Contracts awarded for the construction of 11 river docks on the San Juan River, Chocó

The National Highway Institute, Invías, closed the public bidding process LP-DEO-SMFF-004-2024 for the construction of eleven docks

Atalanta-Fiorentina 4-1 in the Italian Cup, Bergamo in the final – breaking latest news

by Alessandro Bocci, sent to Bergamo A goal from Lookman beyond the 90th minute, first canceled for

Sergio Bonelli Editore presents “DYLAN DOG. MATER MORBI”

SERGIO BONELLI EDITOR presents DYLAN DOG. MATER MORBI NEW EDITION From April 26th one of the most

Popular Stories

Operation Praetorian: MP requests preventive detention for Madureira and “Polaco” | public ministry

This Tuesday, the Public Prosecutor’s Office (MP) requested preventive detention for Fernando Madureira, leader of the Super

Contracts awarded for the construction of 11 river docks on the San Juan River, Chocó

The National Highway Institute, Invías, closed the public bidding process LP-DEO-SMFF-004-2024 for the construction of eleven docks

Atalanta-Fiorentina 4-1 in the Italian Cup, Bergamo in the final – breaking latest news

by Alessandro Bocci, sent to Bergamo A goal from Lookman beyond the 90th minute, first canceled for

Sergio Bonelli Editore presents “DYLAN DOG. MATER MORBI”

SERGIO BONELLI EDITOR presents DYLAN DOG. MATER MORBI NEW EDITION From April 26th one of the most

Travel & Explore the world

Operation Praetorian: MP requests preventive detention for Madureira and “Polaco” | public ministry

This Tuesday, the Public Prosecutor’s Office (MP) requested preventive detention for Fernando Madureira, leader of the Super

Contracts awarded for the construction of 11 river docks on the San Juan River, Chocó

The National Highway Institute, Invías, closed the public bidding process LP-DEO-SMFF-004-2024 for the construction of eleven docks

Atalanta-Fiorentina 4-1 in the Italian Cup, Bergamo in the final – breaking latest news

by Alessandro Bocci, sent to Bergamo A goal from Lookman beyond the 90th minute, first canceled for

Sergio Bonelli Editore presents “DYLAN DOG. MATER MORBI”

SERGIO BONELLI EDITOR presents DYLAN DOG. MATER MORBI NEW EDITION From April 26th one of the most

First yes from the Senate to the Premiership. Reforms, opposition arises

Maria Elisabetta Alberti Casellati during the lectio magistralis at the Luiss School of government Heated tones in

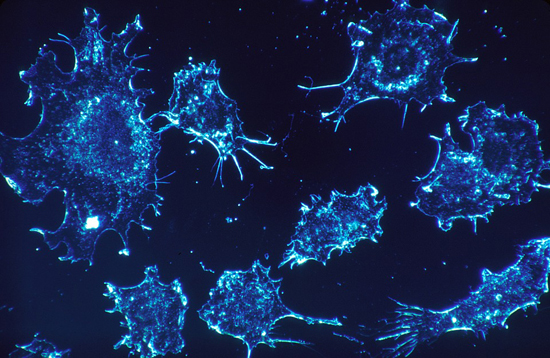

A new trigger for tumors other than mutations has been discovered

MeteoWeb The origin of tumors it should not be looked for only in the presence of mutations

New Generation Director Zeng Guoxiang Shares Insights from Beijing International Film Festival Venture Capital Projects

Zeng Guoxiang Joins 14th Beijing International Film Festival as Venture Capital Judge The 14th Beijing International Film