In the evening of September 16, we will continue to pay attention to Evergrande.

A-share tens of billions of listed companiesWorld Union Bankreleaseannouncement, And Evergrande Group have reached a settlement solution for part of the accounts receivable.Simply put, Evergrande owes itWorld Union BankOver 1 billion, but there is no money to pay back, so everyone sees that at this time, listed companies, like those retail investors who bought Evergrande wealth, can only choose to use housing to repay their debts.

In addition, Xu Jiayin’s good friend, Liu Luanxiong, a wealthy businessman in Hong Kong, recently reduced his holdings of Evergrande by a total of about 30 million shares and cashed out 116 million Hong Kong dollars.

Xu Jiayin’s “Old Friends” Reduces Evergrande

The Hong Kong Stock Exchange documents show that Liu Luanxiong and his wife reduced their holdings on September 10 at an average price of HK$3.58 per share.China Evergrande24.436 million shares, the shareholding ratio dropped from 8.96% to 7.96%.

Prior to this, Liu Luanxiong and his wife also reduced their holdings of 6.312 million shares at an average price of HK$4.48 per share on August 26, reducing their shareholding ratio from 9.01% to 8.96%. Calculated at the average price, the two reductions in total cashed out about 116 million Hong Kong dollars.

Xu Jiayin and Liu Luanxiong knew each other well in 2008. That year, Evergrande’s listing plan was forced to shelve. Among the 37 projects that Evergrande has expanded across the country, only 4 projects have reached the opening sales standards, and the funding gap was once as high as 10 billion.

In order to make up for the funding gap, Xu Jiayin rushed to Hong Kong to relocate soldiers.Through the opening of Evergrande’s opening of the celebrity to help out, Xu Jiayin met the Emperor’s boss Yang Shoucheng. With the help of Yang Shoucheng’s contacts, Xu Jiayin met again.New worldGroup Chairman Zheng Yutong.

Xu Jiayin and Zheng Yutong played for three months, and finally Zheng Yutong teamed up with the Kuwait Investment Bureau,Deutsche BankMerrill LynchBank, Spent US$506 million to invest in Evergrande to help Xu Jiayin tide over the difficulties.

It can be said that the cards of Xu Jiayin and Zheng Yutong are the key to their revival. What everyone didn’t know was that in addition to Zheng Yutong, there was Liu Luanxiong in this game.

It was also after this card game that Xu Jiayin and Liu Luanxiong were very close in the past and supported them at various points in Evergrande.

In 2009, Evergrande launched its listing again. Liu Luanxiong and other “old friends” subscribed for Evergrande stocks of 50 million U.S. dollars, and became Evergrande’s basic investors. At the beginning of 2010, he twice subscribed for corporate bonds issued by Evergrande, with a total amount of US$750 million.

However, as the stock price of Evergrande plummeted in the first half of the year,shareholderChinese Real Estate(00127.HK) recently disclosed that in the first half of this year, its holdingsChina EvergrandeDue to changes in the fair value of the stock, an unrealized loss of approximately HK$4.11 billion was recorded.

according toChina EvergrandeThe 2020 annual report, as of December 31, 2020,Chinese Real EstateHolds 789 million shares of China Evergrande, with a shareholding ratio of 5.96%.Chinese Real EstateThe actual controller is Chen Kaiyun, wife of Hong Kong wealthy businessman Liu Luanxiong. According to the disclosures of listed companies, Chen Kaiyun holds a total of 8.86% of China Evergrande shares as an individual and as a company, and is the second largest shareholder of China Evergrande, second only to Xu Jiayin, who holds 76.76%.

Chinese Property’s ownPerformanceAlso rely more on EvergrandeDividends. In 2020, Chinese Land’s dividend income from Evergrande reached 1.968 billion Hong Kong dollars, accounting for 64.7% of total revenue.

World Union Bank: A total of 1.24 billion yuan receivable to Evergrande

240 million yuan will be settled in the house

Evergrande Group has encountered a debt crisis recently, and the situation has caused market concerns.

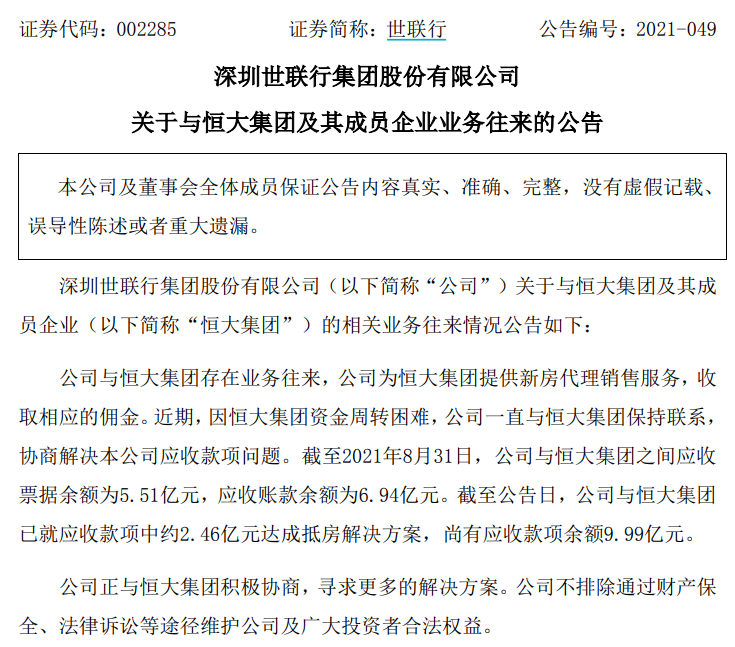

On the evening of September 16, World Union Bank, an A-share listed company, issued the “Announcement on Business Transactions with Evergrande Group and its member companies”, emphasizing that the company is currently operating normally.

The announcement pointed out that the company provided Hengda Group with new house agency sales services and charged corresponding commissions. Recently, due to the difficulties of Evergrande Group’s capital turnover, the company has been keeping in touch with Evergrande Group to negotiate and resolve the company’s receivable issues.

As of August 31, 2021, the balance of notes receivable between the company and Evergrande Group was 551 million yuan, and the balance of accounts receivable was 694 million yuan, for a total of 1.245 billion yuan. As of the announcement date, the company and Evergrande Group have reached a settlement of about 246 million yuan in receivables, and there is still a balance of 999 million yuan in receivables.

The company is actively negotiating with Evergrande Group to seek more solutions. The company does not rule out protecting the legal rights and interests of the company and the majority of investors through means such as property preservation and legal litigation.

According to the data, the World Union Bank was established in Shenzhen in 1993 and was the first domestic A-share company.real estateComprehensive service provider, with 300 subsidiaries so far.

It is worth mentioning that in the secondary market, the share price of World Union Bank has been slumped continuously following the fermentation of the Evergrande incident, and has been cut in half. From nearly 8 yuan per share at the beginning of September, it continued to decline to 4.47 yuan per share, and the market value fell below 10 billion, evaporating about 7 billion.

You know, the World Union Bank’s total revenue last year was less than 7 billion, andNet profitJust over 100 million! If the money is not returned, it is equivalent to many years of doing it for nothing.

Evergrande hires financial consultant

Trying to solve the liquidity dilemma

As the company’s debt overdue and other incidents continued to occur, Evergrande Group hired a financial consultant to help deal with liquidity issues.

On September 14, China Evergrande issued an announcement stating that the company expects that September property contract sales will drop sharply, and the liquidity problems encountered by the company have not been improved. At the same time, it has hired Huali Anuoji (China) Co., Ltd. and Zhonggang Capital Co., Ltd. The company is the company’s joint financial advisor.

China Evergrande stated that the joint financial adviser will work with the company to evaluate the company’s current capital structure, study the liquidity situation, explore all feasible solutions to alleviate the current liquidity problem, and strive to reach the best solution for all stakeholders as soon as possible.

Valian was once Enron in 2001 and Lehman Brothers went bankrupt in 2008ReorganizationThe trader, another joint financial adviser, Zhong Gang Capital, has served as the same debt crisisreal estateenterpriseBlu-ray developmentwithChina FortuneFinancial advisor.

On the 16th, the stock price of China Evergrande Hong Kong stock fell below 2.7 Hong Kong dollars. Compared with the high point, it has fallen by more than 90% of its market value.

Evergrande releases corporate bondsSuspensionOne day’s announcement, which will open on the 17thResumption of trading. At the same time, China Chengxin International downgraded Evergrande’s main credit rating from AA to A.

(Article source: ChinafundNewspaper)

.