(Original title: Increase positions! Increase positions! Top-ranking fund managers zoom in on their moves, and the latest positions are exposed)

As the disclosure of the 2022 quarterly reports of public funds kicked off, many top-tier fund managers adjusted positions and swapped shares and their views on the market outlook came to life.

Among them, Qiu Dongrong of Zhonggeng Fund explained the overall asset allocation strategy and the latest views on the market with a “small composition” of nearly 4,000 words. In the fourth quarter, Qiu Dongrong maintained a relatively high stock position and actively allocated Hong Kong stocks. He believes that the value stocks of Hong Kong stocks are cheaper than the corresponding A shares, and the corresponding dividend yield is extremely high, and its implied expected return level is very high.

In addition, SDIC UBS Fund Shi Cheng has significantly increased its position in new energy. He believes that after the growth industry represented by new energy and semiconductors has experienced a devaluation in 2022, the overall market sentiment and expectations are at a low point. We are optimistic that 2023 will be able to realize the market of growth industries. In addition, he predicts that the economy will gradually improve in 2023. The development of the economy is based on value and growth. Against the background of growth, he is optimistic about the performance of growth.

Qiu Dongrong: Maintain a relatively high stock position and actively allocate Hong Kong stocks

Qiu Dongrong of Zhonggeng Fund used more than 3,600 words to elaborate on the investment strategy for the fourth quarter and his views on the market outlook in the latest quarterly report. The fund manager made some key points for everyone.

Among them, Qiu Dongrong mentioned that based on the asset allocation strategy of equity risk premium, the valuation of equity assets is still at the absolute bottom position, corresponding to a high level of risk compensation, which is a systematic allocation opportunity. With a high ratio of equity asset allocation, it also actively allocates Hong Kong stocks. Over the past year or so, China’s “steady growth” and global “anti-inflation” have been the most important macro backgrounds. Now these are undergoing positive changes. The direction has been given, and the magnitude is more critical.

Going back to the valuation, Qiu Dongrong believes that the overall valuation level of A shares is in the cyclical low point area in various indicators. Generally, this valuation level corresponds to systematic opportunities, and opportunities outweigh risks. Further, from a structural point of view, currently only stocks in the category of large-cap growth are still at a level above neutral, and other types of stocks are basically in the undervalued area, from large-cap stocks to small-cap stocks, from value stocks to growth stocks, Both have good layout opportunities. Hong Kong stocks rebounded in a V-shape in the fourth quarter, but each valuation dimension is basically within the historical 20% percentile, and is still highly attractive in the long run. We maintain our judgment on systematic opportunities and continue to make strategic allocations.

Qiu Dongrong emphasized in the Four Seasons News that he will adhere to the concept of low valuation value investment, and build a cost-effective investment portfolio by selecting individual stocks with reduced fundamental risks, positive profit growth, and cheap valuations, and strive to obtain sustainable excess returns.

In terms of investment direction, including value stocks with historically low valuations, Qiu Dongrong said that he will focus on supply-side contraction or rigid industries, and their potential elasticity under the recovery of demand. The main industries include real estate and finance among large-cap value stocks. Resource companies and energy companies represented by metals. At the same time, the value stocks of Hong Kong stocks are cheaper than the corresponding A shares, and the corresponding dividend yield is extremely high, and the implied expected return level is very high.

In addition, he also mentioned that he invested in undervalued but promising growth stocks, focusing on domestic demand growth and supplying cost-effective companies with competitive advantages. The main industries include pharmaceutical manufacturing, non-ferrous metal processing, chemicals, and automobiles. Parts, electrical equipment and new energy, light industry, machinery, computer, electronics, etc.

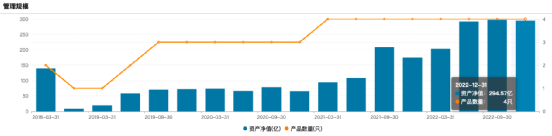

As of the Four Seasons Report, Qiu Dongrong’s management scale reached 29.457 billion yuan, a slight drop from the end of the third quarter.

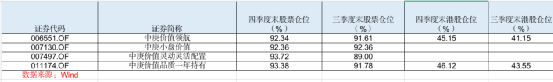

In terms of positions, the Four Seasons News shows that the Zhonggeng Value Pilot, Zhonggeng Value Quality One-Year Holding, and Zhonggeng Value Smart all managed by him have increased their positions to varying degrees, while Zhonggeng Small Cap Value has maintained its original stock position. As of the end of the fourth quarter, the stock positions of the four funds remained above 92%. Among them, the position of Zhonggeng Value Leader stock increased from 91.61% at the end of the third quarter to 92.34% at the end of the fourth quarter, while the position of Hong Kong stocks increased from 41.15% at the end of the third quarter to 45.15% at the end of the fourth quarter. Zhonggeng Value Quality’s one-year stock position rose from 91.78% at the end of the third quarter to 93.38% at the end of the fourth quarter, while its position in Hong Kong stocks rose from 43.55% to 46.12%.

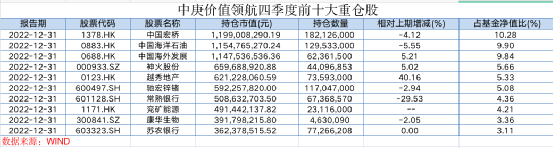

From the perspective of the top ten heavily held stocks, taking Qiu Dongrong’s representative work Zhonggeng Value Pilot as an example, in the fourth quarter, the fund reduced its holdings of China Hongqiao, the first and second largest holdings of CNOOC, and the number of shares held decreased by 4.12% compared with the previous period. , 5.55%, as of the Four Seasons News, the market value held by them was 1.199 billion yuan and 1.155 billion yuan respectively. In addition, Chihong Zinc and Germanium, Changshu Bank, and Kanghua Biotech have been reduced to varying degrees. Among them, Changshu Bank has the largest reduction in holdings, and the number of shares held has decreased by nearly 30% compared with the previous period. As of the fourth quarter report, the market value of holdings is 509 million yuan. . In terms of increasing holdings, in the fourth quarter, Zhonggeng Value led the increase in positions in China Overseas Land, Shenhuo, and Yuexiu Real Estate. Among them, Yuexiu Real Estate increased its position the most, and the number of shares held increased by 40.16% compared with the end of the third quarter. With a market value of 621 million yuan, it ranks the fifth largest holding. In addition, Yankuang Energy “newly entered” the top ten, and ranked seventh at the end of the fourth quarter, while Meituan-W withdrew from the top ten. The number of shares held by Sunong Bank remained unchanged from the previous period, ranking the 10th largest holding.

Shi Cheng: Substantial increase in new energy, optimistic about the growth industry market in 2023

Thanks to the booming new energy track market, SDIC UBS Fund Shi Cheng has gradually begun to establish his own status in the world since 2020. In the newly disclosed Four Seasons Report, Shi Cheng said that in the fourth quarter of 2022, the domestic economy will be temporarily sluggish due to the impact of the epidemic. With the normalization of epidemic control and the gradual normalization of personnel flow, we expect the economy to gradually improve in 2023. The development of the economy is based on value and growth. Against the background of growth, we are optimistic about the performance of growth.

Overseas, Europe continues to be affected by the Russia-Ukraine War, high energy inflation, dull overall economic outlook, and limited global economic highlights. Most of the investment opportunities in 2022 will come from the energy crisis caused by the Russia-Ukraine War, including coal, energy storage , oil transportation, etc. He predicts that overseas opportunities will also be limited in 2023.

Despite the impact of the overall macro economy, the growth of the growth industry is still rapid. From the perspective of 2023, many manufacturing industries will pass through the node of overcapacity. Looking forward to the future, profitability will no longer decline, and it has investment value. Upstream resource products have resource attributes, and due to the speed limit of their long-term supply, they will have high profitability for a long time. These are the two links that he believes have investment value.

In terms of specific industries, Shi Cheng said that in the equipment manufacturing industry, due to certain restrictions on the total volume, the market pays more attention to various new technologies. However, the fulfillment of many new technologies is doubtful. In 2022, the interpretation of new technologies has reached a relatively sufficient position, so he will look for links that can be industrialized for investment.

In terms of new energy vehicles, Shi Cheng believes that sales in 2023 will significantly exceed current market expectations. From the perspective of China and Europe, the constraints of chips, wiring harnesses and other links will be eased, and the production of automobiles will increase. New energy vehicles represented by Tesla and BYD have the power to further reduce prices to seize the market after the launch of new production capacity. At present, the unit profit of fuel vehicles is already low. Foreign investors value profits, and there may be moves to stabilize prices and ensure profits in the future. Therefore, the replacement logic of new energy vehicles is smooth. He believes that China’s new energy vehicles are likely to have no obvious obstacles until the penetration rate reaches 80%. At present, the valuation of the entire electric vehicle industry chain is at a historically low level, and we are optimistic about the overall performance of the industry.

In the new energy power generation industry, the price of silicon materials is on a downward path and prices began to drop in the fourth quarter. Shi Cheng is optimistic about the rapid growth of the photovoltaic industry in 2023. However, due to the relatively consistent market expectations for large volumes and high expectations for unit profitability, the cost performance of the overall industrial chain investment is not particularly high. He chooses new technologies and low-penetration products for investment.

In terms of TMT industry, Shi Cheng is optimistic about smart cars. The production capacity of the auto industry has been fully released, making competition in 2023 fierce. As an industry with economies of scale, head companies may quickly widen the gap with tail companies, and 2023 is likely to be a year of intense polarization. The winners of car companies emerging from differentiation may continue to go global in the future, and we will carefully observe their investment opportunities.

Shi Cheng believes that the overall market sentiment and expectations are at a low point after the depreciation in 2022 for the growth industries represented by new energy and semiconductors. He is optimistic that the market for growth industries will be realized in 2023.

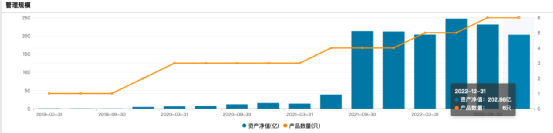

As of the Four Seasons Report, Shicheng’s management scale reached 20.296 billion yuan, a decrease of 2.819 billion yuan from the end of the third quarter.

According to the Four Seasons Report, the six funds managed by Shi Cheng have increased their positions to varying degrees. Among them, the stock positions of SDIC UBS Advanced Manufacturing, SDIC UBS New Energy A, SDIC UBS Jinbao, and SDIC UBS Industrial Trend A increased by 4-6% respectively. At the end of the year, the stock positions were above 92%. And UBS SDIC, which was just established last year, held for two years for industrial upgrading and UBS SDIC for one year for industrial transformation, which increased their positions significantly, jumping from 77.73% and 54.08% of the stock positions in the third quarter to 91.63% at the end of the third quarter. %, 89.27%, and the positions in Hong Kong stocks have also increased to varying degrees, from 0.86% and 0.47% at the end of the third quarter to 2.58% and 7.24% at the end of the fourth quarter.

From the perspective of holdings, taking Shi Cheng’s masterpiece UBS Advanced Manufacturing as an example, he still prefers the new energy industry, and the overall holdings are relatively high. In the fourth quarter, the fund increased its holdings of Huayou Cobalt and Tianci Materials, and the number of shares held increased by 7.81% and 19.82% respectively compared with the end of the third quarter. At the end of the fourth quarter, the market value of holdings was 267 million yuan and 245 million yuan respectively. Mount Everest in Tibet and Tibet Mining became the 9th and 10th most heavily held stocks. As of the end of the fourth quarter, their market values were 202 million yuan and 186 million yuan, respectively. It is worth noting that Tibet Mining ranked the 8th largest holding in last year’s mid-term report, and withdrew from the top ten at the end of the third quarter. This time, the Four Seasons Report once again entered the top ten. In addition, as of the end of the fourth quarter, Shengxin Lithium Energy and Zangge Mining had withdrawn from the top ten. The number of shares held by SDIC UBS Advanced Manufacturing in Jiangte Electric, Tianqi Lithium, Yongxing Materials, Rongjie, China Mining Resources, and Keda Manufacturing has not changed compared with the third quarter.

Another fund managed by Shi Cheng, SDIC UBS Industrial Transformation, held for one year, and it has greatly increased its holdings of Tianci Materials, Yongxing Materials, Tianqi Lithium, Huayou Cobalt, Shengxin Lithium Energy, Xinzhoubang, Jun Da shares and other new energy materials, new energy vehicles related stocks. In addition, Yiwei Lithium Energy, Ningde Times, and Tianqi Lithium are among the top ten new energy leading stocks.

Editor: Xiaomo

Disclaimer: The Securities Times strives for truthful and accurate information, and the content mentioned in the article is for reference only and does not constitute substantive investment advice, so operate at your own risk

Download the “Securities Times” official APP, or follow the official WeChat public account, you can keep abreast of stock market trends, gain insight into policy information, and seize wealth opportunities.