Wall Street still down, gripped by fear of a recession in the United States. Fear rekindled by JP Morgan’s number one, CEO Jamie Dimon, who admitted that inflation could cause a recession in the United States during 2023. At around 4 pm Italian time, the Dow Jones lost 0.16%. the S&P 500 falls 0.50%, the Nasdaq loses 0.84%.

In an interview just released on CNBC’s “Squawk Box,” Dimon said that consumers and businesses in the United States are currently in good shape; however, this situation may not last for much longer.

Consumers, explained the CEO of the number one bank in the States, have excess savings at their disposal that amount to $1.5 trillion, available thanks to the stimulus programs that were launched during the pandemic period: the point is that, he did note the banker, against this figure, Americans are spending 10% more than in 2021.

Not only. Jamie Dimon said that a Fed terminal rate of around 5% “might not be enough” to dampen inflation, thus also rekindling fears of a more hawkish Fed than forecasts.

The same fears led Wall Street to close in the red yesterday:

the Dow Jones Industrial Average slipped 482.78 points, or 1.4%, to 33,947.10; the S&P 500 lost 1.79% to 3,998.84, the Nasdaq Composite retreated 1.93% to 11,239.94. The decline in the Nasdaq Composite was the worst since Nov. 9; it was also the worst session in almost a month for the S&P 500.

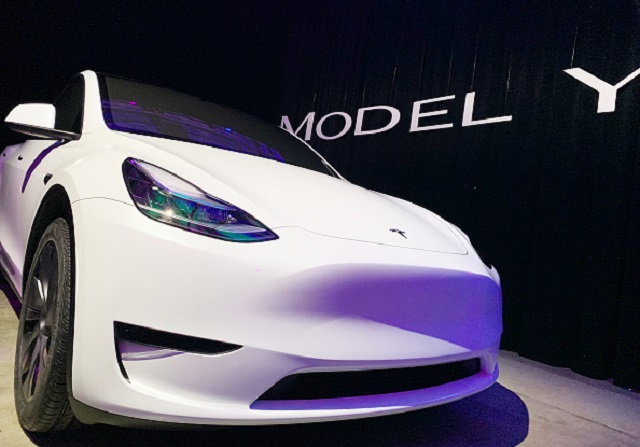

Tesla, the title of the electric car (EV) giant founded and managed by Elon Musk, which yesterday paid for some rumors about a production cut in the Shanghai factory, slipped by more than 6%. Stock prices are dropping almost 3%.

Expectations remain high for the next meeting of the Fed, scheduled for December 13 and 14: the bet is on a rate increase of 50 basis points, after four consecutive tightening of 75 basis points, which brought the cost of US money at the top since 2008, between 3.75% and 4%.

However, traders’ fear is shifting more and more from the entity of the rates to the value of the terminal rate, or rather the final rate, which the Fed chairman Jerome Powell himself said could be confirmed as higher. Yesterday, rates on 10-year Treasuries jumped nearly 9 basis points to 3.588%. Yields reversed today, falling to 3.568%.