chain must cooperate, support and develop together. Tianqi has been cooperating with downstream companies with similar concepts. The company will continue to strategically deploy new energy materials and next-generation battery technology manufacturers including solid-state batteries in the new energy value chain, and carry out more in-depth cooperation with them, such as in precursor production, lithium battery recycling and other businesses. Collaborate to prepare for future trends in better utilization of lithium in new battery applications.

The company also talked about the logic of upstream and downstream cooperation: from the current industry trend, if the downstream wants to expand production in an orderly and guaranteed way, it needs a stable supply of upstream resources. , the upstream and downstream penetrate each other and seek development. We are also actively paying attention to downstream opportunities.”

However, investors are still concerned about Tianqi Lithium’s judgment on the future upstream market. Tianqi Lithium also mentioned that in general, the expansion rate of downstream battery manufacturers in the next few years is expected to be higher than the upstream lithium supply, and the downstream expansion cycle is shorter, and the upstream expansion cycle is longer, so in the short term Lithium supply will remain tight in the medium term. According to Wood Mackenzie’s forecast, supply and demand will tighten year by year since 2021. The supply gap will be about 100,000 tons by 2025, and will expand to more than 1 million tons by 2030.

daily economic newsReturn to Sohu, see more

Editor:

Disclaimer: The opinions of this article only represent the author himself, Sohu is an information publishing platform, and Sohu only provides information storage space services.