Kourtney Kardashian recommends the “breastfeeding diet” online. Advice and false myths to dispel

diValentina Rorato The expert: there is no forbidden food, women can drink and eat what they want,

Ryan Reynolds’ Dedication to ‘Deadpool’: A Look Behind the Scenes

Hollywood Superstar Ryan Reynolds Pays Screenwriter’s Salary for First “Deadpool” Movie In a surprising revelation, it has

Konami continues: eFootball 2024 has been downloaded more than 750 million times

Konami Celebrates eFootball’s 750 Million Downloads Milestone In just four months since announcing 700 million downloads, Konami’s

Popular Stories

Dacia Duster, we tried the new generation. Here’s what it offers, how it goes and how much it costs

Listen to the audio version of the article Forefather of the next generation of the Dacia family,

Kourtney Kardashian recommends the “breastfeeding diet” online. Advice and false myths to dispel

diValentina Rorato The expert: there is no forbidden food, women can drink and eat what they want,

Ryan Reynolds’ Dedication to ‘Deadpool’: A Look Behind the Scenes

Hollywood Superstar Ryan Reynolds Pays Screenwriter’s Salary for First “Deadpool” Movie In a surprising revelation, it has

Konami continues: eFootball 2024 has been downloaded more than 750 million times

Konami Celebrates eFootball’s 750 Million Downloads Milestone In just four months since announcing 700 million downloads, Konami’s

Travel & Explore the world

Dacia Duster, we tried the new generation. Here’s what it offers, how it goes and how much it costs

Listen to the audio version of the article Forefather of the next generation of the Dacia family,

Kourtney Kardashian recommends the “breastfeeding diet” online. Advice and false myths to dispel

diValentina Rorato The expert: there is no forbidden food, women can drink and eat what they want,

Ryan Reynolds’ Dedication to ‘Deadpool’: A Look Behind the Scenes

Hollywood Superstar Ryan Reynolds Pays Screenwriter’s Salary for First “Deadpool” Movie In a surprising revelation, it has

Konami continues: eFootball 2024 has been downloaded more than 750 million times

Konami Celebrates eFootball’s 750 Million Downloads Milestone In just four months since announcing 700 million downloads, Konami’s

“Participate in the Future”: Competition gives students what is still missing in class

“Participate in the future”: Big competition gives students what is still missing in class Email Share More

31st matchday of the Bundesliga: Three top games – high tension no, anticipation yes

As of: April 25, 2024 5:55 p.m On the 31st matchday of the Bundesliga, the first six

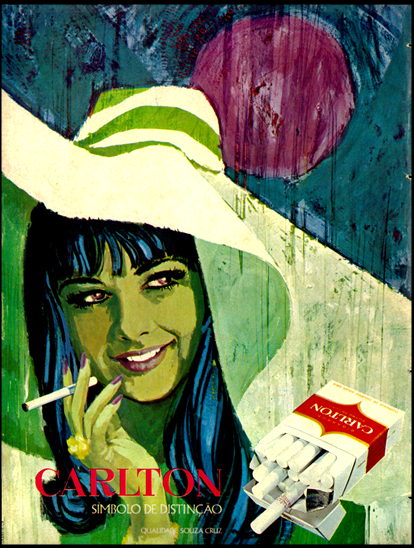

cigarette advertising campaigns – MONDO MODA

In 2001, cigarette advertisements were banned in all media outlets, however, between 1950 and 1990, they dominated

:format(webp)/cloudfront-us-east-1.images.arcpublishing.com/grupoclarin/NAB2VTVOSBFABO4XLMYIDY6OMQ.gif)