Inculmat toured the parishes of La Pica, Los Godos and Las Cocuizas with dance

The parishes of Maturín will dance until Saturday, April 27, with a special program promoted by the

US Senate also approves aid package for Ukraine: “Sending weapons and material this week”

The entire aid package that was approved is worth 95 billion, of which the largest part (61

Six apartments uninhabitable after heavy fire in Geel (Geel)

Yellow – A serious fire raged in a complex with social apartments in the Verbueckenstraat in Geel

Popular Stories

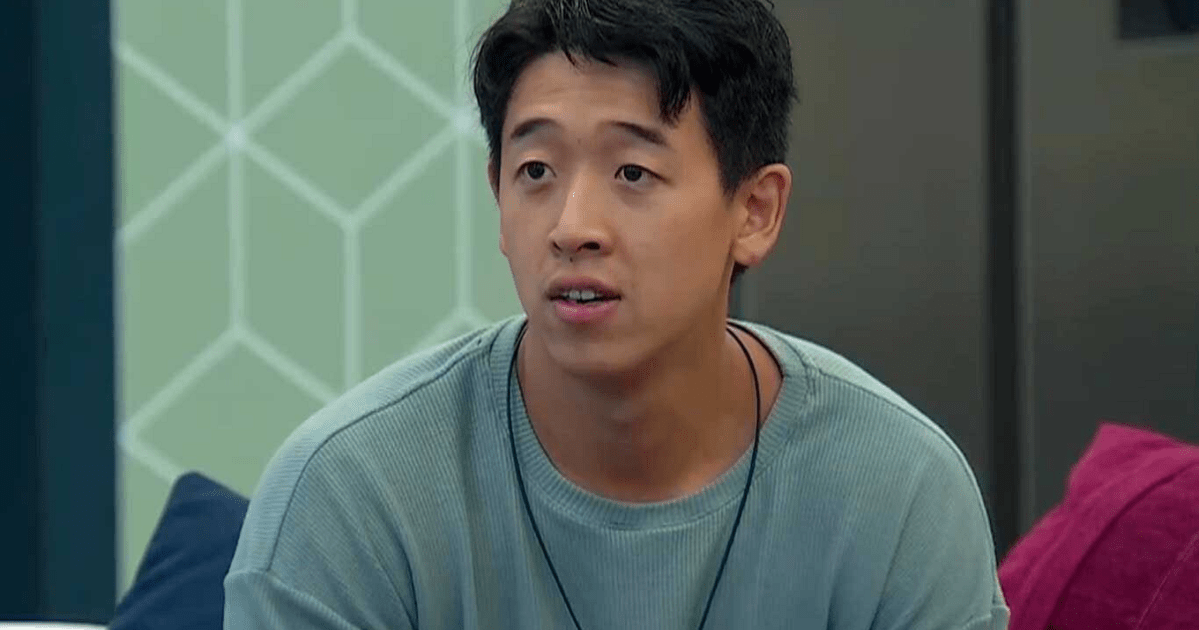

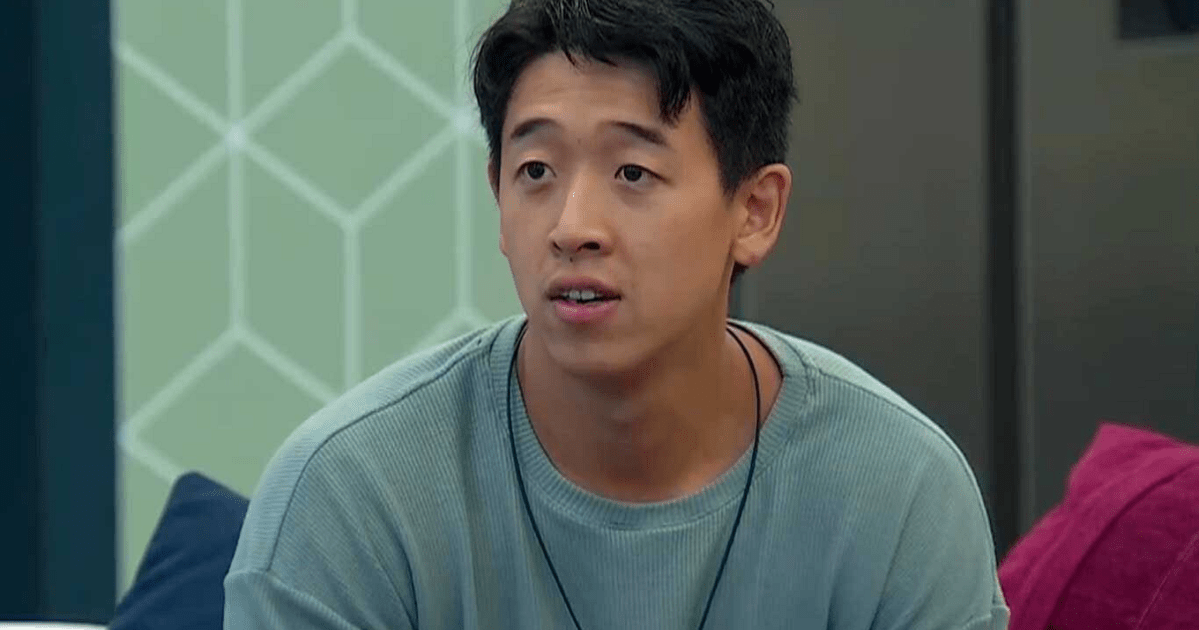

Martín Ku received an unpleasant insult from abroad and this is how he reacted

Martín Ku received an unpleasant scream from abroad and fears for his continuity in the Big Brother

Inculmat toured the parishes of La Pica, Los Godos and Las Cocuizas with dance

The parishes of Maturín will dance until Saturday, April 27, with a special program promoted by the

US Senate also approves aid package for Ukraine: “Sending weapons and material this week”

The entire aid package that was approved is worth 95 billion, of which the largest part (61

Six apartments uninhabitable after heavy fire in Geel (Geel)

Yellow – A serious fire raged in a complex with social apartments in the Verbueckenstraat in Geel

Travel & Explore the world

Martín Ku received an unpleasant insult from abroad and this is how he reacted

Martín Ku received an unpleasant scream from abroad and fears for his continuity in the Big Brother

Inculmat toured the parishes of La Pica, Los Godos and Las Cocuizas with dance

The parishes of Maturín will dance until Saturday, April 27, with a special program promoted by the

US Senate also approves aid package for Ukraine: “Sending weapons and material this week”

The entire aid package that was approved is worth 95 billion, of which the largest part (61

Six apartments uninhabitable after heavy fire in Geel (Geel)

Yellow – A serious fire raged in a complex with social apartments in the Verbueckenstraat in Geel

Innovation center Sirris invests one and a half million in Genk

Sirris invests 4 million in three laboratories. — © rr Technology Genk – The innovation center for

:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/GP4HNXAVGVF7PCJBGC2SKZ2XNA.jpg)

‘The House of the Famous Colombia’ will see the return of one of those eliminated: “What are you going to enter?”

The host of the reality show on social networks confirmed that the comedian will return home next

[Notice]For customers from the European Economic Area (EEA) and the United Kingdom – Yahoo! JAPAN

From Wednesday, April 6, 2022, Yahoo! JAPAN is no longer available in the EEA and the United