Pandemic, inflation, andcurrencyPolicy shift is still the three major keywords of the macro market in 2022, and market participants also judged that 2022 will be a year of tremendous changes in the global macro market.This year will faceMidlandThe economy has shifted from easing to a tight environment.Have experienced three times in the past 30 yearsMidlandThe interest rate hike cycle will mark the fourth time in 2022. At the same time, the current European and AmericanQualcommInflation reached the highest level since 1980. Under the attack of austerity and inflation, emerging countries are at the core of risk.

From the perspective of industry insiders, 2020 and 2021 are both major macro trading years. The epidemic is a key variable. The global loose monetary policy and fiscal stimulus have pushed up the valuation of risky assets. 2022 will still be a macroeconomic policy dominated by a decline in policy. Trading year. From the macro perspective of bulk commodities, the past four major commodity turnarounds have been accompanied by the decline of financial policies and economic fundamentals.Judging from historical performance, the market will trade in advanceMidlandThe Reserve Bank raised interest rates, while emerging market stock markets have shown an upward trend during the gradual increase in interest rates. Compared to 2021, how will the three key variables of epidemic, inflation and monetary policy change in 2022? What risks will emerging economies face? Where will the pandemic, inflation, and Fed tightening expectations take the global economy?

Judging the risks of emerging countries from the experience of historical interest rate hikes

Compared with 2021, the three major “keywords” of the epidemic, inflation, and monetary policy shift will have different performances in 2022.

“There are still variables in the development of the epidemic in 2022, and there may even be new variant strains. However, compared with 2021, the impact or pressure of the epidemic may be high and low. At present, the global economy is affected by the epidemic. The impact is still large. With the gradual warming of the northern hemisphere in the second quarter, the launch of new crown specific drugs, and the popularization of intensified injections, the impact of the epidemic on the economy of various countries and the global economy will tend to be inactivated, and it is not unreasonable that the epidemic will even evolve into flu. possible.”South China FuturesMacro foreign exchangeAnalystMa Yan said that inflation in 2022 is still not to be underestimated. From the perspective of the overall trend, overall inflation in 2022 may show the characteristics of high and low, and overall decline. From the perspective of the structure of the upper, middle and lower reaches, inflation is expected to move from the upstream to the middle and lower reaches. However, the specific intensity needs to be determined in conjunction with the actual economic recovery situation and demand performance. It is expected that the tension in the supply chain will be eased compared with 2021.

In December 2021, the Fed announced the acceleration of Taper. The current market expects that the Fed will raise interest rates for the first time in May 2022, a total of 2-3 times throughout the year. The Bank of England raised interest rates more than expected in December 2021. Overall, the global liquidity margin tightening in 2022 is also relatively certain.

“As far as the market is concerned, the Fed’s interest rate hike expectations are mainly concerned with inflationary pressures. If the current market benchmark is expected, the Fed will end Taper in the first quarter of 2022 and raise interest rates three times during the year.interest rateIt is very likely that the whole year will be high and then low. The US dollar index will rise first and then fall. There may also be a certain adjustment risk in US stocks. “Ma Yan said.

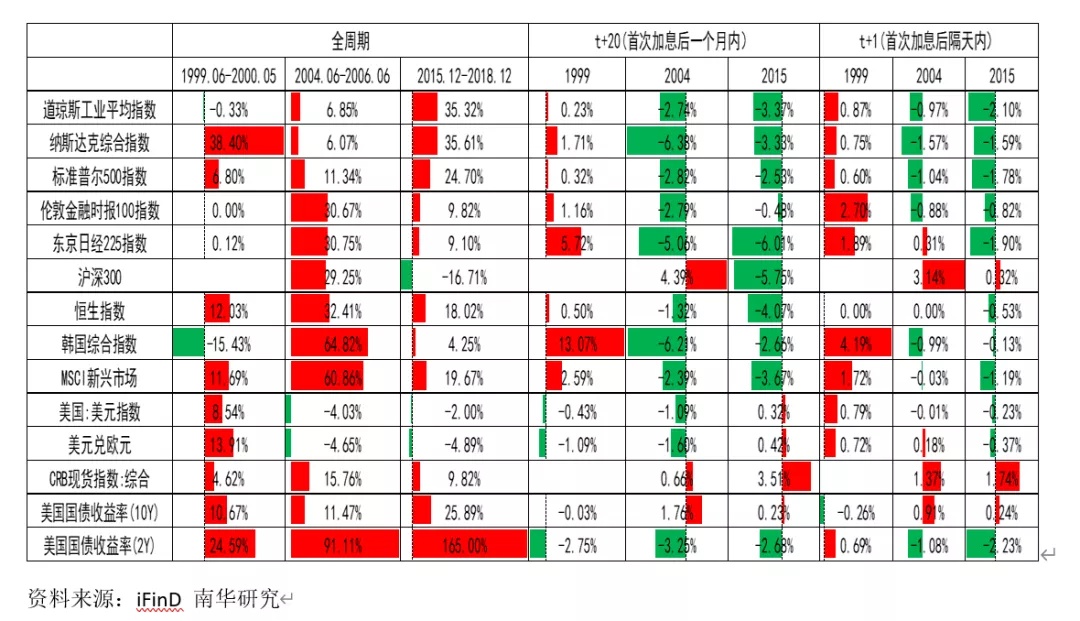

It is understood that the Fed has experienced three rounds of interest rate hikes in the past 30 years, from June 1999 to May 2000, June 2004 to June 2006, and December 2015 to December 2018. In comparison with history, the current period is actually the most similar to the period before the acceleration of Taper in October 2014 to the interest rate hike in December 2015.

“In the past 30 years, the Federal Reserve has had three rounds of monetary policy cycles ranging from 8 to 10 years. The U.S. was in a state of high unemployment during the first half of the 10-year cycle, and monetary policy was relatively loose, and entered the unemployment rate in the second half. The decline, the rise in inflation, and the beginning of a shift in monetary policy from easing to tightening.” said Li Ershi, chief analyst of macro finance at SDIC Essence Futures, said that the impact of interest rate hikes on the market is intuitively pressured on risky assets, especially emerging market countries. However, based on past experience, we should not look at monetary policy alone, but should look at the entire US economic policy portfolio, and also look at the global system.

According to him, the Fed began to raise interest rates in the mid to late 1990s. During this period, the United States was a combination of “tight currency and tight finances.” Market countries have brought a significant impact. In the cycle before the financial crisis from 2000 to 2008, after the United States began to raise interest rates, the United States was in a policy combination of “tight currency and lenient fiscal”, and because globalization was heading toward its peak, non-US economies Stronger, this round of interest rate hikes is a weak US dollar, and the currencies and stock indexes of emerging market countries have performed better.Especially after the 2008 financial crisis, the Fed’s monetary policy entered zero.interest rateIn the QE era, this problem has become more complicated again.

“For the normalization of the Fed’s monetary policy, after QE, it generally reduces the purchase volume (Taper) first, then raises interest rates, and then shrinks the balance sheet. Starting from the Taper stage, although the state of zero interest rates is still maintained, It has begun to have a tightening effect on the global financial market. The global commodities and the stock indexes of emerging market countries have had a significant impact, such as 2014-2015.” Li Ershi said, we can see that in terms of the Fed’s interest rate hike cycle, it is as specific as Its impact on financial markets needs to be judged by looking at the entire policy portfolio of the United States, combined with the perspective of globalization.

“From historical experience, the Fed’s tightening may trigger the backflow of the U.S. dollar, increase the value of the U.S. dollar and U.S. Treasury bond interest rates, trigger potential risks in the international financial market, and cause global asset price fluctuations. Emerging market countries have weak industrial foundations and large external debts. The Fed’s tightening policy may increase the risk of foreign debt, capital outflow, and currency depreciation.”Guotai JunanFutures analyst Huang Liunan said that considering the current high global commodity prices, exchange rate depreciation will further aggravate the risk of imported inflation in these countries. At the same time, the weak financial strength of emerging market countries and the weaker public health capabilities of developed economies have resulted in lower vaccination rates than developed economies and relatively worse economic recovery. This risk cannot be ignored in 2022.

According to industry insiders, the Fed began to reduce debt purchases from QE in 2014, which caused the US dollar index to rise from 80 to 99, which was more than 20%. The Fed started to raise interest rates in 2015. After the interest rate hike, the U.S. dollar went sideways. The main rise occurred in the second half of reducing debt purchases.

“If the above trend repeats in 2022, the time of greatest impact will be after the Spring Festival and before the Fed meeting in March. The dollar appreciates, funds return to the United States, the stocks of emerging countries suffer from foreign exchange markets, and commodities fall due to the appreciation of the dollar.” The above-mentioned person said that it has been. Saw the Turkish stock exchange double kill. In 2021, Brazil, which has raised interest rates 7 times in a row to fight inflation, has a historically low exchange rate. Once the dollar appreciates again, the risks of emerging countries will rise.

The international macro changes have relatively limited impact on the domestic market

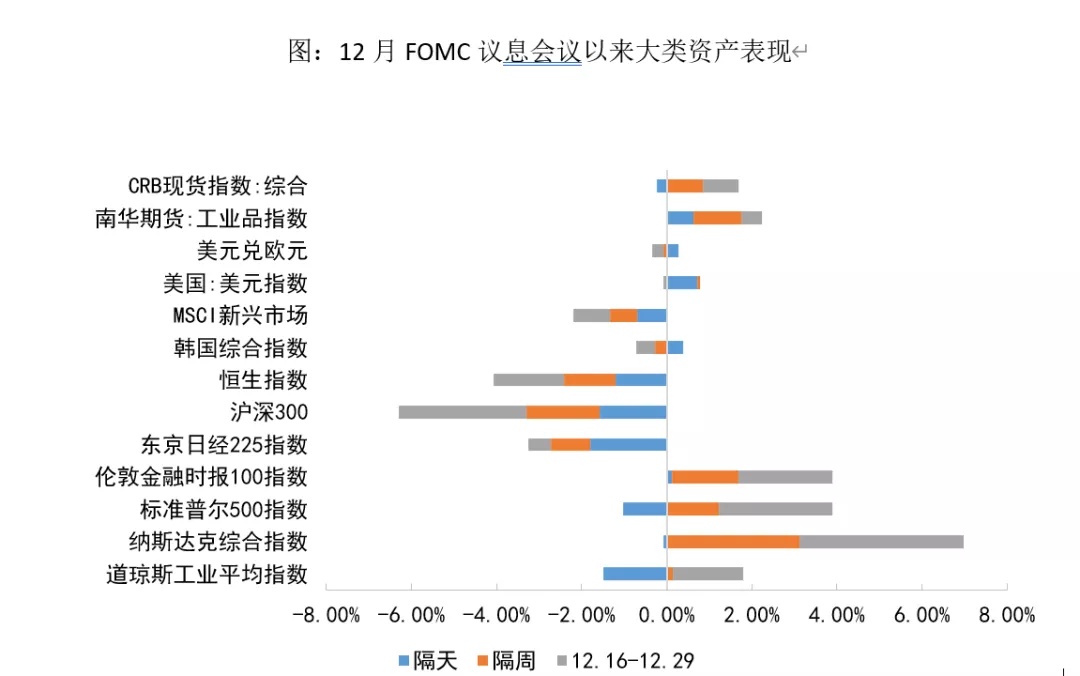

Regarding the advancement of the interest rate hike expectations, in fact, from the perspective of market performance, the hawkish tone of the December 2021 FOMC meeting is not much different from the market expectations before the meeting. “The interest rate hike expectations reflected in the dot matrix at the interest rate meeting are basically consistent with the market’s most hawkish tone, which can basically be regarded as expected fulfillment. Judging from the market performance of the US dollar index on the day of the interest rate meeting, it also reflects this. The logic of buying expectations and selling reality.” Ma Yan said.

Judging from the current market performance, the market has fully anticipated price-in interest rate hikes. Although the next day after the interest rate decision was announced to accelerate Taper, most major asset classes have experienced varying degrees of correction except for a few. “Including within a week after the resolution, the stock markets in Japan, Hong Kong and other emerging markets continued to pull back, but the stock markets in developed economies such as the United States have already ended their corrections. In addition, from the perspective of the US dollar index, only the US dollar index was held on the day of the interest rate meeting. With the support of interest rate hike expectations, there was a slight increase, and the subsequent period has actually been in a state of exhaustion of profits.” Ma Yan said.

Entering the fourth quarter of 2021, the Fed began to use more hawkish signals to lead the dollar to strengthen, trying to manage inflation through this deleveraging of the dollar. “This process did bring about a certain degree of cooling for global re-inflation transactions, but the cooling of currencies, stock indexes and credit bonds of emerging market countries was greater than the cooling brought to commodities.” Li Ershi said, if the Fed continues to continue If the posture of speeding up Taper and speeding up interest rate hikes, coupled with the complexity of the epidemic, still slows down the recovery process of economic activities in developing countries, then the currencies and stock indexes of many EM countries are still under pressure. And if, in the large austerity channel, the United States will gradually slow its own austerity pace and the pressure of global supply constraints will be eased, then the pressure on emerging market countries, especially manufacturing countries, will be eased.

At present, the global interest rate hike cycle is relatively clear. Some developed countries such as Norway, New Zealand, and the United Kingdom have begun to raise interest rates. Emerging market countries are under pressure from their own inflation and capital outflows, and the process of raising interest rates has become more radical.

“For emerging markets, the tightening of global liquidity and the advancement of interest rate hikes before the economic recovery is complete will make the financial markets of emerging market countries face certain adjustment risks, but different assets will not be affected by the tightening of liquidity. 1. Moreover, different countries should pay attention to their internal differentiation. Specifically, emerging economies with advanced economic recovery and better epidemic prevention and control may have relatively low risks, and China’s impact on the tightening of the Fed’s policy is relatively limited. “Ma Yan said.

During the interview, the reporter learned that the impact of international macro changes on the domestic market is relatively limited or controllable. This is also a current market consensus.

“The domestic outstanding performance in epidemic prevention and control is self-evident. The successive variant strains prove the correctness of the domestic epidemic prevention and control strategy, and the impact of the epidemic on the domestic economy is relatively limited.” Ma Yan said in my country’s financial market. In fact, it is more determined by my country’s economic fundamentals and economic policies, but it is not that the Fed’s monetary tightening has no effect on my country. The Fed’s monetary policy under inflationary pressure will affect my country’s monetary policy and financial markets. In turn, my country The strength of stabilizing growth may also affect the Fed’s monetary policy.

Regarding the view of my country’s economy in 2022, most institutions in the market currently predict that in 2022GDPThe growth rate is expected to be between 5.0% and 5.5%. The pressure to stabilize growth is still relatively large, and it is specifically reflected in the three pressures of demand contraction, supply shock, and expected weakening. In fact, it is very accurate to point out the current economic weakness in consumption and GDP growth. Rapid decline, weakening of industrial production andPPIHigh growth, export and real estate expectations are under pressure, so in the future, whether the domestic economy will be on the upper or lower edge of the range depends on the strength of domestic policies to stabilize growth.

Beginning in the second half of 2021, risks in the global supply chain have begun to be fully exposed, and stagflation characteristics have begun to spread globally. my country’s policy can be “self-oriented”, that is, in the process of normalization of the Fed’s monetary policy, the currency can be stabilized to deal with it while maintaining the stability of the exchange rate. This is an important difference between my country and other emerging market countries.

In Li Ershi’s view, in 2022, my country will also be in a process of fighting against “quasi-stagflation”, and the Central Economic Work Conference has also output such a signal. “In terms of the’internal’ and’external’ driving forces of the economy, the state of’external’ strong and internal’ weak has entered an extreme state in 2021. It is expected that in 2022, external demand will gradually move downwards, and domestic demand will stabilize and rise. Second, In terms of internal inflation structure, PPI andCPIThe scissors gap is expected to converge, and inflation and profit structures are expected to be rebalanced.Third, regarding PPI andSMEsIn terms of the trend, the “stagflation-like” state is expected to be corrected, that is, the PPI oscillation will move downward, and the growth factor will stabilize from downward to low. “

Li Ershi believes that in the process of tremendous changes in international macroeconomics, my country’s policies have responded to it in a relatively active state, and the domestic market, especially the equity market, faces a better basic macroeconomic environment. “For risk factors, the first is to pay attention to the development of the global epidemic, which is related to the effectiveness of the global fight against stagflation, which will also affect the effect of my country’s policy implementation; the second is to pay attention to the development of the real estate market, which is related to Whether the domestic stable growth hedging policy can effectively hedge the downward pressure on the economy; the third is to track the development of Sino-US economic and trade relations.”

The tightening cycle opens or suppresses demand for bulk commodities

It is worth mentioning that the factors affecting inflation, in addition to the Fed’s policy, the epidemic and the originalOil priceLattice is also very important. After the intensive outbreak of the energy crisis in early October 2021, the market’s expectations for global inflation have risen sharply, driving the Fed’s interest rate hike expectations to advance quickly, and the main factor affecting inflation is energy prices.

Although the Omicron new crown mutant strain is fierce, it has not changed the determination of Europe and the United States to gradually open up the flow of people. Currently Europe and the United States are lifted from isolation, and most gatherings and air travel only require vaccination certificates and nucleic acid reports. The market is generally optimistic that after the spring of 2022, as the temperature rises, the epidemic will be brought under control and demand for crude oil will rise.

However, European and American countries and OPEC have “different views” of the crude oil outlook for the first quarter of 2022. OPEC believes that crude oil will have a surplus of 1.7 million barrels per day in the off-season of the first quarter, while Europe and the United States believe that crude oil may be in short supply. The current crude oil market has become more complicated due to European energy issues and the effects of the cold winter.

“Due to the current tension between Russia and Ukraine, originally Russia built the Beixi No. 2 submarine natural gas pipeline (completely parallel to Beixi No. 1) in order to bypass the Ukrainian oil and gas pipeline and directly supply natural gas to Germany. It is expected to start gas supply in 2021. As a result, in December 2021, the new German government announced that Beixi No. 2 was illegally built and could not be approved for use.” In the eyes of industry insiders, the chaos in the use of natural gas in winter in Europe has indirectly increased fuel demand. These changes have made crude oil prices exceptionally strong in the past three months, and have obscured the real needs of the macro economy.

South China FuturesEnergy and chemical analyst Liu Shunchang said that energy prices need to pay attention to crude oil and natural gas, especially after the European natural gas price rises, driving European inflation expectations stronger; at the same time, as the king of commodities, oil prices are closely related to inflation. For the crude oil market, after the Fed continues to raise interest rates in 2022, the demand side of crude oil may face shocks, and geopolitical tensions may also have a certain impact on the supply side.

“On the one hand, after inflation continues to exceed expectations, pay attention to the Fed’s rate hike rhythm. The current market expects the Fed to raise interest rates three times in 2022, pushing the yields of 2-year U.S. Treasury bonds to continue to rise. The continued broadening will push the U.S. dollar index to strengthen; at the same time, the rapid decline in global currency growth and the high probability that the U.S. bond real interest rate indicator reflecting the cost of U.S. dollar funds will bottom out will promote the acceleration of global liquidity tightening in 2022, triggering turmoil in emerging markets. Emerging economies such as Turkey and possibly Brazil in the future have adversely affected the demand for commodities and crude oil. On the other hand, the impact of geopolitics on the crude oil supply side is increasing. The OPEC+ production cut implementation rate remains high, Nigeria, Libya and other countries Crude oil production fell short of expectations; at the same time, the conflict between Russia and the United States over the Ukraine issue has intensified, Russian energy exports are facing challenges, and the supply-side tensions in the energy market have increased. The impact of supply-side geopolitics on oil prices cannot be ignored.” Liu Shunchang said.

“From the macro environment, the opening of the tightening cycle in major overseas economies is the most certain negative. The potential upside risk of the US dollar caused by the poor economic recovery in Europe and the United States and the difference in the credit cycle between China and the United States may restrict the rebound of oil prices in the long term in 2022.” Huang Liunan said. , Looking forward to 2022, the downside risk of oil prices in the first half of the year is very high, and there may even be extreme downsides. However, the center of gravity may rebound slightly in the second half of the year. China’s main refinery crude oil replenishment may provide a critical marginal increase for global demand. “From the low point of the whole year, SC may test 350 yuan/barrel again, and Brent and WTI may test 45 US dollars/barrel.”

Liu Shunchang told reporters that the Federal Reserve raised interest rates ahead of schedule, while the European Central Bank remained unchanged in 2022. The widening US-European interest rate spread pushed the US dollar index to continue to strengthen, detonating risks in some emerging economies and suppressing the demand side of bulk commodities. “The current global currency growth rate has fallen sharply, but the cost of funds is still low. If the real interest rate of U.S. Treasuries bottoms out in the future, it is currently a high probability situation, and the total currency volume will fall and the cost of funds will rise, and global liquidity will be tight. The situation will intensify, and it will affect the growth of the global economy.ChangheThe impact on the demand side of bulk commodities will continue to increase, which is a negative impact on bulk commodities at the macro level. At the same time, the supply-side growth of bulk commodities is still affected by geopolitics and may be less than expected. “

“Looking forward to 2022, from a macro perspective, bulk commodities do not have the basis for a sharp rise. In 2022, commodities will return to their respective supply and demand contradictions.” said Yu Jie, a macro researcher at Everbright Futures. It is relatively certain that the easing policy of the economy will continue to decline. It can be expected that the inflection point of the main economy M2 has appeared and will continue to decline in 2022. “The Fed’s interest rate hike and the US economic growth may be stronger than other major economies, both of which determine that the US dollar index may still be an upward trend.”

According to Yu Jie, the past four strong commodity cycles are often accompanied by a weak dollar cycle, that is, the highs of commodity prices correspond to the lows of the US dollar index. This negative correlation reflects the financial attributes of commodities denominated in U.S. dollars and the monetary attributes of U.S. dollars as a currency. “The trend of the U.S. dollar index in 2022 may be somewhat similar to that of 2008. The U.S. dollar index may still be on an upward trend, which is negative for commodity prices.”

“In 2022, as the global liquidity margin is tightening, output growth is gradually returning to normal, and real interest rates have rebounded, the overall commodity will be adjusted. However, considering carbon neutral supply suppression and new investment demand, and Global inflation is running, and commodities still have structural opportunities.” Li Ershi said that as for changes in trends, each product may require specific analysis of specific issues, but overall, commodities may be weak as a whole, and more attention should be paid to the marginal changes brought about by replenishment. .

What makes the market concerned is the epidemic, inflation, and Fed tightening expectations. Where will the global economy be taken? In the eyes of industry insiders, it is still unclear, and major changes may not appear until after New Year’s Day. “Before the Spring Festival, it is the peak period of corporate debt servicing and the greatest capital demand. If the financial market can pass the risky period from New Year’s Day to the Fed meeting in March, the market may have a bright performance in the second quarter.”

(Source: Futures Daily)

.