At the time the actual controller vowed to launch the “request to increase shareholding”, now the stock price is almost cut in half, and the employee shareholding plan has ended in a hurry. On December 4, “Paper Mao”Zhongshun JierouReceive a letter of concern from the Shenzhen Stock Exchange.

The Shenzhen Stock Exchange asked the company to further explain the true intentions of the continuous rollout of employee stock ownership plans and the “undercover” increase in shareholding initiative, and whether there is a misleading situation for investors.

Zhongshun JierouHas issued a bottom-up holdings initiative

The stock price has almost been cut since June

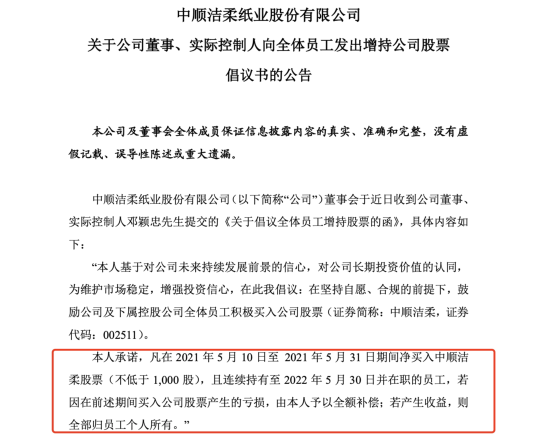

The thing is like this, on May 10 this year,Zhongshun JierouDeng Yingzhong, the director and actual controller of the company, once issued the “recommendation to increase shareholding.”

Deng Yingzhong advocates that all employees of the company and its subsidiary holding companies actively buy the company’s stock, and promises Deng Yingzhong will fully compensate the losses incurred from entering the company’s stocks; if gains are generated, all of them will be owned by the employees.

It is understood that more than ten days after the announcement of the bottom-up holdings increase initiative, Zhongshun Jierou will hold the fifth meeting of the fifth board of directors on May 21 and June 7, 2021 and the fourth temporary meeting of 2021.shareholderThe conference reviewed and approved the “Third Employee Stock Ownership Plan (Draft) and Summary” and other related proposals.

The above-mentioned draft shows that the holders of this employee stock ownership plan are the company’s directors, senior managers and core personnel, with a total of no more than 200 people, and the total capital limit for the establishment of the employee stock ownership plan is 200 million yuan.

However, things backfired. Zhongshun Jierou, which had been soaring continuously before, has been “falling down endlessly” since June, and it has fallen by nearly 50% so far, and the high point has almost been cut in half.

Zhongshun Jierou suddenly terminated its employee stock ownership plan

Shenzhen Stock Exchange: Is there any situation that misleads investors?

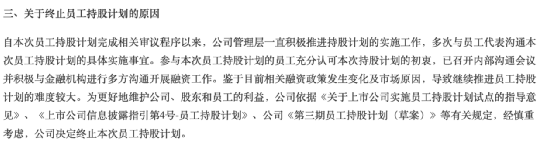

But on December 1, Zhongshun Jierou suddenly announced that it would terminate the third phase of its employee stock ownership plan.ShunjierouannouncementSaid that in view of the current changes in related financing policies and market reasons, it is more difficult to continue to promote the employee stock ownership plan. The company decided to terminate the employee stock ownership plan. This matter will not affect the company’s development strategy, business planning, etc.

It is worth noting that Zhongshun Jierou has repeatedly disclosed the “Announcement on the Progress of the Company’s Phase III Employee Stock Ownership Plan”, all of which stated that “As of the date of this announcement, the company’s Phase III Employee Stock Ownership Plan has not yet begun to purchase the company. stock.”

In this regard, the Shenzhen Stock Exchange stated in the letter of concern that the progress in fulfilling the commitments of the relevant entities of Zhongshun Jierou, if there is no substantive progress, it is necessary to further explain the company’s continuous rollout of employee shareholding plans and the true intentions of the initiative to increase shareholding. , Whether there is a situation that misleads investors.

The Shenzhen Stock Exchange also asked Zhongshun Jierou to explain whether its decision on the employee stock ownership plan in May 2021 was prudent;General meeting of shareholdersAfter review and approval of the employee stock ownership plan, the measures taken by the board of directors to implement the resolutions of the general meeting of shareholders, and the reasons why the employee stock ownership plan has not started to purchase company stocks for a long time; explain that the general meeting of shareholders authorized the board of directors to terminate the shareholding in advance of the employee stock ownership plan Whether the situation of the plan corresponds to the termination of the plan specified in the employee stock ownership plan, and whether your company should submit the termination of the employee stock ownership plan to the general meeting of shareholders for deliberation; whether there is any negative information that has not been disclosed due to disclosure.

At the same time, the Shenzhen Stock Exchange also pointed out that since 2021, in addition to the re-election of the board of directors, Zhongshun Jierou President Deng Guanbiao, Vice President Ye Longfang, Directors Yue Yong, Dai Zhenji, and Board Secretary Zhou Qichao have voluntarily resigned. The Shenzhen Stock Exchange asked Zhongshun Jierou to explain whether the changes in the number of directors, supervisors, and senior staff since 2021 will have an adverse impact on the company’s production, operation and internal management.

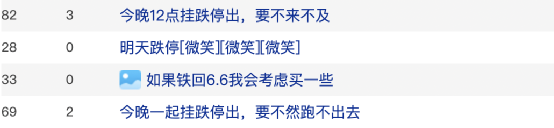

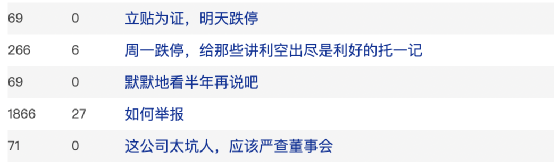

Stock bar fryer

The vows that were made at the beginning are dreadful, but now they can only end in a staggering way. As soon as the above news came out, Zhongshun Jierou’s stockholders fryed the pot. Many people said, “Monday’s limit is lower.” “This company is too cheating and should be investigated.”

As the stock price of Zhongshun Jierou has been sluggish recently and has continued to fall, some stockholders said: “I want to buy some Jierou tissues to wipe away my tears.”

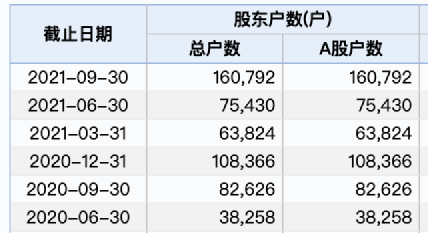

As of the end of the third quarter, the stock has 168,000 shareholders.

Zhongshun JierouExecutivesFrequent changes

Earnings data declined for the first time

It is understood that Zhongshun Jierou is the first domestic paper company listed on the A-share market, specializing in the production of household paper products. The company owns well-known domestic paper brands such as “Jierou” and “Sun”. The main products are roll paper, handkerchief paper, soft draw paper and box tissue paper.

OperatingPerformanceAspect, Zhongshun JierouNet profitA sharp decline. According to data, in the first three quarters, Zhongshunjierou achieved revenue of approximately 6.275 billion yuan, an increase of 12.95% year-on-year; net profit attributable to parent company was 484 million yuan, a year-on-year decrease of 27.88%. It is worth noting that this is the company’s first decline in profit data over the same period since 2015.

At the same time, well-knownfundThe manager has already left.Top Ten Zhongshun JierouTradable shareholdersThe data shows that at the end of the third quarterSocial securityThe wealthy Tianhui Selected Growth Fund managed by the fund and well-known fund manager Zhu Shaoxing disappeared from the list of the top ten tradable shareholders.

Many market voices have interpreted that this may be related to the frequent changes in the management of Zhongshun Jierou. On October 28, the company’s vice president Ye Longfang resigned; on July 30, the company’s board secretary and vice president Mr. Zhou Qichao resigned; on July 13, the company’s supervisor Li Youquan resigned.

In this regard, on October 29, the Secretary of the Board of Directors of Zhongshun Jierou stated on the investor interaction platform that since January 2021, the company’s directors and supervisors have changed significantly, mainly due to the company’s re-election of directors and supervisors, of which the term of independent directors Two terms have expired. At the same time, while ensuring that the company’s normal production and operation are not significantly affected, the professional manager system will be further promoted, and the company’s management talent structure will continue to be enriched and improved.

(Source: China Fund News)

.