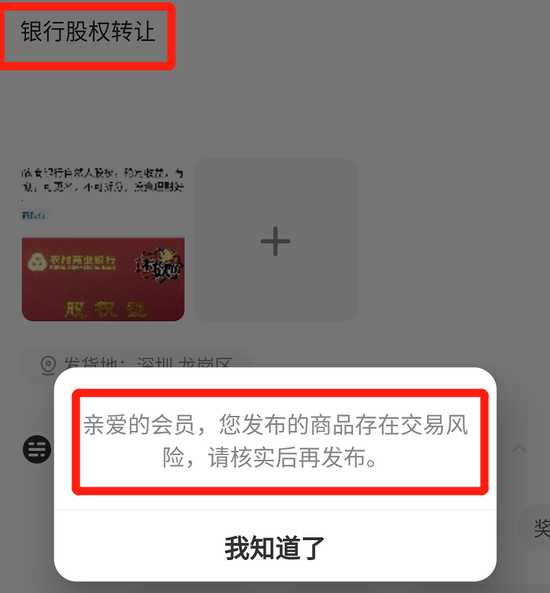

Recently, “free fish soldbankThe issue of “equity” has attracted attention from all parties. On June 19, when CDC Finance searched for relevant content on the Xianyu platform, “bankAll related products of “equity” have been removed from the shelves. For related products, Xianyu has made restrictions and releasedEquity transferThe user of the product will receive “the product you posted has transaction risk” and will not release it. In order to verify whether this action was the result of Xianyu’s risk management control, CDC Finance called Xianyu, but it was not connected before the release of the manuscript.

Phenomenon: natural personshareholderSell offbankEquity

Recently, many media reported that on the trading website of Xianyu’s second-hand platform, many natural person shareholders are publicly “selling” and “selling” their bank shares.

In the product description, the seller claimed to be a natural person shareholder of these rural commercial banks and rural cooperative institutions. In some product links, the seller posted photos of the equity certificates he held. The reason for the transfer is mostly the individual needs of the shareholders, such as capital turnover. These banks are mostly based on rural commercial banks and rural credit cooperatives, such as Huarong Xiangjiang Bank, Bianjing Rural Commercial Bank, Zhejiang Yiwu Rural Commercial Bank, Kunming Wuhua District Rural Credit Cooperative, Luqiao Rural Credit Cooperative, Lanzhou Rural Commercial Bank, etc. Most of the shares sold are below 100,000 shares, and most do not exceed 300,000 shares. The scale is generally small. Except for the number and the bank, the remaining equity information provided is less.There are many sellers playing “investmentFinancial managementSlogans such as “high operating efficiency” are preferred.

Judging from the published transaction information, the number of bank shares to be traded varies, ranging from a few thousand shares to hundreds of thousands of shares. Usually, the seller will indicate the selling price and year of the sold bank shares in the transaction details.DividendsAnd other specific information. At the same time, the transfer price level at which the equity of each bank is listed is also different. The highest price is 10.18 yuan per share, and the lowest is only 1.2 yuan per share.

Process: Hang the idle fish for display only, and the transaction must be done offline

It is reported that the shares held by the idle fish trading platform Xianyu for resale are just for information display. The formal transaction is not conducted on the Xianyu platform, but natural person shareholders and buyers go to the bank to complete the procedures and conduct on-site transactions.

According to the provisions of the bank’s articles of association, if shareholders of the bank transfer or dispose of their equity by way of listing or auction, the shareholders shall inform the board of directors in advance in writing, and the bank shall inform the listing institution and auctioneer of relevant regulations before listing or auction. The registration company directly handles the change of shares of natural person shareholders whose shareholding ratio is less than 5% of the bank’s total shares in accordance with relevant regulations, and reports the change of shareholding to the office of the board of directors on a monthly basis.

On January 5, 2018, Article 13 of the “Interim Measures for the Management of Equity in Commercial Banks” issued by the original China Banking Regulatory Commission also clarified that “commercial bank shareholders shall inform the transferee that they must comply with laws and regulations and the CBRC when they transfer their equity in commercial banks. Stipulated conditions.”

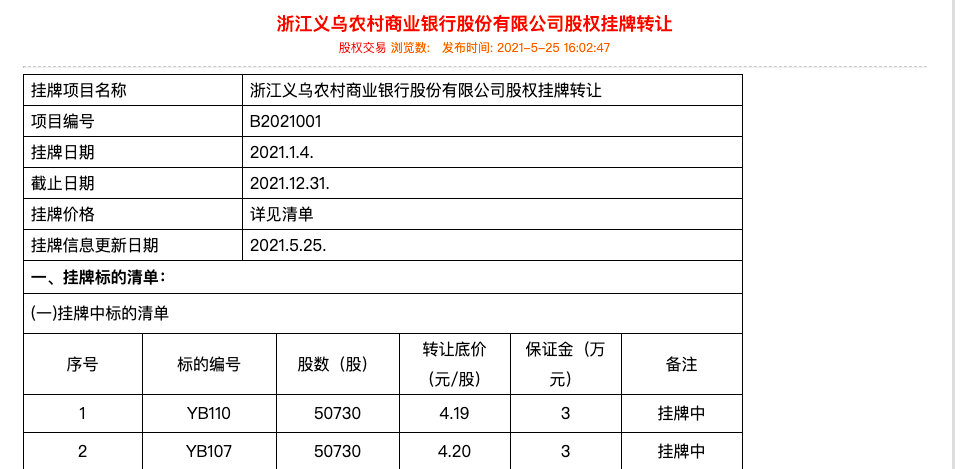

According to an equity transfer of Zhejiang Yiwu Rural Commercial Bank Co., Ltd. announced by the Yiwu Equity Exchange, the information disclosure of the subject matter of the equity transfer includes the transfer price (indicated to include the income tax payable), the amount of the deposit, the qualifications of the transferee, and Trading conditions and so on.announcementIt is reminded that the bidder shall apply for registration and submit relevant materials to Yiwu Property Rights Exchange during the listing period. Only after paying the corresponding deposit can they become an official bidder.

Expert comment: The new channel has not yet introduced regulatory measures

According to a report in the Securities Times, Li Guangzi, director of the Banking Research Office of the Institute of Finance of the Chinese Academy of Social Sciences, pointed out that the bank equity held by natural persons was mainly acquired in the process of bank restructuring. Most natural persons were or were employees of the bank itself, and some natural person shares were Obtained through subsequent equity transfer. “Natural persons purchase equity mainly to obtain dividend income or equity appreciation.”

According to the Xinhua Financial Media Watch Financial Report, analysts said that “natural person shareholders transfer bank equity through second-hand transfer platforms such as Xianyu is an innovative way, and the relevant supervision is not perfect at present.” The above-mentioned person said that taking into account the protection of the legitimate rights and interests of buyers, It is recommended that relevant information product links should be disclosed in a timely manner to inform the transferee that it needs to meet the conditions of laws, regulations and regulatory requirements. “In addition to information disclosure, the pricing and confirmation of equity transfers, as well as the dispute resolution mechanism, etc. all need to be regulated.”

According to the Beijing Business Daily, Shenzhen Banking analyst Wang Jianhui said that in terms of pricing, this type of platform transaction uses bilateral bargaining. It stands to reason that there is no fraud, but the information that needs to be paid attention to is this kind of virtual assets. The biggest risk in transactions is still credit risk. Most natural-person buyers do not have the means to query. If information disclosure is not transparent, it will have some impact on the pricing of equity. In addition, the scale of such transactions is relatively small and fragmented, and unified supervision is not yet mature. For buyers, it is necessary to have a more professional insight and analysis ability to intervene.

Su Xiaorui, a senior observer in the banking industry, analyzed that from the bottom of the analysis, the frequent transfer of equity is due to the impact of the macro environment. Banks’ short-termPerformanceThe performance is not optimistic, and shareholders are eager to let go. From the supervisory level, it is necessary to work with judicial agencies to formulate a special enforcement system; it is also necessary to further formulate special operating guidelines for equity management to refine supervisory behavior, and build a special equity trading system or transfer platform to facilitate banks.

Understand the research institute senior researcher Bu Zhenxing analyzed that the sale of bank equity on Xianyu second-hand platform provides a new way for bank equity transfer, but whether the platform has the qualifications for equity transfer, as well as equity transfer pricing and right confirmation, etc. There are various problems.

Xianyu Reply: Disputes in offline transactions cannot be guaranteed by the platform

According to Xinhua Financial Media’s financial report, Xianyu’s official customer service replied to reporters that if there is a transaction dispute at the end of the transaction, the prerequisite for Xianyu’s intervention is that the transaction is completed on the Xianyu platform. “If the buyer and seller do not trade in Xianyu and form an order, the platform will not be able to guarantee both parties to the transaction in the event of a dispute.”

According to the Beijing Business Daily, the platform’s customer service staff said, “The platform mainly transfers idle goods. Regarding bank equity or some virtual goods, it is not recommended for users to publish or sell, because the platform publishes a large number of targets. Under normal circumstances, it is reviewed here. The similar transaction mode will be taken off the shelf directly, and some will not be reviewed, and it will be displayed as a continuous online state.”

The above-mentioned customer service staff reminded, “Generally, it is not recommended to trade bank equity virtual goods, because such goods are not easy to verify, and are different from the physical goods. The physical goods have logistics, and the platform can verify problems. If users want to buy such goods, Be sure to contact the other party to keep all the vouchers, and if there is a dispute later, you can also apply for a refund, and at the same time apply for customer service to intervene for processing.”

(Source: CDC Finance)

.